Resources

About Us

Satellite Communication Systems Market for Defense by System Component (Space Segment, Ground Segment, User Segment), Satellite Type, Platform, Application, Frequency Band, Service Type, End User, & Geography - Global Forecast to 2035

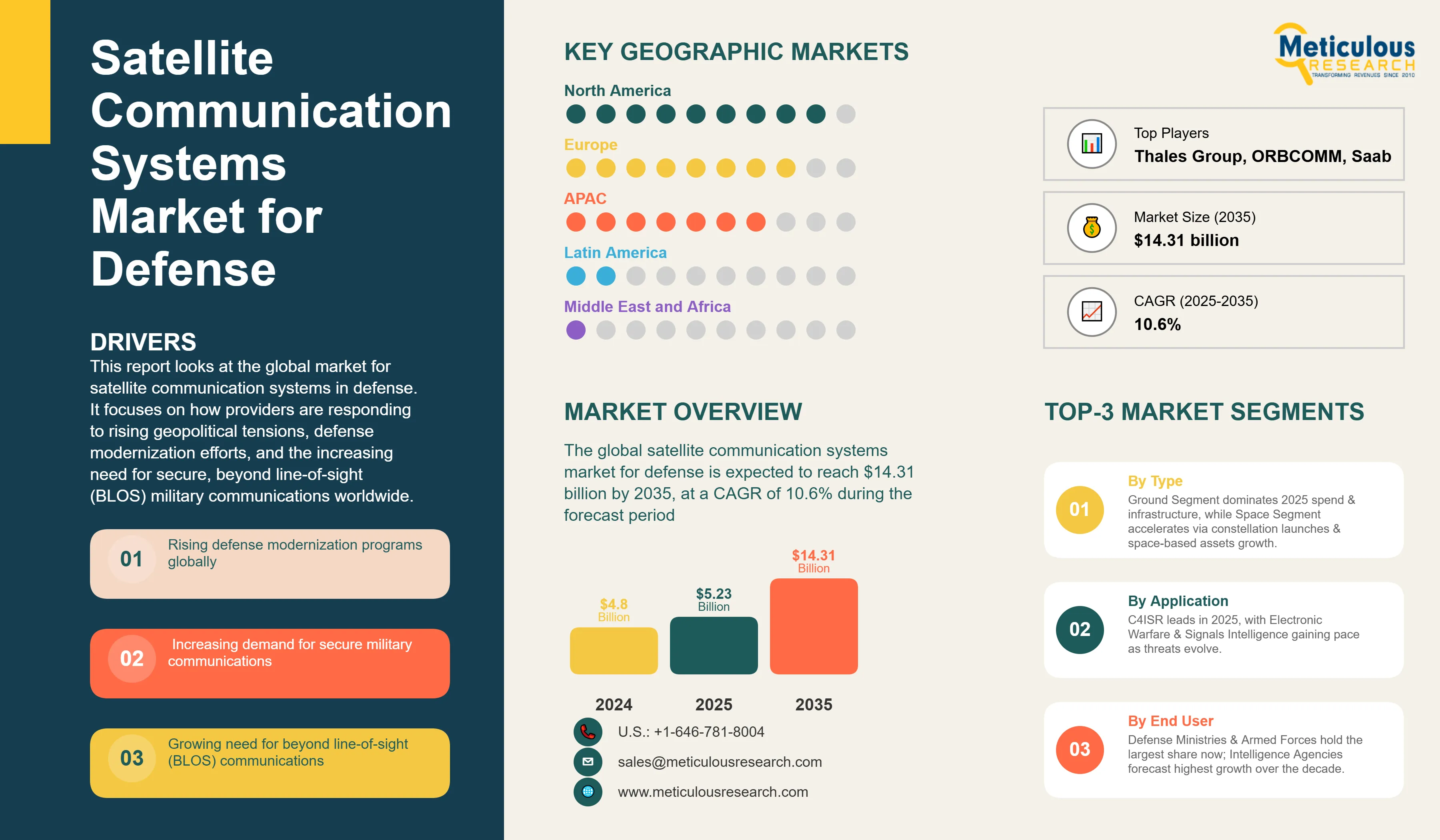

Report ID: MRAD - 1041592 Pages: 285 Sep-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global satellite communication systems market for defense was valued at $4.80 billion in 2024. This market is expected to reach $14.31 billion by 2035, growing from an estimated $5.23 billion in 2025, at a CAGR of 10.6% during the forecast period of 2025–2035.

Report Overview

This report looks at the global market for satellite communication systems in defense. It focuses on how providers are responding to rising geopolitical tensions, defense modernization efforts, and the increasing need for secure, beyond line-of-sight (BLOS) military communications worldwide. It evaluates market dynamics, forecasts growth through 2035, and examines competitive positioning on global and regional/country levels.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The satellite communication systems market for defense is mainly driven by growing defense modernization programs worldwide, the rising demand for secure military communications, the need for beyond line-of-sight (BLOS) communications and heightened geopolitical tensions and border security concerns. The integration of satellite communications in network-centric warfare and the move toward multi-orbit satellite structures are transforming the industry. Advances in flat panel antenna technology, the use of artificial intelligence in satellite operations, and the development of quantum-secured satellite communications are also gaining traction. Furthermore, the rollout of Low Earth Orbit (LEO) constellations, the adoption of software-defined satellite technology, and the integration of military 5G with edge computing are pushing market growth, particularly in developed areas with advanced defense infrastructure.

Key Challenges

While the satellite communication systems market for defense has significant growth potential, it faces several challenges. High initial capital investments and operational costs are major hurdles. The industry also struggles with vulnerabilities to cyber-attacks and jamming and issues related to space debris and orbital congestion. Additionally, obstacles like regulatory restrictions, export controls, interoperability issues between different satellite systems, and challenges in spectrum management and interference mitigation could slow market adoption across various defense organizations. Keeping operations running during conflicts remains a critical issue for defense planners.

Growth Opportunities

The satellites communication systems market for defense offers many opportunities for growth. Deploying Low Earth Orbit (LEO) constellations presents a chance for market players to enhance connectivity and reduce latency. The adoption of software-defined satellite technology allows for flexible and reconfigurable communication setups. Moreover, partnerships between commercial and military SATCOM and integrating military 5G with edge computing are creating new revenue streams for providers as defense organizations look for better alternatives to traditional communication methods.

Market Segmentation Highlights

By System Component

The Ground Segment is projected to hold the largest share of the satellite communication systems market for defense in 2025. This is due to its key role in satellite control operations and increasing investments in ground infrastructure across defense organizations worldwide. However, the Space Segment is expected to grow at a competitive rate during the forecast period, driven by more satellite deployments, constellation development, and technological advancements in satellite design.

By Satellite Type

The Military Dedicated Satellites segment is anticipated to dominate the satellite communication systems market for defense in 2025. This is mainly due to their enhanced security features, dedicated military frequency allocations, and widespread use in classified operations. Conversely, the Commercial Satellites (Military Use) segment is expected to grow at the fastest rate during the forecast period, fueled by cost-effectiveness, quick deployment capabilities, and more commercial-military partnerships.

By Platform

The Land-Based Platforms segment is likely to hold the largest share of the satellite communication systems market for defense in 2025 due to the high volume of ground-based military operations and extensive deployment of fixed and mobile ground stations. However, the Airborne Platforms segment is expected to see rapid growth in the forecast period, driven by increasing modernization programs for military aircraft and rising demand for in-flight connectivity solutions.

By Application

The Command, Control, Communications, Computers, Intelligence, Surveillance & Reconnaissance (C4ISR) segment is set to hold the largest share of the satellite communication systems market for defense in 2025. This is because of the critical role of C4ISR systems in modern warfare and rising defense investments in intelligence capabilities. On the other hand, the Electronic Warfare and Signals Intelligence segment is expected to grow significantly during the forecast period due to evolving threats and a focus on enhancing electronic warfare capabilities.

By Frequency Band

The X-Band segment is projected to dominate the satellite communication systems market for defense in 2025, primarily due to its wide use in military satellite communications and established infrastructure. However, the Ka-Band segment is expected to grow at the fastest pace during the forecast period, driven by its high-throughput capabilities, improved bandwidth efficiency, and increasing adoption in next-generation military SATCOM systems.

By Service Type

The Managed Services segment is likely to hold the largest share of the satellite communication systems market for defense in 2025, as more organizations prefer outsourced satellite communication operations and comprehensive service packages. Meanwhile, the Professional Services segment is expected to experience steady growth during the forecast period, driven by the increasing complexity of satellite systems and the growing need for specialized consulting and integration services.

By End User

The Defense Ministries and Armed Forces segment is expected to hold the largest share of the satellite communication systems market for defense in 2025. This is due to their primary role as end users of military satellite systems and the substantial budgets dedicated to communication infrastructure. However, the Intelligence Agencies segment is projected to exhibit a notable growth rate in the forecast period, driven by expanding intelligence operations and rising investments in secure communication capabilities.

By Geography

North America is expected to hold the largest share of the global satellite communication systems market for defense in 2025. This is due to its advanced defense infrastructure, significant defense spending, strong uptake of innovative military technologies, and major investments in satellite communication capabilities. The presence of leading defense contractors and established military satellite programs also contributes to market dominance. Europe is the second-largest market, supported by growing defense cooperation initiatives and a focus on modernization. However, Asia-Pacific shows the fastest growth rate during the forecast period, mainly due to rising geopolitical tensions, increasing defense budgets, expanding military modernization efforts, and growing investments in local satellite capacities.

Competitive Landscape

The global satellite communication systems market for defense features a diverse competitive environment. This includes established aerospace and defense manufacturers, satellite technology specialists, communication solution providers, and innovative tech companies, each using different approaches to advance military satellite communication technologies. Within this landscape, providers are grouped into industry leaders, market differentiators, vanguards, and contemporary stalwarts, each pursuing distinct strategies to maintain their competitive edge. Leading companies focus on integrated solutions that combine cutting-edge satellite technologies with robust defense communication capabilities while addressing security issues specific to military applications. Key players in the global satellite communication systems market for defense include Lockheed Martin Corporation, L3Harris Technologies, Inc., Thales Group, General Dynamics Corporation, Airbus Defence and Space, Northrop Grumman Corporation, Boeing Defense, Space & Security, Raytheon Technologies, Inmarsat Global Limited, Eutelsat Communications, Viasat, Inc., Cobham Limited, Comtech Telecommunications Corp., KVH Industries, Inc., Honeywell International Inc., Indra Sistemas, S.A., ORBCOMM Inc., Telesat Corporation, Hughes Network Systems (EchoStar), Saab AB, CACI International Inc., Leonardo S.p.A., and others.

|

Particulars |

Details |

|

Number of Pages |

285+ |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

10.6% |

|

Market Size (Value) in 2025 |

USD 5.23 Billion |

|

Market Size (Value) in 2035 |

USD 14.31 Billion |

|

Segments Covered |

Market Assessment, by System Component

Market Assessment, by Satellite Type

Market Assessment, by Platform

Market Assessment, by Application

Market Assessment, by Frequency Band

Market Assessment, by Service Type

Market Assessment, by End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Netherlands, Switzerland, Rest of Europe), Asia-Pacific (China, Japan, South Korea, Taiwan, India, Singapore, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), Middle East & Africa (UAE, Saudi Arabia, Israel, South Africa, Rest of MEA) |

|

Key Companies |

Lockheed Martin Corporation, L3Harris Technologies, Inc., Thales Group, General Dynamics Corporation, Airbus Defence and Space, Northrop Grumman Corporation, Boeing Defense, Space & Security, Raytheon Technologies, Inmarsat Global Limited, Eutelsat Communications, Viasat, Inc., Cobham Limited, Comtech Telecommunications Corp., KVH Industries, Inc., Honeywell International Inc., Indra Sistemas, S.A., ORBCOMM Inc., Telesat Corporation, Hughes Network Systems (EchoStar), Saab AB, CACI International Inc., Leonardo S.p.A. |

The global satellite communication systems market for defense was valued at approximately $4.80 billion in 2024. This market is expected to reach approximately $14.31 billion by 2035, growing from an estimated $5.23 billion in 2025, at a CAGR of 10.6% during the forecast period of 2025–2035.

The global satellite communication systems market for defense is expected to grow at a CAGR of 10.6% during the forecast period of 2025–2035.

The global satellite communication systems market for defense is expected to reach approximately $14.31 billion by 2035, growing from an estimated $5.23 billion in 2025, at a CAGR of 10.6% during the forecast period of 2025–2035.

The key companies operating in this market include Lockheed Martin Corporation, L3Harris Technologies, Inc., Thales Group, General Dynamics Corporation, Airbus Defence and Space, Northrop Grumman Corporation, Boeing Defense, Space & Security, Raytheon Technologies, Inmarsat Global Limited, Eutelsat Communications, Viasat, Inc., and others.

Major trends shaping the market include multi-orbit satellite architectures, flat panel antenna technology advancement, artificial intelligence in satellite operations, quantum-secured satellite communications, Low Earth Orbit (LEO) constellation deployment, and software-defined satellite technology adoption.

• In 2025, the Ground Segment is expected to dominate the overall satellite communication systems market for defense by system component

• Based on satellite type, the Military Dedicated Satellites segment is expected to hold the largest share of the overall market in 2025

• Based on platform, the Land-Based Platforms segment is expected to hold the largest share of the overall market in 2025

• Based on application, the C4ISR segment is expected to hold the largest share of the overall market in 2025

• Based on frequency band, the X-Band segment is expected to hold the largest share of the global market in 2025

• Based on service type, the Managed Services segment is expected to dominate the overall market in 2025

• Based on end user, the Defense Ministries and Armed Forces segment is expected to hold the largest share of the global market in 2025

North America is expected to hold the largest share of the global satellite communication systems market for defense in 2025, driven by advanced defense infrastructure, significant defense spending, and major investments in satellite communication capabilities. Asia-Pacific is witnessing the fastest growth rate during the forecast period due to rising geopolitical tensions and expanding defense budgets.

The growth of this market is driven by rising defense modernization programs globally, increasing demand for secure military communications, growing need for beyond line-of-sight (BLOS) communications, rising geopolitical tensions and border security concerns, and integration of satellite communications in network-centric warfare.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Satellite Communication Systems for Defense Market, by System Component

3.2.2. Satellite Communication Systems for Defense Market, by Satellite Type

3.2.3. Satellite Communication Systems for Defense Market, by Platform

3.2.4. Satellite Communication Systems for Defense Market Application

3.2.5. Satellite Communication Systems for Defense Market Frequency Band

3.2.6. Satellite Communication Systems for Defense Market Service Type

3.2.7. Satellite Communication Systems for Defense Market End User

3.2.8. Satellite Communication Systems for Defense Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising defense modernization programs globally

4.2.1.2. Increasing demand for secure military communications

4.2.1.3. Growing need for beyond line-of-sight (BLOS) communications

4.2.1.4. Rising geopolitical tensions and border security concerns

4.2.1.5. Integration of satellite communications in network-centric warfare

4.2.2. Restraints

4.2.2.1. High initial capital investment and operational costs

4.2.2.2. Vulnerability to cyber attacks and jamming

4.2.2.3. Space debris and orbital congestion issues

4.2.2.4. Regulatory restrictions and export controls

4.2.3. Opportunities

4.2.3.1. Low Earth Orbit (LEO) constellation deployment

4.2.3.2. Software-defined satellite technology adoption

4.2.3.3. Military 5G and edge computing integration

4.2.3.4. Commercial-military SATCOM partnerships

4.2.4. Trends

4.2.4.1. Multi-orbit satellite architectures

4.2.4.2. Flat panel antenna technology advancement

4.2.4.3. Artificial intelligence in satellite operations

4.2.4.4. Quantum-secured satellite communications

4.2.5. Challenges

4.2.5.1. Interoperability between different satellite systems

4.2.5.2. Spectrum management and interference mitigation

4.2.5.3. Maintaining operational continuity during conflicts

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on the Satellite Communication Systems for Defense Market

4.4.1. Multi-Orbit & Protected Waveform Evolution

4.4.1.1. LEO/MEO/GEO orchestration for latency/capacity/availability trade offs

4.4.1.2. Anti-jam/anti-spoof waveforms, beam-hopping, null-steering, and interference cancellation

4.4.2. Digital Backbone & Autonomic Networking

4.4.2.1. SDA-style optical crosslinks and mesh routing to bypass congestion/jamming

4.4.2.2. AI-driven path selection and QoS management across contested theaters

4.4.3. Terminals & Ground Segment Modernization

4.4.3.1. Multi band, electronically steered arrays (ESA) for mobile platforms

4.4.3.2. Virtualized gateways, zero trust architectures, and sovereign key management

5. Impact of Sustainability on Satellite Communication Systems for Defense Market

5.1. Energy-efficient ground stations & renewable-powered gateways

5.2. Low-impact hosted payload strategies vs. dedicated launches

5.3. Lifecycle e-waste reduction in terminals & crypto hardware

5.4. Spectrum efficiency and congestion mitigation as environmental stewardship

5.5. ESG-aligned vendor selection for long-term defense infrastructure

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Satellite Communication Systems for Defense Market Assessment—By System Component

7.1. Overview

7.2. Space Segment

7.3. Ground Segment

7.4. User Segment

7.5. Others

8. Satellite Communication Systems for Defense Market Assessment—By Satellite Type

8.1. Overview

8.2. Military Dedicated Satellites

8.3. Commercial Satellites (Military Use)

8.4. Hybrid Satellite Solutions

9. Satellite Communication Systems for Defense Market Assessment—By Platform

9.1. Overview

9.2. Land-Based Platforms

9.3. Naval Platforms

9.4. Airborne Platforms

9.5. Space-Based Platforms

10. Satellite Communication Systems for Defense Market Assessment—By Application

10.1. Overview

10.2. Command, Control, Communications, Computers, Intelligence, Surveillance & Reconnaissance (C4ISR)

10.3. Navigation and Positioning

10.4. Electronic Warfare and Signals Intelligence

10.5. Missile Defense Systems

10.6. Disaster Response and Humanitarian Operations

10.7. Border Security and Surveillance

10.8. Military Training and Simulation

11. Satellite Communication Systems for Defense Market Assessment—By Frequency Band

11.1. Overview

11.2. L-Band

11.3. S-Band

11.4. C-Band

11.5. X-Band

11.6. Ku-Band

11.7. Ka-Band

12. Satellite Communication Systems for Defense Market Assessment—By Service Type

12.1. Overview

12.2. Managed Services

12.3. Professional Services

12.4. Maintenance and Support Services

12.5. Leased Capacity Services

13. Satellite Communication Systems for Defense Market Assessment—By End User

13.1. Overview

13.2. Defense Ministries and Armed Forces

13.3. Intelligence Agencies

13.4. Coast Guard and Border Security

13.5. NATO and Allied Organizations

13.6. Defense Contractors and Integrators

13.7. Government Communication Agencies

14. Satellite Communication Systems for Defense Market Assessment—By Geography

14.1. Overview

14.2. North America

14.2.1. U.S.

14.2.2. Canada

14.3. Europe

14.3.1. Germany

14.3.2. U.K.

14.3.3. France

14.3.4. Netherlands

14.3.5. Switzerland

14.3.6. Rest of Europe

14.4. Asia-Pacific

14.4.1. China

14.4.2. Japan

14.4.3. South Korea

14.4.4. Taiwan

14.4.5. India

14.4.6. Singapore

14.4.7. Australia

14.4.8. Rest of Asia-Pacific

14.5. Latin America

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Argentina

14.5.4. Rest of Latin America

14.6. Middle East & Africa

14.6.1. UAE

14.6.2. Saudi Arabia

14.6.3. Israel

14.6.4. South Africa

14.6.5. Rest of Middle East & Africa

15. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

15.1. Lockheed Martin Corporation

15.2. L3Harris Technologies, Inc.

15.3. Thales Group

15.4. General Dynamics Corporation

15.5. Airbus Defence and Space

15.6. Northrop Grumman Corporation

15.7. Boeing Defense, Space & Security

15.8. Raytheon Technologies

15.9. Inmarsat Global Limited

15.10. Eutelsat Communications

15.11. Viasat, Inc.

15.12. Cobham Limited

15.13. Comtech Telecommunications Corp.

15.14. KVH Industries, Inc.

15.15. Honeywell International Inc.

15.16. Indra Sistemas, S.A.

15.17. ORBCOMM Inc.

15.18. Telesat Corporation

15.19. Hughes Network Systems (EchoStar)

15.20. Saab AB

15.21. CACI International Inc.

15.22. Leonardo S.p.A.

15.23. Other Key Players

16. Appendix

16.1. Available Customization

16.2. Related Reports

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates