Resources

About Us

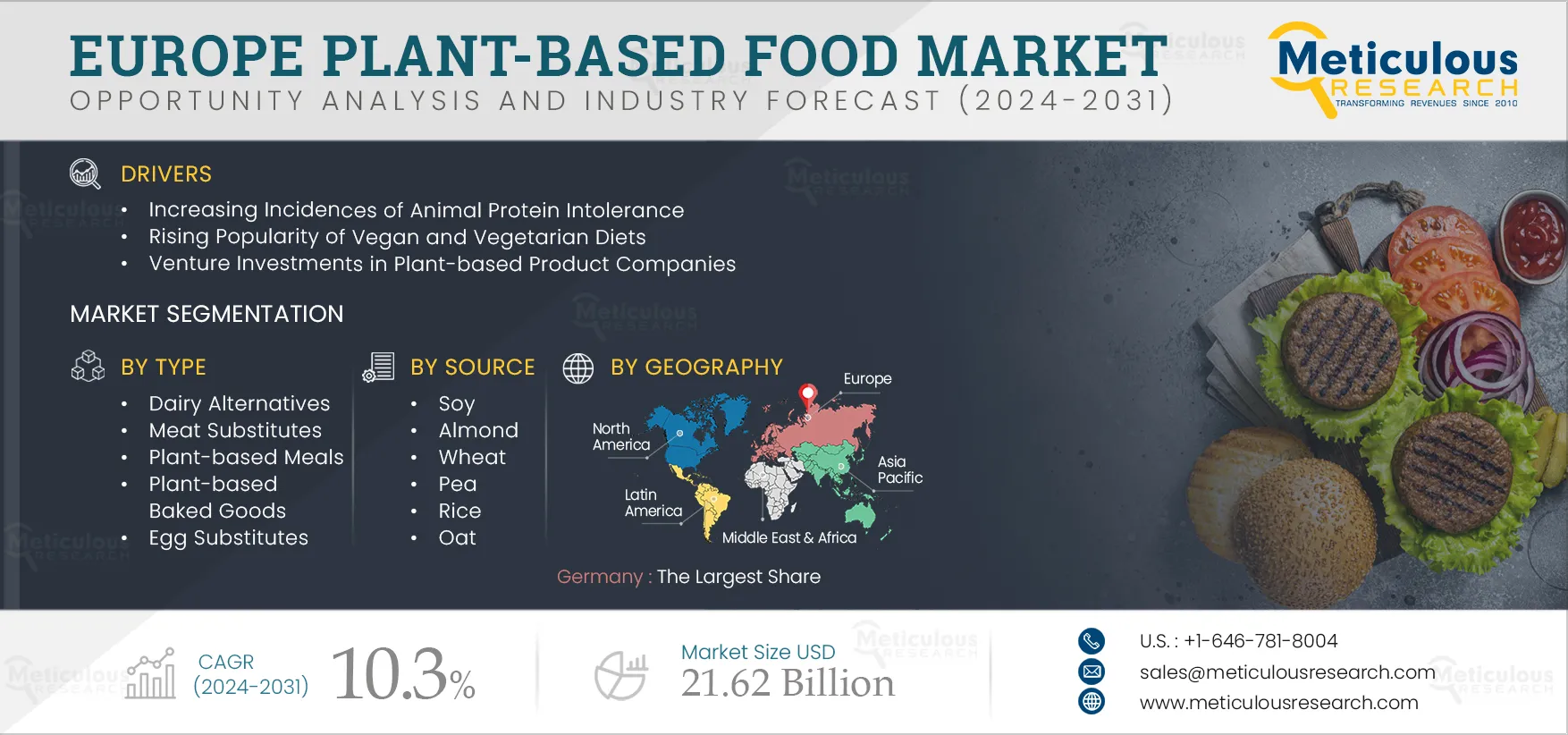

Europe Plant-based Food Market Size, Share, Forecast, & Trends Analysis by Type (Dairy Alternatives, Plant-based Meat, Egg Alternatives, Seafood), Source (Soy, Pea), Distribution Channel (B2B, B2C [Convenience Store, Online Retail]) - Forecast to 2031

Report ID: MRFB - 104574 Pages: 190 Sep-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is driven by the increasing prevalence of animal protein intolerance, the surging interest in vegan and vegetarian diets, increased venture capital investments in plant-based foods enterprises, and ongoing innovations in food technology. In addition, the launch of new products by manufacturers of plant-based foods and protein alternatives is anticipated to generate significant opportunities for market players.

However, factors such as the higher cost of plant-based foods and a strong consumer preference for animal-based products are expected to pose significant challenges to market growth.

In recent years, vegetarianism and veganism have gained popularity in Europe, driven by increased health awareness, environmental concerns, and compassion for animals. According to the European Vegetarian Union, around 10% of the European population identified as vegetarian in 2023, up from 3% in 2007, while 3% were vegan. A study by Veganz, a German vegan supermarket, found that the number of vegans in Germany has doubled since 2016, reaching 2.8 million in 2023.

Vegetarian and vegan consumers increasingly favor plant-based foods. The Academy of Nutrition and Dietetics indicates that well-planned vegetarian (including vegan) diets are healthy and nutritionally sufficient. These diets can lower the risk of various health issues, such as ischemic heart disease, type 2 diabetes, hypertension, obesity, and certain cancers. They are suitable for all life stages, including pregnancy, lactation, infancy, childhood, adolescence, and older adulthood, as well as for athletes. Additionally, lactose-intolerant consumers seek dairy alternatives due to their difficulty in digesting lactose, the sugar present in milk and dairy products (Source: National Institutes of Health).

Lactose tolerance is prevalent in Northern European countries like Sweden and Finland. In contrast, Turkey, Italy, Germany, and Spain have some of the highest rates of lactose intolerance. The target market for plant-based food and beverage products extends beyond vegans to include flexitarians, lactose-intolerant consumers, and those seeking clean-label food and beverage options. Consequently, the increasing popularity of vegan and vegetarian diets is fueling the growth of the plant-based foods market in Europe.

Click here to: Get Free Sample Pages of this Report

Plant-based products are increasingly becoming integral to modern diets. Consumer demand for ethical, sustainable, and healthy protein sources is driving significant investments and innovation in the meat and dairy substitute industry. Innovative food encompasses novel products and ingredients, including alternative meats (both plant-based and cell-culture-based), insect protein, alternative sugars, and flavor enhancers. According to the Good Food Institute, the global alternative proteins sector attracted USD 523 million in disclosed investments in 2023, with approximately USD 190 million allocated for R&D. Additionally, although the number of start-ups in the AgriFood Tech sector is relatively small, the food research and innovation sector secured around USD 6.8 billion in total investment in 2023 (Source: European Commission). This category is led by animal-free meat and dairy alternatives, and healthy ingredients, indicating a strong commitment to supporting alternative proteins in Europe.

Advancements in plant-based products are boosting consumer interest and expanding shelf space in retail settings. According to the World Resources Institute (WRI), even the most efficient meat source, chicken, converts only about 11% of gross feed energy into animal protein (WRI 2022). This inefficiency highlights the need for a systemic change within the industry. As a result, a technological revolution is underway, producing a variety of plant-based products that can effectively compete with their animal-based counterparts. Consequently, innovation in food technologies is a key driver of market growth.

Plant-based products are gaining traction, showcasing significant growth in vegan product development. Companies across the food value chain are seeking to drive growth through innovation and product development in plant-based offerings, both by enhancing their existing brands and introducing new products. Some plant-based product developments in the Europe market are as follows:

Similarly, numerous food innovators are developing new formulations aimed at transforming the existing protein supply chain, highlighting significant opportunities for vendors in the European plant-based foods market.

Based on type, the Europe plant-based foods market is segmented into dairy alternatives, meat substitutes, plant-based meals, plant-based baked goods, plant-based confectionery, plant-based beverages, egg substitutes, fish and seafood alternatives, and other plant-based foods. In 2024, the dairy alternatives segment is expected to account for the largest share of 67.2% of the Europe plant-based foods market. This segment's large market share can be attributed to the rising number of lactose-intolerant individuals, growing ethical concerns among consumers regarding animal welfare in modern dairy farming, and the nutritional advantages provided by plant-based dairy products.

However, the fish and seafood alternatives segment is anticipated to register the highest CAGR of 28.7% during the forecast period. This segment's growth is driven by the increasing consumer demand for vegan seafood, increased investment and food innovation in species-specific seafood alternatives, and increased new product launches.

Based on source, the Europe plant-based foods market is segmented into soy, almond, wheat, pea, rice, oat, and other sources. In 2024, the soy segment is expected to account for the largest share of the Europe plant-based foods market. This segment's large market share is driven by the easy and extensive availability of raw materials, lower costs compared to other sources, strong demand from meat alternative manufacturers, high levels of consumer acceptance, and its broad range of applications across various food and beverage sectors, including meat, dairy alternatives, and bakery products.

However, the pea segment is anticipated to register the highest CAGR during the forecast period. This segment's growth is fueled by consumers' increasing demand for sustainable and tasty alternatives to animal-based proteins and a rising number of investments from major manufacturers to boost pea protein production. Furthermore, the growing adoption of pea protein in plant-based foods contributes to this growth. Peas are also allergen-free, gluten-free, and lactose-free, further driving the demand for pea-based products.

Based on distribution channel, the Europe plant-based foods market is segmented into business-to-business and business-to-consumer. In 2024, the business-to-consumer segment is expected to account for a larger share of 70.2% of the Europe plant-based foods market. This segment's large market share can be attributed to several factors, including the rising sales of plant-based foods in established supermarkets and hypermarkets, consumer preference for shopping at brick-and-mortar stores due to their accessibility and availability, and increasing consumer spending on vegan products.

Moreover, the business-to-consumer segment is anticipated to register the highest CAGR of 11.7% during the forecast period. This growth is attributed to the rapidly expanding online retail sector, which offers enhanced accessibility, convenience, and cost-effectiveness.

Based on geography, the Europe plant-based foods market is majorly segmented into Germany, the U.K., Spain, Italy, France, the Netherlands, Belgium, Austria, Poland, Portugal, Denmark, Romania, Sweden, and the Rest of Europe. In 2024, Germany is expected to account for the largest share of 23.9% of the Europe plant-based foods market. Germany’s plant-based foods market is estimated to be worth USD 2.59 billion in 2024. Several key factors, including the modernization of the F&B industry, increased consumer awareness of the benefits of plant-based foods, growing concerns about animal welfare, and a rise in new product launches within the plant-based foods sector, drive Germany's large market share. Moreover, Germany is poised to register the highest CAGR of 11.3% during the forecast period. This growth is attributed to the rapidly expanding vegetarian population and the increasing number of vegan and vegetarian restaurants in Germany. Veganism is emerging as a significant trend, with the number of vegans doubling from 1.3 million in 2016 to 2.8 million in 2023. Additionally, nearly 75% of German households express a desire for a wider variety of vegetarian products in supermarkets, although less than two-thirds actively purchase these products.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the Europe plant-based foods market are Beyond Meat Inc. (U.S.), Danone S.A. (France), Amy’s Kitchen Inc. (U.S.), The Hain Celestial Group, Inc. (U.S.), Daiya Foods Inc. (Canada), Marlow Foods Ltd. (U.K.), Taifun –Tofu GmbH (Germany), Vbite Food Ltd (U.K.), Plamil Foods Ltd (U.K.), Plant & Bean Ltd (U.K.), Unilever PLC (U.K.), Berief Food GmbH (Germany), Nestlé S.A. (Switzerland), The Meatless Farm (U.K.), and Veganz Group AG (Germany).

|

Particulars |

Details |

|

Number of Pages |

190 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2024 |

|

CAGR (Value) |

10.3% |

|

Market Size (Value) |

USD 21.65 Billion by 2031 |

|

Segments Covered |

By Type

By Source

By Distribution Channel

|

|

Countries Covered |

Germany, U.K., Spain, Italy, France, Netherlands, Belgium, Austria, Poland, Portugal, Denmark, Romania, Sweden, and Rest of Europe |

|

Key Companies |

Beyond Meat Inc. (U.S.), Danone S.A. (France), Amy’s Kitchen Inc. (U.S.), The Hain Celestial Group, Inc. (U.S.), Daiya Foods Inc. (Canada), Marlow Foods Ltd. (U.K.), Taifun –Tofu GmbH (Germany), Vbite Food Ltd (U.K.), Plamil Foods Ltd (U.K.), Plant & Bean Ltd (U.K.), Unilever PLC (U.K.), Berief Food GmbH (Germany), Nestlé S.A. (Switzerland), The Meatless Farm (U.K.), and Veganz Group AG (Germany) |

This study focuses on market analysis and opportunity assessment based on the sales of Europe plant-based foods across various countries and market segments. It also includes a competitive analysis based on key market players’ product portfolios, geographic presence, and growth strategies adopted in the last three to four years.

The Europe plant-based foods market study provides valuable insights, market sizes, and forecasts in terms of value by type, source, distribution channel, and country.

The Europe plant-based foods market is expected to reach $21.62 billion by 2031, at a CAGR of 10.3% during the forecast period.

The dairy alternatives segment is expected to hold a major share of the Europe plant-based foods market in 2024.

The pea segment is anticipated to register the highest CAGR during the forecast period from 2024 to 2031.

In 2024, the business-to-consumer segment is expected to hold a major share of the Europe plant-based foods market.

The increasing incidence of animal protein intolerance, the rising popularity of vegan and vegetarian diets, increasing venture investments in companies offering plant-based foods, and innovation in food technologies are the key factors supporting the growth of this market. Moreover, product launches by plant-based foods and protein alternatives manufacturers create opportunities for players operating in this market.

The key players operating in the Europe plant-based foods market are Beyond Meat Inc. (U.S.), Danone S.A. (France), Amy’s Kitchen Inc. (U.S.), The Hain Celestial Group, Inc. (U.S.), Daiya Foods Inc. (Canada), Marlow Foods Ltd. (U.K.), Taifun –Tofu GmbH (Germany), Vbite Food Ltd (U.K.), Plamil Foods Ltd (U.K.), Plant & Bean Ltd (U.K.), Unilever PLC (U.K.), Berief Food GmbH (Germany), Nestlé S.A. (Switzerland), The Meatless Farm (U.K.), and Veganz Group AG (Germany).

Germany is expected to experience substantial growth during the forecast period, driven by a rapidly increasing vegetarian population and a rising number of vegan and vegetarian restaurants. Veganism is becoming a significant trend in the country, with the number of vegans doubling from 1.3 million in 2016 to 2.8 million in 2023. Additionally, nearly 75% of German households express a desire for a greater variety of vegetarian products in supermarkets, although less than two-thirds intentionally purchase these items.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates