Resources

About Us

Plant-based Food Market by Type (Dairy Alternatives, Plant-based Meat, Meals, Confectionery, Beverages, Egg Alternatives, Seafood), Source (Soy, Wheat, Pea, Rice), Distribution Channel (B2B, B2C [Convenience Store, Online Retail]) - Global Forecast to 2031

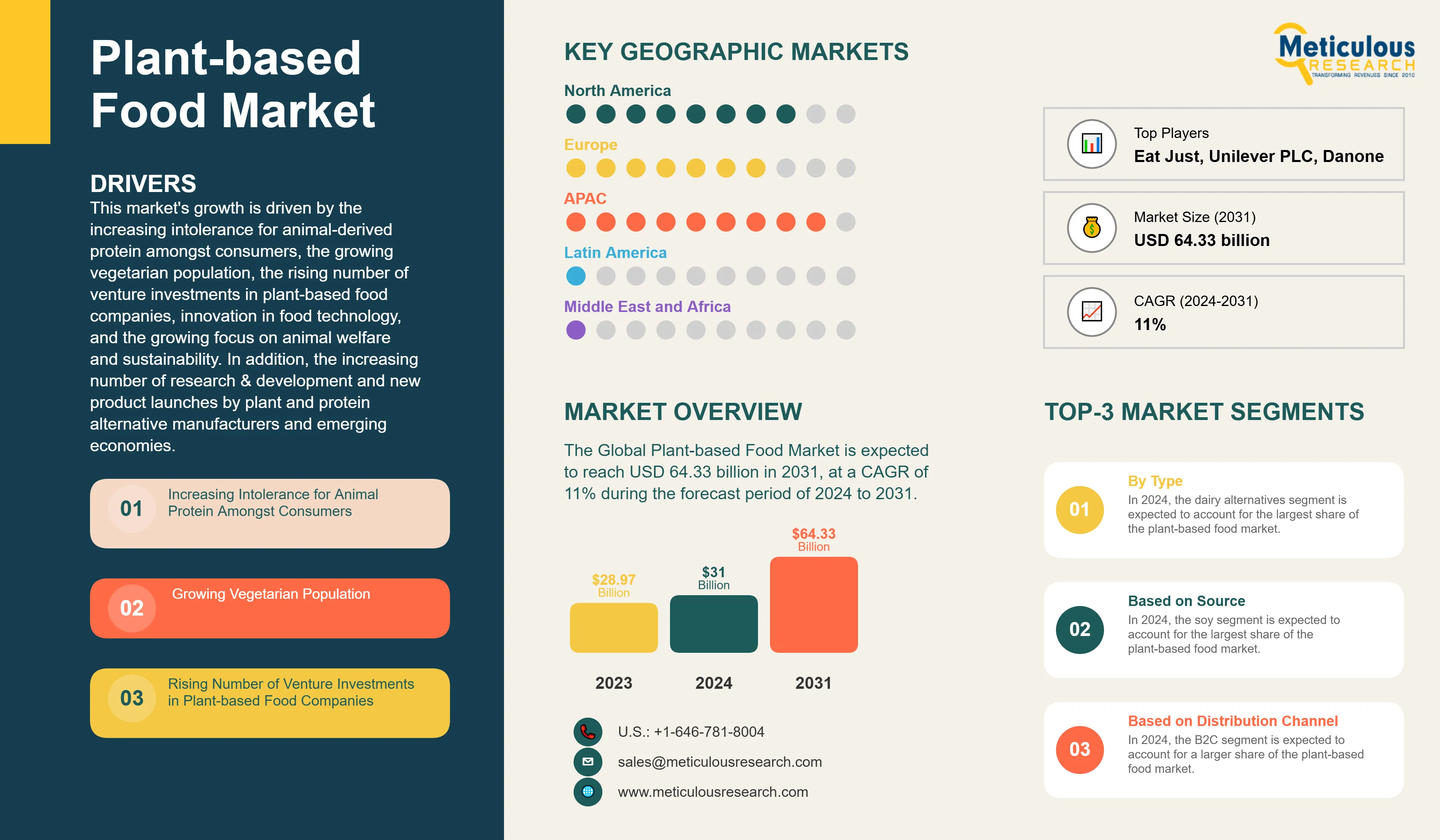

Report ID: MRFB - 104412 Pages: 263 Aug-2025 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Global Plant-based Food Market was valued at USD 28.97 billion in 2023. This market is expected to reach USD 64.33 billion in 2031, and is projected to reach approximately USD 31 billion by 2024, at a CAGR of 11% during the forecast period of 2024 to 2031.

This market's growth is driven by the increasing intolerance for animal-derived protein amongst consumers, the growing vegetarian population, the rising number of venture investments in plant-based food companies, innovation in food technology, and the growing focus on animal welfare and sustainability. In addition, the increasing number of research & development and new product launches by plant and protein alternative manufacturers and emerging economies, such as Asia-Pacific, Latin America, and the Middle East & Africa, are expected to create lucrative opportunities for players operating in this market.

However, factors such as the comparatively higher price range of meat substitutes, significant preference for animal-based products, and consumer preference for soy and gluten-free products are expected to hinder the growth of this market to a notable extent.

Click here to: Get Free Sample Pages of this Report

The report includes a competitive analysis based on an extensive assessment of the key growth strategies adopted by leading market players in the past three to four years and the benchmarking of key players' product offerings by type. The key players profiled in the plant-based food market are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.).

Plant-based products are trending and have marked serious growth in vegan product development. Across the food value chain, companies are looking to generate growth through innovation and product development in plant-based products, both within their legacy brands and by creating new product offerings. Some plant-based product developments in the global market are as follows:

Likewise, many food innovators are exploring new formulations to impact the existing protein supply chain, showcasing the opportunity for vendors in the global plant-based food market.

In recent years, the plant-based foods industry has witnessed an influx of investments aimed at capitalizing on the veganism trend and the surging demand for sustainable foods. Alongside the growing risk profile of livestock production, well-established meat and dairy players are increasingly under attack by animal welfare groups. Protein diversification has the potential to transform a food company’s core business and value proposition.

The growing trend of millennials adopting flexitarian and meat-free diets signals a change in purchasing habits that significantly shift from earlier generations. However, the plant-based movement is bigger than any one generation. Everyone, from celebrities to athletes to entire companies, including Google, and countries as big as China, are supporting the movement to eat more plant-based foods. The key players across the food value chain, from producers to retailers, are already investing in these opportunities.

Some companies are hedging against or preparing for the decline of demand for animal products by investing in other companies producing alternatives. The market has received investments and funding from several high-profile individuals, financial investors, and companies in the past few years. According to the Good Food Institute, in 2022, the alternative proteins industry received USD 2.9 billion in disclosed investments. In the same year, plant-based meat, egg, and dairy companies received USD 1.9 billion in investments, a significant increase over USD 693 million raised in 2019. Plant-based meat, seafood, egg, and dairy companies have raised USD 6.3 billion in investments since 2010.

Some of these investments are as follows:

Thus, growing venture capital investments in plant-based product companies are expected to drive the global plant-based food market.

Based on type, the plant-based food market is segmented into dairy alternatives, meat substitutes, plant-based meals, plant-based baked goods, plant-based confectionery, plant-based beverages, egg substitutes, fish and seafood alternatives, and other plant-based foods. In 2024, the dairy alternatives segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the increasing number of lactose intolerant people, the growing ethical concerns amongst consumers about animal abuse in modern dairy farming practices, and the nutritional benefits offered by plant-based dairy products.

However, the egg substitute segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the increasing consumer demand for egg alternatives, the rising number of investments and food innovations in egg alternatives, the increasing number of new product launches, and the low cholesterol levels provided by egg substitutes.

Based on source, the plant-based food market is segmented into soy, almond, wheat, pea, rice protein, and other sources. In 2024, the soy segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the easy and wide availability of raw materials, lower cost compared to other sources, significant demand from meat alternatives manufacturers, higher consumer acceptance level, and its wide range of applications in numerous food & beverage sectors, including meat, dairy alternative, and bakery.

However, the pea segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the increasing desire amongst consumers to find sustainable and good-tasting alternatives to animal-based proteins, the rising number of investments from leading manufacturers to increase pea protein production, and the growing adoption of pea protein in plant-based foods. In addition, peas are allergen-free, gluten-free, and lactose-free, which further increases the demand for pea-based food.

Based on distribution channel, the plant-based food market is segmented into business-to-business and business-to-consumer. In 2024, the B2C segment is expected to account for a larger share of the plant-based food market. This segment's large market share is attributed to factors such as the increased sales of plant-based food in well-established supermarkets and hypermarket chains, consumer preference for shopping from brick-and-mortar grocers due to easy access and availability, and the increasing consumer expenses on vegan food products.

Additionally, this segment is also expected to grow at the fastest CAGR during the forecast period due to the rapidly growing online retail sector. The rapid growth of this segment is mainly attributed to the faster accessibility, convenience, and cost-effectiveness offered by the online retail sector.

Based on geography, in 2024, Asia-Pacific is expected to account for the largest share of the plant-based food market. The leading position of Asia-Pacific in the plant-based food market is attributed to factors such as collaborations between international and domestic food companies, increasing protein-rich diet awareness, booming food & beverages industry, growing economy, rapid urbanization, and the large base of vegan and vegetarian population. Additionally, this country is expected to grow at the fastest CAGR during the forecast period due to increasing investment in the plant-based sector and the growing adoption of emerging technologies for product innovation.

|

Particular |

Details |

|

Page No. |

263 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

11% |

|

Market Size (Value) |

USD 64.33 billion |

|

Segments Covered |

By Type

By Source

By Distribution Channel

|

|

Countries/Regions Covered |

North America (U.S., Canada), Europe (Germany, U.K., Spain, Italy, France, Netherlands, Belgium, Austria, Poland, Portugal, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.). |

The plant-based food market is projected to reach $64.33 billion by 2031, at a CAGR of 11% during the forecast period.

The dairy alternatives segment is expected to account for the largest share of the plant-based food market in 2024.

The business-to-consumer segment is projected to record the highest CAGR during the forecast period of 2024–2031.

This market's growth is driven by the increasing intolerance for animal protein amongst consumers, the growing vegetarian population, the rising number of venture investments in plant-based food companies, innovation in food technology, and the growing focus on animal welfare and sustainability. In addition, the increasing number of research & development and new product launches by plant and protein alternative manufacturers and emerging economies, such as Asia-Pacific, Latin America, and the Middle East & Africa, are expected to create lucrative opportunities for players operating in this market.

Countries from Asia-Pacific and Latin America are projected to offer significant growth opportunities for vendors in this market.

The key players profiled in the plant-based food market study are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.).

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates