Resources

About Us

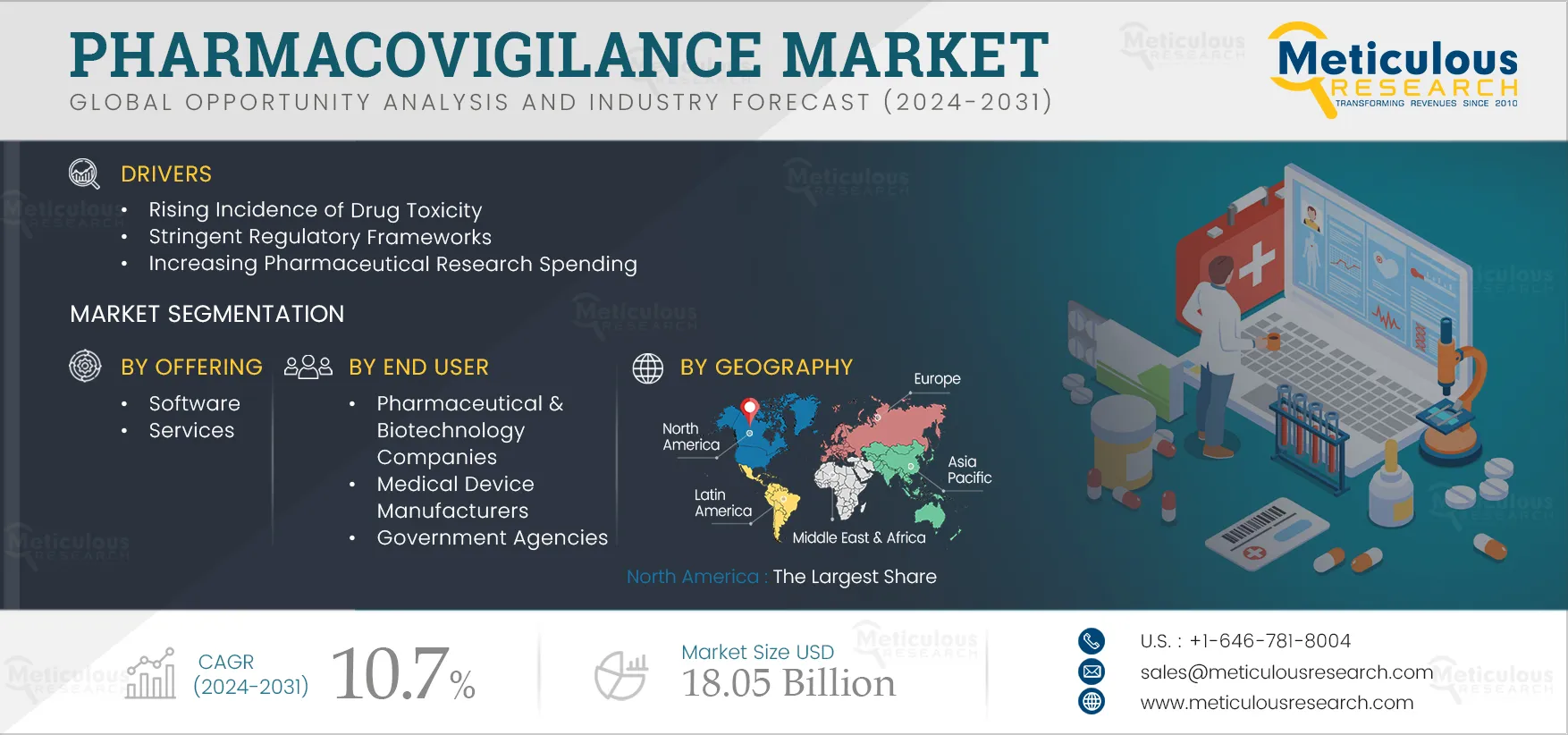

Pharmacovigilance Market Size, Share, Forecast, & Trends Analysis by Offering (Software [Adverse Event Reporting, Issue Tracking, Drug Safety Audit], Services [Spontaneous Reporting, Case Logging]), Phase, Therapeutic Area, End User – Global Forecast to 2032

Report ID: MRHC - 1041211 Pages: 400 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is primarily driven by the rising incidence of drug toxicity, stringent regulatory frameworks, increasing pharmaceutical research spending, rising need for new drug development, and increasing focus on medical device safety. Furthermore, the introduction of technologically advanced software, growing awareness regarding adverse drug reactions, therapeutic approaches requiring a combination of drugs, and the increasing trend of outsourcing pharmacovigilance are expected to offer growth opportunities for market stakeholders.

Drug toxicity can happen as a result of the over-ingestion of medication, causing too much of the drug to be in the human body. With certain medications, drug toxicity can occur as an adverse drug reaction. ADRs can be serious, affecting patient health or even proving fatal. According to the U.S. FDA, around 6.7% of patients experience serious ADRs, with a 0.3% mortality rate. Hospitalization is also increasing due to ADRs. According to the CDC, ADRs cause around 1.3 million emergency department visits each year in the U.S., of which around 35,000 patients are hospitalized immediately after their emergency department visit.

The incidence of ADRs varies and depends on factors such as age, sex, ethnicity, existing disorders, genetic and environmental factors, administration route, treatment duration, dosage, and drug type. Moreover, increased age and polypharmacy also lead to ADRs. Pharmacovigilance is used to detect problems in medicine usage, reduce risks, and communicate observations in a disciplined way.

Click here to: Get a Free Sample Copy of this Report

Medical device companies, pharmaceutical companies, and Contract Research Organizations (CROs) are constantly under pressure to meet time-critical regulatory requirements using limited resources. Companies should manage and identify drug safety events before they become fatal for patients. Companies also need to maintain rigorous compliance with evolving regulations, necessitating the use of pharmacovigilance software and services.

Pharmacovigilance gathers and analyzes information about regulatory frameworks and policies, helping these companies make informed decisions about drug development and testing. Pharmacovigilance also helps in assessing the impact of regulatory changes on a company’s product portfolio. Thus, frequently changing regulatory frameworks are increasing the demand for pharmacovigilance services.

Integration of AI into pharmacovigilance is important in task automation, efficient and effective adverse event detection & analysis, improvements in data processing, and optimization of pharmacovigilance processes. AI's role in pharmacovigilance includes improved clinical trial prioritization, faster adverse event detection, and accurate dosing recommendations. By analyzing large datasets and automating processes, AI enhances drug safety, monitoring, and patient care in the pharmaceutical industry.

AI is used to automate the identification of adverse event detection in large datasets. AI can extract information directly from sources like medical literature, electronic health records, and social media to detect and categorize adverse events. AI also helps automate the case report generation process by obtaining appropriate information from unstructured data sources, thus reducing the time & effort required for manual data entry. Machine Learning (ML) algorithms can predict possible drug-drug interactions by examining patient data and detecting drug combinations that may pose a risk.

The pharmaceutical & life sciences sector is currently shifting toward cloud-based drug safety platforms for easy data processing, collection, and analysis, and adverse event reporting. The use of cloud-based tools & technologies has accelerated digital transformation in pharmacovigilance and drug safety. Cloud computing helps in digital transformation by offering a platform that is much more efficient, scalable, secure, and cost-effective, manages high volumes of data, and automates drug safety processes.

One of the main benefits offered by cloud-based solutions is the ease of upgrading systems. As the regulations for drug safety continuously change or new technological innovations emerge, cloud-based systems analyzing data regarding drug adverse events are automatically upgraded to support the new requirements. This can be useful for pharmaceutical companies as on-premises applications are considered extremely expensive and sometimes time-consuming.

The trend of outsourcing pharmacovigilance is increasing among pharmaceutical & biotechnology companies and medical device manufacturers. Instead of setting up and maintaining an in-house pharmacovigilance department, pharmaceutical companies are partnering with external service providers for resource optimization and management. Outsourcing allows partner companies to optimize resource allocation according to project demand. Outsourcing also offers an advantage in terms of time and customization of services. Benefits such as increased business capacity & model flexibility, on-demand access to specialized expertise, and multidisciplinary as well as intellectual property knowledge are driving the demand for outsourced pharmacovigilance services. With the increasing number of pharmaceutical companies, the demand for pharmacovigilance outsourcing is also increasing. According to IQVIA (U.S.), 67% of pharmaceutical and biotechnology companies outsource their pharmacovigilance operations, and 54% outsource their regulatory activities.

Based on offering, the pharmacovigilance market is segmented into software and services. In 2025, the services segment is expected to account for the larger share of 97.6% of the pharmacovigilance market. This segment is also projected to record the higher CAGR of 10.8% during the forecast period 2025–2032. The increasing number of molecules in clinical development and the growing importance of drug safety are driving the outsourcing of pharmacovigilance services, contributing to the segment’s large share. In 2024, the U.S. FDA approved 55 drugs in comparison to 37 drugs in 2022 (source: U.S. FDA). The rising number of drug approvals drives the demand for pharmacovigilance services, supporting the growth of this segment.

Based on drug development phase, the pharmacovigilance market is segmented into Phase IV, Phase III, Phase II, Phase I, and preclinical studies. In 2025, the phase IV segment is expected to account for the largest share of 72.5% of the pharmacovigilance market. Phase IV clinical trials involve larger patient populations, increasing the likelihood of rare adverse events. Phase IV clinical trials monitor the effectiveness and safety of drugs. The demand for pharmacovigilance services & software is high as the volume of data generated from real-world evidence is significant. During Phase IV, undetected or unsuspected ADRs can be detected due to testing being conducted on a large number of patients and over a longer observation period. Thus, the high complexity of Phase IV is increasing the adoption of pharmacovigilance services for the efficient management of clinical trials.

Based on therapeutic area, the pharmacovigilance market is segmented into oncology, cardiology/vascular diseases, infectious diseases, immunology, neurology, and other therapeutic areas. In 2025, the oncology segment is expected to account for the largest share of the pharmacovigilance market. The segment’s large share is attributed to the availability of funding for oncology, life science & healthcare research, the increasing demand for personalized therapies, and high cancer incidence necessitating newer therapies to be launched in the market.

Biopharmaceutical companies’ growing emphasis on research activities and rising government support for the development of cancer treatment are supporting the outsourcing of pharmacovigilance services. For instance, in February 2025, BioNTech SE (Germany) invested USD 200 million in Autolus Therapeutics (U.K.) and collaborated with the company to support the cancer therapy pipeline. Pharmacovigilance solutions monitor patient safety during treatment for the detection of long-term complications and adverse events, contributing to oncology drug safety.

Based on end user, the pharmacovigilance market is segmented into pharmaceutical & biotechnology companies, medical device manufacturers, government agencies, and other end users. In 2025, the pharmaceutical & biotechnology companies segment is expected to account for the largest share of the pharmacovigilance market. The segment’s large share is attributed to pharmaceutical & biotechnology companies’ high investments in research & development. For instance, global pharmaceutical R&D expenditure is expected to reach USD 213 billion in 2026 from USD 179 billion in 2020 (Source: International Federation of Pharmaceutical Manufacturers & Associations - IFPMA). This growing focus on R&D is supporting the development of newer therapies, driving the need for pharmacovigilance services.

In 2025, North America is expected to account for the largest share of 44.3% of the pharmacovigilance market. North America’s large share is attributed to the presence of key market players, advanced infrastructure and resources supporting research & development, the large number of clinical trials and drug approvals, and increased reporting of adverse drug events in the region. The number of drugs in the pipeline is also increasing in North America. For instance, AbbVie Inc. (U.S.) has more than 90 indications, compounds, or devices in development, individually or in collaboration. According to Pharmaceutical Research and Manufacturers of America (U.S.), 1,600 vaccines and treatments for cancer are under development. Thus, the region’s significant drug pipeline is increasing the need for pharmacovigilance solutions for monitoring drug safety.

However, Asia-Pacific is slated to register the highest growth rate of 12.3% during the forecast period. The countries in Asia-Pacific, including China, India, and South Korea, are expected to hold significant growth opportunities for the vendors in this market. Growing cancer incidence, rising awareness about ADRs, and increasing funding and supportive initiatives for drug discovery are driving the growth of this regional market. For instance, in July 2022, the Council of Scientific and Industrial Research (CSIR) (India) invested USD 6.73 million in R&D activities for drug discovery and development. Additionally, the increasing number of clinical trials in the region is driving the growth of the pharmacovigilance market. According to the WHO, the number of clinical trials in Southeast Asia increased to 11,030 in 2022 from 9,175 in 2020.

The report includes a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years. The key players operating in the pharmacovigilance market are IQVIA (U.S.), Cognizant Technology Solutions Corporation (U.S.), Linical Co., Ltd (U.S.), International Business Machines Corporation (U.S.), Laboratory Corporation of America Holdings (U.S.), ICON plc (Ireland), Parexel International (U.S.), Wipro Limited (India), Sanofi S.A. (France), Pharmaceutical Product Development Inc. (a subsidiary of Thermo Fisher Scientific Inc.) (U.S.), Capgemini SE (France), Syneos Health (U.S.), ArisGlobal (U.S.), Ennov (France), EXTEDO GmbH (Germany), Oracle Corporation (U.S.), Sparta Systems Inc. (U.S.), United BioSource, LLC (UBC) (U.S.), and AB Cube S.A.S. (France).

In December 2024, Pharmaceutical Product Development, Inc., a subsidiary of Thermo Fisher Scientific Inc. (U.S.), launched CorEvidence, a patented cloud-based data lake platform for the optimization of pharmacovigilance case processing and safety data management processes.

In March 2024, ArisGlobal (U.S.) launched Intelligent Content Management for Safety. The solution can organize and store extensive documentation related to safety activities. It builds on LifeSphere’s Clinical counterpart, which supports the electronic Trial Master File (eTMF) solution.

|

Particulars |

Details |

|

Number of Pages |

400 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

10.7% |

|

Estimated Market Size (Value) |

$18.05 Billion by 2032 |

|

Segments Covered |

By Offering

By Drug Development Phase

By Therapeutic Area

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Belgium, Netherlands, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

IQVIA (U.S.), Cognizant Technology Solutions Corporation (U.S.), Linical Co., Ltd (U.S.), International Business Machines Corporation (U.S.), Laboratory Corporation of America Holdings (U.S.), ICON plc (Ireland), Parexel International (U.S.), Wipro Limited (India), Sanofi S.A. (France), Pharmaceutical Product Development Inc. (a subsidiary of Thermo Fisher Scientific Inc.) (U.S.), Capgemini SE (France), Syneos Health (U.S.), ArisGlobal (U.S.), Ennov (France), EXTEDO GmbH (Germany), Oracle Corporation (U.S.), Sparta Systems Inc. (U.S.), United BioSource, LLC (UBC) (U.S.), and AB Cube S.A.S. (France) |

The pharmacovigilance market report covers the qualitative and quantitative assessment of the pharmacovigilance market. This report provides market sizes and forecasts for pharmacovigilance market segments and subsegments by offering, drug development phase, therapeutic area, and end user at the regional and country levels. The report also provides insights on factors impacting market growth, along with a regulatory analysis and Porter’s Five Forces analysis for the pharmacovigilance market.

The pharmacovigilance market is projected to reach $18.05 billion by 2032 at a CAGR of 10.7% from 2025 to 2032.

Based on offering, in 2025, the services segment is expected to account for the larger share of 97.6% of the pharmacovigilance market. The increasing number of molecules in clinical development and the growing importance of drug safety are driving the outsourcing of pharmacovigilance services, contributing to the segment’s large share.

Based on therapeutic area, in 2025, the oncology segment is expected to account for the largest share of the pharmacovigilance market. According to GLOBOCAN, global cancer prevalence is expected to reach 32.64 million in 2045 from 19.98 million in 2022. The rising incidence of cancer is increasing the demand for newer therapies and drugs, increasing the adoption of pharmacovigilance solutions.

The growth of the pharmacovigilance market is driven by the rising incidence of drug toxicity, stringent regulatory frameworks, increasing pharmaceutical research spending, the rising need for new drugs, increasing public awareness regarding drug safety, and the rising focus on medical device pharmacovigilance. Furthermore, the introduction of technologically advanced software, growing awareness regarding adverse drug reactions, growing cases of diseases requiring a combination of drugs, and the increasing outsourcing of pharmacovigilance services are expected to generate growth opportunities for the stakeholders in this market.

The key players operating in the pharmacovigilance market are IQVIA (U.S.), Cognizant Technology Solutions Corporation (U.S.), Linical Co., Ltd (U.S.), International Business Machines Corporation (U.S.), Laboratory Corporation of America Holdings (U.S.), ICON plc (Ireland), Parexel International (U.S.), Wipro Limited (India), Sanofi S.A. (France), Pharmaceutical Product Development Inc. (a subsidiary of Thermo Fisher Scientific Inc.) (U.S.), Capgemini SE (France), Syneos Health (U.S.), ArisGlobal (U.S.), Ennov (France), EXTEDO GmbH (Germany), Oracle Corporation (U.S.), Sparta Systems Inc. (U.S.), United BioSource, LLC (UBC) (U.S.), and AB Cube S.A.S. (France).

Asia-Pacific is slated to register the highest growth rate during the forecast period. The high growth of this regional market is attributed to increasing research on vaccines, policies supporting the adoption of pharmacovigilance, increasing pharmaceutical R&D expenditures, a growing focus on personalized medicine, and advancements in the biotechnology sector in Asia-Pacific.

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates