Resources

About Us

Transformers Market by Type (Power, Distribution, Instrument, Special Application), Cooling Method (Liquid-immersed, Dry-type), and Application (Utilities, Industrial, Renewables, Railways) – Global Forecast to 2036

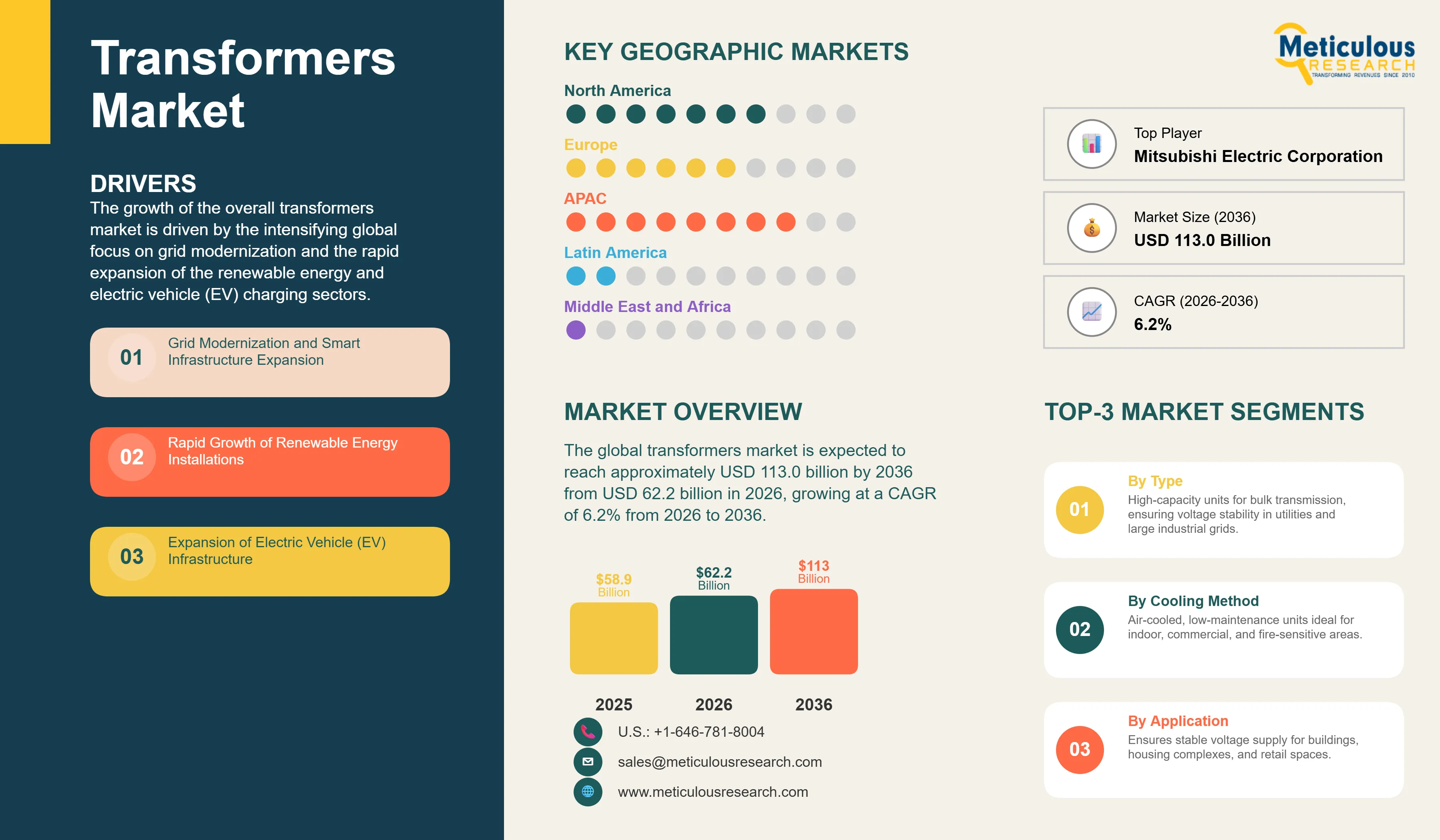

Report ID: MREP - 1041793 Pages: 272 Feb-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global transformers market was valued at USD 58.9 billion in 2025. The market is expected to reach approximately USD 113.0 billion by 2036 from USD 62.2 billion in 2026, growing at a CAGR of 6.2% from 2026 to 2036. The growth of the overall transformers market is driven by the intensifying global focus on grid modernization and the rapid expansion of the renewable energy and electric vehicle (EV) charging sectors. As utilities seek to integrate more functionality into smaller, smarter, and more resilient grid substrates, advanced power equipment has become essential for maintaining high-speed signal integrity and mechanical durability. The rapid expansion of the 5G-enabled smart grid infrastructure and the increasing need for high-density interconnect solutions in offshore wind farms and advanced driver-assistance systems (ADAS) for grid monitoring continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Transformers are critical interconnection systems used to provide electrical connectivity while allowing for mechanical flexibility and space-saving designs throughout the power grid assembly process. These systems include power, distribution, instrument, and special application transformers, which are designed to withstand repeated electrical stress and fit into non-linear environments. The market is defined by high-efficiency materials such as biodegradable ester fluids and advanced copper alloys, which significantly enhance thermal stability and signal performance in high-frequency applications. These systems are indispensable for manufacturers seeking to optimize their internal grid architecture and meet aggressive carbon reduction targets.

The market includes a diverse range of configurations, ranging from simple distribution transformers for basic residential sensors to complex multilayer HVDC systems for high-performance offshore wind and medical imaging facilities. These systems are increasingly integrated with advanced components such as embedded sensors and ultra-thin insulation foils to provide services such as high-speed data routing and improved heat dissipation. The ability to provide stable, high-precision connectivity while minimizing physical footprint has made advanced transformers the technology of choice for industries where space efficiency and reliability are paramount.

The global energy sector is pushing hard to modernize production capabilities, aiming to meet AI-driven hardware and IoT connectivity targets. This drive has increased the adoption of high-density flexible circuits in grid monitoring, with advanced mSAP (modified Semi-Additive Process) techniques helping to stabilize production yields for ultra-fine line features in smart meters. At the same time, the rapid growth in the electric vehicle and autonomous driving markets is increasing the need for high-reliability, vibration-resistant power solutions.

Manufacturers across the power industry are rapidly shifting to AI-optimized hardware, moving well beyond traditional circuit designs toward high-speed, low-loss digital setups. Hitachi Energy’s latest high-layer count grid automation modules deliver significantly higher data throughput for AI servers, while Siemens Energy’s recent installations have slashed signal interference in 5G-enabled smart substations. The real game-changer comes with “smart” transformers featuring integrated sensors and shielding capabilities that maintain peak performance even in electromagnetically noisy environments. These advancements make high-precision power management practical and cost-effective for everyone from energy tech startups to global utility giants chasing autonomous grid excellence and lower system weight.

Innovation in eco-efficient and ultra-thin hybrid systems is rapidly driving the transformers market, as grid components become more compact and multi-functional. Equipment suppliers are now designing units that combine the structural integrity of rigid transformers with the versatility of flexible digital controls in a single assembly, saving valuable internal space and simplifying assembly logistics. These systems often involve advanced laser drilling and plasma etching capable of handling ultra-fine pitches without compromising mechanical strength or electrical reliability.

At the same time, growing focus on sustainable energy is pushing manufacturers to develop transformer solutions tailored to circular economy principles. These systems help reduce material waste through additive manufacturing processes and the use of recyclable substrates. By combining high-density interconnectivity with robust environmental performance, these new designs support both technological advancement and corporate sustainability, strengthening the resilience of the broader energy value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 113.0 Billion |

|

Market Size in 2026 |

USD 62.2 Billion |

|

Market Size in 2025 |

USD 58.9 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 6.2% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Cooling Method, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A key driver of the transformers market is the rapid movement of the global energy industry toward smaller, more portable, and highly functional grid devices. Global utility demand for sleek substations, smart meters, and health-monitoring grid patches has created significant incentives for the adoption of advanced power circuitry. The trend toward “invisible” technology and the integration of electronics into grid clothing and medical patches drive manufacturers toward scalable solutions that transformers can uniquely provide. It is estimated that as utility adoption of IoT-enabled sensors rises and grid diagnostic tools become more decentralized through 2036, the need for robust, bendable circuitry increases significantly; therefore, multilayer and rigid-flex systems, with their ability to ensure high-density packaging, are considered a crucial enabler of modern grid design strategies.

The rapid growth of the electric vehicle market and autonomous grid driving technologies provides great opportunities for the transformers market. Indeed, the global surge in EV production has created a compelling demand for systems that can replace heavy wire harnesses and integrate seamlessly into battery management systems (BMS). These applications require high reliability, thermal resistance, and the ability to handle high-vibration environments, all attributes that are met with advanced power circuits. The EV infrastructure market is set to expand significantly through 2036, with transformers poised for an expanding share as utilities seek to maximize operational range and minimize system weight. Furthermore, the increasing demand for ADAS sensors and infotainment displays is stimulating demand for modular power solutions that provide high-speed data transmission and design flexibility.

The power transformers segment accounts for a significant portion of the overall transformers market in 2026. This is mainly attributed to the versatile use of this technology in supporting high-speed power transmission and complex circuitry within extremely tight spaces, such as in premium industrial and high-performance utility modules. These systems offer the most comprehensive way to ensure signal integrity across diverse high-frequency applications. The utility and industrial sectors alone consume a large share of power transformer production, with major projects in Asia Pacific and North America demonstrating the technology’s capability to handle high-density interconnect requirements. However, the distribution transformers segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for robust interconnections in smart grids, medical implants, and aerospace systems.

Based on application, the utilities segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of electricity transmission and the rigorous design standards required for modern grid devices. Current large-scale manufacturing plants are increasingly specifying high-density power circuits to ensure compliance with global performance standards and consumer expectations for thinner, lighter devices.

The renewable energy segment is expected to witness the fastest growth during the forecast period. The shift toward vehicle electrification and the complexity of autonomous sensor suites are pushing the requirement for advanced power systems that can handle varied temperatures and mechanical stresses while ensuring absolute reliability for safety-critical energy systems.

The liquid-immersed segment commands the largest share of the global transformers market in 2026. This dominance stems from its superior thermal stability, chemical resistance, and excellent mechanical properties, making it the substrate of choice for high-performance power circuits. Large-scale operations in aerospace, automotive, and high-end industrial electronics drive demand, with advanced films from suppliers like Hitachi and Siemens enabling reliable performance in extreme environments.

However, the dry-type segment is poised for steady growth through 2036, fueled by expanding applications in low-cost transport goods and simple membrane switches. Manufacturers face mounting pressure to optimize costs for high-volume, less demanding applications, where PET provides a cost-effective alternative for basic power connectivity.

Asia Pacific holds the largest share of the global transformers market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world’s largest power manufacturing hubs, particularly in China, India, and Japan. China alone accounts for a significant portion of global transformer production, with its position as a leading exporter of high-end equipment driving sustained growth. The presence of leading manufacturers like TBEA and a well-developed power supply chain provides a robust market for both standard and high-density power solutions.

North America and Europe together account for a substantial share of the global transformers market. The growth of these markets is mainly driven by the need for technological modernization in the aerospace, defense, and medical sectors. The demand for advanced power systems in North America is mainly due to its large-scale defense projects and the presence of innovators like GE Vernova and Eaton.

In Europe, the leadership in power engineering and the push for medical technology innovation are driving the adoption of high-reliability power circuits. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating smart power solutions into industrial automation and advanced healthcare devices to ensure the highest levels of performance and reliability.

The companies such as Hitachi Energy, Siemens Energy AG, GE Vernova, and Schneider Electric SE lead the global transformers market with a comprehensive range of power and distribution solutions, particularly for large-scale utilities and high-speed applications. Meanwhile, players including ABB Ltd., Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, and Eaton Corporation plc focus on specialized multilayer and high-density circuits targeting the automotive, medical, and aerospace sectors. Emerging manufacturers and integrated players such as Hyundai Electric & Energy Systems Co., Ltd., Bharat Heavy Electricals Limited (BHEL), and TBEA Co., Ltd. are strengthening the market through innovations in mSAP technology and modular power platforms.

The global transformers market is expected to grow from USD 62.2 billion in 2026 to USD 113.0 billion by 2036.

The global transformers market is projected to grow at a CAGR of 6.2% from 2026 to 2036.

Power transformers are expected to dominate the market in 2026 due to their superior ability to support high-density circuitry and high-speed signals in premium utility devices. However, Distribution transformers are projected to be the fastest-growing segment owing to their increasing adoption in smart grids, medical devices, and aerospace applications where both rigidity and flexibility are required.

AI and 5G are transforming the transformers landscape by demanding higher signal integrity, lower latency, and improved thermal management. These technologies drive the adoption of advanced materials like LCP and ultra-thin copper foils, enabling transformer manufacturers to support the complex routing and high-frequency requirements of next-generation AI servers and 5G infrastructure.

Asia Pacific holds the largest share of the global transformers market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world’s largest power manufacturing hubs in China, India, and Japan. North America and Europe together account for a substantial share, driven by high-end applications in aerospace, defense, and medical electronics.

The leading companies include Hitachi Energy, Siemens Energy AG, GE Vernova, Schneider Electric SE, and ABB Ltd.

Published Date: Jan-2026

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates