Resources

About Us

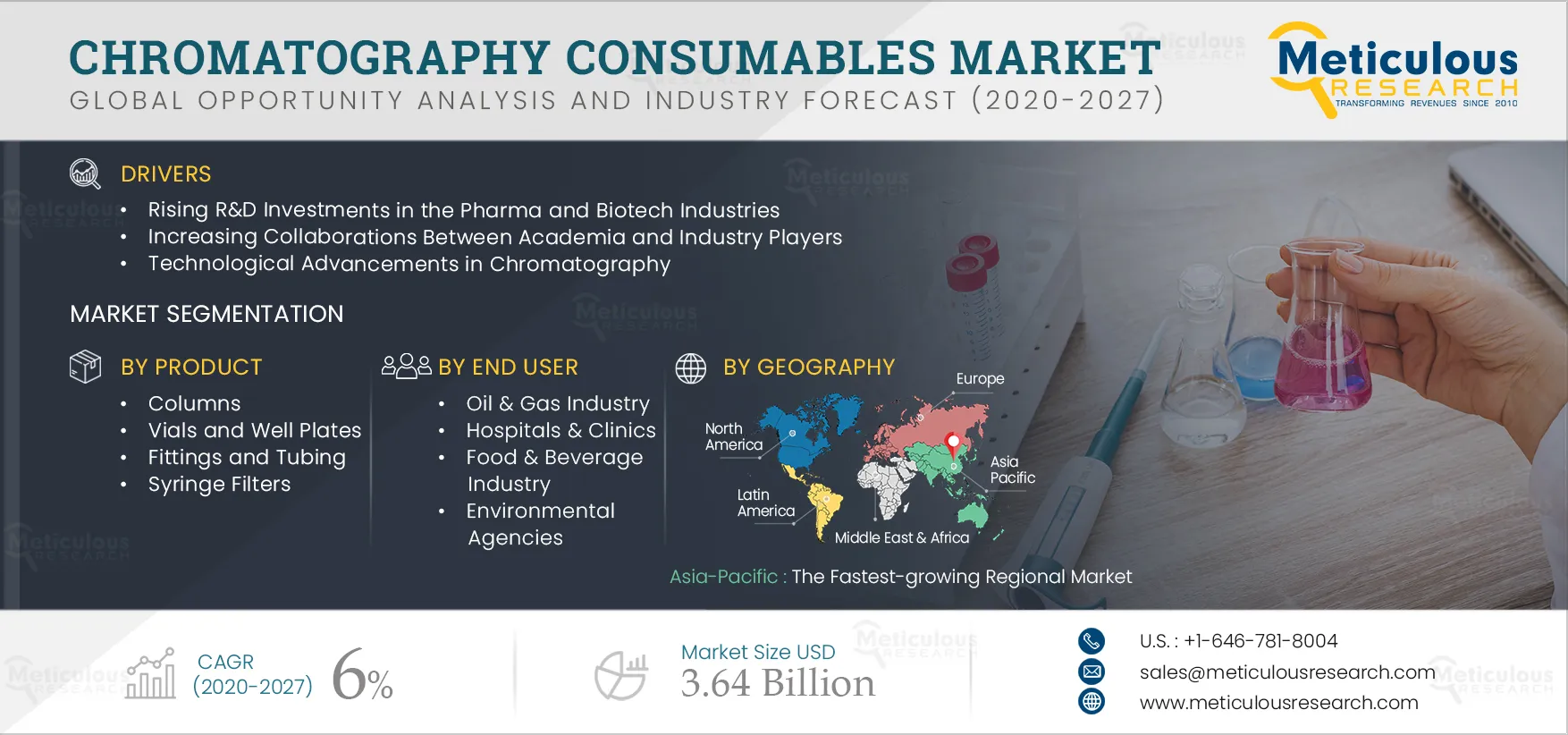

Chromatography Consumables Market by Product (Prepacked Columns [Analytical, Preparative], Vials, Tubing), Technology (HPLC, GC, UPLC), End User (Pharma, Biotech, Hospitals, F&B, Oil & Gas, Environmental Agencies) and Geography - Global Forecast to 2027

Report ID: MRHC - 104475 Pages: 215 Mar-2021 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Chromatography Consumables Market is expected to grow at a CAGR of 6% from 2020 to 2027 to reach $3.64 billion by 2027. Chromatography is an analytical technique used in pharmaceutical, chemicals, food, and environmental testing laboratories to separate mixtures. Chromatography consumables are single-use products used for separating components or solutes from gas, solvent, water, or any mobile fluid.

The growth of this market is primarily driven by factors such as the rising R&D investments in the pharma and biotech industries, increasing collaborations between academia & industry players, technological advancements, policies & initiatives to reduce pollution, and rising food safety concerns. Further, the rising demand from emerging economies in Asia-Pacific and Latin America and growth in the proteomics and genomics markets are expected to offer significant opportunities for players operating in the chromatography consumables market.

The ongoing global COVID-19 pandemic has impacted healthcare markets. To combat this pandemic, several COVID-19 therapeutics, diagnostic products, and vaccines are under clinical studies, for which the demand for various reference materials, including chromatography consumables, has been increased. For instance, as of September 2020, there are ~596 therapeutics and 179 vaccines under development (Source: BioWorld).

Collaborations among the market players are accelerating amid the COVID-19 pandemic for supporting the development of therapeutics, diagnostic products, and vaccines. For instance, in February 2021, RotaChrom Technologies LLC (Hungary) collaborated with CycloLab Cyclodextrin Research and Development Ltd. (Hungary) to combine its scalable Centrifugal Partition Chromatography (CPC) technology with Cyclolab’s knowledge and experience with cyclodextrins to enhance the production of COVID-19 treatment.

In September 2020, F. Hoffmann-La Roche AG (Switzerland) introduced chromatography immunoassay-based SARS-CoV-2 Rapid Antigen Test, with a distribution partnership with SD BIOSENSOR (Korea). Such strategic developments are expected to generate the demand for chromatography consumables. Further, researchers worldwide are employing analytical techniques like chromatography to understand the virus morphology to find an effective cure. For instance,

Thus, the growing research related to COVID-19 using chromatography to understand the virus and develop better therapies, vaccines, and diagnostic tools is expected to drive market growth.

Increasing collaborations between academia and industry players support market growth

Pharmaceutical, biopharmaceutical, and biotechnological research is a complex arena, as fewer medicines are launched despite extensive research. Thus, to solve this problem, pharmaceutical companies are collaborating with third-party players to gain access to an enlarged set of skills and technologies, such as novel drug targets, validation of targets, signal transduction pathway know-how, animal models, disease expertise, translational medicine know-how, and new biomarkers. In April 2020, the University of Oxford (U.K.) announced a strategic partnership with AstraZeneca Plc. (U.K.) for the development and large-scale distribution of the COVID-19 vaccine.

These academia-industry collaborations are expected to drive research studies in academic & research institutes. This is projected to accelerate the demand for various analytical techniques and consumables, including chromatography instruments and related consumables among academic institutions. Chromatography consumables are used for various applications, including Metabolomics, proteomics, and genomics. Consumable manufacturers are increasingly partnering with academic/research institutions to provide suitable products and services. For instance:

Accelerated R&D in the area of proteomics is expected to create several opportunities for market growth

In the past decade, there has been an increase in proteomics-based studies, mainly due to technological advancements and the need to understand the molecular bases of various diseases. Proteomics is used to identify proteins, structure functions, and respective modifications in various research areas, mainly medical research and drug discovery & diagnostics.

The recent outbreak of COVID-19 has led to an increase in proteomics research. For instance, reverse transcription-polymerase chain reaction (RT-PCR) was deemed the most reliable method to detect the viral genes in COVID-19-positive patients. Though this method is widely established, there exist problems in its performance. Due to the potent mutability of the viral genes, the technique might not be sensitive enough to detect the virus if it has mutated. Furthermore, RT-PCR tends to exhibit low throughput due to intermediate and long reaction times.

Thus, the growth in proteomics studies is expected to increase the use of chromatography consumables suitable for protein studies, thereby driving the market’s growth.

Click here to : Get Free Sample Pages of this Report

Based on product, the columns segment is expected to account for the largest share of the market in 2020

Based on product, the chromatography consumables market is segmented into columns, syringe filters, vials and well plates, fittings and tubing, and other consumables, which include sample loops, fused silica adapters, methanizers, membranes, and disposable gas cylinders. In 2020, the columns segment is estimated to account for the largest share of the chromatography consumables market. Chromatographic columns are further segmented into pre-packed and empty columns. In 2020, the pre-packed columns segment is estimated to account for the largest share of the chromatography columns market. Pre-packed columns help avoid the laborious and time-consuming process of packing chromatographic columns, providing more time for processing the products. In addition to routine downstream processing, pre-packed chromatography columns are also widely adopted for the large-scale cGMP manufacturing of biopharmaceuticals.

The liquid chromatography segment is expected to register the highest CAGR during the forecast period

Based on technology, the chromatography consumables market is segmented into liquid chromatography, gas chromatography, and other technologies. The liquid chromatography segment is projected to grow at the highest CAGR during the forecast period. Technological advancements in liquid chromatography analytical methods and the growth in biosimilars, generics, and CROs due to the rising demand for drug development are some of the factors driving the growth of this segment.

Pharmaceutical and biotechnology organizations to dominate the chromatography consumables market

Based on end user, the chromatography consumables market is segmented into academic & research institutes, pharmaceutical and biotechnology organizations, food & beverage organizations, hospitals & clinics, environmental agencies, oil & gas organizations, and other end users. In 2020, the pharmaceutical and biotechnology organizations segment is estimated to account for the largest share of the chromatography consumables market. The large share of this segment is primarily attributed to the increasing production of drug molecules, R&D investments in the pharmaceutical and biopharmaceutical industries, and growing collaborations of pharmaceutical and biotechnology companies with CROs.

Asia-Pacific: Fastest-growing regional market

Based on geography, the chromatography consumables market is categorized into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific region is expected to grow at the highest CAGR during the forecast period due to rising government spending toward increasing manufacturing base and related R&D activities across the APAC life science sector, the introduction of various technological and healthcare reforms, and increasing trend of pharmaceutical outsourcing for drug discovery and development studies. Moreover, the rising demand for food safety testing with the growing F&B industry and increasing gas chromatography adoption in the oil & gas sector are further expected to support the chromatography consumables market in the Asia-Pacific region.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past three years. The key players profiled in the chromatography consumables market report are Merck KGaA (Germany), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Hitachi High-Tech Corporation (Japan), Bruker Corporation (U.S.), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), PerkinElmer, Inc. (U.S.), and Shimadzu Corporation (Japan).

Scope of the Report:

Chromatography Consumables Market, by Type

(Note: Other consumables include sample loops, fused silica adapters, methanizers, membranes, and disposable gas cylinders)

Chromatography Consumables Market, by Technology

Chromatography Consumables Market, by End User

Chromatography Consumables Market, by Geography

Key questions answered in the report:

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates