Resources

About Us

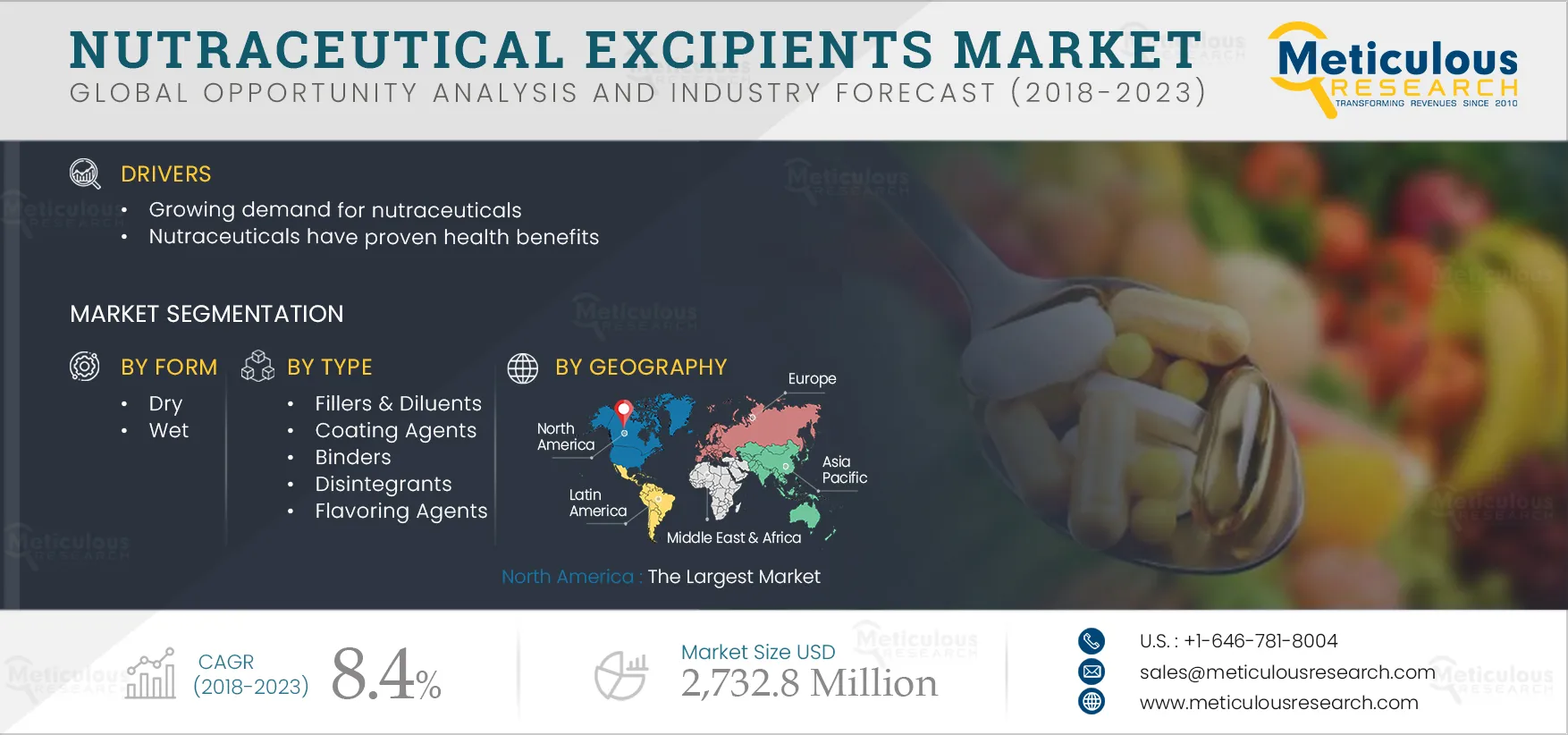

Nutraceutical Excipients Market By Type (Fillers, Diluents, Coating Agents, Binder, Disintegrants), End Products (Protein and Amino Acids, Vitamin, Minerals, Omega 3 Fatty Acids, And Others) - Global Forecast to 2023

Report ID: MRFB - 10489 Pages: 140 Apr-2018 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Nutraceutical Excipients Market is expected to reach USD 2,732.8 million by 2023, at a CAGR of 8.4% during the forecast period of 2018 to 2023. The nutraceutical excipients market is majorly driven by growing demand for nutraceuticals. Nutraceuticals have proven health benefits and their consumption keeps diseases at bay and allow humans to maintain an overall good health. The demand for nutraceuticals is driven by increase in consumer awareness about health and fitness; rise in disposable income and middle-class consumers in countries such as India and China; growing ageing population; growing urbanization; increase in incidence of lifestyle related diseases such as blood pressure, diabetes, and cardiac diseases; inadequate nutrition due to the consumer’s busy lifestyle; and high cost of healthcare. Moreover, development of multifunctional excipients further provides significant opportunities for the various stakeholders in this market. However, factors such as declining R & D investments for nutraceutical excipients are expected to hinder the growth of this market to some extent.

Nutraceutical products contain various compounds which are unstable to heat, light, oxygen, alkaline pH, and elevated humidity. They may also have poor flow, bulk density, and variable particle size distribution. This unstable nature of compounds is controlled by incorporating different nutraceutical excipients such as fillers, diluents, disintegrants, binders, coating agents, flavoring agents, colorant, sweeteners, lubricants, and others during the production of different form of supplements i.e. tablets, capsules, powders, and liquid syrups.

Click here to: Get Free Request Sample Copy of this report

This report gives an extensive outlook on various end products. These products include vitamins, minerals, proteins & amino acids, prebiotics & probiotics, omega 3 fatty acids, and others. Proteins and amino acid commanded the largest share in the global nutraceutical excipients market in 2017. The increased demand for protein consumption is driving the demand for protein supplements across the globe. Also, the increasing concerns of consumers over healthcare and the increasing fitness centers, health clubs, and gymnasiums across the world are the main factors behind the significant growth of protein supplements which fuels the use of nutraceutical excipients in protein and amino acid supplements.

Geographically, the report identifies North America to be the largest market, followed by Asia Pacific, Europe, and Rest of World. The large share of this region is mainly attributed to increasing prevalence of chronic diseases such as diabetes, cancer, cardiovascular diseases, respiratory diseases; sedentary lifestyle; rising public healthcare cost; growing public awareness of the link between diet and health; and growing aging population.

The report also includes the competitive landscape based on extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 3-4 years (2014-2018). The key players operating in the global nutraceutical excipients market are Kerry Group plc (U.S.), Innophos Holdings, Inc. (U.S.), SensientColors LLC (U.S.), JRS PHARMA (Germany), Cargill, Incorporated (U.S.), Hilmar Ingredients. (U.S.), E. I. du Pont de Nemours and Company (U.S.), Ingredion Incorporated (U.S.), Roquette Freres SA (France), MEGGLE Group Wasserburg (Germany), and ABF Ingredients (U.K.).

Scope of Nutraceutical Excipients Market report

Market by Form

Market by Type

Market by End Product

Market by Geography

Key questions answered in Nutraceutical Excipients Market report:

Growing proteins & amino acids and omega 3 fatty acids help to drive the adoption of nutraceutical excipients

The North American nutraceutical excipients market favors larger providers that compete in multiple segments

Recent agreements, acquisitions, and expansions have taken place in the nutraceutical excipients market

Published Date: Jun-2023

Published Date: Jun-2023

Published Date: Jun-2024

Published Date: Oct-2023

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates