Resources

About Us

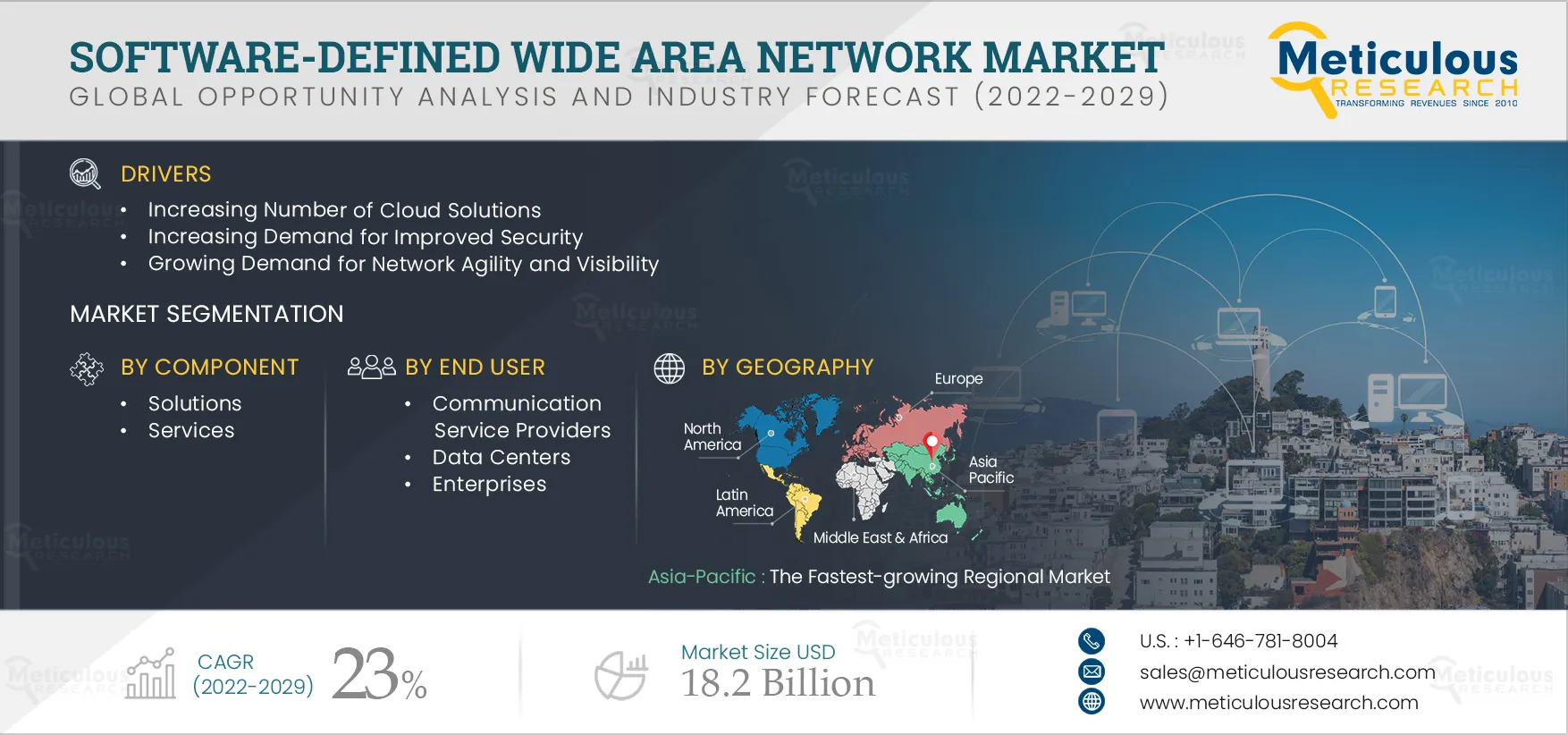

Software-Defined Wide Area Network (SD-WAN) Market by Component, Organization Size, Deployment Mode, End User (Communication Service Providers, Data Centers, and Enterprises), and Geography—Global Forecast to 2029

Report ID: MRICT - 104701 Pages: 230 Nov-2022 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the increasing number of cloud solutions, the rising demand for internet broadband connections to replace more expensive solutions, the increasing demand for improved security, and the growing need for network agility and visibility.

However, the reliability issues in SD-WAN may restrain the market’s growth. The increasing proliferation of SD-WAN solutions to automate operations to simplify workflows and the rising demand for connecting data centers and multiple offices are expected to offer significant growth opportunities for the stakeholders in the software-defined wide area network market.

Furthermore, the concerns over SD-WAN security and the lack of standards for software-defined networking are expected to pose challenges to the growth of the SD-WAN market.

The latest trends in the global software-defined wide area network market are the move to hybrid or multi-cloud environments, firewall as a service, and secure access service edge.

The COVID-19 pandemic created several challenges for the software-defined wide area network market due to the lockdowns imposed during the second and third quarters of 2020. The pandemic lowered consumers' financial potential, which decreased the sales of SD-WAN services and solutions. However, in 2021, many enterprises, data centers, and communication service providers started recovering from the economic setbacks triggered by the pandemic. The COVID-19 pandemic moderately impacted the SD-WAN market due to delayed and postponed orders for SD-WAN solutions; however, it started recovering rapidly in the last quarter of 2020.

Click here to: Get Free Sample Copy of this report

Increasing Number of Cloud Solutions to Fuel the Market Growth

SD-WAN is the ideal solution for deploying, managing, and monitoring cloud WAN. It helps deliver network and security services within a cloud WAN (or cloud network). Cloud Managed SD-WAN solutions offer notable benefits such as operational infrastructure support & maintenance, reduced operational risks, reduced service startup costs, and provides customized control and visibility.

In recent years, there has been an increase in the adoption of multi-cloud and SaaS applications. The growing demand for agile, secure, and reliable direct connectivity, the increasing popularity of cloud-managed network and security functions, and the rising need to reduce bandwidth and operational costs are driving the demand for cloud-based SD-WAN solutions, subsequently driving the growth of the SD-WAN market.

Furthermore, the increasing emphasis by leading SD-WAN providers to launch cloud-based SD-WAN solutions is improving their market demand. For instance, in 2022, Nokia Corporation (Finland) and stc (Saudi Arabia) launched a managed SD-WAN solution, stc SD-WAN, based on Nuage Networks from Nokia Virtualized Network Services (VNS) platform. Additionally, in 2020, Fortinet, Inc. (U.S.) partnered with Equinix (U.S.) to accelerate cloud connectivity with the addition of Fortinet secure SD-WAN on Equinix’s network edge. Such developments are expected to drive the demand for cloud-based SD-WAN solutions and contribute to the growth of the software-defined wide area network market.

Based on Component, in 2022, the Solutions Segment is Expected to Dominate the market

Based on component, in 2022, the solutions segment is expected to account for the largest share of the global SD-WAN market. The large market share of this segment is attributed to the growing demand for cloud-based SD-WAN solutions, the rising popularity of SD-WAN solutions among large enterprises, and the increasing demand for SD-WAN solutions from large telecommunication service providers, data centers, and campus environments to solve challenges such as operational complexity, slow service delivery, and lack of visibility across both physical and virtual networks.

Based on Deployment Mode, the Cloud-based Deployment Segment is Expected to Register the Higher CAGR During the Forecast Period

In 2022, the cloud-based deployment segment is expected to register the higher CAGR during the forecast period. The rising need to manage complex network requirements, the need to reduce initial and working expenses for infrastructures, and heavy investments from enterprises to accelerate their SD-WAN infrastructure with cloud-based deployment are expected to support the growth of this segment. Several organizations are gradually transitioning to cloud infrastructure, a trend that is expected to grow in the coming years. The benefits of cloud infrastructure, such as ease of adoption, minimal requirement for in-house infrastructure, high scalability, and easy installation of SD-WAN solutions, support the growth of the cloud-based segment.

Based on Organization Size, the Large Enterprises Segment is Expected to Register the Higher CAGR During the Forecast Period

In 2022, the large enterprises segment is expected to register the higher CAGR during the forecast period. The growing demand for SD-WAN solutions by large telecommunication service providers and large data centers and campus environments to solve challenges such as operational complexity, slow service delivery, and lack of visibility across both physical and virtual networks is expected to support the growth of this segment.

Asia-Pacific: The Fastest-growing Regional Market

Asia-Pacific is projected to register the highest CAGR. The rapid growth of software-defined wide area network solutions & services in the urban population is due to growing economies in the region, such as China, India, and Japan. The increasing demand for SD-WAN solutions for reducing infrastructure and operational costs, the growing demand for SD-WAN solutions by mobile phone operators across emerging economies such as China, Japan, and India, and the presence of well-established SD-WAN providers are supporting the market’s growth in the region. Furthermore, the increasing deployments of SDN and NFV by regional enterprises and the rising demand for a broad range of value-added network services contribute to the growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2022. The key players operating in the software-defined wide area network market include Cisco Systems, Inc.(U.S.), VMware, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Nokia Corporation (Finland), Hewlett Packard Enterprise Development LP (U.S.), Tata Communications (India), Huawei Technologies Co., Ltd.(China), Fortinet Inc. (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), NEC Corporation (Japan), Oracle Corporation (U.S.), Adaptiv Networks Inc. (Canada), Riverbed Technology Inc. (U.S.), Silver Peak Systems Inc. (U.S.), and Aryaka Networks Inc. (U.S.).

Scope of the Report:

Software-Defined Wide Area Network Market, by Component

Software-Defined Wide Area Network Market, by Organization Size

Software-Defined Wide Area Network Market, by Deployment Mode

Software-Defined Wide Area Network Market, by End User

Software-Defined Wide Area Network Market, by Geography

Key questions answered in the report:

The global software-defined wide area network market is projected to reach $18.2 billion by 2029, at a CAGR of 23% during the forecast period.

Based on end user, in 2022, the enterprises segment is expected to account for the largest share of the global software-defined wide area network market. The large market share of this segment is mainly attributed to the growing demand to automate routine workflows and processes of data centers and the increasing need to reduce repetitive or mundane tasks, speed up processes, and drive down overhead.

The cloud-based deployment segment is projected to register the highest CAGR during the forecast period due to the high preference for cloud-based deployments among large enterprises, the increasing need for cloud-based retail SD-WAN solutions for processing large amounts of customer data, surging demand to manage complex network requirements, and the necessity to reduce initial and working expenses for infrastructures.

The growth of this market is driven by the increasing number of cloud solutions, the rising demand for internet broadband connections to replace more expensive solutions, the increasing demand for improved security, and the high demand for network agility and visibility.

Furthermore, the increasing proliferation of SD-WAN solutions to automate operations to simplify workflows and the rising demand for connecting data centers and multiple offices are expected to offer significant growth opportunities for the stakeholders in the software-defined wide area network market.

The key players operating in the global software-defined wide area network market include Cisco Systems, Inc. (U.S.), VMware, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Nokia Corporation (Finland), Hewlett Packard Enterprise Development LP (U.S.), Tata Communications (India), Huawei Technologies Co., Ltd. (China), Fortinet Inc. (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), NEC Corporation (Japan), Oracle Corporation (U.S.), Adaptiv Networks Inc. (Canada), Riverbed Technology Inc. (U.S.), Silver Peak Systems Inc. (U.S.), and Aryaka Networks Inc. (U.S.).

At present, North America dominates the global software-defined wide area network market. However, Germany, Japan, China, India, South Korea, the Netherlands, and the U.K. are expected to witness strong growth in demand for software-defined wide area network solutions & services in the coming years.

Published Date: Aug-2025

Published Date: May-2025

Published Date: Jan-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates