Resources

About Us

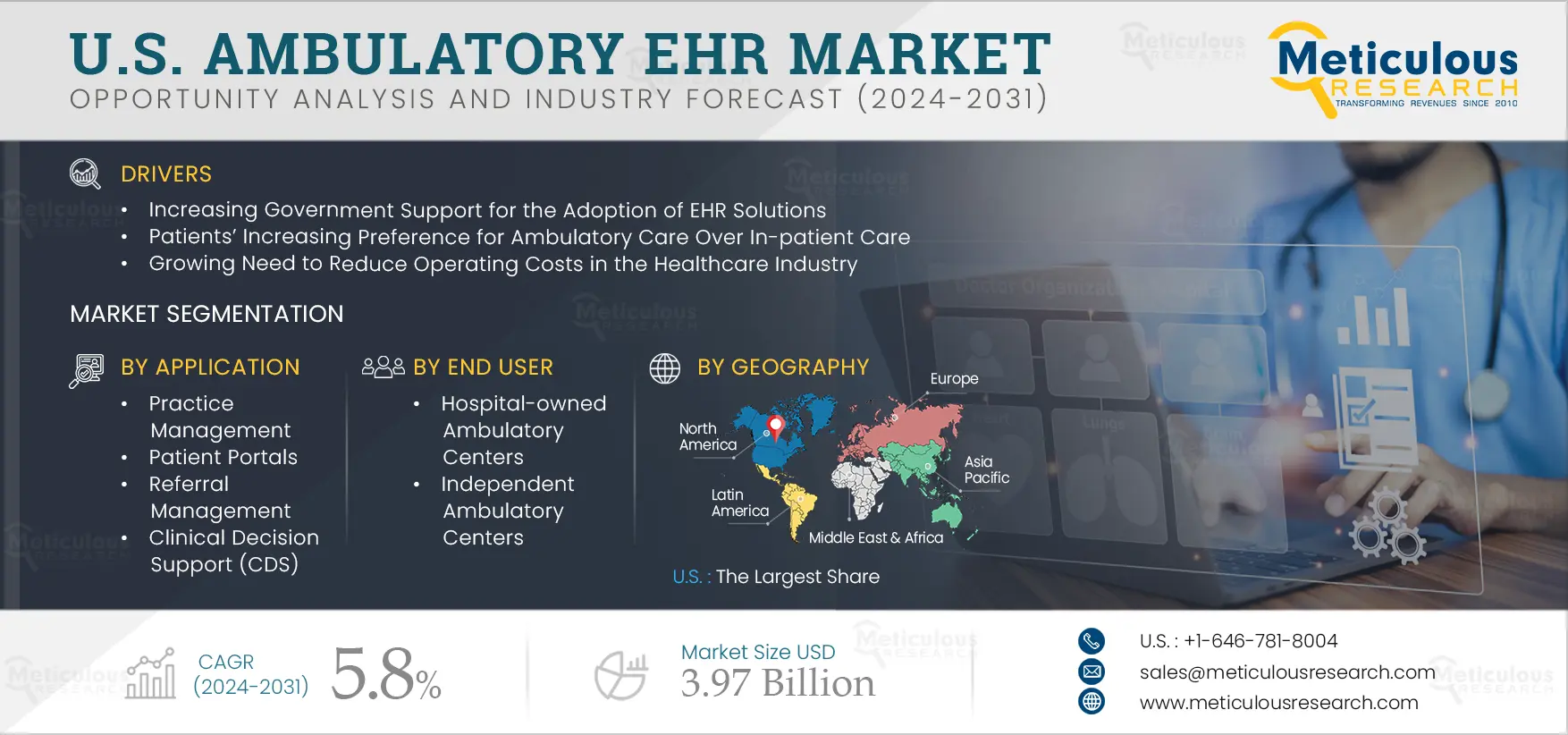

U.S. Ambulatory EHR Market Size, Share, Forecast, & Trends Analysis by Deployment Mode (Cloud, On-premise) Type (All-in-one, Modular) Application (Practice, Patient Portal, CPOE, CDS, Referral, Population Health), Practice, End User - Forecast to 2031

Report ID: MRHC - 104926 Pages: 86 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of this market include increasing government support for the adoption of EHR solutions, patients’ increasing preference for ambulatory care over in-patient care, and healthcare organizations’ growing need to reduce operating costs.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies and the changing technological landscape in developing countries are expected to create growth opportunities for market stakeholders. The high deployment costs and high product replacement rates pose a challenge to the growth of the market.

The U.S. government is increasingly supporting the adoption of EHR solutions due to their various advantages over traditional paper-based health records, which has led to the widespread implementation of EHR. Both patients and ambulatory practices benefit from EHR adoption due to enhanced patient treatment, improved care coordination, faster access to records, greater efficiency in practice, savings through decreased paperwork, increased patient participation & transparency, and improved diagnostic and patient outcomes resulting from accurate prescribing. According to the National Coordinator for Health Information Technology, as of 2021, around 9 out of 10 (88%) U.S. office-based physicians had adopted an Electronic Health Record (EHR) solution, and nearly 4 in 5 (78%) had adopted a certified EHR solution. Moreover, the U.S. government is undertaking various initiatives to implement EMR/EHR in various healthcare facilities, which is further expected to create awareness among ambulatory centers in the U.S., driving EHR adoption among outpatient centers across the U.S.

Many patients prefer outpatient care over in-patient care due to its convenience. The adoption of ambulatory EHRs has increased drastically over the last decade due to outpatient treatments becoming the preferred option for most patients. The number of Ambulatory Surgery Centers (ASCs) in the U.S. has increased steadily over the last decade, with over 6,377 ASCs operating in the U.S. as of August 2024. An ambulatory surgery center allows patients to be discharged within 23 hours of care, reducing the risk of hospital-acquired infections. The overall cost of care in ambulatory settings is lower for both patients and payers due to lower costs of staffing, space, and supplies. These factors have led to the proliferation of ambulatory care centers in the U.S.

Moreover, patients have increasingly opted for ambulatory care in the last few years. The shift toward ambulatory care is mainly attributed to advances in clinical technology, healthcare systems’ shift toward value-based care, faster patient recovery, and shorter hospital stays in ambulatory care settings.

Furthermore, many outpatient facilities are being expanded to cater to the increasing number of patients. These facilities are more accessible and convenient for patients. Since the services offered in ambulatory care centers and outpatient clinics are limited, these facilities charge less than hospitals, further supporting the shift in patients’ preference toward ambulatory care. As a result, larger health systems and networks are keen on acquiring outpatient facilities to retain their patients and improve referral networks. Larger healthcare networks are also increasing outpatient budgets, leading to the introduction of technologies such as EHR and telehealth systems. Thus, patients’ increasing preference for ambulatory care over in-patient care is increasing the adoption of ambulatory EHRs, driving the growth of this market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Electronic Health Records (EHRs) are a digital collection of all sources of patient data consolidated into a single database that includes medical histories, data related to treatments, diagnoses, prescriptions, allergies to medications or foods, immunization records, images generated laboratories, and test results. The primary aim of implementing EHR is to enhance patient care through improved treatment quality. The integration of artificial intelligence and machine learning into EHR solutions is expected to help achieve this goal.

One of the most advantageous aspects of integrating EHR into healthcare processes is data availability. The easy accessibility of data in EHRs makes them ideal for many ML-powered data science operations. Artificial Intelligence (AI) makes EHR solutions more flexible and intelligent. Artificial intelligence and machine learning can be implemented in various applications such as data mining, natural language processing, data analytics & visualization, predictive analytics, and regulatory compliance. AI is also being used in various fields to enhance clinical decisions by analyzing EHRs. For instance, AI techniques have been widely used with EHR data in cardiology studies for the early detection of heart failure, to predict the onset of congestive heart failure, and to improve risk assessment in patients with suspected coronary artery disease. The current AI capabilities of EHRs are limited, but rapid improvements are expected in the near future. Moreover, companies are already offering features such as data extraction from free text, diagnostic or predictive algorithms, clinical documentation & data entry, and clinical decision support to improve treatment quality. Thus, AI and machine learning can enable EHRs to adapt to users’ preferences in real time and improve clinical outcomes and patients’ quality of life.

Based on deployment mode, the U.S. ambulatory EHR market is segmented into cloud/web-based ambulatory EHR and on-premise ambulatory EHR. In 2024, the cloud/web-based ambulatory EHR segment is expected to account for a larger share of 79.2% of the U.S. ambulatory EHR market. This segment’s large market share can be attributed to the benefits of cloud/web-based ambulatory EHR systems, including lower upfront costs, automated data backups, reduced maintenance requirements, and quicker deployment. Additionally, advantages such as enhanced flexibility, real-time monitoring, stronger data security, and lower implementation costs compared to on-premise solutions contribute to the higher adoption of cloud-based EHR systems.

Based on type, the U.S. ambulatory EHR market is segmented into all-in-one ambulatory EHR and modular ambulatory EHR. In 2024, the all-in-one ambulatory EHR segment is expected to account for a larger share of 68.2% of the U.S. ambulatory EHR market. This segment’s large market share can be attributed to the benefits of all-in-one systems, including ease of use, comprehensive functionality, and seamless integration of software and hardware.

Based on practice size, the U.S. ambulatory EHR market is segmented into large practices, small-to-medium-sized practices, and solo practices. In 2024, the large practices segment is expected to account for the largest share of 49.6% of the U.S. ambulatory EHR market. This segment’s large market share can be attributed to the strong bargaining power of large practices when selecting vendors and their superior financial resources, enabling them to invest in robust EHR systems that offer scalability and seamless integration with other healthcare technologies.

Moreover, the large practices segment is projected to record the highest CAGR during the forecast period.

Based on application, the U.S. ambulatory EHR market is segmented into practice management, patient portals, computerized physician order entry (CPOE), clinical decision support (CDS), population health management, referral management, and other applications. In 2024, the practice management segment is expected to account for the largest share of 26.0% of the U.S. ambulatory EHR market. This segment’s large market share can be attributed to the rising need for practice management software for various tasks, such as capturing patient data, scheduling appointments, and performing billing tasks. Practice management software impacts nearly every aspect of clinical workflow, managing patient encounters from start to finish. It typically includes features such as appointment scheduling, patient demographics, resource planning, document management, billing, and claim management. These functionalities are essential to the daily operations of ambulatory practices.

Based on end user, the U.S. ambulatory EHR market is segmented into hospital-owned ambulatory centers and independent centers. In 2024, the hospital-owned ambulatory centers segment is expected to account for a larger share of the U.S. ambulatory EHR market. Hospital-owned centers are typically required to meet more stringent accreditation standards than non-hospital-based outpatient clinics. The increasing need to organize unstructured health data, coupled with the availability of resources for adopting EHR solutions, contributes to the large market share of this segment.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants over the past three to four years. The key players profiled in the U.S. ambulatory EHR market report are Greenway Health (U.S.), CureMD Healthcare (U.S.), AdvancedMD, Inc. (U.S.), Kareo, Inc. (U.S.), CompuGroup Medical Inc. (U.S.), Athenahealth, Inc. (U.S.), Nextgen Healthcare Inc. (U.S.), and eClinicalWorks LLC (U.S.).

|

Particulars |

Details |

|

Page No |

86 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

5.8% |

|

Market Size (Value) |

$3.97 billion by 2031 |

|

Segments Covered |

By Deployment Mode

By Type

By Practice Size

By Application

By End User

|

|

Countries Covered |

U.S. |

|

Key Companies |

Greenway Health (U.S.), CureMD Healthcare (U.S.), AdvancedMD, Inc. (U.S.), Kareo, Inc. (U.S.), CompuGroup Medical Inc. (U.S.), Athenahealth, Inc. (U.S.), Nextgen Healthcare Inc. (U.S.), and eClinicalWorks LLC (U.S.). |

This study offers insights into the U.S. ambulatory EHR market, which is segmented by deployment mode, type, practice size, application, and end user. The report includes a detailed value analysis of the various segments and sub-segments within the U.S. ambulatory EHR market.

The U.S. Ambulatory EHR market is projected to reach $3.97 billion by 2031, at a CAGR of 5.8% during the forecast period.

In 2024, the cloud/web-based ambulatory EHR segment is expected to account for a larger share of the U.S. ambulatory EHR market. This segment’s large market share can be attributed to the benefits of cloud/web-based ambulatory EHR systems, including lower upfront costs, automated data backups, reduced maintenance requirements, and quicker deployment.

Based on the application, in 2024, the practice management segment is expected to account for the largest share of the U.S. ambulatory EHR market.

Based on end user, the hospital-owned ambulatory centers segment is projected to register the highest growth rate during the forecast period.

Key factors driving the growth of this market include increasing government support for the adoption of EHR solutions, patients’ increasing preference for ambulatory care over in-patient care, and healthcare organizations’ growing need to reduce operating costs.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies and the changing technological landscape in developing countries are expected to create growth opportunities for market stakeholders.

The key players operating in the U.S. ambulatory EHR market are Greenway Health (U.S.), CureMD Healthcare (U.S.), AdvancedMD, Inc. (U.S.), Kareo, Inc. (U.S.), CompuGroup Medical Inc. (U.S.), Athenahealth, Inc. (U.S.), Nextgen Healthcare Inc. (U.S.), and eClinicalWorks LLC (U.S.).

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: May-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates