Resources

About Us

Latin America Software-Defined Wide Area Network (SD-WAN) Market by Component, Organization Size, Deployment Mode, End User, and Country—Regional Forecast to 2035

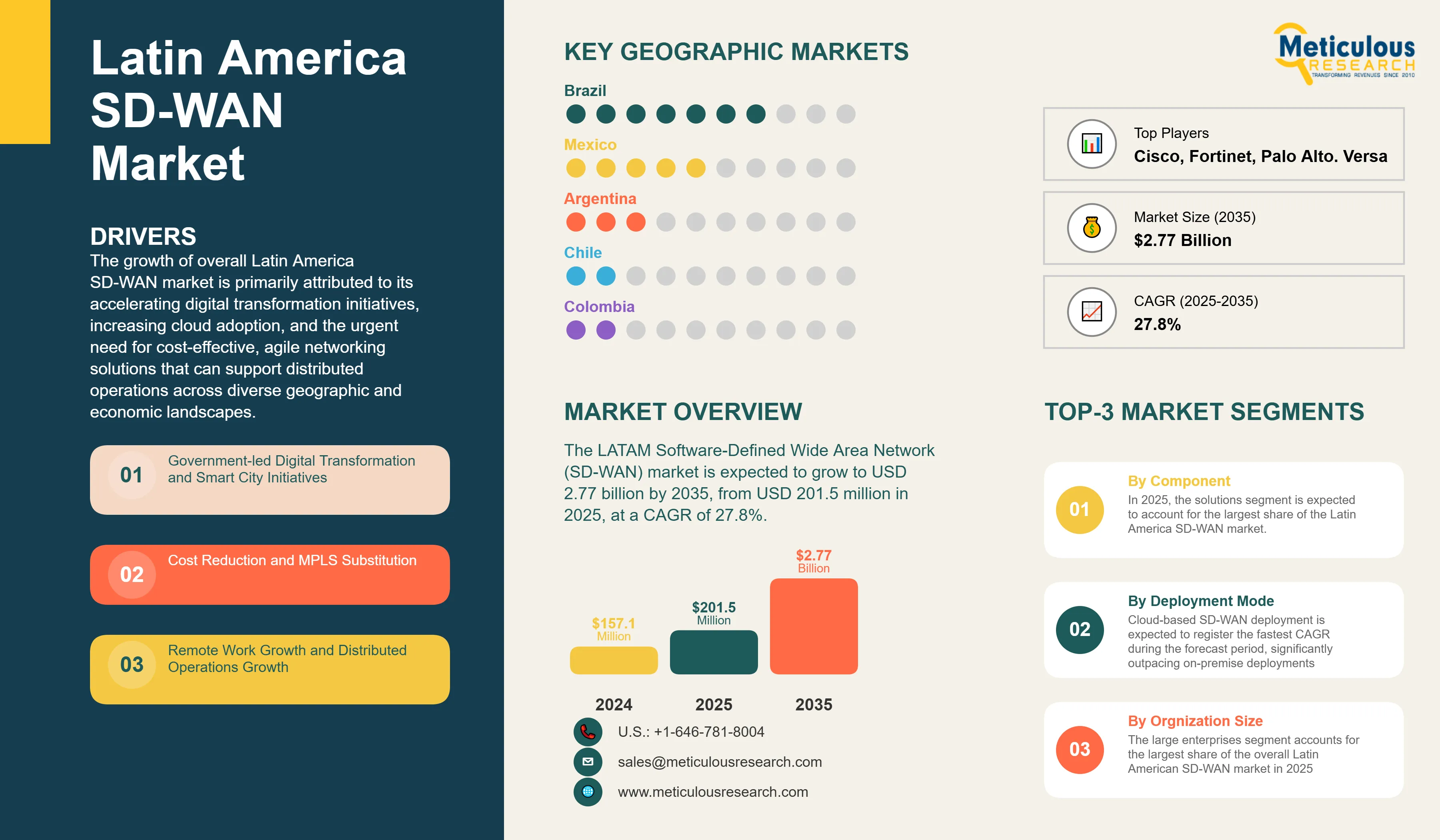

Report ID: MRICT - 1041540 Pages: 185 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of overall Latin America SD-WAN market is primarily attributed to its accelerating digital transformation initiatives, increasing cloud adoption, and the urgent need for cost-effective, agile networking solutions that can support distributed operations across diverse geographic and economic landscapes.

Competitive Landscape

The Latin America SD-WAN market is characterized by the presence of global technology leaders and well-established regional service providers. Global vendors Cisco, VMware, and Fortinet lead the way in terms of the technology stack used in SD-WAN implementations. Meanwhile, regional telecommunications giants such as América Móvil, Telefónica, and Embratel are using strategic partnerships with global vendors to provide local markets with managed SD-WAN services. The combination of global technologies and regional services is paving new pathways to innovation, which provides new opportunities for tailor-made solutions that contend with the connectivity characteristics of the varied Latin American markets.

For instance, Brazilian telecommunications leader Embratel is a case-in-point with respect to this evolving partnership-based approach, deploying NSX SD-WAN infrastructure, powered by VeloCloud, to provide unified cloud-connectivity throughout Brazil. Another success story includes Fortinet's implementation with Banco Fibra when banks transitioned to working remotely due to COVID, demonstrating secure SD-WAN solutions will be essential for business continuity and operated resilience in Latin America.

Recent Developments

Regional Infrastructure Modernization

Increasing Cloud Adoption

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting Latin America SD-WAN Market (2025–2035)

Base CAGR: 27.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Government Digital Transformation and Smart City Projects |

National digitalization programs launch |

Mature digital government ecosystems |

▲ +4.2% |

|

2. Cost Optimization and MPLS Migration |

Enterprises seek cost-effective alternatives |

Widespread MPLS replacement adoption |

▲ +3.8% |

|

|

3. Remote Work and Distributed Operations |

Hybrid work models become standard |

Fully distributed enterprise networks |

▲ +3.1% |

|

|

Restraints |

1. Infrastructure Limitations and Connectivity Issues |

Rural deployment challenges persist |

Improved regional infrastructure reduces impact |

▼ −2.1% |

|

2. Economic Volatility and Investment Uncertainty |

Currency fluctuations affect purchasing decisions |

Economic stabilization enables growth |

▼ −1.8% |

|

|

Opportunities |

1. Regional Trade Integration and Nearshoring |

Cross-border business operations increase |

Integrated regional digital economy |

▲ +3.5% |

|

2. 5G Infrastructure Rollout and Edge Computing |

Initial 5G deployments in major cities |

Comprehensive 5G-enabled edge networks |

▲ +2.8% |

|

|

Trends |

1. Managed Services and Outsourcing Preference |

Enterprises seek turnkey solutions |

Managed SD-WAN becomes standard delivery model |

▲ +1.9% |

|

2. Security Integration and SASE Adoption |

Security becomes integrated requirement |

Complete SASE platform implementations |

▲ +1.6% |

|

|

Challenges |

1. Regulatory Complexity and Cross-Border Compliance |

Varying national regulations complicate deployments |

Harmonized regional frameworks emerge |

▼ −1.2% |

Regional Analysis

Brazil: Market Leadership Through Telecommunications Innovation

Brazil is steadily taking a dominant position in the SD-WAN market in Latin America and is estimated to account for around 30-35% of the overall Latin American SD-WAN market in 2025. Its modern telecommunications infrastructure-bolstered with backing from firms like Embratel and digital transformation efforts by larger companies-is a rich environment for the SD-WAN. The government's drive toward the digital economy and Industry 4.0 initiatives further drives the demand in manufacturing, financial services, and the public sector.

Mexico: Strategic Location Drives Cross-Border Connectivity Demand

Mexico's location strategically positions it as a bridge connecting North and South America, combining with the nearshoring trends and benefits from USMCA trade, thus propelling the demand for reliable and high-performance networking solutions. Companies like América Móvil and TelMex are making huge capital investments into SD-WAN capabilities that support enterprises with cross-border operations and manufacturing facilities.

Argentina: Financial Services and Agricultural Technology Lead Adoption

Argentina's sophisticated financial services sector and growing agricultural technology market are driving SD-WAN adoption, particularly for organizations requiring secure, reliable connectivity between urban centers and rural operations. Economic challenges are accelerating the adoption of cost-effective SD-WAN solutions as alternatives to traditional MPLS networks.

Segmental Analysis

Solutions Segment Set to Lead Market Share In 2025

On the basis of component, the solutions segment is expected to hold the largest share of the Latin America SD-WAN in 2025, with around 60-70% share. The large share of this segment is mainly attributed to the increasing enterprise demand for software-based SD-WAN capabilities as they look to modernize with minimal investment in hardware. Solutions includes software and virtual appliances, and virtual SD-WAN solutions, in particular, are gaining traction in the region because they are inexpensive and easy to deploy.

The growth of the solutions segment indicates the more sophisticated approach on behalf of Latin American enterprises, as they are looking to software-defined solutions that are scalable and able to accommodate the varied infrastructure profiles of countries in the region. The current large technology providers (Cisco, VMware, Fortinet, etc.) are exploiting this opportunity and offering complete software that can be deployed in many interdependent network environments.

Cloud-Based Deployment Forecasted to Register the Highest Growth Rate

Based on deployment, cloud-based SD-WAN deployment is projected to register the highest CAGR of 31.8%, significantly higher than the on-premise deployment pace. This growth mainly driven by the growing need of Latin American enterprises to minimize upfront investments (i.e., physical and technical) while ensuring rapid deployment. The cloud-first approach fits well with regional economic realities and preferences for OPEX, or operational expenditure, instead of a capital expense commitment.

The cloud deployment model is especially attractive to small and medium enterprises in the region, as it minimizes the need for skilled local technical support, while the enterprise networking capabilities are available with a managed service provider. The economic development of large urban areas with improved internet infrastructure and better cloud connectivity also supports this trend.

Large enterprises lead current market adoption

The large enterprises segment accounts for the largest share of the overall Latin American SD-WAN market in 2025. The technical requirements and financial resources available to large enterprises (e.g., multinational corporations, regional banks, or large telecoms) make them especially attractive for SD-WAN implementations. Adoption remains particularly strong among large enterprises in banking, manufacturing, and retail, through multi-site installs with complicated networking requirements.

The small and medium enterprises (SME) segment is projected to see the highest CAGR during the forecast period, as SD-WAN becomes more readily accessible and affordable. Managed SD-WAN service availability is making SD-WAN service technology more accessible to smaller organizations that could not consider a capital investment in traditional WAN infrastructures.

IT & Telecommunications Sector Maintains Market Leadership

The IT and telecommunications end-user segment holds the largest share of around 35-40% of the overall SD-WAN market in Latin America in 2025. This is mainly due to the technical capabilities and performance and reliability requirements of these organizations for networking solutions when delivering their own service. Additionally, telecommunications providers are increasingly offering SD-WAN functionality in their networks as a managed service to customers, driving a continuous cycle of adoption and market growth.

While IT & telecommunications is the largest segment, the banking, financial services, and insurance (BFSI) end-user segment is continuing to be the fastest growing with a CAGR of 30.2% largely as a result of the shift to digital banking, expansion of new fintech capabilities, and regulatory requirements for secure and reliable connectivity across a distributed branch network. In this regard, the growth is accentuated for example in markets like Brazil and Mexico, where financial inclusion and digital payment initiatives are driving new networking requirements.

Report Specifications

|

Report Attribute |

Details |

|

Market size (2025) |

USD 201.5 million |

|

Revenue forecast in 2035 |

USD 2.77 billion |

|

CAGR (2025-2035) |

27.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Regional market size and forecast, competitive landscape, country-level analysis, digital transformation impact, growth drivers and market dynamics |

|

Segments covered |

Component (Solutions, Services), Organization Size (Large Enterprises, SMEs), Deployment Mode (On-premise, Cloud, Hybrid), End User (CSP, Data Centers, Enterprises) |

|

Country scope |

Brazil, Mexico, Argentina, Chile, Colombia, Peru, and Rest of Latin America |

|

Key companies profiled |

Cisco Systems; VMware/VeloCloud; Fortinet; Palo Alto Networks; Embratel; América Móvil; Telefónica; TelMex; Cirion Technologies; Flo Networks; Hughes; GTT Communications |

|

Customization |

Comprehensive report customization available with purchase. Country-specific analysis, additional market segments, and competitive intelligence can be tailored to specific requirements |

|

Pricing Details |

Flexible pricing options available to meet diverse research needs and budget requirements |

The Latin America SD-WAN market is projected to reach USD 2.77 billion by 2035, growing at a CAGR of 27.8% from USD 201.5 million in 2025, driven by digital transformation acceleration and cost optimization needs.

Brazil leads with 30-35% market share, followed by Mexico and Argentina, with these three countries accounting for majority of Latin America SD-WAN market share.

Cloud-based deployment dominates growth due to reduced infrastructure requirements and cost-effectiveness, while hybrid deployments are gaining traction among larger enterprises seeking operational flexibility.

Banking and financial services lead adoption, followed by IT and telecommunications, manufacturing, and government sectors, with fintech expansion creating new growth opportunities.

Global technology leaders partner with regional service providers to deliver localized solutions, with companies like Embratel-VMware and América Móvil-Cisco partnerships defining the competitive landscape.

Published Date: May-2025

Published Date: Mar-2024

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates