Resources

About Us

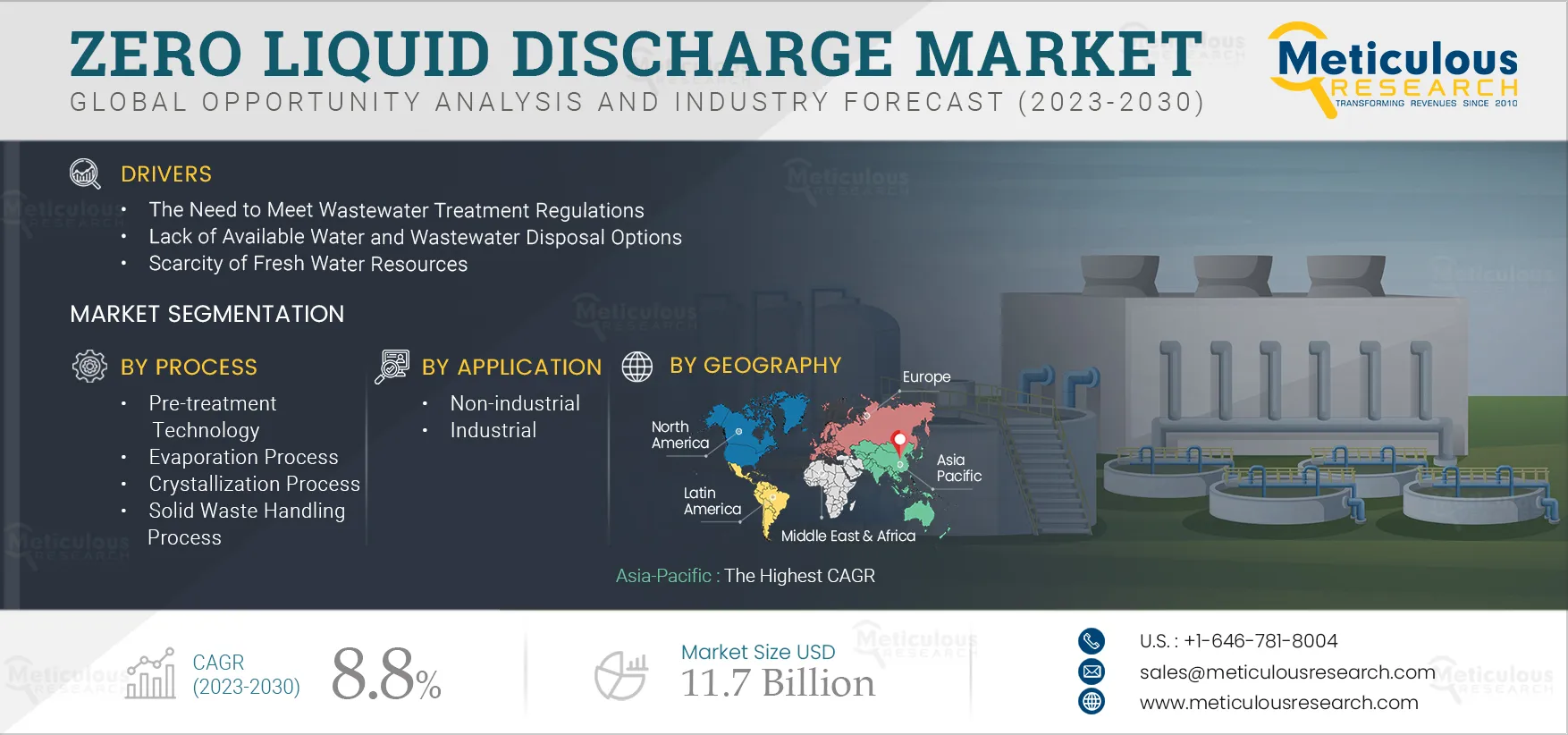

Zero Liquid Discharge Market by Process (Pre-treatment Technology, Evaporation Process, Crystallization Process, Solid Waste Handling Process and Other Processes) Application (Non-industrial and Industrial) and Geography - Global Forecast to 2030

Report ID: MRSE - 104885 Pages: 263 Jul-2023 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe Zero Liquid Discharge Market is expected to reach USD 11.7 billion by 2030, at a CAGR of 8.8% during the forecast period from 2023 to 2030. The growth of the zero liquid discharge market is driven by the need to meet wastewater treatment regulations, a lack of available water and wastewater disposal options, and the scarcity of freshwater sources. However, high installation, maintenance, and operating costs and intensive energy consumption restrain the growth of this market.

The recovery of valuable resources and growing demand for energy-efficient and advanced water treatment solutions are expected to create market growth opportunities. However, upgrading and repairing aging water infrastructure is a major challenge for the zero liquid discharge market.

Intensified freshwater scarcity caused by climate change and overexploitation will likely facilitate ZLD implementation. The prolonged drought in the Southwest U.S. and accelerating growth of water-intensive industries such as coal-fired power plants in China exhibit a worldwide freshwater scarcity. Likewise, the province of Zeeland is also facing freshwater deficiency. In order to address these challenges, the Dutch authorities plan to use brackish effluent from communal and industrial wastewater treatment plants to be desalinated and treated into high-quality process water by 2024. Similarly, industries in Europe and North America are pressured to pursue ZLD strategies due to the high wastewater disposal costs. This is attributed to stringent environmental regulations looking to limit water pollution. As a result, more companies are opting for ZLD practices to limit water pollution worldwide. In such cases, ZLD can be a needed strategy that assures sustainable water supply.

Click here to: Get Free Request Sample Copy of this report

ZLD is witnessing significant technological advancements, such as the energy efficiency of reverse osmosis (RO) and expanding the salinity range of RO. A robust RO system with higher resistance to hydraulic pressure and fouling/scaling effectively improves the energy efficiency and economic feasibility of ZLD. At the core of such systems are fouling mitigation technologies, such as fouling and scaling-resistant membranes, which can reduce the operation cost through less extensive pre-treatment and cleaning needs and enhance the quality of the product water for reuse. Noteworthy progress has been made in the development of RO membranes with resistance to organic and biological fouling. However, further testing is still needed to evaluate their performance in ZLD systems under different feedwater compositions and extremely high concentration factors.

The Pre-treatment Technology Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on process, the global zero liquid discharge market is segmented into pre-treatment technology, evaporation process, crystallization process, solid waste handling process, and other processes. The pre-treatment technology segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the stringent environmental regulations and wastewater discharge limits imposed by authorities that incentivize industries to implement sustainable practices like ZLD. Furthermore, growing concerns over water scarcity and the need for freshwater conservation push industries to reduce their water footprint and maximize water recovery through ZLD systems. In addition, the potential cost savings achieved by recovering valuable resources from wastewater and reducing freshwater intake make ZLD an attractive solution for industries.

The Non-industrial Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on application, the global zero liquid discharge market is segmented into non-industrial and industrial. The non-industrial segment is expected to register the higher CAGR during the forecast period. The adoption of ZLD technologies by municipalities and hospitals drives the segment's growth, leading to increased investments and advancements in ZLD technologies. Moreover, the need for regulatory compliance, hazardous waste management, infection control, water conservation, and resource management are key factors driving the adoption of ZLD systems across non-industrial sectors worldwide.

Asia-Pacific Slalted to Register the Highest CAGR During the Forecast Period

Based on geography, the zero liquid discharge market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The market in Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this regional market is driven by the growing demand for advanced treatment solutions, advancements in membrane technology, environmental deterioration, declining availability of clean water, and increased research & development expenditures.

Key Players

The key players operating in the global zero liquid discharge market are AQUARION AG (Switzerland), Veolia Environnement SA (France), Aquatech International LLC (U.S.), GEA Group Aktiengesellschaft (Germany), DuPont de Nemours, Inc. (U.S.), Evoqua Water Technologies LLC (U.S.), H2O GmbH (Germany), IDE Technologies (Israel), SafBon Water Service (China), Saltworks Technologies Inc. (Canada), WOG Technologies (India), Thermax Limited (India), Petro Sep Corporation (Canada), Samco Technologies, Inc. (U.S.), and Condorchem Envitech (Spain).

Scope of the Report:

Zero Liquid Discharge Market Assessment, by Process

Zero Liquid Discharge Market Assessment, by Application

Zero Liquid Discharge Market Assessment, by Geography

Key Questions Answered in the Report:

This report analyzes the global zero liquid discharge market based on process, application, and geography. The study also evaluates industry competitors and analyses the country and regional-level markets.

The global zero liquid discharge market is expected to reach USD 11.7 billion by 2030, at a CAGR of 8.8% during the forecast period from 2023 to 2030.

Based on the process, in 2023, the pre-treatment technology segment is expected to account for the largest share of the global zero liquid discharge market.

Based on application, in 2023, the oil & gas segment is expected to account for the largest share of the global zero liquid discharge market.

The growth of the zero liquid discharge market is driven by the need to meet wastewater treatment regulations, a lack of available water and wastewater disposal options, and the scarcity of freshwater sources. Furthermore, the recovery of valuable resources and growing demand for energy-efficient and advanced water treatment solutions are expected to create market growth opportunities.

The key players operating in the global zero liquid discharge market are AQUARION AG (Switzerland), Veolia Environnement SA (France), Aquatech International LLC (U.S.), GEA Group Aktiengesellschaft (Germany), DuPont de Nemours, Inc. (U.S.), Evoqua Water Technologies LLC (U.S.), H2O GmbH (Germany), IDE Technologies (Israel), SafBon Water Service (China), Saltworks Technologies Inc. (Canada), WOG Technologies (India), Thermax Limited (India), Petro Sep Corporation (Canada), Samco Technologies, Inc. (U.S.), and Condorchem Envitech (Spain).

Asia-Pacific is projected to offer significant growth opportunities for this market. The growth of this regional market is driven by the growing demand for advanced treatment solutions, advancements in membrane technology, environmental deterioration, declining availability of clean water, and increased research & development expenditures.

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates