Resources

About Us

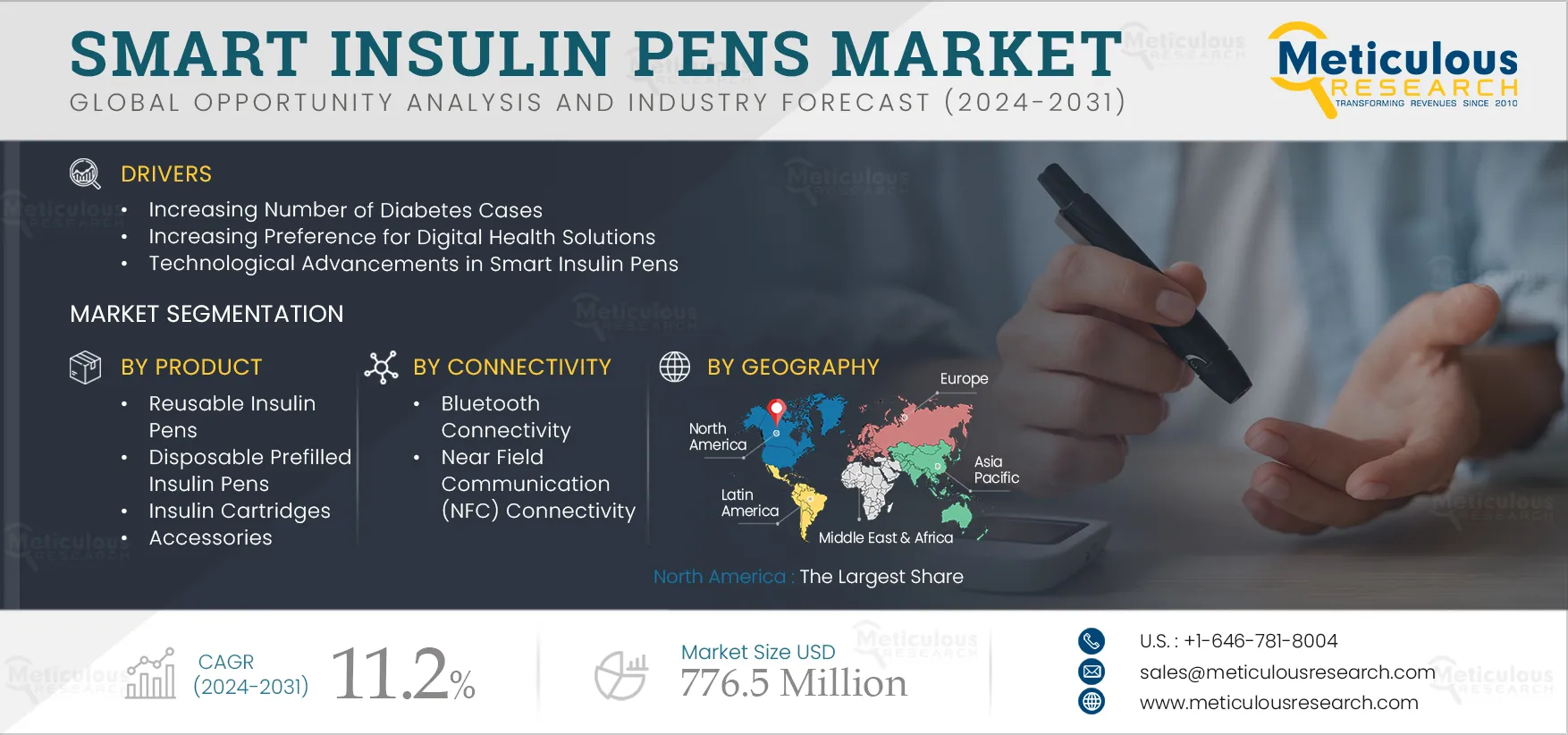

Smart Insulin Pens Market Size, Share, Forecast, & Trends Analysis by Product (Reusable, Disposable Prefilled, Cartridge) Connectivity (Bluetooth, NFC) Compatibility (Blood Glucose Monitor, CGM) Channel (Hospital, Retail, Online) - Global Forecast to 2032

Report ID: MRHC - 1041300 Pages: 270 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThis market's growth is being driven by a spike in diabetes cases, a preference for digital health solutions, technological advancements in smart insulin pens, an increase in demand for drug self-administration, and diabetes awareness initiatives. The expensive cost of smart insulin pens, along with the availability of alternatives, may limit market expansion.

Furthermore, rising demand for remote monitoring and telemedicine, partnerships and collaborations among smart insulin pen manufacturers, expanding economies, and personalized diabetes management are expected to create market growth. However, a lack of understanding about the use of smart insulin pens in developing nations, as well as a preference for traditional insulin delivery techniques, pose substantial challenges to the market's growth.

Moreover, the integration with Continuous Glucose Monitoring (CGM) systems is a prominent trend in the smart insulin pens market.

Diabetes, a chronic condition caused by lack of physical activity, being overweight, heredity, and lack of insulin in the body, is a significant driver of the smart insulin pens market. The increasing prevalence of diabetes, as reported by the International Diabetes Federation (IDF) and the Centers for Disease Control and Prevention (CDC), is expected to significantly impact the market.

In addition, in 2021, 61 million people lived with Type 2 Diabetes (T2D) in Europe. (Source: International Diabetes Federation (IDF)). Diabetes requires regular management and monitoring of insulin levels. Smart insulin pens automatically record when a person injects insulin, identifying the amount injected and the time of day. Thus, the rising prevalence of diabetes is driving the growth of the smart insulin pens market.

Click here to: Get Free Sample Pages of this Report

Technological advances in insulin delivery were restricted to insulin pump users, and traditional methods of insulin delivery, such as vials, syringes, and insulin pens, were unaffected by modern digital technologies. With the recent introduction of smart insulin pens, an increasingly wider population with diabetes is able to utilize a digital tool to simplify and improve insulin therapy.

Smart insulin pens offer several advantages over traditional insulin delivery systems, such as preventing skipping or missing scheduled doses, calculating each dose by utilizing the patient's current carbohydrate intake, blood glucose level, meal size, active insulin, and the parameters indicated by medical professionals, delivering diabetes data analysis to the doctor as required, and connecting with a smartphone and watch with established diabetes.

In addition, enhanced data tracking caps were approved and added to disposable insulin pens to track doses. For instance, in May 2021, Bigfoot Biomedical Inc. (U.S.) obtained FDA 510(k) clearance approval for the Bigfoot Unity diabetes management system, which includes linked smartpen caps for insulin pens used to treat type 1 and 2 diabetes. Such advances present an opportunity for the smart insulin pens market.

The demand for remote monitoring and telemedicine has increased rapidly after the pandemic as they reduce hospital visits, facilitate virtual consultations, and prevent the spread of viral diseases. Further, they help transmit patient-related data to physicians from remote places. Smart insulin pens are coupled with telemedicine platforms, permitting patients to transmit insulin usage information to their doctors during virtual visits. This data interchange allows doctors to modify insulin dosages, make accurate treatment decisions, and deliver personalized suggestions remotely.

In addition, remote monitoring technologies enable doctors and nurses to observe and track their patients’ health data, such as blood glucose levels, insulin use, and other important indicators. Smart insulin pens communicate and record insulin dose data, providing real-time insights. Further, remote monitoring and telemedicine eliminate geographical challenges, making medical treatments more accessible, particularly among people who have limited mobility and live in distant places. Smart insulin pens enhance this ability by allowing people to easily share their insulin results with doctors from their own homes. This easily accessible feature accelerates the adoption of smart insulin pens, creating an opportunity to market.

Various public-private organizations are focusing on partnerships and collaborations to assist people with diabetes management more easily and to enhance treatment outcomes. For instance:

In March 2024, Diabeloop SA (France) and Novo Nordisk A/S (Denmark) collaborated to integrate Novo Nordisk's NovoPen 6 and NovoPen Echo Plus, new-generation connected and reusable pens, with Diabeloop's DBL-4pen, a self-learning algorithm for Multiple Daily Injection (MDI) therapy. The integrated technology will be tested on people with Type 2 diabetes to assess its effectiveness and therapeutic benefits.

Thus, increasing partnerships and collaborations between the companies create an opportunity for the smart insulin pens market.

Integration with Continuous Glucose Monitoring (CGM) permits smart insulin pens to connect real-time insulin or blood sugar levels of a diabetic patient instantly from the CGM sensor. This real-time data allows people to make more informed choices about insulin doses. By integrating glucose levels with insulin administration, patients can modify their insulin doses depending on their present glucose levels, thereby improving glycemic control.

Furthermore, various companies are launching CGM-integrated smart insulin pen. For instance, in September 2024, Medtronic plc (Ireland) received the CE (Conformité Européenne) Mark approval for Simplera, continuous glucose monitors integrated with InPen smart insulin pen, to offer personalized, real-time dosing guidance to simplify diabetes management.

Based on product, the smart insulin pens market is segmented into reusable insulin pens, disposable prefilled insulin pens, insulin cartridges, and accessories. In 2025, the insulin cartridges segment is expected to account for the largest share of 63.3% of the smart insulin pens market. This segment’s large market share is attributed to the increasing number of diabetes cases and benefits offered by insulin cartridges, such as providing greater comfort and ease of use than standard vials and syringes. Pre-filled cartridges are readily put into insulin pens, making insulin administration easier for people with diabetes.

Moreover, this segment is also expected to register the highest CAGR of 12.5% during the forecast period.

Based on connectivity, the smart insulin pens market is segmented into Bluetooth connectivity and Near Field Communication (NFC) connectivity. In 2025, the Bluetooth connectivity segment is expected to account for the larger share of the smart insulin pens market. This segment’s large market share can be attributed to the benefits offered by Bluetooth connectivity in smart insulin pens, such as the ability to connect and send information to mobile applications, the long range of connectivity, and the ability to provide insulin recommendations through the integration of CGM systems.

Based on glucose monitor compatibility, the smart insulin pens market is segmented into Blood Glucose Monitors (BGMs) compatible pens and Continuous Glucose Monitors (CGMs) compatible pens. In 2025, the Blood Glucose Monitors (BGMs) compatible pens segment is expected to account for the larger share of the smart insulin pens market. This segment's substantial share of the market is due to the benefits that BGMs provide over CGMs, such as lower cost, no need to connect equipment to the body, and no need to implant sensors into the user's skin.

Based on purchase channel, the smart insulin pens market is segmented into hospital pharmacies, retail pharmacies, and online/E-commerce platforms. In 2025, the retail pharmacies segment is expected to account for the largest share of 49.2% of the smart insulin pens market. This segment’s large market share is attributed to the availability of retail pharmacies in nearby areas and the opportunity for customers to inspect the product before making a purchase.

In 2025, North America is expected to account for the largest share of 35% of the smart insulin pens market, followed by Europe and Asia-Pacific. North America’s significant market share can be attributed to several key factors, including the presence of major smart insulin pens companies such as Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), and Medtronic plc (Ireland), increasing healthcare expenditure, rising demand for self-administration of drugs, technological advancements in smart insulin pens, and rising number of diabetes cases in this region are some of the major factors driving the growth of the region.

Moreover, the market in Asia-Pacific is expected to register the highest CAGR of 12.1% during the forecast period. The rise of this regional market can be ascribed to increased knowledge of smart insulin pens, diabetes awareness campaigns in countries such as China and India, and improved healthcare infrastructure.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the smart insulin pens market are Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Sanofi S.A. (France), Medtronic plc (Ireland), Emperra GmbH E-Health Technologies (Germany), pendiq GmbH (Germany), Jiangsu Delfu medical device Co., Ltd (China), Tandem Diabetes Care, Inc. (U.S.), Ypsomed AG (Switzerland), and Bigfoot Biomedical, Inc. (U.S.).

In February 2024, Innovation Zed Ltd. (Ireland) received CE mark clearance in Europe for its InsulCheck Dose insulin pen, which provides real-time injection event data to a matching display device.

In December 2022, BIOCORP (France) received FDA 510(K) authorization to market Mallya, a smart medical device that connects insulin pens.

|

Particulars |

Details |

|

Number of Pages |

270 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

11.2% |

|

Market Size (Value) |

USD 776.5 Million by 2032 |

|

Segments Covered |

By Product

By Connectivity

By Glucose Monitor Compatibility

By Purchase Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Austria, Netherlands, Rest of Europe) Asia–Pacific (Japan, China, India, South Korea, Australia, Rest of Asia–Pacific), Latin America, and Middle East & Africa |

|

Key Companies |

Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Sanofi S.A. (France), Medtronic plc (Ireland), Emperra GmbH E-Health Technologies (Germany), pendiq GmbH (Germany), Jiangsu Delfu medical device Co., Ltd (China), Tandem Diabetes Care, Inc. (U.S.), Ypsomed AG (Switzerland), and Bigfoot Biomedical, Inc. (U.S.), |

This study offers a detailed assessment of the smart insulin pens market sizes & forecasts based on product, connectivity, glucose monitor compatibility, and purchase channel. This report also involves the value analysis of various segments and subsegments of the smart insulin pens market at the regional and country levels.

The smart insulin pens market is expected to reach 776.5 million by 2032, at a CAGR of 11.2% during the forecast period.

Among the products covered in this report, in 2025, the insulin cartridges segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the increasing number of diabetes cases and benefits offered by insulin cartridges, such as providing greater comfort and simplicity of use than standard vials and syringes. Pre-filled cartridges are readily put into insulin pens, making insulin administration easier for people with diabetes.

Among the connectivity covered in this report, in 2025, the Bluetooth connectivity segment is expected to account for the largest share of the smart insulin pens market. The large market share of this segment can be attributed to the benefits offered by Bluetooth connectivity in smart insulin pens, such as the ability to connect and send information to mobile applications and the long range of connectivity, contributing to the significant market share of this segment.

The growth of this market is driven by the increasing number of diabetes cases, the increasing preference for digital health solutions, technological advancements in smart insulin pens, the increasing demand for drug self-administration, and increasing diabetes awareness programs.

Moreover, growing demand for remote monitoring and telemedicine, partnerships and collaborations by smart insulin pens companies, emerging economies, and personalized diabetes management are expected to create market growth opportunities.

The key players profiled in the smart insulin pens market report are Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Sanofi S.A. (France), Medtronic plc (Ireland), Emperra GmbH E-Health Technologies (Germany), pendiq GmbH (Germany), Jiangsu Delfu medical device Co., Ltd (China), Tandem Diabetes Care, Inc. (U.S.), Ypsomed AG (Switzerland), and Bigfoot Biomedical, Inc. (U.S.).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the growing awareness of diabetes, increasing demand for self-administration of drugs, and increasing number of diabetes cases in these countries.

Published Date: Oct-2024

Published Date: Jun-2024

Published Date: May-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates