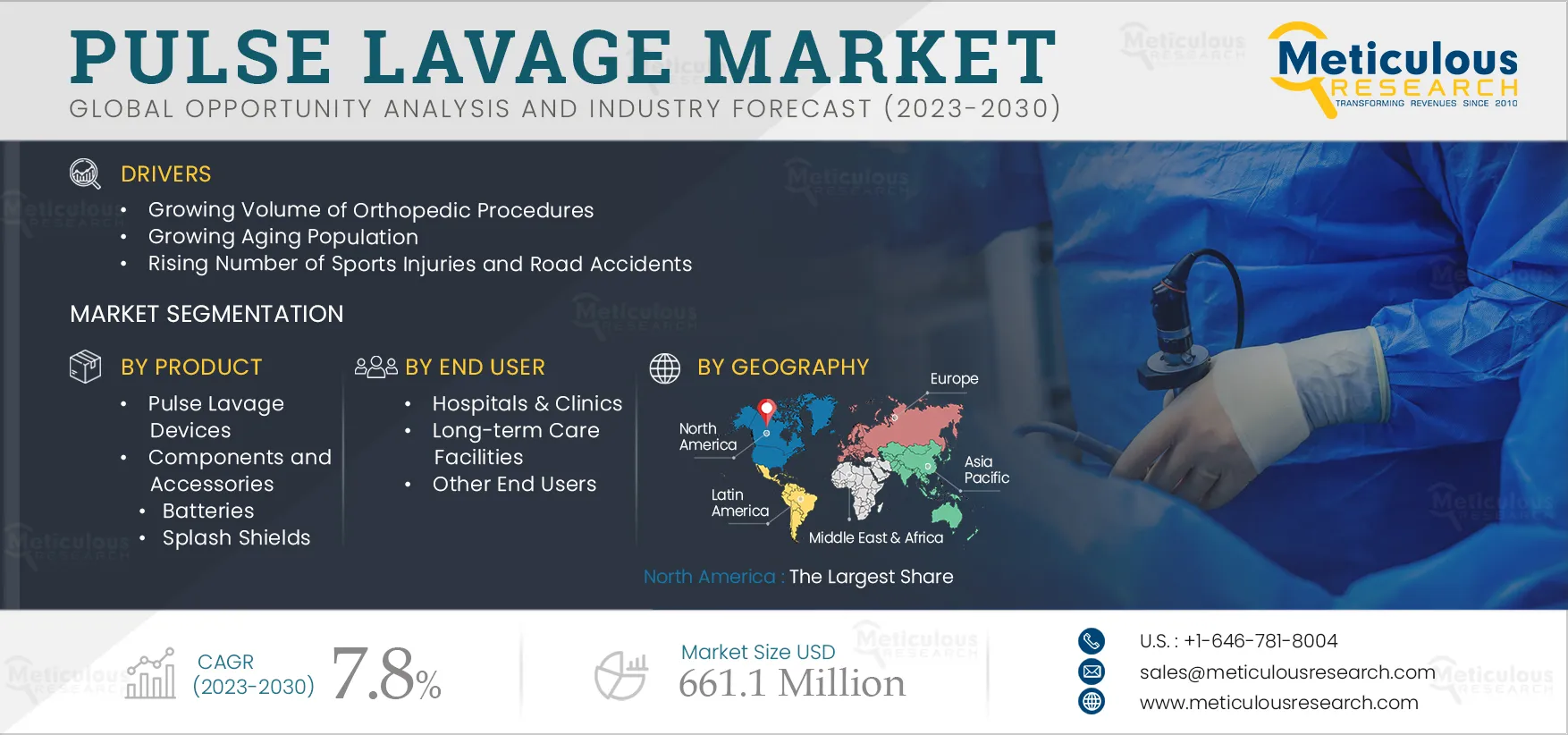

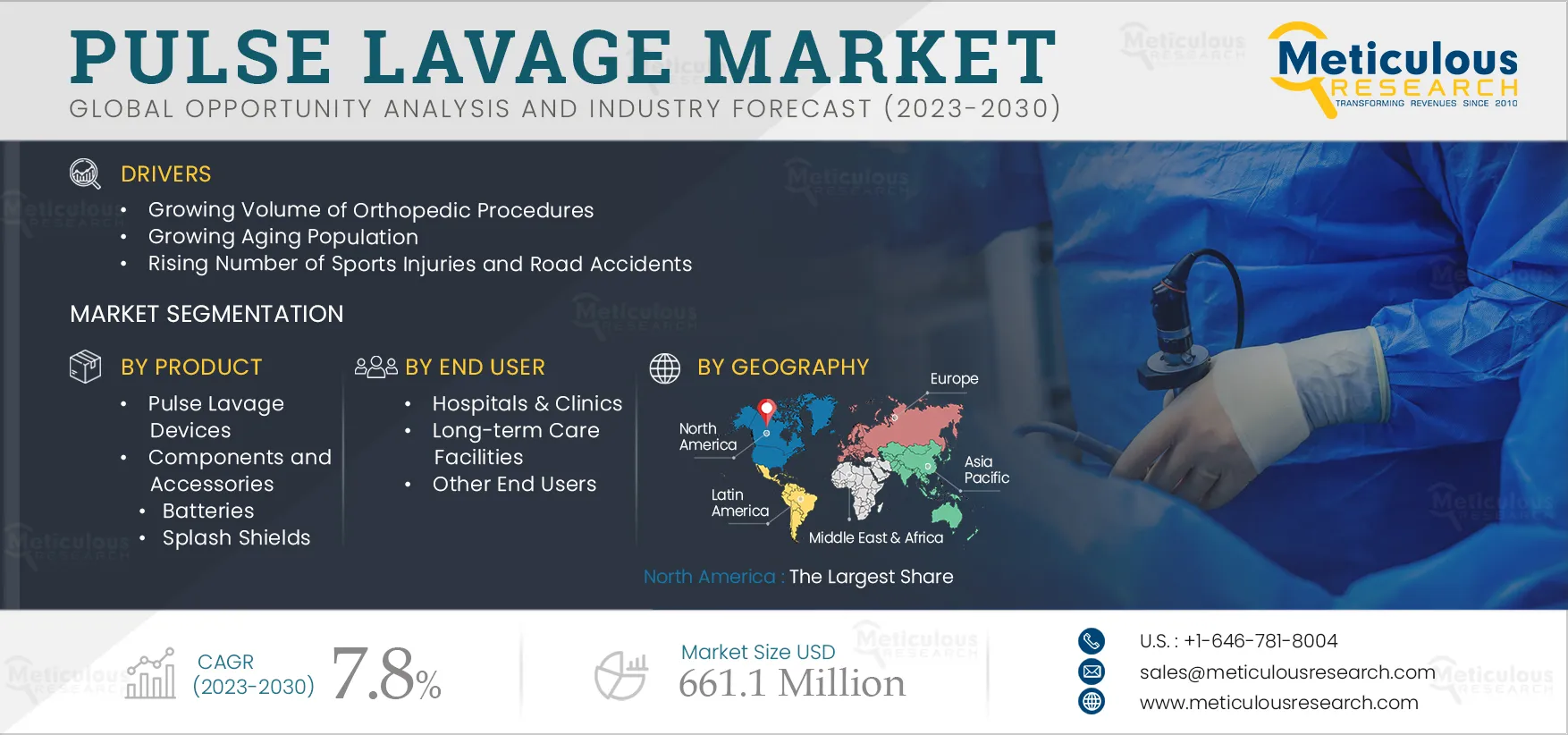

The Pulse Lavage Market is projected to reach $661.1 million by 2030, at a CAGR of 7.8% from 2023 to 2030. Pulse lavage devices are medical devices used for wound irrigation and debridement in surgical and non-surgical settings. These devices typically consist of a handheld unit that delivers a pulsating stream of sterile saline or other irrigation solution to the wound site using a variety of nozzle types. The pulsating action helps to dislodge debris and bacteria from the wound, while the irrigating solution helps to flush away any remaining contaminants.

The growth of this market is driven by the increasing number of orthopedic procedures, growing aging population, and rising sports injuries and road accidents. In addition, untapped opportunities in developing economies are offering opportunities for market growth. However, delayed recovery from the wounds due to high-pressure irrigation and inconsistent medical reimbursement policies hinder this market's growth to some extent.

Rising Number of Sports Injuries and Road Accidents to Drive the Demand for Pulse Lavage

Over the last decade, youth participation in sports activities has increased considerably. This rise in sports participation has brought about an associated increase in both traumatic and other injuries in athletes. According to the Sports & Fitness Industry Association and Sports Marketing Surveys, in the U.S., in 2021, nearly 232.6 million Americans participated in organized sports and fitness activities. It was further estimated that more than 1.1 million children aged 14 and younger were treated in hospital emergency rooms for sports-related injuries in 2021.

In November 2022, 29,000 people were injured in traffic accidents in Germany, and it is reported that the number of injuries increased by 9% compared to the same month a year earlier [Source: The Federal Statistical Office]. Similarly, according to the Italian National Institute of Statistics, in 2021, 151,875 road accidents occurred in Italy, resulting in 204,728 injuries.

Therefore, the increasing number of accidental and sports injuries is leading to an increased demand for pulse lavage systems for wound care and surgical applications.

Click here to: Get a Free Sample Copy of this report

Increasing demand for Orthopedic Procedures to Drive the Demand for Pulse Lavage

The demand for surgical procedures is continuously increasing owing to the increasing population, lifestyle disorders, and advancements in surgical technologies. In recent years, minimally invasive orthopedic surgeries have been increasing. The technique has reduced the incision size and minimized the trauma to the soft tissues caused during conventional arthroplasty or joint replacement procedures. Also, the blood loss is reduced due to the smaller incision, which ensures fast recovery with less hospital stay. Owing to these benefits, joint replacement surgeries are increasing globally.

According to Canadian Joint Replacement Registry, in 2020–2021, a total of 110,585 joint replacements performed i.e., 55,300 hip replacements and 55,285 knee replacements were performed in Canada, with increases of 12.9% and 26.4%, respectively, when compared to the number of surgeries performed in 2019–2020. Additionally, in the U.S., nearly 2.4 million hip and knee surgeries were reported, with an increase of 18.3% in 2020. (Source: American Joint Replacement Registry 2021).

Therefore, the growing number of orthopedic surgeries is expected to increase the demand for surgical devices, including pulse lavage systems

Key Findings in the Pulse Lavage Market Study

In 2023, the Pulse Lavage Devices Segment to Account for the Largest Share of the Pulse Lavage Market

Based on product, the pulse lavage market is segmented into pulse lavage devices and components & accessories. In 2023, the pulse lavage devices segment is expected to account for the largest share of the pulse lavage market. The large market share of this segment is attributed to its easy mobility and relatively low cost of devices, high rate of hospital admissions due to crucial injuries, and the high adoption of pulse lavage devices for improving patient health outcomes.

The AC-Powered Segment to Offer Lucrative Growth Opportunities for Players in this Market

Based on the power source, the pulse lavage market is segmented into AC, battery, and gas. The AC-powered segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by the reusability of AC adapters, single-use of the handpiece, and the elimination of the costs associated with the disposal of batteries when compared with battery-powered systems.

In 2023, the Disposable Pulse Lavage Systems Segment to Account for the Largest Share of the Pulse Lavage Market

Based on usability, the pulse lavage market is segmented into disposable pulse lavage systems, semi-disposable pulse lavage systems, and reusable pulse lavage systems. In 2023, the disposable pulse lavage systems segment is expected to account for the largest share of the pulse lavage market. The large market share of this segment is attributed to higher adoption to reduce the cross-infections that can occur with reusable pulse lavage systems.

In 2023, the Orthopedics & Trauma Segment to Account for the Largest Share of the Pulse Lavage Market

Based on application, the pulse lavage market is segmented into orthopedics & trauma and wound care. Orthopedics & trauma is further divided into joint reconstruction & arthroplasty and spinal implants. In 2023, the orthopedics & trauma segment is expected to account for the largest share of the pulse lavage market. The large market share of this segment is attributed to the high prevalence of musculoskeletal disorders such as osteoarthritis and the rise in the number of related surgical procedures.

In 2023, the Hospitals & Clinics Segment to Account for the Largest Share of the Pulse Lavage Market

Based on end user, in 2023, the hospitals & clinics segment is expected to account for the largest share of the pulse lavage market. Hospitals & clinics are preliminary healthcare facilities. The large market share is attributed to a large number of patient visits for wound care and surgical procedures in hospitals due to the high burden of the geriatric population and associated comorbidities.

North America to Dominate the Market in 2023

In 2023, North America is expected to account for the largest share of the pulse lavage market. The key factors contributing to this large market share are the high burden of the geriatric population, advanced healthcare infrastructure, high number of orthopedic surgeries, and the presence of key market players.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2023. The key players profiled in the pulse lavage market report are Stryker Corporation (U.S.), Zimmer Biomet Holdings, Inc. (U.S.), Premier Surgical Ltd. (Ireland) (Atlantic Surgical Ltd.), MicroAire Surgical Instruments LLC (U.S.), Judd Medical Ltd. (U.K.), Smith & Nephew plc (U.K.), Mölnlycke Health Care AB (Sweden), C. R. Bard, Inc. (A Subsidiary of Becton Dickinson & Company)(U.S.), Corin Group PLC (A Subsidiary of 2IL Orthopaedics Limited) (U.K.), and De Soutter Medical Limited (U.K.).

Scope of the Report:

Pulse Lavage Market, by Product

- Pulse Lavage Devices

- Components and Accessories

- Irrigation Tips and Tubes

- Batteries

- Splash Shields

- Other Components and Accessories

(Note: Other components & accessories include irrigation bags, waste pipes, adaptors, and handpieces)

Pulse Lavage Market, by Usability

- Disposable Pulse Lavage Systems

- Semi-Disposable Pulse Lavage Systems

- Reusable Pulse Lavage Systems

Pulse Lavage Market, by Power Source

- AC-powered

- Battery-powered

- Gas-powered

Pulse Lavage Market, by Application

- Orthopedics & Trauma

- Joint Reconstruction and Arthroplasty

- Knee Joint

- Hip Joint

- Other Extremities

- Spinal Implants

- Wound Care

(Note: Other extremities include ankle, elbow, shoulder, and hand/wrist)

Pulse Lavage Market, by End User

- Hospitals & Clinics

- Long-term Care Facilities

- Other End Users

(Note: Other end users include ambulatory surgery centers, homecare settings, and academic & research institutes)

Pulse Lavage Market, by Geography

- North America

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Key questions answered in the report: