Resources

About Us

Ultrapure Water Market Size, Share, Forecast & Trends by Technology (Filtration, Ion Exchange, EDI) Application (Semiconductors, Pharmaceuticals, Power) End-Use Industry - Global Forecast to 2035

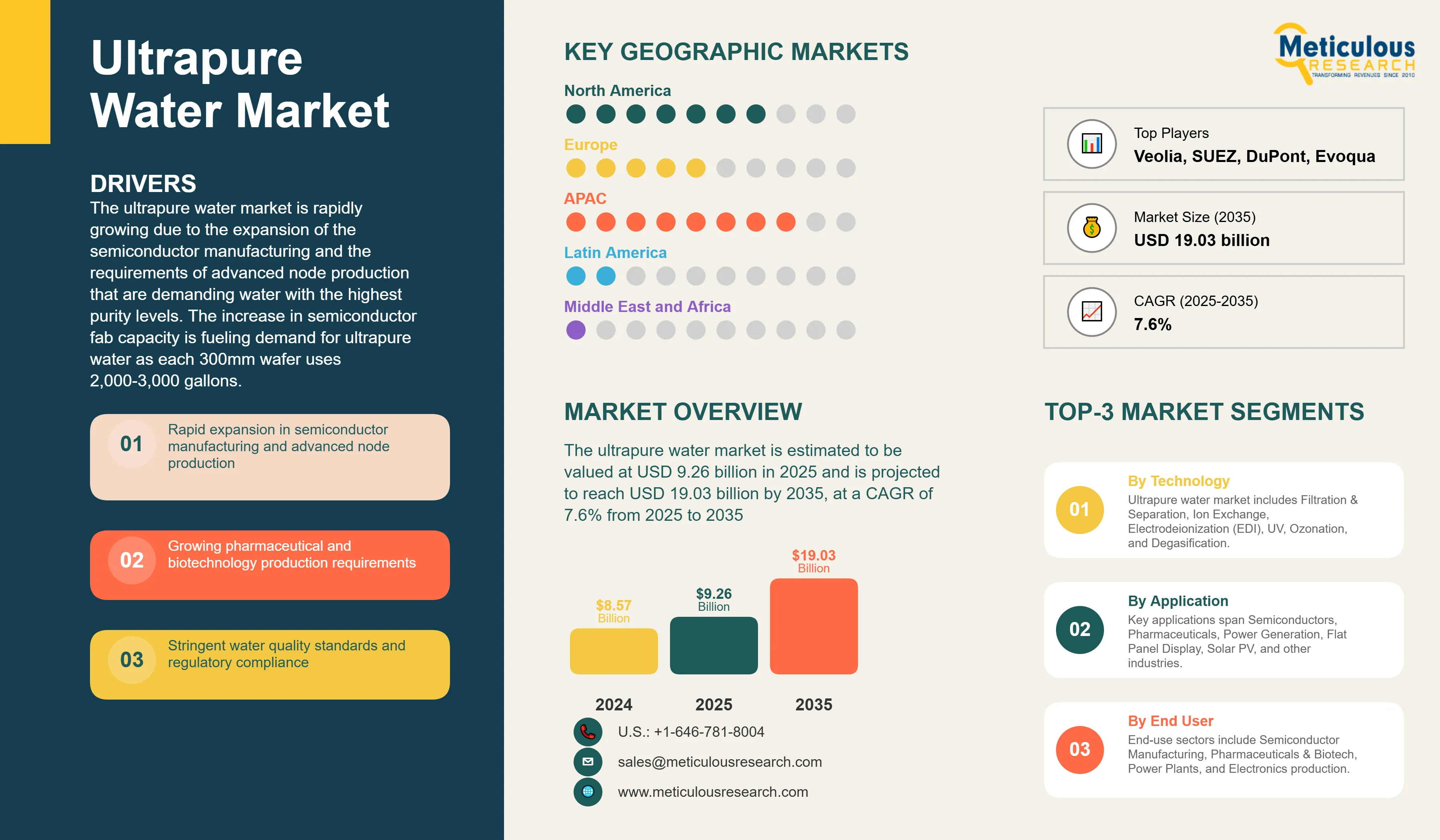

Report ID: MRSE - 1041564 Pages: 215 Aug-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe ultrapure water market was worth USD 8.57 billion in 2024. The market is estimated to be valued at USD 9.26 billion in 2025 and is projected to reach USD 19.03 billion by 2035, at a CAGR of 7.6% from 2025 to 2035.

Ultrapure Water Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 9.26 billion |

|

Market Value (2035) |

USD 19.03 billion |

|

CAGR (2025-2035) |

7.6% |

|

Largest Technology Segment |

Filtration & Separation (30-40% share) |

|

Fastest Growing Technology |

Electrodeionization/EDI (9.7% CAGR) |

|

Leading Application |

Semiconductors (40-45% share) |

|

Dominant End-Use Industry |

Semiconductor Manufacturing (35-40% share) |

|

Fastest Growth Region |

Asia-Pacific (9.7% CAGR) |

|

Top Country by CAGR |

China (10.8%) |

|

Market Concentration |

Top 5 players hold 40-50% share |

Ultrapure Water Market Overview

Click here to: Get Free Sample Pages of this Report

Why the Global Ultrapure Water Market is Growing?

The ultrapure water market is rapidly growing due to the expansion of the semiconductor manufacturing and the requirements of advanced node production that are demanding water with the highest purity levels. The increase in semiconductor fab capacity is fueling demand for ultrapure water as each 300mm wafer uses 2,000-3,000 gallons. Additionally, with smaller nodes being produced (5nm, 3nm, 2nm) the water requires resistivity of better than 18.2 MΩ·cm and total organic carbon being less than 1 ppb.

The market growth is also being supported by the rigid pharmaceutical regulations that are requiring Water for Injection (WFI) grade standards for injectable drugs and biologics. Biopharmaceutical facilities require 500,000-1 million gallons of purified water on a daily basis. Power generation facilities require ultrapure water due to the scaling and corrosion of equipment and achieved 5-7% efficiency loss, with global losses in the billions per year.

Innovations in the use of electrodeionization (EDI) systems and advanced membrane technologies, the development of real-time monitoring capabilities of water purification technologies, are increasing purification efficiency, and yet capturing operational cost reductions. IoT sensors, and AI driven predictive maintenance systems, support consistent water quality, whilst decreasing downtime. Increased investment in water recycling technologies, such as zero liquid discharge, will continue to drive a growth and development period for advanced water purification solutions.

Ultrapure Water Market Size and Forecast

|

Metric |

Value |

|

Ultrapure Water Market Value in (2025) |

USD 19.03 billion |

|

Ultrapure Water Market Forecast Value in (2035 F) |

USD 9.26 billion |

|

Forecast CAGR (2025 to 2035) |

7.6% |

Market Segmentation

The ultrapure water market has been segmented based on technology type, equipment type, application, end-use industry, service type, and geography. Based on technology type, the ultrapure water market is segmented into Filtration & Separation, Ion Exchange, Electrodeionization (EDI), UV Systems, Ozonation, and Degasification. By application, the ultrapure water market is segmented into Semiconductors, Pharmaceuticals, Power Generation, Flat Panel Display, Solar Photovoltaics, and Others. The ultrapure water market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Filtration & Separation Technology Leads Ultrapure Water Market with 30-40% Share

Filtration & separation systems dominate the ultrapure water market within the technology category, with significant market share of 30-40%, as it’s the principal treatment step in multi-barrier purification systems. This technology has proprietary removal rates; reverse osmosis membranes remove 99.99% of dissolved solids; ultrafiltration removes contaminants down to 0.01 microns and endotoxins that are essential pharmaceutical applications.

Filtration technology is widely accepted across all end-use industries since this technology has excellent modularity, allowing systems to scale from 100 to 100,000 gallons per day production capacities. Advanced thin-film composite membranes exhibit greater chemical resistance and thermal stability, maintaining performance at a temperature of 45° C, while resisting chlorine degradation, making them amenable to continuous process flows in industrial environments.

The increasing use of this technology segment is further enhanced by membrane innovations reducing energy consumption by 20-30%, reducing pressure requirements and utilizing energy recovery devices. As water quality specifications become more stringent and sustainability initiatives drive water recycling, filtration & separation systems will be the continued core technology to achieve ultrapure water specifications across applications.

Semiconductor Application Dominates Ultrapure Water Market with 40-45% Share in 2025

On the basis of application, the semiconductor segment dominates the overall ultrapure water market at 40-45% share with a significant contribution from wafer fabrication processes requiring exceptional water purity for chip manufacturing.

The semiconductor segment continues to grow due to increasing fab capacity worldwide, with more than 80 new fabs scheduled for construction between 2025 and 2030 alone, and even higher water specifications for new fabs transitioning to advanced nodes and employing EUV lithography. Companies build water purification infrastructure of between USD 100-200 million on average, installing systems that flow between 5,000 and 20,000 gallons of ultrapure water per minute for wafer cleaning and CMP and rinse processing.

The expansion of the semiconductor segment is also being accelerated by the geographic diversification of chip manufacturing with new sites being established in the US, Europe, and India, where typically more capacity previously existed only in Asia. The outlook for the semiconductor application is very strong as chip content continues to grow across all applications including automotive, AI, and IoT devices, with ultra-pure water systems that can operate with 99.9999% uptime reliability and include real time monitoring for contamination events.

What are the Drivers, Restraints, and Key Trends of the Ultrapure Water Market?

The ultrapure water market is expanding due to semiconductor industry growth, pharmaceutical production requirements, power generation efficiency needs, and stringent regulatory standards. Additionally, technological advancements, water recycling initiatives, and smart monitoring systems improve their competitiveness in this industry.

Base CAGR: 7.6%

|

Driver |

CAGR Impact |

Key Factors |

|

Semiconductor Expansion |

+2.2% |

• Advanced node production (3nm, 2nm) |

|

Pharmaceutical Growth |

+2.1% |

• Biologics and vaccine production |

|

Power & Energy Demand |

+1.4% |

• Efficiency requirements |

|

Technology Innovation |

+1.2% |

• EDI adoption |

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

High Capital Costs |

-1.3% |

• Modular systems |

|

Operating Expenses |

-0.8% |

• Energy recovery |

|

Technical Complexity |

-0.6% |

• Automation |

Pharmaceutical and Biotechnology Production Requirements Accelerate Market Growth

The pharmaceutical industry's requirement for ultrapure water is increasing extensively because of the rising production of biologics, vaccines, and injectable medicines all of which require water for injection (WFI) grade water that meets USP, EP and JP pharmacopoeia standards. Biopharmaceutical facilities tend to use purified water on the order of 500,000-1 million gallons a day; approximately 60% of which used for production of active pharmaceutical ingredients and 40% of consumption is going to cleaning and sterilization of equipment. The global biologics market is growing at a rate of 12% annually and is projected to reach USD 700 billion by 2030, which is a primary driver for advanced water purification systems.

Today, pharmaceutical plants are increasingly using continuous manufacturing methods that necessitate consistent water quality at sub 1.3 μS/cm conductivity, total organic carbon of 500 ppb, and bacterial endotoxin < 0.25 EU/ml. The COVID-19 pandemic emphasized the importance of water quality in vaccine manufacturing, allocating 50-100 liters of WFI for each vaccine dose, throughout the manufacturing process. This has increased funding into redundant water systems and real-time monitoring capabilities for the continuous manufacture of essential medicines.

Regulatory requirements are constantly changing, and agencies around the world are imposing added quality controls and data integrity regulations in accordance with FDA 21 CFR Part 11, EU Annex 1, and others. Pharmaceutical companies are reacting to the evolving regulatory environment by integrating innovative water systems with continuous electrodeionization, hot water sanitization capabilities, and extensive instrumentation that account for critical quality attributes with real-time monitoring, supporting growth in the market for sophisticated ultrapure water solutions.

Power Generation Efficiency and Asset Protection Drive Ultrapure Water Adoption

Power generation facilities require ultrapure water for high-pressure boilers, cooling systems, and turbine operations to prevent scaling, corrosion, and efficiency losses that can cost facilities millions in downtime and repairs annually. Combined cycle power plants operating at temperatures above 600 °C require boiler feed water with silica below 10 ppb, sodium < 2 ppb, and conductivity <= 0.2 μS/cm to restrain deposits on turbine blades which reduces efficiency by 5-7 percent. For example, nuclear power facilities operate with even stringent requirements. They maintain reactor coolant water with conductivity less than 0.1 μS/cm and conductivity below 0.15 ppm to avoid stress corrosion cracking of critical components.

The migration to renewable energy sources is leading to new uses for ultrapure water. Concentrated solar power plants need very high-purity water for steam generation and cleaning mirrors, and in green hydrogen production through electrolysis, water is required to have a conductivity of less than 5 μS/cm in order to avoid severely corroding the expensive catalyst materials. The global push for carbon neutrality means power plants are looking for improvement in efficiency, and ultrapure water enables larger and larger heat transfer efficiencies, while extending the lifespan of equipment, as plants and operators using properly treated water systems can expect operational lives of their equipment to be 50% longer than comparable systems using conventional treatment.

Utilizing sophisticated monitoring and treatment technologies to improve water chemistry in real-time and AI-enabled systems are predicting scaling and corrosion potential while adjusting treatment parameters. Power generation companies are developing new zero liquid discharge systems that provide ultrapure water and all of the water they use while addressing operational efficiencies, sustainability commitment, and reducing water sourcing costs by 30-40%.

Competitive Landscape

As the ultrapure water market expands, the competitive landscape will be shaped by technological innovation, system integration capabilities, and a wide range of service offerings. The leading companies in the global ultrapure water market have committed substantial R&D funding towards developing better, more efficient, energy saving systems with higher recovery rates, as well as lower operational costs and environmental impact. In addition, companies are forming strategic partnerships with semiconductor manufacturers, pharmaceutical companies, and engineering companies, increasing project execution capabilities and technology development.

Leading companies in the global ultrapure water market are introducing digitalization and IoT introduction that provides predictive maintenance, long-distance monitoring, and optimization services. Both modular and standardized systems with a strong emphasis on commonality allows for rapid deployment, scalability, and capital cost savings. Companies are also differentiating themselves through subject matter expertise in specific industry verticals, with some focused on semiconductor-grade systems while others focus on pharmaceuticals or power generation. Full lifecycle service contracts, performance guarantees, and a water-as-a-service model continue to help companies create recurring revenue streams and guarantee end users the best possible system performance.

Ultrapure Water Market Growth, By Key Regions/Countries

|

Country |

CAGR |

|

China |

10.8% |

|

India |

10.5% |

|

South Korea |

8.8% |

|

Taiwan |

8.6% |

|

United States |

7.1% |

|

Germany |

6.8% |

|

Japan |

6.1% |

The global ultrapure water system market is projected to grow at a CAGR of 7.6% from 2025 through 2035, with Asia-Pacific showing the largest growth resulting from the expansion of semiconductor fabrication and overall pharmaceutical manufacturing. China has the highest projected growth, with a 10.8% CAGR, as it has the largest volume of new semiconductor fab constructions (over 30 planned) and the fastest-growing pharmaceutical industry. India follows with a projected growth of 10.5%, primarily on the back of semiconductor manufacturing plans to export success, along with additions to power capacity generation.

South Korea exhibits a high 8.8% growth, driven by memory chips and increased display production, while Taiwan reports a CAGR of 8.6%, driven by TSMC's market share of leading edge nodes and investments into their advanced manufacturing fabs for the near future. The U.S. is showing consistent 7.1% growth primarily driven by initiatives in "reshoring" of semiconductors back to the US, biopharmaceutical design and development, and modernization of utility power plants. Germany and Japan are more moderate with respective growth rates of 6.8% and 6.1%, reflecting their more mature markets, and technology upgrades and efficiency improvements.

Country-Specific Growth Analysis

China's Ultrapure Water Market Accelerates at 10.8% CAGR (2025-2035)

China's CAGR for the ultrapure water market increased from 9% for the 2020-2024 period to 10.8% for the 2025-2035 period, with unprecedented demand for ultrapure water systems driven by extraordinary semiconductor manufacturing growth. By 2030, China plans to build over thirty new semiconductor fabs, each requiring a water purification investment between USD 100 million to USD 150 million. China's pharmaceutical industry is expanding at 15% annually and is on its way to becoming the World's second-largest market, while requiring advanced water systems with internationally acceptable water quality for export markets. New capacity for power generation each year is approaching 100 GW, including ultra-supercritical coal plants and nuclear plants each requiring sophisticated water treatment to ensure operational efficiency. Domestic development of technologies and manufacturing capability will reduce the country's dependence on imports and be more price competitive especially in the domestic and export markets.

India's Semiconductor and Pharmaceutical Sectors Drive 10.5% CAGR Growth

The ultrapure water system market in India is projected to grow at a CAGR of 10.5% between 2025 and 2035, driven by the government's USD 10 billion semiconductor manufacturing incentive program which is bringing global chipmakers to India. The pharmaceutical industry, which provides 20% of the world's generic drugs, is investing in upgrading their water systems to meet the new standards imposed by the FDA and EU for their export markets. The growth of the power sector with an additional 200 GW of capacity coming in by 2030 also requires advanced water treatment to manage the performance of new supercritical plants with higher temperature and pressure operations. New industrial corridors and manufacturing zones are developing volume demand centers to build single ultrapure water facilities servicing multiple industries with lower costs. In addition, India's strategy to develop technology partnerships with global players is allowing local manufacturing and enabling project costs to be reduced by a further 25-30% compared to imported systems.

Key Players in Ultrapure Water Market Expand Global Reach with Advanced Technology

Top companies in the global ultrapure water market are developing platforms that integrate multiple purification technologies to deliver solutions that meet ever-increasing quality requirements across a variety of industries. Companies like Veolia Water Technologies and SUEZ Water Technologies & Solutions have complete, turnkey solutions including operation and leverage their decades-long experience, technology expertise, and references to multiple global projects. Their key selling points include the minimizing of the total cost of ownership based on their energy efficient designs, and maintenance predictive capabilities.

Both DuPont Water Solutions and Pall Corporation (Danaher) are advancing membrane technology development with their next generation products that allow higher percentages of rejection while running longer before replacement. Kurita Water Industries and Organo Corporation lead the Asian companies with their knowledgeable staff who both have specialized understanding of the water needs of semiconductor-fabrication an company that sold-to a well developed national service package for finished products.

Evoqua Water Technologies and Pentair continue to build out solutions that are standardized and modular so that these solutions can be installed quickly and scaled when necessary. Some specialty players include Merck KGaA (MilliporeSigma) and Thermo Fisher Scientific that are targeting lab and pharmaceutical type applications with their validated systems that operate within a regulatory framework legally. Strategic initiatives in the market are shifting with emerging digital service platforms, water as license or service, and circular economy solutions of producing ultrapure water with ancillary-zero liquid discharge.

Recent Developments in the Global Ultrapure Water Market

In the first quarter of 2025, Veolia Water Technologies secured over $750 million in new flagship contracts across energy and semiconductor industries, reflecting the success of its strategic positioning. A major component of this portfolio is a $550 million contract to design, construct, and operate a state-of-the-art water and wastewater treatment facility for a semiconductor manufacturing plant in the U.S. Midwest. This facility will incorporate the latest ultrafiltration and reverse osmosis membrane technologies, including ZeeWeed™ hollow fiber membranes, and is designed to recycle approximately 8,000 cubic meters of water daily over a 16-year period.

|

Item |

Value |

|

Market Size (2025) |

USD 9.26 Billion |

|

Technology Type |

Filtration, Ion Exchange, EDI, UV Systems, Ozonation, Degasification |

|

Application |

Semiconductors, Pharmaceuticals, Power Generation, Flat Panel Display, Solar PV, Others |

|

End-Use Industry |

Semiconductor Manufacturing, Pharmaceutical & Biotech, Power & Energy, Electronics, Others |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Veolia, SUEZ, DuPont, Evoqua, Kurita, Pentair, Pall Corporation, Merck KGaA, Thermo Fisher, MANN+HUMMEL, Organo, Ovivo |

|

Additional Attributes |

Porter's Five Forces Analysis, technology impact analysis, sustainability assessment, competitive benchmarking, digital transformation trends, water recycling rates, regulatory compliance analysis, total cost of ownership models |

The global ultrapure water market is estimated to be valued at USD 9.26 billion in 2025.

The market size for ultrapure water is projected to reach USD 19.03 billion by 2035.

The ultrapure water market is expected to grow at 7.6% CAGR between 2025 and 2035.

Filtration & separation technology commands the largest share at 30-40% due to its critical role in multi-stage purification systems.

Semiconductors represent 40-45% of applications, driven by fab expansion and advanced node production requiring exceptional water purity.

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates