Resources

About Us

Satellite Internet Market by Solution (Equipment [User Terminals, Gateways, Modems], Services), Band (K-band [Ka, Ku], L-band, C-band), Orbit (LEO, GEO, MEO), End-User (Residential, Commercial, Government & Defense, Maritime, Aviation), and Region – Global Forecast to 2036

Report ID: MRICT - 1041701 Pages: 265 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Global Satellite Internet Market Size?

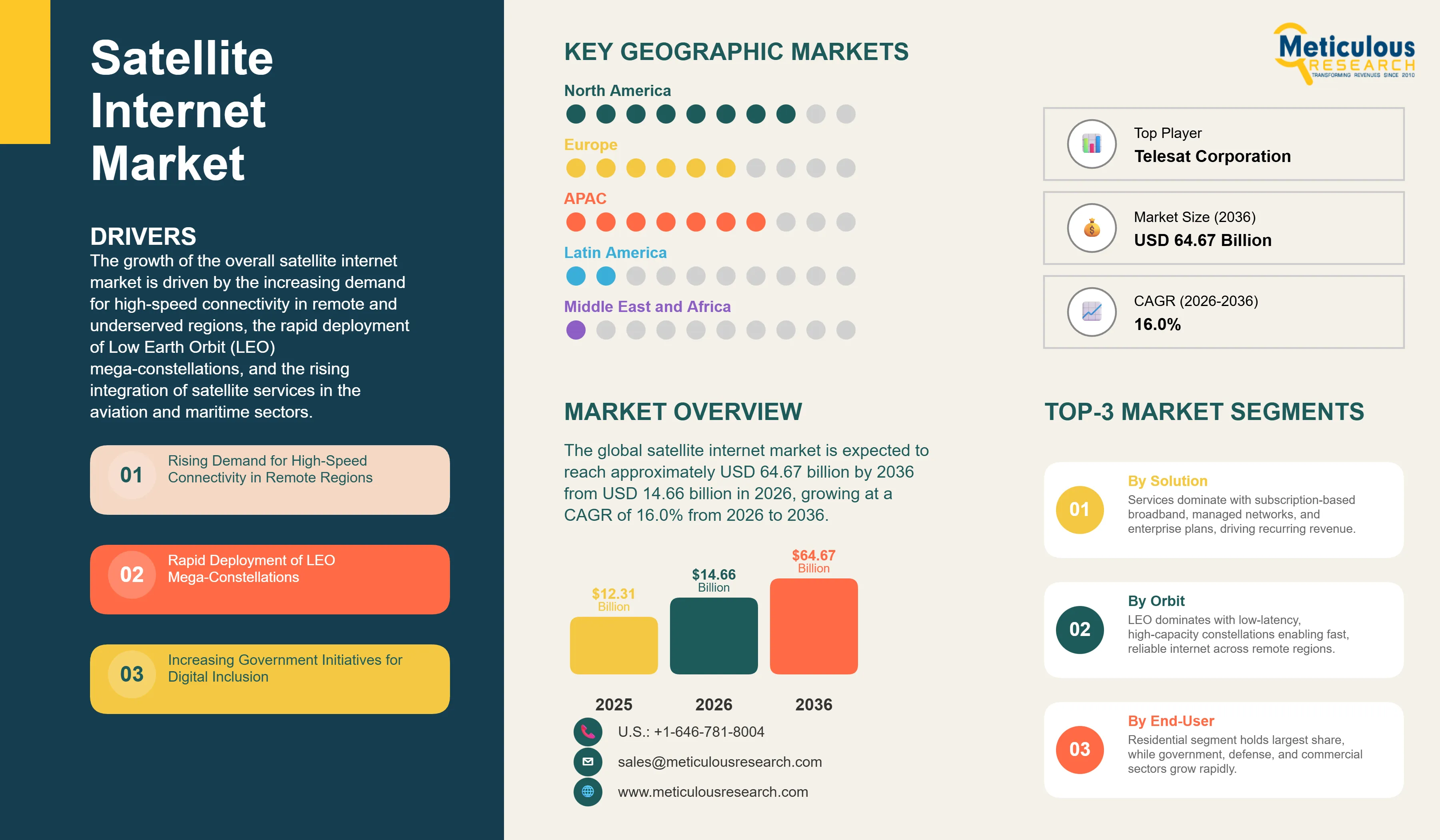

The global satellite internet market was valued at USD 12.31 billion in 2025. The market is expected to reach approximately USD 64.67 billion by 2036 from USD 14.66 billion in 2026, growing at a CAGR of 16.0% from 2026 to 2036.

The growth of the overall satellite internet market is driven by the increasing demand for high-speed connectivity in remote and underserved regions, the rapid deployment of Low Earth Orbit (LEO) mega-constellations, and the rising integration of satellite services in the aviation and maritime sectors. As global telecommunication providers and private enterprises seek to bridge the digital divide and provide ubiquitous broadband coverage, advanced satellite constellations have become essential for reliable, low-latency communication. The rapid expansion of the “NewSpace” ecosystem, coupled with the increasing need for resilient backhaul solutions for 5G networks, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Satellite internet represents a sophisticated domain of telecommunications that utilizes a network of orbital spacecraft to deliver high-speed data services to ground-based users. Unlike traditional terrestrial broadband, which relies on physical cables and towers, modern satellite systems leverage advanced phased-array antennas, digital beamforming, and inter-satellite laser links to provide seamless connectivity across the globe. The market is defined by high-capacity technologies that enable “ubiquitous connectivity,” optimizing network performance and reducing the total cost of ownership (TCO) for users in geographically challenged or infrastructure-poor environments.

The market includes a diverse range of hardware and software solutions, from high-performance user terminals with auto-tracking capabilities to complex gateway ground stations that manage terabits of data traffic. These systems are increasingly integrated with AI-driven network management and edge computing to ensure mission success in high-demand environments. The ability to operate in diverse climatic conditions while maintaining stable, high-bandwidth connections has made satellite internet the technology of choice for the next generation of global digital infrastructure and emergency response.

The global telecommunications sector is pushing hard to modernize connectivity, aiming to enhance network resilience and bridge the digital divide. This drive has increased the adoption of LEO constellations for low-latency applications and the use of satellite backhaul for expanding 5G coverage into rural areas. At the same time, the rapid growth in the mobility sector, including connected aircraft and maritime vessels, is increasing the need for high-performance, mobile-optimized satellite terminals. By combining high-throughput satellite (HTS) technology with robust terminal designs, these new systems support both individual consumer needs and the burgeoning industrial IoT economy.

What are the Key Trends in the Global Satellite Internet Market?

Proliferation of LEO Mega-Constellations and Low-Latency Services Satellite operators are rapidly shifting toward LEO architectures, moving well beyond the traditional geostationary (GEO) models toward high-density, low-latency constellations. SpaceX’s Starlink has already demonstrated the feasibility of global consumer broadband, while Amazon’s Project Kuiper and Eutelsat OneWeb are scaling up their deployments to deliver enterprise-grade connectivity. The real game-changer comes with inter-satellite laser links (ISL) that allow data to travel between satellites in space, bypassing ground stations and reducing latency significantly. These advancements make satellite internet a practical and cost-effective alternative for everything from high-frequency trading to real-time remote surgery.

Innovation in Direct-to-Device (D2D) Connectivity Innovation in satellite technology is rapidly driving the market toward seamless integration with standard smartphones. Manufacturers and operators are now designing systems that allow unmodified mobile devices to connect directly to satellites for messaging and emergency services. This often involves massive satellite antennas and sophisticated signal processing to handle the low power levels of handheld devices. At the same time, growing focus on “Satellite-to-Cell” services is pushing manufacturers like AST SpaceMobile and Lynk Global to develop constellations tailored to 4G and 5G protocols. These systems help establish a continuous connection for users in remote areas, extending the reach of mobile networks instead of relying solely on terrestrial towers.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 64.67 Billion |

|

Market Size in 2026 |

USD 14.66 Billion |

|

Market Size in 2025 |

USD 12.32 Billion |

|

Market Growth Rate |

CAGR of 16% (2026-2036) |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Solution, Band, Orbit, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Demand for Global Connectivity and Digital Inclusion

A key driver of the satellite internet market is the rapid movement of the global community toward universal broadband access and the closing of the digital divide. Global requirements for ensuring connectivity in rural and remote areas have created significant incentives for the adoption of LEO and GEO satellite solutions. The ability to provide high-speed internet where fiber-optic cables are impractical drives governments and operators toward scalable satellite platforms. It is estimated that as the number of unserved and underserved individuals decreases through 2036, the role of satellite internet in national digital strategies increases significantly; therefore, satellite systems, with their ability to deploy rapidly across large geographies, are considered a crucial enabler of modern economic growth.

Opportunity: Expansion of the Mobility Sector and 5G Integration

The rapid growth of the mobility sector provides great opportunities for the satellite internet market. Indeed, the global surge in connected transportation, such as commercial aviation and maritime shipping, has created a compelling demand for autonomous systems that can maintain high-bandwidth connections while in motion. These applications require high reliability, aerodynamic terminal designs, and the ability to switch between different satellite beams seamlessly. The inflight connectivity (IFC) market is set to expand significantly through 2036, with satellite providers poised for an expanding share as airlines seek to monetize high-speed Wi-Fi services. Furthermore, the transition to 5G networks is stimulating demand for satellite backhaul solutions that provide network flexibility and coverage extension for mobile network operators (MNOs).

Solution Insights

Why Do Services Dominate the Market?

The services segment, comprising broadband subscriptions, managed network services, and data plans, accounts for around 60-65% of the overall satellite internet market in 2026. This is mainly attributed to the recurring revenue generated from millions of residential and enterprise subscribers globally. Subscription models for high-speed internet offer the most efficient way for operators to recoup the high capital expenditure of satellite launches. The residential and commercial sectors alone consume the vast majority of these services, with major projects in North America and Europe demonstrating the technology’s capability to handle high-volume data traffic.

However, the equipment segment (including user terminals, gateways, and modems) is expected to grow at a significant CAGR during the forecast period, driven by the growing number of new constellation deployments and the rising demand for next-generation flat-panel antennas. The ability to provide “Plug-and-Play” hardware makes these solutions highly attractive for modern consumers and businesses.

Band Insights

How Does K-band (Ka and Ku) Lead the Market?

Based on band, the K-band (comprising Ka and Ku bands) segment holds the largest share of the overall market in 2026, accounting for around 70-75% of the overall market. From consumer broadband to enterprise VSAT networks, the use of K-band frequencies is central to modernizing satellite infrastructure. Current large-scale LEO constellations are increasingly specifying Ka-band for user links due to its high throughput capabilities and the availability of wider bandwidths compared to lower frequency bands.

The L-band and C-band segments continue to find critical applications in maritime safety and legacy broadcasting where high reliability and weather resilience are essential. However, the shift toward high-capacity data services is pushing the requirement for advanced K-band terminals that allow businesses to scale their connectivity capacity while minimizing their hardware footprint.

End-User Insights

Why Does the Residential Segment Maintain a Significant Share?

Based on end-user, the residential segment holds the largest share of the overall market in 2026, accounting for around 45-50% of the overall market. This dominance is primarily driven by substantial demand from households in rural and suburban areas where terrestrial broadband options are limited or non-existent. The ease of installation and competitive pricing of modern satellite internet kits have made high-speed connectivity accessible to a broader consumer base.

However, the commercial and government & defense segments are expected to witness the fastest CAGR during the forecast period, fueled by the rapid growth of enterprise digital transformation, military modernization, and the need for resilient emergency communication networks. The increasing adoption of satellite internet for industrial IoT and remote site operations are key drivers for this accelerated growth.

Orbit Insights

Why Does Low Earth Orbit (LEO) Dominate the Market?

Based on orbit, the Low Earth Orbit (LEO) segment holds the largest share of the overall market in 2026, accounting for around 50-55% of the overall market. This is primarily due to the proliferation of mega-constellations for broadband internet (e.g., Starlink, OneWeb) which offer significantly lower latency compared to traditional GEO satellites. The high density of satellites in LEO drives significant demand for ground equipment and managed services to ensure seamless handovers and continuous connectivity.

However, the Geostationary Earth Orbit (GEO) segment remains critical for high-capacity broadcast and dedicated enterprise links, particularly in the Middle East and Africa. The development of Very High Throughput Satellites (VHTS) in GEO is a major catalyst for maintaining its relevance in the market through 2036.

Regional Insights

How is North America Maintaining Dominance in the Global Satellite Internet Market? North America holds the largest share of the global satellite internet market in 2026. The largest share of this region is primarily attributed to the early and aggressive deployment of LEO constellations by U.S.-based companies and the high consumer willingness to adopt new connectivity technologies. The U.S. alone accounts for a significant portion of global satellite internet consumption, with its position as a leading hub for space innovation and the presence of large rural populations driving sustained growth. The presence of leading manufacturers and providers like SpaceX, Viasat, Hughes Network Systems (EchoStar), and Amazon, along with a well-developed regulatory framework, provides a robust market for both consumer and enterprise solutions.

Which Factors Support Asia Pacific and Europe Market Growth? Asia Pacific is expected to witness the fastest growth, driven by the need for sovereign connectivity and the expansion of digital services in emerging economies. Countries like China and India are at the forefront, with significant focus on integrating satellite broadband into their national infrastructure plans. In Europe, the push for digital sovereignty and the expansion of the IRIS² constellation are driving the adoption of high-security satellite services. Germany, France, and the UK are leading the way, with a strong focus on enterprise connectivity and the integration of satellite services into the 5G ecosystem through players like Eutelsat and Airbus.

The companies such as Space Exploration Technologies Corp. (SpaceX), Viasat, Inc., EchoStar Corporation (Hughes Network Systems), and Eutelsat Group (OneWeb) lead the global satellite internet market with a comprehensive range of orbital constellations and service solutions, particularly for residential and enterprise applications. Meanwhile, players including Amazon.com, Inc. (Project Kuiper), SES S.A., Telesat Corporation, and Iridium Communications Inc. focus on specialized high-throughput GEO/MEO systems and low-latency LEO services targeting the commercial and government sectors. Emerging manufacturers and integrated players such as Gilat Satellite Networks Ltd., ST Engineering iDirect, Comtech Telecommunications Corp., and AST SpaceMobile, Inc. are strengthening the market through innovations in user terminals, ground station equipment, and direct-to-cell technologies.

The global satellite internet market is projected to reach approximately USD 64.67 billion by 2036, growing at a CAGR of 16.0% from 2026 to 2036.

The services segment is expected to dominate the market in 2026, accounting for around 60–65% of the overall market, driven by recurring revenues from broadband subscriptions and managed network services.

Key Drivers:

- Rising demand for high-speed connectivity in remote and underserved regions

- Rapid deployment of LEO mega-constellations

- Growing adoption of satellite internet in aviation and maritime sectors

Key Opportunities:

- Expansion of in-flight and maritime connectivity

- Integration with 5G networks

- Growth of Direct-to-Device (D2D) satellite connectivity for smartphones

- Largest market: North America (2026)

- Fastest-growing region: Asia Pacific during the forecast period

Key players include: SpaceX, Viasat, EchoStar (Hughes), Eutelsat (OneWeb), Amazon (Project Kuiper), SES, Telesat, Iridium, Gilat, ST Engineering iDirect, Comtech, AST SpaceMobile, Kymeta, ThinKom, and Globalstar.

The growth of LEO mega-constellations is increasing competition by providing lower latency and higher bandwidth, challenging traditional GEO operators and accelerating innovation in user terminals and ground infrastructure.

Major trends include:

- Expansion of LEO constellations with inter-satellite laser links (ISL)

- Development of Direct-to-Device (D2D) satellite connectivity for smartphones

- 5G integration is expanding satellite's role in network backhaul and coverage extension

- D2D connectivity is enabling direct satellite communication for standard mobile devices, particularly in remote areas

Spectrum allocation, licensing, and space regulations significantly shape deployment timelines and market entry strategies—sometimes creating barriers, but also promoting digital inclusion initiatives.

Both sectors are major growth drivers due to rising demand for reliable, high-speed connectivity for:

- Passenger Wi-Fi

- Operational data transfer

- Remote monitoring and navigation support

Published Date: Aug-2024

Published Date: Jul-2024

Published Date: Jul-2024

Published Date: Jul-2024

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates