Resources

About Us

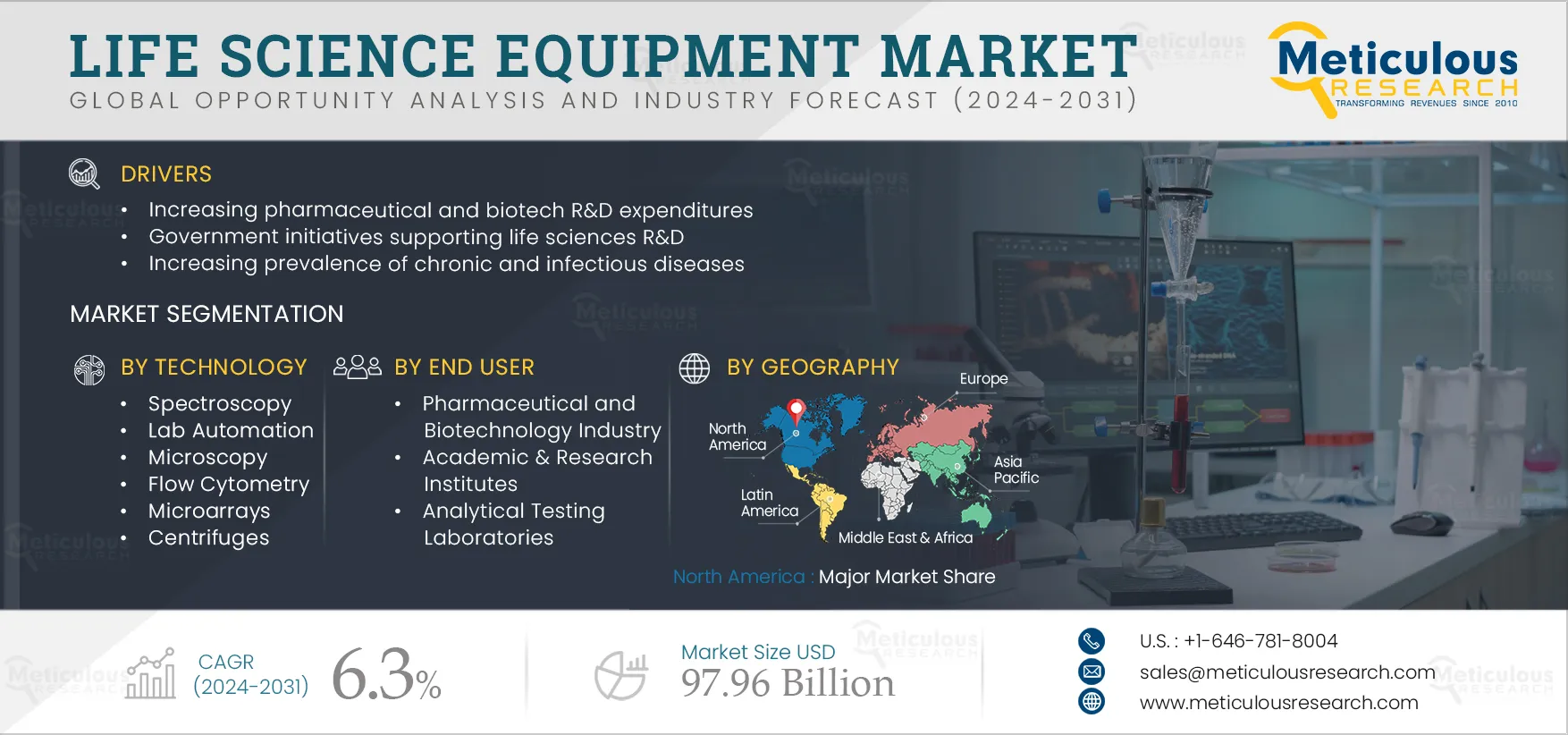

Life Science Equipment Market Size, Share, Forecast, & Trends Analysis By Technology (Spectroscopy, Microscopy, Chromatography (HPLC, GC, TLC), PCR, Immunoassay, Sequencing, Flow Cytometry, Microarray, Centrifuge) End User – Global Forecast to 2031

Report ID: MRHC - 10445 Pages: 686 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the life science equipment market is attributed to increasing pharmaceutical and biotech R&D expenditures, government initiatives supporting life sciences R&D, the increasing prevalence of chronic and infectious diseases, and growth in initiatives to control environmental pollution.

Furthermore, the growth in genomics and proteomics, the increasing awareness and growing adoption of personalized medicines, increasing automation and digitalization in the life sciences industry, and the increasing focus on food safety and quality are generating growth opportunities for the players operating in this market.

Increasing funding and investment in the life sciences industry, including pharmaceuticals, biotechnology, medical devices, and diagnostics, is critical for driving innovation, advancing research and development, and improving patient outcomes. There has been a growing investment trend in the life sciences sector, which includes pharmaceuticals, biotechnology, agriculture, and diagnostics. This investment comes from various sources, such as governments, associations, and private funding from venture capitalists, which has led to the significant growth of the sector. For instance, in 2022, the investments and funding by venture capitalists in biotech and pharma companies in the U.S. increased to USD 30.7 billion from USD 18.7 billion in 2019 (Source: National Venture Capital Association). The increase in funding and investments drives the growth of the life sciences industry, driving the adoption of laboratory equipment used in life sciences laboratories. These investments and funding can support research and development efforts to develop new and improved laboratory equipment with enhanced features, capabilities, and performance. This can include innovations in areas such as automation, data analysis, sample preparation, and miniaturization, leading to the introduction of new products and technologies in the market.

Thus, the increasing funding level in the life science industry is increasing the demand for technologically advanced laboratory equipment to support R&D in the life science industry.

Click here to: Get Free Sample Pages of this Report

Such initiatives supporting life sciences R&D are expected to drive the growth of the life sciences and laboratory equipment market.

In recent years, laboratories have increased their focus on automating workflows to boost efficiency and accelerate research. Manual processes are highly prone to human error. Laboratory automation ensures high precision and prevents human-introduced errors. Some robotic automation workstations are equipped with robotic arms and sophisticated software that ensure high precision and consistent dispensing of liquids.

Sample preparation is the most critical part of any laboratory experiment. Robotic laboratory automation systems can now be used for preparing samples and handling tasks such as pipetting, centrifugation, and mixing of substances. In fields like proteomics and genomics, where vast numbers of samples need processing, robots ensure that no sample is left unprocessed and that results are reproducible every time.

HPLC is among the most widely used analytical techniques in separation applications. The technique is routinely applied in various research and industrial laboratories. Advancements in HPLC systems have enabled better separation of components in shorter timespans. These advancements facilitate higher separation efficiency with lower column back pressures, reduced solvent consumption, high-speed analysis, detection, and quantification of substances at low levels, separation over wider temperature ranges, availability of almost the complete pH range for analysis, greater mechanical robustness of packed columns, and longer lifespans and large sample load capacities of columns. Recent technology trends in the HPLC segment include advances in stationary phases, column switching, the development of miniaturized HPLC systems, and Ultra-Performance Liquid Chromatography (UPLC).

Genomics, the study of the complete set of genes of an organism, relies on DNA sequencing technologies. With advancements in DNA sequencing technologies and reduced costs, there has been a significant increase in demand for DNA sequencing in genomics research, clinical diagnostics, and personalized medicine. This has created a growing need for high-throughput DNA sequencers, sample preparation equipment, and data analysis tools, providing opportunities for the manufacturers and suppliers of laboratory equipment.

Similarly, proteomics, the study of the entire set of proteins in an organism, is a rapidly growing field with applications in drug discovery, biomarker research, and diagnostics. Proteomics research often requires complex equipment for protein separation, identification, and characterization, such as mass spectrometers, protein analyzers, and protein purification systems. As proteomics research advances, there will be a growing demand for specialized laboratory equipment for proteomics applications, providing opportunities for market players to develop and supply such equipment.

Based on technology the life science equipment market is segmented into spectroscopy, microscopy, chromatography, lab automation, immunoassay analyzers, PCR, sequencing, flow cytometry, incubators, microarray, centrifuges, electrophoresis, and other equipment. In 2024, the spectroscopy segment is expected to account for the largest share of 21.9% the life science equipment market. Several factors have contributed to the significant market share of this segment, including its wide range of applications, high precision and sensitivity, advancements in technology, and large user base. Spectroscopy plays a crucial role in life sciences research and analysis, with applications in pharmaceuticals, biotechnology, food and beverage, environmental testing, and clinical diagnostics. Techniques such as UV-Vis spectroscopy, infrared spectroscopy, Raman spectroscopy, and nuclear magnetic resonance (NMR) spectroscopy are widely used for qualitative and quantitative analysis of molecules, material characterization, and chemical structure determination, making spectroscopy an indispensable tool in various life sciences research areas.

However, the sequencing segment is expected to grow at the highest CAGR of 13.5% during forecast period of 2024-2031. The capability of sequencing technology to generate high-yield error-free throughput, the growing integration of this technology in clinical and research settings, and increasing partnerships and collaborations among sequencing instrument manufacturers to expand and improve product offerings are some of the factors contributing to the growth of the segment.

Based on end user the life science equipment market is segmented into pharmaceutical and biotechnology industry, academic & research institutes, hospitals and diagnostic laboratories, analytical testing laboratories, agriculture and food industry, forensic laboratories, and other end users. In 2024, the pharmaceutical and biotechnology industry segment is expected to account for the largest share of 31.9% of the life science equipment market. The large market share of this segment can be attributed to the significant investments in research and development (R&D) activities, quality control testing for drugs and biologics manufactured, innovation and technological advancements, large budget allocations for R&D and manufacturing, and growth in pharma and biotech industry globally. Pharmaceutical companies and biotech companies invest heavily in R&D activities for the development of new drugs, therapies, and technologies. These R&D activities require advanced laboratory equipment for various stages of drug discovery, preclinical and clinical research, and quality control. As a result, pharmaceutical and biotech companies have a high demand for life sciences and laboratory equipment, including instruments for genomics, proteomics, chromatography, and spectroscopy.

However, the hospitals & diagnostic laboratories segment is expected to grow at the highest CAGR of 7.1% during the forecst period of 2024 to 2031. The growth of this segment is attributed to the the growth in diagnostic laboratories and initiatives to increase diagnostic capabilities of the hospitals due to the pandemic and adoption of newer technologies by the hospitals.

In 2024, North America is expected to account for the share of 41.1% of the life science equipment market. North America’s major market share is attributed to the presence of key market players, its well-established life science industry, growing life sciences sector-based research, the presence of many key vendors in this region, and substantial spending on R&D activities by pharmaceutical and biotech companies. For instance, according to EFPIA, in 2020, the pharmaceutical R&D expenditure of the U.S. was USD 72,412 million, which increased from 64,357 million in 2019. Thus, the rising R&D expenditure is expected to contribute to the largest market share of North America.

However, Asia-Pacific is expected to grow at the highest CAGR of 7.3% during the forecst period of 2024 to 2031. The growth of this region is attributed to the by rising healthcare and R&D expenditures, increasing pharmaceutical research outsourcing in the region owing to lower cost advantages, increasing government funding, and improving healthcare infrastructure. In addition, the significantly growing pharmaceutical, biotechnology, and medical devices industry in Asia, primarily due to the huge demand for medical care from a large population base with increasing incidence & prevalence of chronic disease and the aging population.

The report offers a competitive landscape based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them in the last three to four years. The key players profiled in the life science equipment report are Agilent Technologies, Inc. (U.S.), Becton, Dickinson, and Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), F. Hoffmann LA-Roche AG (Switzerland), PerkinElmer, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Bruker Corporation (U.S.), Shimadzu Corporation (Japan), Siemens Healthineers AG (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), and QIAGEN N.V. (Netherlands).

|

Particular |

Details |

|

Page No |

686 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

6.3% |

|

2031 Market Size (Value) |

$97.96 billion |

|

Segments Covered |

By Technology

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea Rest of APAC), Latin America (Brazil, Mexico, Rest of LATAM), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Key Companies |

Agilent Technologies, Inc. (U.S.), Becton, Dickinson, and Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), F. Hoffmann LA-Roche AG (Switzerland), PerkinElmer, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Bruker Corporation (U.S.), Shimadzu Corporation (Japan), Siemens Healthineers AG (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), and QIAGEN N.V. (Netherlands). |

This study offers a detailed assessment of the life science equipment market, including the market sizes & forecasts for market segments such as technology and end user. The study also provides an in-depth analysis of various segments & subsegments of life science equipment at the regional and country levels.

The life science equipment market is projected to reach by 2031, at a CAGR of during the forecast period.

In 2024, the spectroscopy segment is expected to account for the largest share. The wide range of applications, high precision and sensitivity, advancements in technology, and large user base contribute to the large market share of this segment.

Based on end user, the hospitals and diagnostic laboratories segment is expected to grow with the highest CAGR due to growth in the number of hospitals and diagnostic laboratories and initiatives to increase diagnostic capabilities of the hospitals due to the emergence of sudden pandemic situations.

The growth of this market is attributed to several factors, including increasing funding and investment in the pharma, biotech, and life science industries, government initiatives to strengthen R&D for biotech and life sciences, rising prevalence of chronic diseases, and growing clinical capabilities globally. Additionally, the growth in genomics and proteomics, increasing awareness, growing adoption of personalized medicine, and emerging economies are expected to provide significant opportunities for players operating in the market.

The key players profiled in the life science equipment study are Agilent Technologies, Inc. (U.S.), Becton, Dickinson, and Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), PerkinElmer, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Waters Corporation (U.S.), Bruker Corporation (U.S.), Shimadzu Corporation (Japan), Siemens Healthineers (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), and QIAGEN N.V. (Germany).

In 2024, North America is expected to dominate the life science equipment market. North America’s major market share is attributed to the presence of key market players, the well-established life science industry, and substantial spending on R&D activities by pharmaceutical and biotech companies.

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates