Resources

About Us

Label-free Detection Market Size, Share, Forecast, & Trends Analysis by Product (Biosensor, Microplate, Microcalorimeter), Technology (SPR, BLI), Process (Binding Kinetic, Lead Generation, Hit Confirmation), Application, End User - Global Forecast to 2032

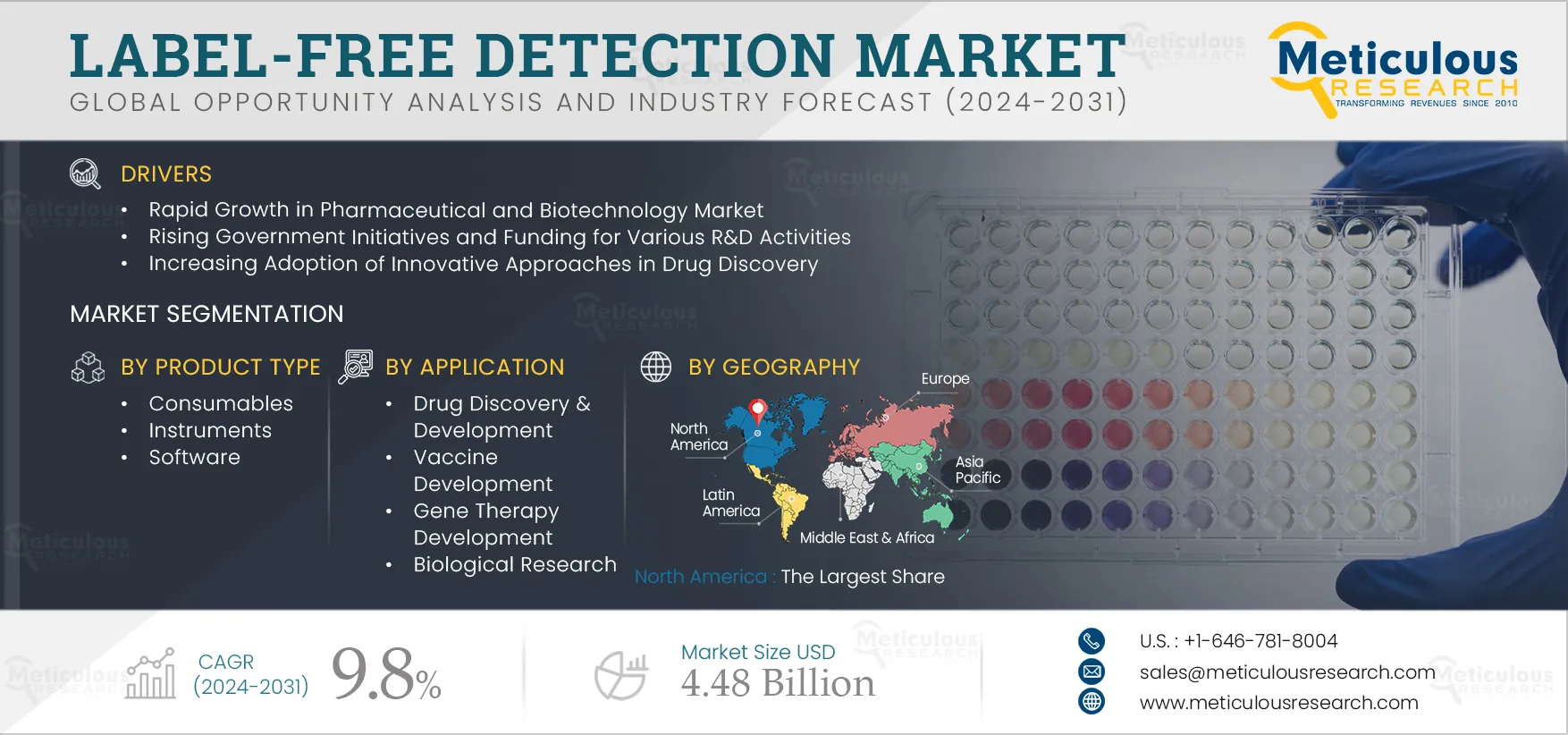

Report ID: MRHC - 10427 Pages: 320 Feb-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the high growth in the pharmaceutical and biotechnology market, government initiatives, rising R&D funding, and increasing adoption of innovative approaches in drug discovery. Moreover, technological advancements in label-free detection, growing applications of label-free detection in point-of-care testing, and emerging economies are expected to offer growth opportunities for the players operating in this market.

In recent years, fragment-based drug discovery has grown in popularity as an effective method to discover lead molecules. Label-free detection technologies, such as thermal shift assays and SPR, are ideal for fragment screening due to their high capacity and sensitivity to evaluate low affinity binding. Label-free approaches enable the identification of low molecular weight fragments, which can be used as starting points for further lead generation and improvement in drug development programs.

Moreover, the adoption of high-throughput screening is growing as it is a crucial phase in early-stage drug discovery, which involves testing broad chemical databases against specific targets. Also, the adoption of phenotypic screening and drug repurposing assists in identifying new therapeutic candidates. Label-free detection technology delivers useful information on compound efficacy, biomolecular interactions, and binding kinetics, which helps to study drug-target interactions, optimize therapeutic candidates, and identify lead compounds. Thus, the adoption of innovative approaches in drug discovery, such as phenotypic screening, fragment-based approaches, and target-based strategies, drives the demand for label-free detection technologies.

Click here to: Get Free Sample Pages of this Report

The pharmaceutical and biotechnology industry is growing at a high rate owing to continuous innovation and more affordable alternatives available for drug discovery and development. Pharmaceutical and biotechnology companies rely significantly on label-free detection technologies for a wide range of applications, including drug discovery & development, vaccine development, biological research, and many others. Label-free detection techniques are critical for the early stages of drug discovery and development. They help researchers with real-time monitoring of biomolecular interactions, examine potential drug candidates, investigate chemical interactions, and determine binding kinetics and affinities. It also delivers useful information on drug-target interactions, which aids in the discovery and development of lead compounds.

The rising number of drug targets, combined with the requirement for efficient screening methods and growing demand for biologic drugs, has boosted the demand for label-free detection technology in the growing pharmaceutical and biotechnology industry.

Artificial intelligence (AI) and machine learning (ML) technologies integrated with label-free detection systems can improve the ability of optical sensors to interpret, analyze, and predict the data during investigations of small traces of biomolecules and disease markers more effectively. This combination of AI and ML with label-free detection speeds up the drug discovery process and increases its probability of effective candidate selection. Furthermore, optical sensors combined with machine learning are effective in identifying and detecting the virus even when the signal is low in strength and high in noise. This label-free approach is quick, sensitive, precise, and economical. However, the majority of the AI and ML-enabled label-free detection technologies are currently in the research phase.

Microfluidics allows exact monitoring of the flow of fluid, resulting in better sample handling and higher accuracy in label-free detection. The shrinking of lab-on-a-chip platforms additionally minimizes sample and reagent volumes, resulting in reduced expenses and faster analysis times.

In addition, the integration of label-free detection platforms with lab-on-a-chip and microfluidics offers several advantages, such as high-throughput screening, cost-effectiveness, the combination of multiple functions, and improved sensitivity, which increase its adoption in label-free detection technology.

Recent improvements in label-free detection technologies have resulted in promising diagnostic instruments that integrate ease of use, rapid pathogen identification, user-friendliness, accuracy, operational efficiency, and cost-effectiveness, with a tendency toward the development of portable platforms. Advancements in sensor technologies utilized for label-free detection result in higher resolution, sensitivity, and signal-to-noise ratios. For instance, Surface Plasma Resonance (SPR) sensors have undergone improvements in terms of multiplexing capability, response time, and sensitivity.

In addition, the integration of label-free detection with microfluidics and lab-on-a-chip devices has transformed the industry, allowing for automation, downsizing, and higher performance. Microfluidic systems minimize reagent usage, offer accurate oversight over sample handling, and allow for effective analysis. Lab-on-a-chip systems combine sample analysis, detection, and preparation on a single platform, allowing for more convenient and faster point-of-care applications.

Furthermore, label-free detection technology offers several advantages over traditional technology, such as enabling researchers to conduct studies that are just not possible with conventional approaches that only yield end-point results. These include affinity and kinetic analysis and binding specificity evaluation, made possible by label-free monitoring's dynamic, real-time interaction analysis capabilities. These advancements in label-free detection technology create opportunities for market players to invest in expanding their product offerings.

Based on product type, the label-free detection market is segmented into consumables, instruments, and software. In 2025, the consumables segment is expected to account for the largest share of the label-free detection market. This segment's large market share is attributed to the recurring use of consumables, technological advancements in label-free detection technologies, and their increasing adoption for screening biomolecules and assays for accurate and easy diagnosis of disease and understanding the interaction of these assays with target molecules for drug discovery applications.

The instruments segment is further segmented into optical biosensor instruments, microcalorimeters, and other instruments. In 2025, the optical biosensor instruments segment is expected to account for the largest share of 78.4% of the label-free detection market. The large market share of this segment can be attributed to the benefits offered by optical biosensor instruments, such as the high sensitivity, direct and real-time measurement, in addition to multiplexing capabilities, which increases its adoption.

Based on technology, the label-free detection market is segmented into Surface Plasmon Resonance (SPR), Bio-Layer Interferometry (BLI), Isothermal Titration Calorimetry (ITC) Isothermal Titration Calorimetry (ITC), Differential scanning calorimetry (DSC), and other technologies. In 2025, the Surface Plasmon Resonance (SPR) segment is expected to account for the largest share of the label-free detection market. The large market share can be attributed to the advancements in the SPF technology, including label-free measurement of biomolecular interactions, allowing for the real-time detection of biomolecules, and offering greater versatility compared to other technologies, increasing its adoption. Furthermore, growing demand for SPR systems; hence, companies are focusing on the introduction of innovative offerings. For instance, in April 2022, Sartorius AG (Germany) launched the Octet SF3, the Surface Plasmon Resonance (SPR) system, to offer real-time, label-free analysis of biomolecular interactions.

Based on application, the label-free detection market is segmented into drug discovery & development, vaccine development, gene therapy development, biological research, and other applications. In 2025, the drug discovery & development segment is expected to account for the largest share of the label-free detection market. Label-free detection techniques offer high-throughput screening of various drug candidates for a wide range of target molecules and offer real-time molecular interactions, resulting in improved screening of massive compound databases. The capacity to quickly identify interesting lead compounds is the factor that boosts the demand for label-free detection in drug discovery. Furthermore, to cater to the growing demand for label-free detection technologies in drug discovery & development, companies are actively focusing on the introduction of innovative offerings. For instance, in February 2022, Bruker Corporation (U.S.) launched the timsTOF MALDI PharmaPulse (timsTOF MPP) system for label-free High-Throughput Screening (HTS) in drug discovery.

However, the gene therapy development segment is projected to witness the highest growth rate of 16.7% during the forecast period of 2025–2032. This growth is driven by the increasing adoption of label-free detection technologies in gene therapy development.

Based on process, the label-free detection market is segmented into binding kinetics, hit confirmation, lead generation, endogenous receptor detection, binding thermodynamics, and other processes. In 2025, the binding kinetics segment is expected to account for the largest share of the label-free detection market. The large market share of this segment can be attributed to the advancements in structural biology and the growing focus on personalized medicine. Further, to ensure efficacy and safety, biologics, including monoclonal antibodies, need to be properly characterized and tested in terms of binding kinetics. Label-free detection techniques provide a non-destructive and label-free method for examining complicated interactions, which makes them an excellent alternative for biological research.

Based on end users, the label-free detection market is segmented into pharmaceutical & biotechnology companies, pharmaceutical & biotechnology companies, and contract research organizations. In 2025, the pharmaceutical & biotechnology companies segment is expected to account for the largest share of the label-free detection market. The large market share of this segment can be attributed to the technological advancements that have increased the adoption of label-free technologies by the pharmaceutical & biotechnology companies, and product launches to expand the innovative offering. For instance, in June 2022, Agilent Technologies Inc. (U.S.) launched the LC/MS and GC/MS quadrupole mass spectrometers at the 70th ASMS Conference on Mass Spectrometry in Minnesota, U.S. This system offers an automated sample reinjection function to make simpler lab operations. Further, in February 2021, Creoptix (Switzerland) launched the waveRAPID, a label-free kinetic measurement method to increase productivity in the laboratory.

In 2025, North America is expected to account for the largest share of 43.6% of the label-free detection market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America’s significant market share can be attributed to several key factors, including the presence of major label-free detection companies, increasing adoption of innovative approaches in drug discovery, and technological advancements in label-free detection technologies.

Moreover, the market in Asia-Pacific is slated to register the highest growth rate of 13.2% during the forecast period. The growth of this regional market is attributed to the rising adoption of advanced label-free technologies in the pharmaceutical and biotechnology industries, increasing research activities, the presence of label-free detection consumables and instruments manufacturers in countries such as China, India, and Japan, technological advancements in label-free detection technologies, and increased awareness of label-free techniques.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the label-free detection market are Danaher Corporation (U.S.), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), GE HealthCare Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Sartorius AG (Germany), Corning Inc. (U.S.), Horiba, Ltd. (Japan), Malvern Panalytical Ltd (U.K.), and Bruker Corporation (U.S.).

In April 2022, Sartorius AG (Germany) launched the Octet SF3, a Surface Plasma Resonance (SPR) system that offers real-time, label-free analysis of biomolecular interactions.

In February 2022, Bruker Corporation (U.S.) launched the timsTOF MALDI PharmaPulse (timsTOF MPP) system for label-free High-Throughput Screening (HTS) in drug discovery.

|

Particulars |

Details |

|

Number of Pages |

320 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.8% |

|

Market Size (Value) |

USD 4.48 Billion by 2032 |

|

Segments Covered |

By Product Type

By Technology

By Application

By Process

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, Rest of Europe), Asia–Pacific (India, China, Japan, Rest of Asia–Pacific), Latin America, Middle East & Africa. |

|

Key Companies |

Danaher Corporation (U.S.), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), GE HealthCare Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Sartorius AG (Germany), Corning Inc. (U.S.), Horiba, Ltd. (Japan), Malvern Panalytical Ltd (U.K.), and Bruker Corporation (U.S.). |

This study offers a detailed assessment of the label-free detection market and analyzes the market sizes & forecasts based on product type, technology, application, process, and end user. This report also involves the value analysis of various segments and subsegments of the label-free detection market at the regional and country levels.

The label-free detection market is projected to reach $4.48 billion by 2032, at a CAGR of 9.8% during the forecast period.

Among the product types covered in this report, in 2025, the consumables segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the technological advancements in label-free detection technology and the recurring use of consumables.

Among the technologies covered in this report, in 2025, the Surface Plasmon Resonance (SPR) segment is expected to account for the largest share of the label-free detection market. This segment's large market share can be attributed to advancements in SPF technology, which enables label-free measurement of biomolecular interactions, allows for the real-time detection of biomolecules, and offers greater versatility compared to other technologies.

The growth of this market is driven by factors such as the rapid growth in the pharmaceutical and biotechnology market, rising government initiatives and funding for various R&D activities, increasing adoption of innovative approaches in drug discovery, and rising focus on personalized medicine. Moreover, technological advancements in label-free detection and the growing applications of label-free detection in point-of-care testing are expected to offer significant market growth opportunities.

The key players profiled in the label-free detection market report are Danaher Corporation (U.S.), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), GE HealthCare Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Sartorius AG (Germany), Corning Inc. (U.S.), Horiba, Ltd. (Japan), Malvern Panalytical Ltd (U.K.), and Bruker Corporation (U.S.).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the growing government initiatives and R&D funding, and growing demand for label-free detection instruments and consumables in these countries.

Published Date: Mar-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates