Resources

About Us

Tertiary Water and Wastewater Treatment Technologies Market by Type (Membrane Filtration, UV Radiation, Chlorination, Ozonization, Activated Carbon, and Ion Exchange), Application (Municipal and Industrial), and Geography - Global Forecast to 2031

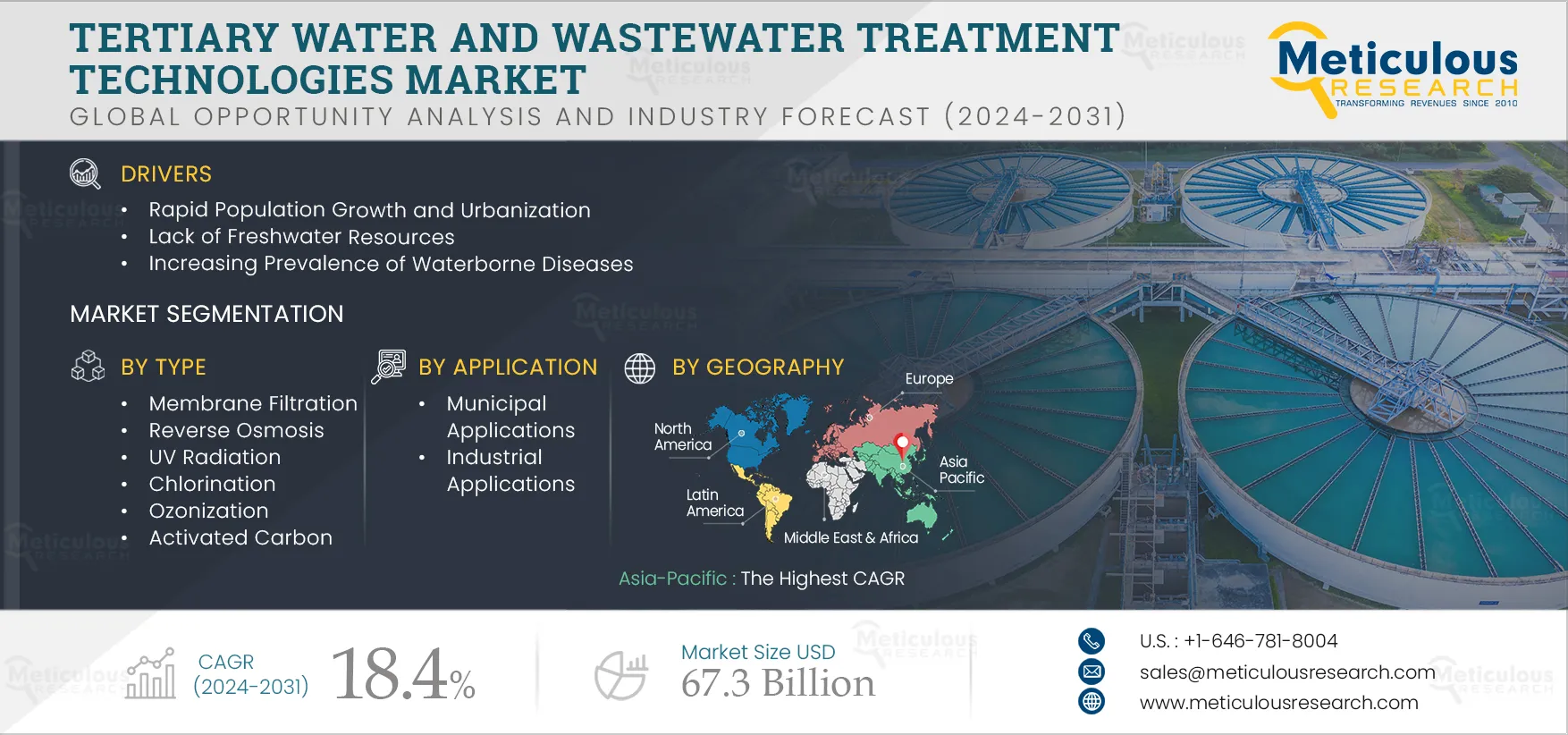

Report ID: MRICT - 104491 Pages: 300 Mar-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Tertiary Water and Wastewater Treatment Technologies Market is projected to reach $67.3 billion by 2031, at a CAGR of 18.4% from 2024 to 2031. The growth of this market is attributed to the rapid population growth and urbanization, lack of freshwater resources, and increasing prevalence of waterborne diseases. However, high installation, maintenance, and operating costs restrain market growth. The growing demand for energy-efficient and advanced water treatment technologies is expected to create significant opportunities for this market. However, upgrading and repairing aging water infrastructure pose challenges to market growth.

The global tertiary water and wastewater treatment technologies market is segmented by type, application, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

The key players profiled in the global tertiary water and wastewater treatment technologies market study include Suez Environment S.A. (France), Veolia Environment SA (France), Xylem, Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), Evoqua Water Technologies Corporation (U.S.), 3M Company, Inc. (U.S.), Pentair plc (U.K.), Calgon Carbon Corporation (U.S.), Kurita Water Industries, Ltd. (Japan), Bio-Microbics, Inc. (U.S.), ASIO, spol. s r.o. (Czech Republic), Scinor Water America, LLC (U.S.), Elgressy Engineering Services Ltd. (Israel), Outotec Oyj (Finland), Blue Eden CleanTech Solutions, Inc. (Canada), Membracon Ltd. (U.K.), Lamor Corporation Ab (Finland), and Ozone Tech Systems (Sweden).

Click here to: Get Free Sample Pages of this Report

According to the United Nations’ World Water Development Report (WWDR4), as the global demand for water increases, freshwater availability in many regions is likely to decrease because of climate change. Water is the driving force of nature; unfortunately, supplies are now running dry at an alarming rate. The world’s population continues to soar, but freshwater supplies have not increased in the same proportion.

Demographic pressures, the rate of economic development, urbanization, and pollution are all creating unprecedented pressure on the world’s water resources. According to the World Resources Institute, in August 2023, 25 countries were exposed to extremely high water stress, as they use over 80% of their renewable water supply for irrigation, livestock, industry, and domestic needs. The WRI data shows Bahrain, Cyprus, Kuwait, Lebanon, Oman, and Qatar are the most water-stressed countries. The water stress in these countries is mostly driven by low supply, paired with demand from domestic, agricultural, and industrial use. Furthermore, the Middle East and North Africa are the most water-stressed regions, where 83% of the population is exposed to extremely high water stress, and South Asia, where 74% of the population is exposed. There is a rapidly surging demand for water, and it is projected to overshoot the supply by 40% in the next 20 years.

Water treatment strategies help alleviate water scarcity across various industries in the residential and industrial sectors. Treated wastewater can be used for washing cars, irrigating landscapes, industrial processing, and flushing toilets. Water treatment technologies such as desalination are used for saline water. The treatment process aims at obtaining fresh drinking water from salty ocean waters or groundwater with high salt concentrations that make them unsuitable for human consumption. Thus, owing to the limited availability of water resources and the growing demand for potable water due to the increasing population and urbanization, the adoption of tertiary water and wastewater treatment technologies is expected to grow during the forecast period.

Based on type, the global tertiary water and wastewater treatment technologies market is segmented into membrane filtration, reverse osmosis, ultraviolet (UV) radiation, chlorination, ozonization, activated carbon, ion exchange, electrochemical water treatment technology, and other treatment technologies. The membrane filtration segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is mainly attributed to the rising health awareness among consumers, growing emphasis on reducing the usage of chemicals in water treatment, and effective purification and reduced cost of operations offered by membrane filtration technology.

Membrane filtration technology is used to separate and purify specific components from the rest of the mixture. Membranes are becoming increasingly popular in producing potable drinking water from the ground, surface, and seawater sources and the tertiary (advanced) treatment of wastewater and desalination. Over the last decade, membrane filtration has been among the most used technologies for water treatment. Different types of membranes allow the passage of solutes and other elements depending on their nature, ionic charge, or size. Reverse osmosis (RO) membranes, microfiltration (MF) membranes, ultrafiltration (UF) membranes, and nanofiltration (NF) membranes are widely used in tertiary water and wastewater treatments.

Based on application, the global tertiary water and wastewater treatment technologies market is segmented into municipal and industrial. The industrial segment is expected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to increasing industrialization and urbanization, declining freshwater resources, increasing energy demand across the globe, and a rising focus on water quality and public health. The increasing prevalence of water-borne diseases, growth in industrial demand, and stringent governmental regulations on treating industrial wastewater also support the growth of this market.

Based on geography, the global tertiary water and wastewater treatment technologies market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to register the highest CAGR of the tertiary water and wastewater treatment technologies market. Asia-Pacific’s high growth is attributed to the region’s rapid population growth and urbanization, rising demand for the advanced treatment of residential water, advancements in membrane technology, increased environmental deterioration, limited availability of water resources, and public sector organizations’ increasing investments in water infrastructure.

|

Particular |

Details |

|

Number of Pages |

300 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

18.4% |

|

Estimated Market Size (Value) |

$67.3 billion by 2031 |

|

Segments Covered |

By Type

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, France, Poland, Switzerland, Sweden, Belgium, Denmark, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Indonesia, Australia, Malaysia, Vietnam, Philippines, Singapore, Taiwan, New Zealand, Rest of Asia-Pacific), Latin America (Brazil, Chile, Argentina, Rest of Latin America, and the Middle East & Africa (Saudi Arabia, United Arab Emirates, Kuwait, Iran, South Africa, Rest of the Middle East & Africa). |

|

Key Companies |

Suez Environment S.A. (France), Veolia Environment SA (France), Xylem, Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), Evoqua Water Technologies Corporation (U.S.), 3M Company, Inc. (U.S.), Pentair plc (U.K.), Calgon Carbon Corporation (U.S.), Kurita Water Industries, Ltd. (Japan), Bio-Microbics, Inc. (U.S.), ASIO, spol. s r.o. (Czech Republic), Scinor Water America, LLC (U.S.), Elgressy Engineering Services Ltd. (Israel), Outotec Oyj (Finland), Blue Eden CleanTech Solutions, Inc. (Canada), Membracon Ltd. (U.K.), Lamor Corporation Ab (Finland), and Ozone Tech Systems (sweden) |

The global tertiary water and wastewater treatment technologies market is segmented based on type, application, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

The global tertiary water and wastewater treatment technologies market is projected to reach $67.3 billion by 2031, at a CAGR of 18.4% from 2024 to 2031.

In 2024, the membrane filtration segment is expected to account for the largest share of the tertiary water and wastewater treatment technologies market.

Based on application, in 2023, the municipal segment is expected to account for the largest share of the tertiary water and wastewater treatment technologies market.

This market's growth is attributed to rapid population growth and urbanization, a lack of freshwater resources, and the increasing prevalence of waterborne diseases. Moreover, the growing demand for energy-efficient and advanced water treatment technologies is expected to create significant opportunities for this market.

The key players profiled in the global tertiary water and wastewater treatment technologies market study include Suez Environment S.A. (France), Veolia Environment SA (France), Xylem, Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), Evoqua Water Technologies Corporation (U.S.), 3M Company, Inc. (U.S.), Pentair plc (U.K.), Calgon Carbon Corporation (U.S.), Kurita Water Industries, Ltd. (Japan), Bio-Microbics, Inc. (U.S.), ASIO, spol. s r.o. (Czech Republic), Scinor Water America, LLC (U.S.), Elgressy Engineering Services Ltd. (Israel), Outotec Oyj (Finland), Blue Eden CleanTech Solutions, Inc. (Canada), Membracon Ltd. (U.K.), Lamor Corporation Ab (Finland), and Ozone Tech Systems (Sweden).

In 2024, Asia-Pacific is expected to register the highest CAGR of the tertiary water and wastewater treatment technologies market. Asia-Pacific’s high growth is attributed to the region’s rapid population growth and urbanization, rising demand for the advanced treatment of residential water, advances in membrane technology, increased environmental deterioration, limited availability of water resources, and public sector organizations’ increasing investments in water infrastructure.

1. Introduction

1.1 Market Definition & Scope

1.2 Currency & Limitations

1.2.1 Currency

1.2.2 Limitations

2. Research Methodology

2.1 Research Approach

2.2 Process of Data Collection and Validation

2.2.1 Secondary Research

2.2.2 Process of Data Collection and Validation

2.3 Market Sizing and Forecast

2.3.1 Market Size Estimation Approach

2.3.1.1 Bottom-up Approach

2.3.1.2 Top-down Approach

2.3.2 Growth Forecast Approach

2.4 Assumption for the Study

3. Executive Summary

3.1 Overview

3.2 Market Analysis, by Type

3.3 Market Analysis, by Application

3.4 Market Analysis, by Geography

4. Market Insights

4.1 Overview

4.2 Factors Affecting Market Growth

4.3 Drivers

4.3.1 Rapid Population Growth and Urbanization

4.3.2 Lack of Freshwater Resources

4.3.3 Increasing Prevalence of Waterborne Diseases

4.4 Restraints

4.4.1 High Installation, Maintenance, and Operating Costs

4.5 Opportunities

4.5.1 Growing Demand for Energy-efficient and Advanced Water Treatment Technologies

4.6 Challenges

4.6.1 Upgrading and Repairing Aging Water Infrastructure

4.7 Value Chain Analysis

4.8 Case Study

4.9 Porters Five Forces Model

5. Global Tertiary Water and Wastewater Treatment Technologies Market Assessment, by Type

5.1 Overview

5.2 Membrane Filtration

5.3 Reverse Osmosis

5.4 Ultraviolet (UV) Radiation

5.5 Chlorination

5.6 Ozonization

5.7 Activated Carbon

5.8 Ion Exchange

5.9 Electrochemical Water Treatment Technology

5.10 Other Treatment Technologies

6. Global Tertiary Water and Wastewater Treatment Technologies Market Assessment, by Application

6.1 Overview

6.2 Municipal Applications

6.3 Industrial Applications

6.3.1 Manufacturing

6.3.2 Pharmaceuticals and Chemicals

6.3.3 Power

6.3.4 Energy

6.3.5 Pulp and Paper

6.3.6 Mining

6.3.7 Petrochemicals

6.3.8 Semiconductors

6.3.9 Other Industrial Applications

7. Tertiary Water and Wastewater Treatment Technologies Market Assessment, by Geography

7.1 Overview

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Asia-Pacific

7.3.1 China

7.3.2 Japan

7.3.3 South Korea

7.3.4 India

7.3.5 Indonesia

7.3.6 Australia

7.3.7 Malaysia

7.3.8 Vietnam

7.3.9 Philippines

7.3.10 Singapore

7.3.11 Taiwan

7.3.12 New Zealand

7.3.13 Rest of Asia-Pacific

7.4 Europe

7.4.1 Germany

7.4.2 U.K.

7.4.3 France

7.4.4 Italy

7.4.5 Spain

7.4.6 France

7.4.7 Poland

7.4.8 Switzerland

7.4.9 Sweden

7.4.10 Belgium

7.4.11 Denmark

7.4.12 Rest of Europe

7.5 Latin America

7.5.1 Brazil

7.5.2 Chile

7.5.3 Argentina

7.5.4 Rest of Latin America

7.6 Middle East & Africa

7.6.1 Saudi Arabia

7.6.2 United Arab Emirates (UAE)

7.6.3 Kuwait

7.6.4 Iran

7.6.5 South Africa

7.6.6 Rest of the Middle East & Africa

8. Competition Analysis

8.1 Overview

8.2 Key Growth Strategies

8.2.1 Market Differentiators

8.2.2 Synergy Analysis: Major Deals & Strategic Alliances

8.3 Competitive Benchmarking

8.4 Competitive Dashboard

8.4.1 Industry Leaders

8.4.2 Market Differentiators

8.4.3 Vanguards

8.4.4 Emerging Companies

8.5 Market Share Analysis, by Key Players, 2023

9. Company Profiles

9.1 Key Players (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

9.1.1 Suez Environment S.A.

9.1.2 Veolia Environment SA

9.1.3 Xylem, Inc.

9.1.4 DuPont de Nemours, Inc.

9.1.5 Evoqua Water Technologies Corporation

9.1.6 3M Company, Inc.

9.1.7 Pentair plc

9.1.8 Calgon Carbon Corporation (Part of Kuraray Co., Ltd.)

9.1.9 Kurita Water Industries, Ltd.

9.1.10 Bio-Microbics, Inc.

(Note: SWOT Analysis of Top 5 Companies Will be Provided)

9.2 Other Players (Business Overview and Product Portfolio)

9.2.1 ASIO, spol. s r.o.

9.2.2 Scinor Water America, LLC

9.2.3 Elgressy Engineering Services Ltd.

9.2.4 Outotec Oyj

9.2.5 Blue Eden CleanTech Solutions, Inc.

9.2.6 Ozone Tech Systems (Part of Melllifiq Ab)

9.2.7 Lamor Corporation Ab

9.2.8 Membracon Ltd.

10. Appendix

10.1 Related Reports

10.2 Available Customization

List of Tables

Table 1 Global Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 2 Global Tertiary Water and Wastewater Treatment Technologies Market for Membrane Filtration, by Country/Region, 2022–2031 (USD Million)

Table 3 Global Tertiary Water and Wastewater Treatment Technologies Market for Reverse Osmosis, by Country/Region, 2022–2031 (USD Million)

Table 4 Global Tertiary Water and Wastewater Treatment Technologies Market for Ultraviolet Radiation, by Country/Region, 2022–2031 (USD Million)

Table 5 Global Tertiary Water and Wastewater Treatment Technologies Market for Chlorination, by Country/Region, 2022–2031 (USD Million)

Table 6 Global Tertiary Water and Wastewater Treatment Technologies Market for Ozonization, by Country/Region, 2022–2031 (USD Million)

Table 7 Global Tertiary Water and Wastewater Treatment Technologies Market for Activated Carbon, by Country/Region, 2022–2031 (USD Million)

Table 8 Global Tertiary Water and Wastewater Treatment Technologies Market for Ion Exchange, by Country/Region, 2022–2031 (USD Million)

Table 9 Global Tertiary Water and Wastewater Treatment Technologies Market for Electrochemical Water Treatment, by Country/Region, 2022–2031 (USD Million)

Table 10 Global Tertiary Water and Wastewater Treatment Technologies Market for Other Treatment, by Country/Region, 2022–2031 (USD Million)

Table 11 Global Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 12 Global Municipal Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 13 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 14 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 15 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Manufacturing, by Country/Region, 2022–2031 (USD Million)

Table 16 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Pharmaceuticals and Chemicals, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Power, by Country/Region, 2022–2031 (USD Million)

Table 18 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Energy, by Country/Region, 2022–2031 (USD Million)

Table 19 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Pulp and Paper, by Country/Region, 2022–2031 (USD Million)

Table 20 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Mining, by Country/Region, 2022–2031 (USD Million)

Table 21 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Petrochemicals, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Semiconductors, by Country/Region, 2022–2031 (USD Million)

Table 23 Global Industrial Tertiary Water and Wastewater Treatment Technologies Market for Other Industrial Applications, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 25 Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 26 Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 27 Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 28 Asia-Pacific: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 29 China: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 30 China: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 31 China: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 32 Japan: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 33 Japan: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 34 Japan: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 35 South Korea: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 36 South Korea: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 37 South Korea: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 38 India: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 39 India: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 40 India: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 41 Indonesia: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 42 Indonesia: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 43 Indonesia: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 44 Australia: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 45 Australia: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 46 Australia: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 47 Malaysia: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 48 Malaysia: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 49 Malaysia: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 50 Philippines: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 51 Philippines: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 52 Philippines: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 53 Singapore: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 54 Singapore: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 55 Singapore: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 56 Taiwan: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 57 Taiwan: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 58 Taiwan: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 59 New Zealand: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 60 New Zealand: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 61 New Zealand: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 62 Rest of Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 63 Rest of Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 64 Rest of Asia-Pacific: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 65 Europe: Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 66 Europe: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 67 Europe: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 68 Europe: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 69 Germany: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 70 Germany: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 71 Germany: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 72 U.K.: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 73 U.K.: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 74 U.K.: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 75 France: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 76 France: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 77 France: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 78 Italy: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 79 Italy: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 80 Italy: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 81 Spain: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 82 Spain: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 83 Spain: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 84 France: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 85 France: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 86 France: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 87 Poland: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 88 Poland: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 89 Poland: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 90 Switzerland: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 91 Switzerland: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 92 Switzerland: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 93 Sweden: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 94 Sweden: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 95 Sweden: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 96 Belgium: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 97 Belgium: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 98 Belgium: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 99 Denmark: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 100 Denmark: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 101 Denmark: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 102 Rest of Europe: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 103 Rest of Europe: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 104 Rest of Europe: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 105 North America: Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 106 North America: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 107 North America: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 108 North America: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 109 U.S.: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 110 U.S.: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 111 U.S.: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 112 Canada: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 113 Canada: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 114 Canada: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 115 Latin America: Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 116 Latin America: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 117 Latin America: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 118 Latin America: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 119 Brazil: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 120 Brazil: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 121 Brazil: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 122 Chile: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 123 Chile: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 124 Chile: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 125 Argentina: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 126 Argentina: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 127 Argentina: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 128 Rest of Latin America: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 129 Rest of Latin America: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 130 Rest of Latin America: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 131 Middle East & Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Country/Region, 2022–2031 (USD Million)

Table 132 Middle East & Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 133 Middle East & Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 134 Middle East & Africa: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 135 Saudi Arabia: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 136 Saudi Arabia: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 137 Saudi Arabia: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 138 United Arab Emirates: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 139 United Arab Emirates: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 140 United Arab Emirates: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 141 Kuwait: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 142 Kuwait: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 143 Kuwait: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 144 Iran: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 145 Iran: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 146 Iran: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 147 South Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 148 South Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 149 South Africa: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 150 Rest of the Middle East & Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

Table 151 Rest of the Middle East & Africa: Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Table 152 Rest of the Middle East & Africa: Industrial Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD Million)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 Global Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2022–2031 (USD

Figure 11 Global Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2022–2031 (USD Million)

Figure 12 Global Tertiary Water and Wastewater Treatment Technologies Market, by Geography, 2022–2031 (USD Million)

Figure 13 Impact Analysis: Global Tertiary Water and Wastewater Treatment Technologies Market

Figure 14 Global Tertiary Water and Wastewater Treatment Technologies Market, by Type, 2024 Vs. 2031 (USD Million)

Figure 15 Global Tertiary Water and Wastewater Treatment Technologies Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 16 Global Tertiary Water and Wastewater Treatment Technologies Market, by Region, 2024 Vs. 2031 (USD Million)

Figure 17 North America: Tertiary Water and Wastewater Treatment Technologies Market Snapshot

Figure 18 Europe: Tertiary Water and Wastewater Treatment Technologies Market Snapshot

Figure 19 Asia-Pacific: Tertiary Water and Wastewater Treatment Technologies Market Snapshot

Figure 20 Growth Strategies Adopted by Leading Market Players (2021–2024)

Figure 21 Vendor Market Positioning Analysis (2022–2024)

Figure 22 Competitive Dashboard: Global Tertiary Water and Wastewater Treatment Technologies Market

Figure 23 Financial Overview (2021–2023): Suez Environnement S.A.

Figure 24 Financial Overview (2021–2023): Veolia Environnement S.A.

Figure 25 Financial Overview (2021–2023): Xylem, Inc.

Figure 26 Financial Overview (2021–2023): Dupont De Nemours, Inc.

Figure 27 Financial Overview (2021–2023): Evoqua Water Technologies Corporation

Figure 28 Financial Overview (2021–2023): 3M Company, Inc.

Figure 29 Financial Overview (2021–2023): Pentair plc

Figure 30 Financial Overview (2021–2023): Kurita Water Industries Ltd.

Figure 31 Financial Overview (2021–2023): Kuraray Co., Ltd.

Figure 32 Financial Overview (2021–2023): Outotec Oyj

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates