Resources

About Us

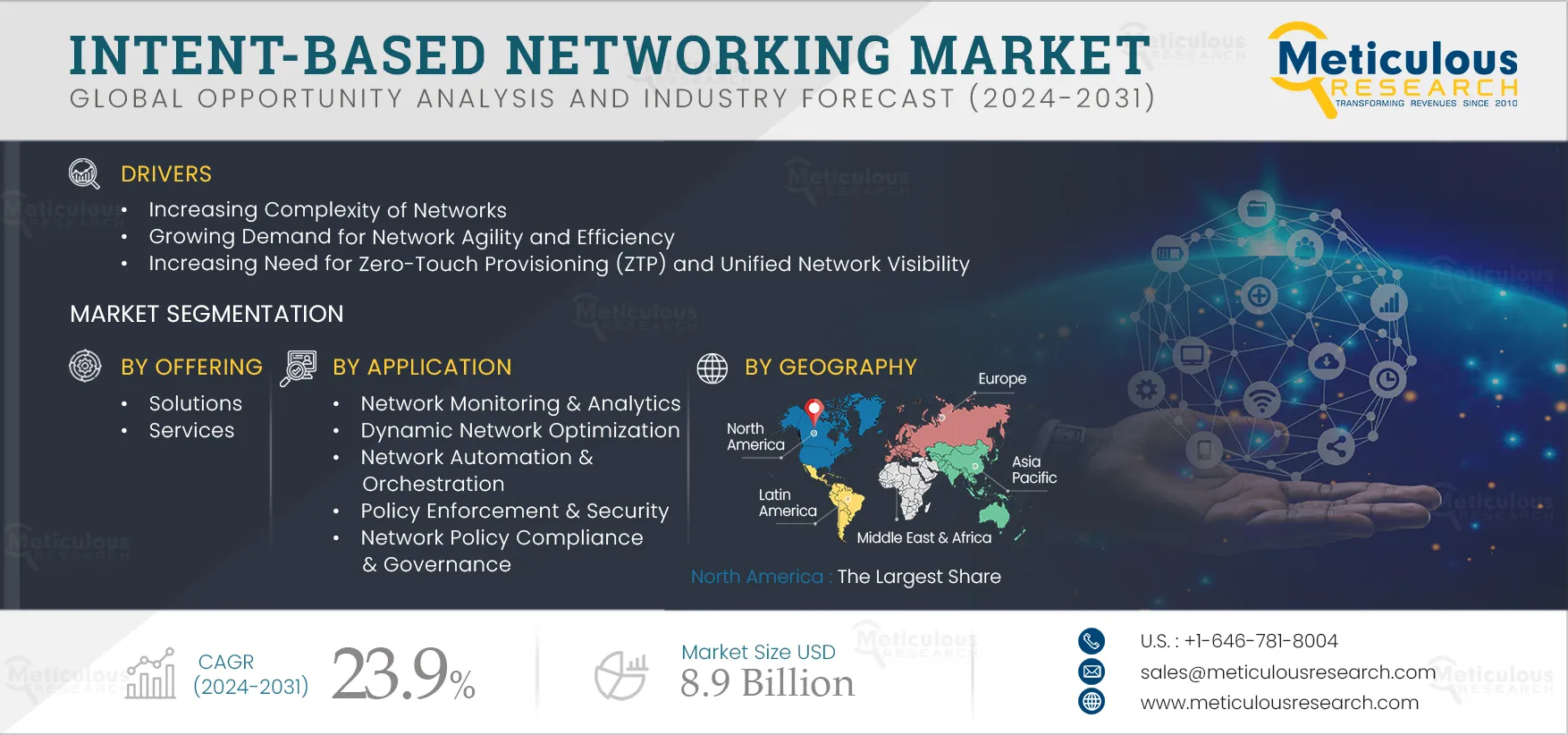

Intent-based Networking Market Size, Share, Forecast, & Trends Analysis by Offering, Deployment Mode, Organization Size, Application (Network Automation & Orchestration, Policy Enforcement & Security, Network Monitoring & Analytics), and End User - Global Forecast to 2031

Report ID: MRICT - 104910 Pages: 263 Jul-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Intent-based Networking Market is expected to reach $8.9 billion by 2031, at a CAGR of 23.9% from 2024 to 2031. The growth of the intent-based networking market is driven by increasing network complexity, the growing demand for network agility and efficiency, and the rising need for Zero-touch Provisioning (ZTP) and unified network visibility. The integration of networking with Artificial Intelligence (AI) & Machine Learning (ML) technologies and the increasing adoption of cloud-based networking are expected to generate growth opportunities for the players operating in this market.

Networks are becoming more heterogeneous, incorporating a mix of devices, technologies, and vendors. Manually managing such diverse and large-scale networks is challenging and time-consuming. With the integration of intent-based networking solutions, companies can easily manage complex networks by abstracting the configuration and management details into high-level intent or policies, enabling efficient network management & control. In addition, network complexity is a barrier to ensuring consistent security and compliance across the entire infrastructure. Intent-based networking allows organizations to define security policies and enforce them across the network, even in overly complex environments. This approach lowers the risk of misconfiguration & vulnerabilities and helps organizations maintain compliance with industry regulations. Thus, as organizations strive to cope with network complexities, the demand for intent-based networking solutions is estimated to rise in the coming years, driving the growth of this market.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The growing demand for network agility and efficiency is a key driver for the intent-based networking market. Traditional network provisioning and configuration processes can be time-consuming and error-prone. Additionally, networks are becoming increasingly complex and scalable, incorporating various technologies, devices, and cloud services. Manually managing and scaling such complex networks can be resource-intensive. Companies are adopting intent-based networking solutions to address these challenges, allowing administrators to define high-level intent or policies that can be automatically translated into network configurations. Automation speeds up the provisioning process, reduces manual errors, and ensures consistency across the network. By defining intent-based policies, administrators can manage complex network environments more efficiently, ensuring consistent configurations and policies across the entire infrastructure, which contribute to driving the growth of the market during the forecast period.

Cloud-based networking allows companies to scale their network infrastructure more efficiently. Intent-based networking can leverage the cloud's elastic capabilities to dynamically provision and scale network resources based on intent to provide flexibility and agility in network management. Cloud-based networking enables centralized control and management of network resources. Intent-based networking can leverage this centralized control to define and enforce intent-based policies consistently across distributed environments, ensuring uniformity and simplifying network management. Additionally, intent-based networking provides a unified network management approach across diverse environments, enabling seamless connectivity, policy enforcement, and security across hybrid and multi-cloud deployments. Thus, the increasing adoption of cloud-based networking is expected to provide growth opportunities for the players in this market.

Zero trust networking aligns closely with the principles of intent-based networking and enhances its security capabilities. It is an IT security model that requires strict identity verification for every individual and device trying to access resources on a private network. Zero trust networking protects modern digital environments by leveraging network segmentation, providing Layer 7 threat prevention, preventing lateral movement, and simplifying granular user-access control. It aims to prevent unauthorized access, minimize the potential attack surface, and protect sensitive data by enforcing rigorous authentication, access controls, and continuous monitoring.

Intent-based networking leverages zero-trust networking to provide robust security controls throughout the network. By integrating zero trust principles into intent-based networking solutions, organizations can enforce fine-grained access policies, monitor user and device behavior, and detect & respond to security threats in real-time. Additionally, intent-based networking, with its automation capabilities, can help streamline the implementation and management of zero-trust policies. By automating the enforcement of access controls, authentication processes, and network segmentation, organizations can lower human error, improve security consistency, and respond quickly to changing security requirements.

Based on offering, the global intent-based networking market is segmented into solutions and services. In 2024, the solutions segment is expected to account for a larger share of 60% of the global intent-based networking market. This segment’s growth is attributed to increasing R&D investments and rising demand for dynamic connectivity among communication service providers.

However, the services segment is estimated to register the highest CAGR during the forecast period. This segment’s rapid growth is driven by enterprises’ growing requirements for network integration and key market players’ emphasis on providing advanced network automation professional services.

Based on deployment mode, the global intent-based networking market is segmented into on-premise deployment and cloud-based deployment. In 2024, the on-premise deployment segment is expected to account for the larger share of 64% of the global intent-based networking market. This segment’s growth is attributed to the high acceptance of intent-based networking among large enterprises, the rising demand for comprehensive network security & control, the increasing deployment of network automation solutions across on-premises data centers, and the growing demand for custom configurations to suit organizations’ unique requirements. Benefits of on-premise deployment of intent-based networking include enhanced network visibility, reduced manual configuration efforts, improved network security, better compliance with business objectives, and increased network efficiency & reliability.

However, the cloud-based deployment segment is anticipated to register the highest CAGR during the forecast period. This segment’s growth is driven by enterprises’ surging need to manage complex network requirements and reduce infrastructures’ initial and operating expenses and their increasing investments in network infrastructure expansion with cloud deployment.

Based on organization size, the global intent-based networking market is broadly segmented into large and small & medium-sized enterprises. In 2024, the small & medium-sized enterprises segment is expected to account for the larger share of 63% of the global intent-based networking market. This segment’s growth is attributed to the SMEs’ rising need to create agile, secure, and efficient work environments and the rising demand for intent-based networking solutions among SMEs operating in the education, retail, healthcare, manufacturing, government, and manufacturing sectors.

Furthermore, this segment is also poised to register the highest CAGR during the forecast period.

Based on application, the global intent-based networking market is broadly segmented into network automation & orchestration, policy enforcement & security, dynamic network optimization, network monitoring & analytics, and network policy compliance & governance. In 2024, the network monitoring & analytics segment is expected to account for the largest share of above 36% of the global Intent-based networking market. The growth of this segment is attributed to the increasing use of network monitoring among organizations to identify and resolve issues promptly, growing demand for network monitoring tools demand for enhanced overall network security and increasing demand for highly reliable and scalable network monitoring solutions.

However, the network automation and orchestration segment is expected to register the highest CAGR during the forecast period. This segment's growth is driven by the growing demand for safe and smart healthcare systems with intent-based networking technology, the growing need to detect and identify old hardware, compliance issues, and storage issues, and the increasing need for zero-touch provisioning and unified network visibility.

Based on end user, the global intent-based networking market is segmented into CSPs, data centers, and enterprises. In 2024, the data centers segment is expected to account for the largest share of 42% of the global intent-based networking market. The growth of this segment is attributed to the data centers’ growing need to automate routine workflows and processes, reduce repetitive/mundane tasks, speed up processes, and drive down overheads, and the increasing deployment of network automation solutions among data centers.

However, the enterprise segment is anticipated to record the highest CAGR during the forecast period. It is further sub-segmented into IT & telecommunications, manufacturing, government and public sector, retail, BFSI, healthcare & life sciences, education, energy & utilities, media & entertainment, and other end-use industries. This segment’s rapid growth is driven by the rising demand for intent-based networking solutions and increasing deployments of network automation solutions across enterprises.

In 2024, North America is expected to account for the largest share, 37%, of the global intent-based networking market. This region’s large market share is attributed to its established sales force for network automation solutions, service providers’ initiatives towards network automation, and increasing demand for data center and IT infrastructure automation.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. The key players operating in the intent-based networking market include Arista Networks, Inc. (U.S), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc (U.S.), Fortinet, Inc. (U.S.), VMware, Inc. (U.S.), Hewlett Packard Enterprise Company (U.S.), Nokia Corporation (Finland), Huawei Technologies Co., Ltd. (China), IBM Corporation(U.S.), Anuta Networks International LLC (U.S.), NetBrain Technologies, Inc. (U.S.), Forward Networks, Inc. (U.S.), Gluware, Inc. (U.S.), NetYCE BV (Netherlands), AppViewX (U.S.), and Itential (U.S.).

|

Particulars |

Details |

|

Number of Pages |

263 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

23.9% |

|

Market Size |

$8.9 billion by 2031 |

|

Segments Covered |

By Offering

By Deployment Mode

By Organization Size

By Application

By End User

|

|

Countries Covered |

Europe (Germany, U.K., France, Italy, Spain, Netherlands, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Thailand, Indonesia, Australia & New Zealand, and Rest of Asia-Pacific), North America (U.S. and Canada), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Israel, and Rest of Middle East & Africa) |

|

Key Companies Profiles |

Arista Networks, Inc. (U.S), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc (U.S.), Fortinet, Inc. (U.S.), VMware, Inc. (U.S.), Hewlett Packard Enterprise Company (U.S.), Nokia Corporation (Finland), Huawei Technologies Co., Ltd. (China), IBM Corporation (U.S.), Anuta Networks International LLC (U.S.), NetBrain Technologies, Inc. (U.S.), Forward Networks, Inc. (U.S.), Gluware, Inc. (U.S.), NetYCE BV (Netherlands), AppViewX (U.S.), and Itential (U.S.). |

The intent-based networking market is expected to reach $8.9 billion by 2031, at a CAGR of 23.9% from 2024 to 2031.

The intent-based networking market study focuses on market assessment and opportunity analysis based on the sales of intent-based networking products across different regions, countries, and market segments. This study also includes a competitive analysis of the intent-based networking market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years.

Based on offering, the solutions segment is expected to account for a larger share of above 60% of the global intent-based networking market. This segment's growth is attributed to increasing R&D investments and rising demand for dynamic connectivity among communication service providers.

Based on end user, the enterprises segment is expected to record the highest CAGR during the forecast period. The segment is further sub-segmented into IT & telecommunications, manufacturing, government and public sector, retail, BFSI, healthcare & life sciences, education, energy & utilities, media & entertainment, and other end-use industries. The segment’s rapid growth is driven by the rising demand for intent-based networking solutions and increasing deployments of network automation solutions across enterprises.

The growth of the intent-based networking market is driven by the rising demand for SAPs in personal care products manufacturing, the increasing adoption of SAPs in agriculture for water management & improved crop yield, and rising awareness about hygiene & healthcare. Furthermore, advancements in bio-based SAPs and the increasing application of SAPs in the oil & gas, food packaging, and agriculture sectors are expected to generate significant growth opportunities for players operating in the Intent-based Networking Market.

The key players operating in the intent-based networking market are Arista Networks, Inc. (U.S), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc (U.S.), Fortinet, Inc. (U.S.), VMware, Inc. (U.S.), Hewlett Packard Enterprise Company (U.S.), Nokia Corporation (Finland), Huawei Technologies Co., Ltd. (China), IBM Corporation(U.S.), Anuta Networks International LLC (U.S.), NetBrain Technologies, Inc. (U.S.), Forward Networks, Inc. (U.S.), Gluware, Inc. (U.S.), NetYCE BV (Netherlands), AppViewX (U.S.), and Itential (U.S.).

Asia-Pacific is estimated to register the highest CAGR of 11% during the forecast period. The increasing deployment of SDN and NFV by enterprises and rising demand for a broad range of value-added network services are the major factors contributing to the market's growth.

Published Date: Mar-2024

Published Date: Mar-2024

Published Date: Aug-2025

Published Date: Nov-2022

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates