Resources

About Us

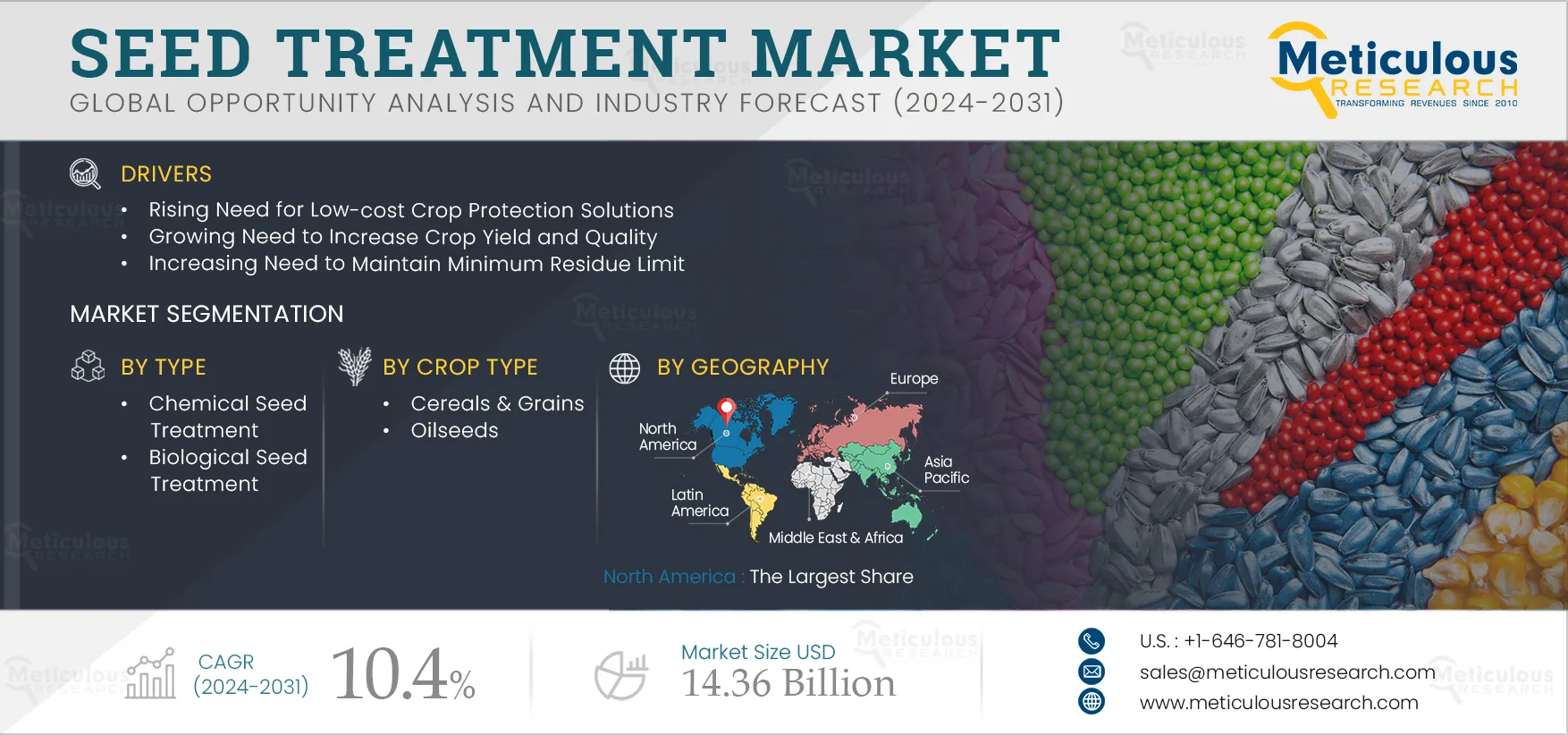

Seed Treatment Market by Type (Chemical {Insecticides}, Biological), Form (Liquid, Dry), Function (Seed Protection, Seed Enhancement), Application Technique (Seed Coating, Seed Dressing), Crop Type (Cereals & Grains, Oilseeds) - Global Forecast to 2031

Report ID: MRAGR - 104376 Pages: 415 Feb-2024 Formats*: PDF Category: Agriculture Delivery: 24 to 48 Hours Download Free Sample ReportThe market's expansion is fueled by the rising need for low-cost crop protection solutions, the growing need to increase crop yield and quality, and the increasing need to maintain minimum residue limit.

The growth of the market is also attributed to the advancements in seed treatment equipment, the rising costs of high-quality seeds (hybrid and GM seeds), the benefits offered by seed treatment, and the declining availability of agricultural land. However, challenges such as stringent and non-standardized regulations, financial hurdles for new entrants, restrictions on the use of neonicotinoids, and limited shelf-life of treated seeds hinder the market's growth to some extent.

The increasing focus on integrated pest management, the growing adoption of biological seed treatment, and the emergence of biodegradable seed coatings are further anticipated to generate opportunities for market growth. Nevertheless, the substantial challenges faced by stakeholders in this market are the complicated process of developing film coating for seed treatment and growing resistance to crop protection products.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 3-4 years. The key players profiled in the Seed Treatment Market research report are Bayer AG (Germany), Syngenta AG (Switzerland) (a part of China National Chemical Corporation/ChemChina), BASF SE (Germany), Corteva Inc. (U.S.), UPL Limited (India), Nufarm Limited (Australia), FMC Corporation (U.S.), Tagros Chemicals India Ltd. (India), Germains Seed Technology (U.K.) (Part of Associated British Foods Plc), Verdesian Life Sciences, LLC (U.S.), Novozymes A/S (Denmark), Valent BioSciences LLC (U.S.), Croda International Plc (U.K.), and Precision Laboratories, LLC (U.S.).

Click here to: Get Free Sample Pages of this Report

The world population is growing rapidly. According to the Department of Economic and Social Affairs (UN), the global population is expected to reach 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100. The growing global population places increased pressure on the world's resources to provide not only more but also different types of food. In addition to the increased demand, there has been a growing demand for nutrient-dense and residue-free food products due to rising health awareness, socio-economic changes, increased income, and rapid urbanization.

The agricultural sector plays a vital role in the stability of the global economy. The global demand and consumption of crops for food, feed, and fuel is increasing rapidly, subsequently driving the need to increase crop yield. Since crop yields are becoming increasingly important, the demand for cost-effective strategies to boost crop yields is also rising significantly. Furthermore, the declining availability of agricultural land has driven agricultural producers to become more efficient and productive to meet the global food demand.

According to the FAO, the demand for cereals for human consumption and animal feed is projected to reach 3 billion tonnes by 2050, an increase from 2.1 billion tonnes in 2018. In addition, the rising demand for biofuels will continue to exert upward pressure on commodity prices, affecting food security and poverty levels in developing countries. Thus, modern agricultural practices such as seed treatments with advanced technologies are necessary for breaking yield barriers and enhancing crop productivity to meet the global food demand while ensuring environmental safety.

Seed treatment helps in improving agriculture productivity as it protects the germinating seed and seedlings from seed-borne or soil-borne pathogenic organisms and storage insects. It also enables the uniform growth of crops in adverse conditions. These benefits increase the adoption of seed treatment globally, driving the growth of the global seed treatment market.

Based on type, the global seed treatment market is segmented into chemical seed treatment and biological seed treatment. In 2024, the chemical seed treatment segment is expected to account for the larger share of the global seed treatment market. The significant market share of this segment is primarily attributed to its increasing use in developing countries, ease of availability, high efficiency, and lower costs compared to biological products.

However, the biological seed treatment segment is expected to register the highest CAGR during the forecast period of 2024–2031 owing to the growing environmental and public health concerns regarding the use of chemical seed treatment, the increasing adoption of organic farming, the high demand for chemical residue-free agricultural products, and the initiatives by governments worldwide to promote the use of biological seed treatment.

Based on form, the global seed treatment market is segmented into liquid and dry. In 2024, the liquid segment is expected to account for the larger share of the global seed treatment market. The significant market share of this segment is primarily attributed to its high usage by farmers due to ease of handling, better seed coverage, better performance, and higher effective duration (up to 6 months) than dry form (up to 3 months).

However, the dry segment is expected to register the highest CAGR during the forecast period of 2024–2031 owing to the benefits of dry form, such as ease of use and storage and low cost.

Based on function, the global seed treatment market is segmented into seed protection and seed enhancement. In 2024, the seed protection segment is expected to account for the larger share of the global seed treatment market. The large market share of this segment is mainly attributed to factors such as low cost, ease of handling, non-injurious to seed under prolonged storage, increasing effectiveness against all diseases, and compatibility with inoculants.

Based on application technique, the global seed treatment market is segmented into seed coating, seed dressing, and seed pelleting. In 2024, the seed coating segment is expected to account for the largest share of the global seed treatment market. The large market share of this segment is mainly attributed to the increasing need to protect seeds from external factors, such as fungi, parasites, pathogens, and extreme temperatures.

However, the seed dressing segment is expected to register the highest CAGR during the forecast period of 2024–2031, owing to the increasing development of seed dressing products and its growing preference in developed countries.

Based on crop type, the global seed treatment market is segmented into cereals & grains, oilseeds, and other crops. In 2024, the cereals & grains segment is expected to account for the largest share of the global seed treatment market. The large market share of this segment is mainly attributed to the growing need to increase cereal & grain production, minimize cereal & grain loss due to pests and diseases, and their increasing use in animal feed, biofuel, and starch & ethanol production.

Based on geography, the global seed treatment market is majorly segmented into North America, Europe, East Asia, South & Southeast Asia, Australasia, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of the global seed treatment market. The significant market share in this sector can be attributed to the growing demand for high-yielding and disease-tolerant crops from domestic markets and export destinations. Moreover, factors such as an organized distribution chain for crop protection chemicals, the availability of water and land, entrepreneurial farmers, the growing awareness about sustainable crop production techniques to lessen environmental impact, and the presence of a large number of stakeholders support the growth of this market in the region.

In addition, the enhancing agronomic trends that comprise the development of high-quality seeds through the enhanced potential offered by genetically modified organisms (GMOs), changes in climatic conditions, flexibility in sowing approaches, and greater pressure from regulatory requirements support the growth of this regional market.

|

Particular |

Details |

|

Number of Pages |

~415 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

10.4% |

|

Estimated Market Size (Value) |

$14.36 Billion by 2031 |

|

Estimated Market Size (Volume) |

NA |

|

Segments Covered |

By Type

By Form

By Function

By Application Technique

By Crop Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, Italy, Spain, U.K., and Rest of Europe), East Asia (China, Japan, South Korea, and Rest of East Asia), South & Southeast Asia (India, Indonesia, and Rest of South & Southeast Asia), Australasia, Latin America (Brazil, Argentina, Mexico, Chile and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Bayer AG (Germany), Syngenta AG (Switzerland) (a part of China National Chemical Corporation/ChemChina), BASF SE (Germany), Corteva Inc. (U.S.), UPL Limited (India), Nufarm Limited (Australia), FMC Corporation (U.S.), Tagros Chemicals India Ltd. (India), Germains Seed Technology (U.K.) (Part of Associated British Foods Plc), Verdesian Life Sciences, LLC (U.S.), Novozymes A/S (Denmark), Valent BioSciences LLC (U.S.), Croda International Plc (U.K.), and Precision Laboratories, LLC (U.S.) |

Seed treatment refers to the application of chemical or biological products (products with active ingredients, such as living microbes, plant extracts, fermentation products, and phytohormones) to the seed before sowing to suppress, control or repel pathogens, insects, and other pests, that attack seeds, seedling, or plants. Seed treatment helps enhance healthy and vigorous plant growth, resulting in better yields.

The global seed treatment market study provides valuable insights, market sizes, and forecasts in terms of both value and volume by type and geography. However, the study provides insights, market sizes, and forecasts only in terms of value based on form, application technique, crop type, and function.

The global seed treatment market is projected to reach $14.36 billion by 2031, at a CAGR of 10.4% during the forecast period.

Based on form, the dry segment is expected to witness the fastest growth during the forecast period of 2024–2031.

o Rising Need for Low-cost Crop Protection Solutions

o Growing Need to Increase Crop Yield and Quality

o Increasing Need to Maintain Minimum Residue Limit

o Advancements in Seed Treatment Equipment

o Rising Costs of High-quality Seeds (Hybrid and GM Seeds)

o Benefits Offered by Seed Treatment

o Declining Availability of Agricultural Land

o Stringent and Non-standardized Regulations

o Financial Hurdles for New Entrants

o Restrictions on the Use of Neonicotinoids

o Limited Shelf-life of Treated Seeds

The key players operating in the seed treatment market are Bayer AG (Germany), Syngenta AG (Switzerland) (a part of China National Chemical Corporation/ChemChina), BASF SE (Germany), Corteva Inc. (U.S.), UPL Limited (India), Nufarm Limited (Australia), FMC Corporation (U.S.), Tagros Chemicals India Ltd. (India), Germains Seed Technology (U.K.) (Part of Associated British Foods Plc), Verdesian Life Sciences, LLC (U.S.), Novozymes A/S (Denmark), Valent BioSciences LLC (U.S.), Croda International Plc (U.K.), and Precision Laboratories, LLC (U.S.).

North America is expected to account for the largest share of the global seed treatment market in 2024, owing to the rising demand for high-yielding and disease-tolerant crops from domestic and export markets. Moreover, factors such as an organized distribution chain for crop protection chemicals, the availability of water and land, entrepreneurial farmers, rising public awareness of environmentally friendly crop production methods, and the presence of a large number of key stakeholders support the growth of this market in the region.

Moreover, the enhancing agronomic trends that comprise the development of high-quality seeds through the enhanced potential offered by genetically modified organisms (GMOs), changes in climatic conditions, flexibility in sowing approaches, and greater pressure from regulatory requirements support the growth of this regional market.

Published Date: Apr-2025

Published Date: Aug-2022

Published Date: Sep-2017

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates