Resources

About Us

Oral Care Market Size, Share, Forecast, & Trends Analysis by Product (Toothpastes, Toothbrush, Mouthwash, Dental Floss, Tongue Cleaner, Probiotic) Age Group (Adults, Children) Distribution Channel (Supermarket, Pharmacies, Online) – Global Forecast to 2032

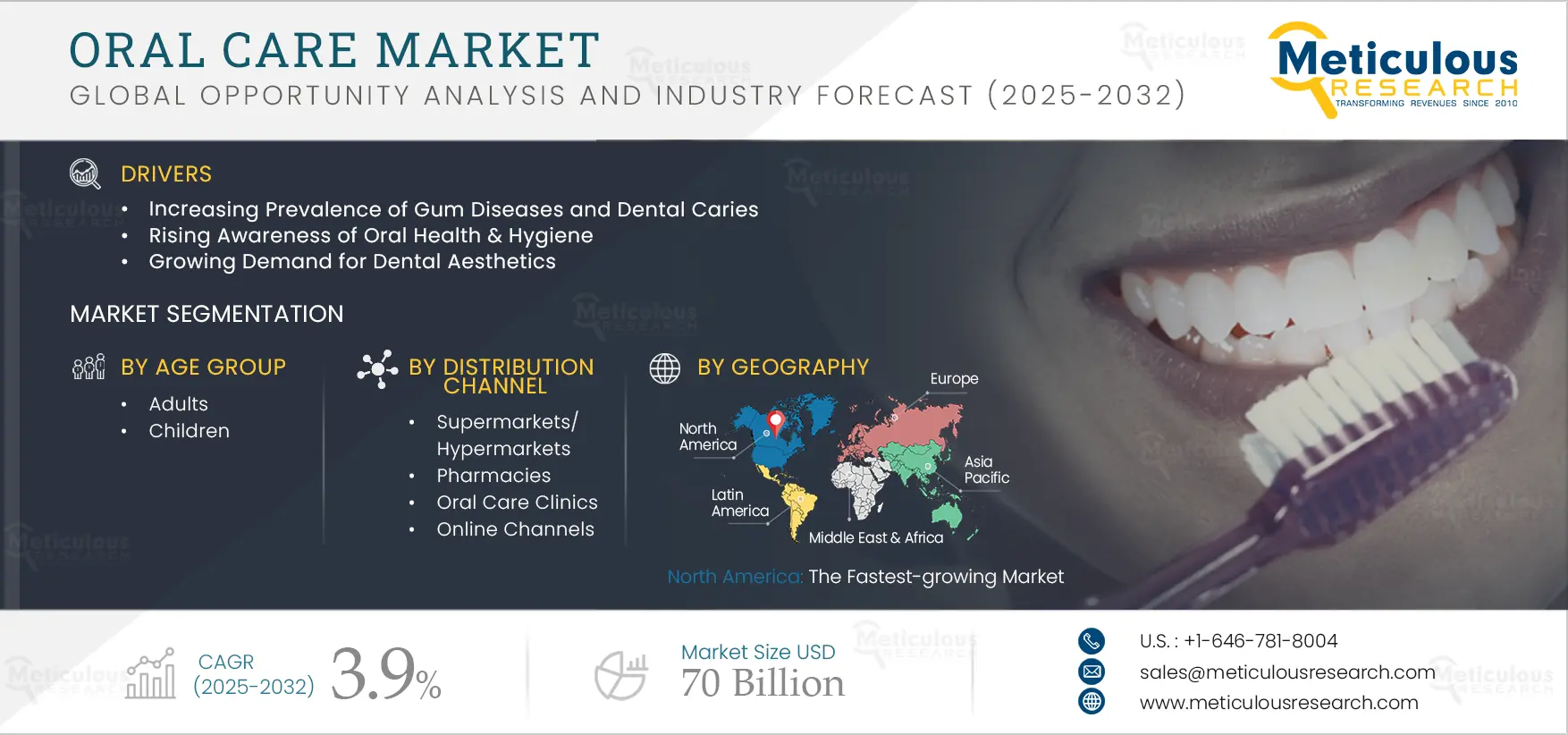

Report ID: MRHC - 1041244 Pages: 373 Apr-2025 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the oral care market is driven by the increasing prevalence of gum diseases and dental caries, rising awareness of oral health & hygiene, growing demand for dental aesthetics, rising consumer awareness regarding oral care products, and increasing use of eco-friendly oral care products. In addition, the shift towards natural and herbal care products and technological advancements in oral care products are expected to provide significant opportunities for stakeholders operating in the global oral care market. Moreover, the emergence of electric toothbrushes, the introduction of skincare-inspired oral care products, and the integration of AI in toothbrushes are major trends in the oral care market. However, the effect of harmful chemicals in oral care products hinders the growth of the oral care market to some extent. Furthermore, limited awareness of specialized oral care products is a major challenge in the global oral care market.

Oral diseases have been a significant health burden across many countries, affecting nearly 3.5 billion people around the world. According to the Global Burden of Diseases, untreated caries in permanent teeth is the most common dental condition globally, and majorly in developing countries, affecting 60-90% of school children and most adults. There are various solutions and oral care products available to treat dental caries. For instance, in June 2023, Incisive Technologies Pty Ltd. (Australia) received the U.S. Food and Drug Administration (FDA) 510(k) clearance for the BluCheck caries Detection and Monitoring preventive care solution, which binds to active carious lesions in the mouth and making them visible with its blue color.

Additionally, risk factors such as smoking, poor oral hygiene, medication, age, heredity, stress, and diabetes have been linked to periodontal diseases. For instance, people with diabetes are at a higher risk of periodontal diseases, an infection of the gums, tissues, and bones that hold the teeth in place. Diabetes can also slow down the healing process, hampering treatments. Additionally, it can cause dry mouth and fungal infections. A dry mouth can lead to ulcers, infections, and tooth decay. Increased blood glucose levels can also increase sugar levels in saliva, wherein bacteria can metabolize sugar, resulting in acid formation, which leads to tooth decay. The increasing prevalence of dental diseases and chronic conditions, which lead to the degradation of dental health, is expected to drive the oral care market globally.

Click here to: Get a Free Sample Copy of this report

Oral care products are used to keep the oral cavity free of dental caries, gum diseases, and other conditions and to maintain oral hygiene. Poor oral health can diminish an individual's quality of life and contribute to the formation of oral diseases. Maintaining oral hygiene is a significant factor in the prevention of diseases and is the responsibility of the patient as well as the dental professional. This hygiene can be achieved using various oral care products.

Product launches of oral care products and awareness programs are increasing their demand. For instance, in February 2022, the Colgate-Palmolive Company (U.S.) launched a public health initiative to empower people to know, understand, and improve their oral health quotient (OQ). The company plans to commit more than USD 100 million over the next five years to address the global health crisis and ensure the incorporation of oral health in broader public health strategies. Apart from this, certain social factors also affect the selection and demand for oral care products.

Similarly, in September 2023, during the World Dental Congress of the FDI World Dental Federation (Switzerland), the World Oral Health Day (WOHD) 2024-2026 campaign was launched with the purpose to empower people with the tools and knowledge to prevent and control oral diseases and promote oral hygiene.

Traditionally, manual toothbrushes are the most common type of products used to clean teeth and the oral cavity. However, some advancements in oral health products and their technologies have led to the rise in the use of electric toothbrushes. Electric, motorized, or battery-powered toothbrushes make rapid bristle motions and provide better plaque removal than manual toothbrushes. Electric toothbrushes have several advantages over manual toothbrushes such as more reliability, specialized features, ease of use, promotes tooth and gum health, and other advancements such as pressure sensors and Bluetooth connectivity.

Electric toothbrushes are also easy to use in case of people suffering from physical disabilities and have limited hand movement. For instance, in September 2023, CURADEN AG (Switzerland) launched Samba, an electric toothbrush. It has a dynamic brushing motion and removes plaque and debris thoroughly from the teeth and gums. Apart from this, there have been various product launches for other electric toothbrushes for regular use. For instance, in March 2022, Colgate-Palmolive India (India), a subsidiary of the Colgate-Palmolive Company (U.S.), introduced sonic technology toothbrushes that provide significantly better cleaning compared to regular toothbrushes.

Various products and devices are used for skin care. Some of these products include serums, balms, and masks, among others. Additionally, certain manufacturers have been integrating these types of products into oral care to enhance and maintain oral hygiene. Products such as tooth creams and tooth masks perform functions like skincare creams and contain chemicals that can help whiten teeth and eliminate bad breath.

From a consumer’s perspective, the idea of treating teeth with the same care as a person’s skin has become equally important in recent times, leading manufacturers to introduce these products. This is mainly done by using certain ingredients in the products. The presence of collagen, niacinamide, and probiotics is increasing greatly in the markets of China, Japan, and South Korea.

With the growing manufacturing of new oral care products, consumers have become more informed regarding the manufacturing and composition of the products that they use. Due to this, there has been a significant change or shift towards natural-composition oral care products such as toothpaste, toothbrushes, gels, pastes, mouthwashes, and mouth fresheners, among others. Natural generally includes products that are produced in a sustainable and environment-friendly manner, with no chemical ingredients.

According to the consulting firm AlixPartners, 64% of consumers find purchasing natural or clean personal care products important. Using natural products provides various advantages, such as recyclable or sustainable materials, better efficacy against bacteria and microorganisms, eco-friendly practices, holistic health benefits, and gentleness on gums and teeth.

Technology advancements in oral care products present a significant opportunity in the oral care market, transforming the way consumers maintain their dental hygiene. Innovations such as electric toothbrushes with smart features, AI-powered oral health monitoring devices, and advanced whitening products are driving growth in the sector. Smart toothbrushes equipped with sensors and mobile apps provide real-time feedback on brushing techniques, enhancing oral hygiene habits and improving overall dental care. Electric toothbrushes with oscillating-rotating and sonic technologies have proven superior in plaque removal compared to manual toothbrushes, offering better cleaning efficacy and user experience. Additionally, water flossers and interdental brushes have revolutionized interdental cleaning, making it more efficient and comfortable.

These technologies not only enhance the effectiveness of oral care routines but also offer personalized solutions by providing real-time feedback and tracking user habits. Furthermore, the development of app connected toothbrushes and oral health sensors allows consumers to receive tailored advice and reminders, fostering better dental care habits. As technology continues to evolve, the potential for more sophisticated, user-friendly, and accessible oral care products remains high, creating new market avenues and expanding consumer demand

Based on products, the market is segmented into toothpastes, toothbrushes, mouthwashes, and other oral care products. In 2025, the toothpastes segment is expected to account for the largest share of 36.7% of the oral care market. Toothpaste is available in various forms, such as gels, pastes, powders, and other forms, and is used to clean the teeth and maintain the oral aesthetics of the mouth. The large share of this segment is attributed to factors such as rising awareness for oral health, a shift in the use of herbal and natural products as compared to chemical-based products, a growing number of market players, growing cases of dental caries and gum diseases, and awareness about oral hygiene.

However, the toothbrushes segment is slated to register the highest CAGR during the forecast period. The segment's growth is attributed to factors such as the increasing adoption of advanced technologies such as electric toothbrushes, mouthpiece toothbrushes, and chewable toothbrushes, the availability of several products to choose from based on their type, growing awareness for oral health and aesthetics, and the use of battery-powered toothbrushes in adults and children.

Based on age groups, the market is segmented into adults and children. In 2025, the adults segment is expected to account for the larger share of the oral care market. The large number of adults using oral care products is a key factor supporting the segment's largest share. The high prevalence of gum problems in adults and high awareness of maintaining oral care among adults are also supporting the segment's largest share. Adults tend to visit dental practitioners often compared to children. Adults have easy access to resources about oral health and hygiene compared to children. Websites, articles, and social media platforms offer educational content on dental care, including the benefits of using toothpaste, recommended oral hygiene practices, and tips for maintaining healthy teeth and gums.

Based on end users, the market is segmented into supermarkets/hypermarkets, pharmacies, oral care clinics, and online channels. In 2025, the supermarket/hypermarkets segment is expected to account for the largest share of 38.1% of the market. Supermarkets/hypermarkets are self-service stores that offer a wide variety of products, including oral care. The large share of the segment is attributed to factors such as the growing number of stores, easy accessibility and availability of oral care products, reasonable price ranges, and greater frequency of offers and discounts.

In 2025, North America is expected to account for the largest share of 31.8% of the oral care market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The large share of the segment is primarily due to the presence of leading manufacturers, support from government and regulatory authorities to promote oral health and hygiene, the presence of large key market players, the high prevalence of dental caries, growing awareness of oral health, high adoption of technological advancements, and the emergence of new distribution channels. For instance, according to the Food Industry Association (U.S.), in 2022, the U.S. had approximately 45,575 supermarkets, which included conventional supermarkets, limited assortment groceries, supercenters, warehouse groceries, conventional clubs, and natural/gourmet stores, along with military commissaries.

A significant trend shaping the North America market is the shift toward natural and organic oral care products. Consumers are becoming more ingredient-conscious, leading to increased demand for fluoride-free toothpaste, herbal mouthwashes, and eco-friendly toothbrushes made from sustainable materials. This trend has prompted brands to innovate and introduce chemical-free, plant-based formulations to meet evolving consumer preferences. Furthermore, the rise of cosmetic dentistry has boosted the market for teeth-whitening products, including whitening strips, gels, and professional-grade treatments. The influence of social media and celebrity endorsements has further amplified this trend, making a brighter smile an aspirational goal for many consumers.

Also, the competitive landscape in North America is intense, with leading players such as Colgate-Palmolive, Procter & Gamble (P&G), Unilever, Johnson & Johnson, and GlaxoSmithKline dominating the market. These companies invest heavily in research and development to introduce innovative products that offer better efficacy, convenience, and advanced oral health benefits. The introduction of smart toothbrushes with artificial intelligence (AI) tracking, probiotics for oral health, and subscription-based oral care kits reflects how brands are continuously evolving to capture consumer interest. E-commerce has significantly impacted competition, allowing smaller and emerging brands to challenge established players by offering direct-to-consumer (DTC) models, personalized dental care solutions, and natural alternatives. Digital marketing strategies, influencer collaborations, and social media campaigns have enabled newer entrants to gain visibility and attract younger, tech-savvy consumers

Asia-Pacific is slated to register the highest CAGR during the forecast period. The rapid growth of this market is because of the improving awareness of dental hygiene, rising disposable incomes, and changing lifestyle choices. China, India, Japan, and South Korea are major drivers of growth in the market, and factors such as urbanization, better healthcare access, and rising oral health awareness are major contributors. With greater awareness of the need for oral care, routine use of toothpaste, toothbrushes, mouthwashes, dental floss, and bleaching products has grown extensively. Moreover, growing incidence of oral diseases such as cavities, gum infections, and tooth sensitivity has created more demand for specialty products like fluoride mouth rinses, herbal toothpaste, and medicated oral care products.

Aesthetic consciousness is also an emerging key driver behind the oral care market in Asia Pacific. Involvement with social media, celebrity endorsements, and the uptrend in cosmetic dentistry fueled demand for whiteners on teeth and improved oral hygiene items. Young people, especially residing in urban locations, are continuously investing in upper-tier oral hygiene items that produce improved dental attractiveness, such as whitening toothpaste, teeth strips, and professional treatments. Electric toothbrushes are also increasing in popularity, particularly in technology-savvy markets such as Japan, South Korea, and Australia, where consumers want intelligent dental solutions with AI-based brushing support.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the oral care market are Colgate-Palmolive Company (U.S.), GlaxoSmithKline plc (U.K.), Koninklijke Philips N.V. (Netherlands), Johnson & Johnson (U.S.), Procter & Gamble (U.S.), Unilever plc (U.K.), Ultradent Products, Inc. (U.S.), M+C Schiffer GmbH (Germany), Dabur India Limited (India), GC Corporation (Japan), Lion Corporation (Japan), Church & Dwight Co., Inc. (U.S.), Arcadia Consumer Healthcare, Inc. (U.S.), and Haleon plc (U.K.).

|

Particulars |

Details |

|

Number of Pages |

273 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

3.9% |

|

Market Size (Value) in 2025 |

USD 53.4 Billion |

|

Market Size (Value) in 2032 |

USD 70 Billion |

|

Segments Covered |

By Product

(Other forms include polishes, tablets, and foams)

By Age Group

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Denmark, Belgium, Switzerland, Sweden, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), Middle East (Saudi Arabia, UAE, Rest of Middle East), and Africa (South Africa and Rest of World) |

|

Key Companies |

Colgate-Palmolive Company (U.S.), GlaxoSmithKline plc (U.K.), Koninklijke Philips N.V. (Netherlands), Johnson & Johnson (U.S.), Procter & Gamble (U.S.), Unilever plc (U.K.), Ultradent Products, Inc. (U.S.), M+C Schiffer GmbH (Germany), Dabur India Limited (India), GC Corporation (Japan), Lion Corporation (Japan), Church & Dwight Co., Inc. (U.S.), Arcadia Consumer Healthcare, Inc. (U.S.), and Haleon plc (U.K.) |

This market study covers the market sizes & forecasts of oral care based on product, age group, distribution channel, and geography. It also provides the value analysis of various segments and sub-segments of the oral care market at country levels.

The oral care market is projected to reach $70 billion by 2032, at a CAGR of 3.9% during the forecast period.

The toothpastes segment is expected to account for the largest share of the market in 2025. Factors such as rising awareness for oral health, a shift in the use of herbal and natural products as compared to chemical-based toothpaste, a growing number of market players, growing cases of dental caries and gum diseases, and the availability of toothpaste in various forms are supporting the largest share.

The growth of the oral care market can be attributed to several factors, including the increasing prevalence of gum diseases and dental caries, rising awareness of oral health, growing demand for dental aesthetics, and growing demand for minimally invasive dental procedures. Moreover, a shift towards natural and herbal oral care products and technological advancements in oral care products are expected to offer growth opportunities for the players operating in this market.

The key players profiled in the oral care market report are Colgate-Palmolive Company (U.S.), GlaxoSmithKline plc (U.K.), Koninklijke Philips N.V. (Netherlands), Johnson & Johnson (U.S.), Procter & Gamble (U.S.), Unilever plc (U.K.), Ultradent Products, Inc. (U.S.), M+C Schiffer GmbH (Germany), Dabur India Limited (India), GC Corporation (Japan), Lion Corporation (Japan), Church & Dwight Co., Inc. (U.S.), Arcadia Consumer Healthcare, Inc. (U.S.), and Haleon plc (U.K.)

In 2025, countries like China, Brazil, and India are expected to offer significant growth opportunities for the vendors in this market during the analysis period. This is due to factors such as the growing awareness of oral health and hygiene, increasing disposable income, technological advancements in oral care products, and the growing prevalence of oral diseases.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates