Resources

About Us

U.S. Water and Wastewater Treatment Technologies Market by Treatment Technologies Type (Membrane Separation & Filtration, Sludge Management Technology, Activated Sludge, Clarification) and Application - Forecast to 2035

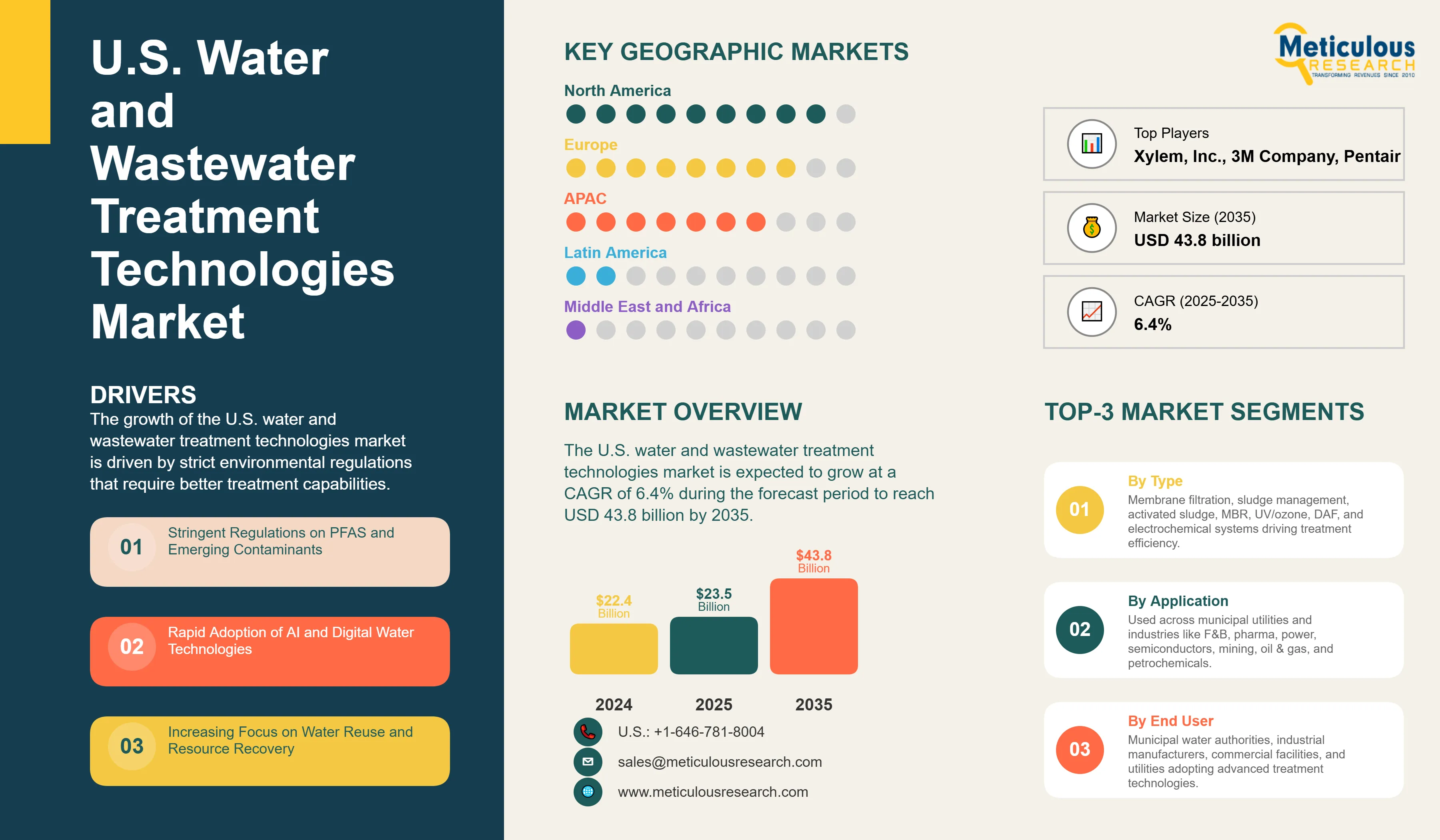

Report ID: MRSE - 104571 Pages: 112 Nov-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe U.S. water and wastewater treatment technologies market was valued at $22.4 billion in 2024. This market is expected to grow at a CAGR of 6.4% during the forecast period to reach USD 43.8 billion by 2035 from an estimated USD 23.5 billion in 2025.

The growth of the U.S. water and wastewater treatment technologies market is driven by strict environmental regulations that require better treatment capabilities. There are also large federal and state infrastructure investment programs, expanding industrial sectors with specific water needs, and rising water scarcity that boosts demand for reuse technologies.

Moreover, the increasing use of membrane technologies and energy-efficient treatment systems is likely to create significant growth opportunities for companies in the U.S. water and wastewater treatment technologies market. However, high capital costs and complex regulatory compliance can limit market growth to some degree. The need to manage treatment waste and upgrade old infrastructure also poses ongoing challenges for the companies operating in this market.

Click here to: Get Free Sample Pages of this Report

Growing Advancements in Wastewater Treatment Technologies

The U.S. water and wastewater treatment industry is growing rapidly due to changing regulations, industrial growth, and new technologies. Federal infrastructure investments of over USD 50 billion by 2032 are helping speed up the use of modern treatment technologies in both municipal and industrial areas.

The implementation of stringent PFAS (per- and polyfluoroalkyl substances) regulations are greatly affecting more than 5,000 water systems in the country. The EPA's regulations introduced in 2024 set strict limits for several PFAS compounds. Compliance deadlines will stretch into 2031. This is creating a strong demand for treatment technologies that can effectively remove these long-lasting pollutants.

Simultaneously, growth in industries like semiconductors, pharmaceuticals, and energy is increasing the need for specialized wastewater treatment solutions. These solutions must address specific contaminants and operational needs. This situation benefits companies that provide integrated solutions for meeting regulations and improving efficiency.

Key Findings of the Study:

The Membrane Separation Technology Segment to Maintain Market Dominance Through 2035

The membrane separation technology segment is expected to maintain the largest share of the overall water and wastewater treatment technologies market in the U.S. This is primarily attributed to stringent regulatory requirements for emerging contaminants removal, growing semiconductor and data center applications requiring ultrapure water, and technological advances reducing energy consumption and improving membrane lifespan.

The Industrial Segment Positioned for Exceptional Growth

The industrial segment is expected to register the highest CAGR during the forecast period of 2025 to 2035. The growth of this segment is attributed to the rapid expansion of the semiconductor industry driven by CHIPS Act funding, explosive growth in AI data center cooling requirements, battery manufacturing expansion for electric vehicles, and increasing focus on water recycling and zero liquid discharge systems.

Competitive Landscape

The dynamics of the U.S. water and wastewater treatment technologies market have changed significantly over the past five years, especially due to major mergers among leading companies.

In May 2023, Xylem completed its acquisition of Evoqua Water Technologies in a stock deal worth about $7.5 billion. This merger formed the largest pure-play water technology company in the world, with a combined revenue of approximately $7.3 billion and over 22,000 employees globally. The merged portfolio provides complete treatment solutions across industrial, municipal, and specialty areas.

Strategic Developments and Market Positioning

Technology Leadership and Innovation Focus: In January 2025, DuPont decided not to spin off its Water Solutions division, keeping the unit that generates about $1.5 billion in revenue. The company leads in reverse osmosis and ion exchange technologies, focusing on tackling PFAS treatment issues and increasing demand for membrane technology.

Venture Investment and Emerging Players

In 2024, Xylem grew its corporate venture capital fund to $50 million, concentrating on innovations that address water scarcity, quality, and decarbonization.

Notable emerging companies attracting significant investment include:

Key Players in Water and Wastewater Treatment Technologies Market in the U.S.

The key active and relevant water and wastewater treatment technology companies in the U.S. market include Veolia Environment S.A., Xylem, Inc., DuPont de Nemours, Inc., 3M Company, Pentair plc, Kurita Water Industries Ltd., Bio-Microbics, Inc., Kuraray Co., Ltd. (owner of Calgon Carbon Corporation), Trojan Technologies Inc., Ecolab, Inc., and GFL Environmental Inc.. Emerging technology providers gaining traction in the US market are Gradiant Corporation, Aquatech International LLC, and IDE Technologies.

These companies collectively offer a broad range of advanced water treatment solutions including membrane filtration, reverse osmosis, ion exchange, activated carbon filtration, UV disinfection, water reuse, and digital water management technologies, addressing industrial, municipal, and commercial water challenges globally.

Scope of the Report:

U.S. Water and Wastewater Treatment Technologies Market, by Type:

U.S. Water and Wastewater Treatment Technologies Market, by Application:

The U.S. water and wastewater treatment technologies market is expected to reach a value of $44.6 billion by 2035, at a CAGR of 5.2% during the forecast period.

Based on treatment technologies type, the membrane separation & filtration segment is expected to account for the largest share of the U.S. water and wastewater treatment technologies market in 2025.

The key players operating in the U.S. water and wastewater treatment technologies market are Veolia Environment S.A., Suez Water Technologies & Solutions, Evoqua Water Technologies, Pentair plc, Xylem Inc., DuPont de Nemours, Inc., 3M Company, Kurita Water Industries Ltd., Bio-Microbics, Inc., Kuraray Co., Ltd., Trojan Technologies Inc., Ecolab, Inc., and GFL Environmental Inc. Emerging technology providers gaining traction in the US market are Gradiant Corporation, Aquatech International LLC, and IDE Technologies.

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates