1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

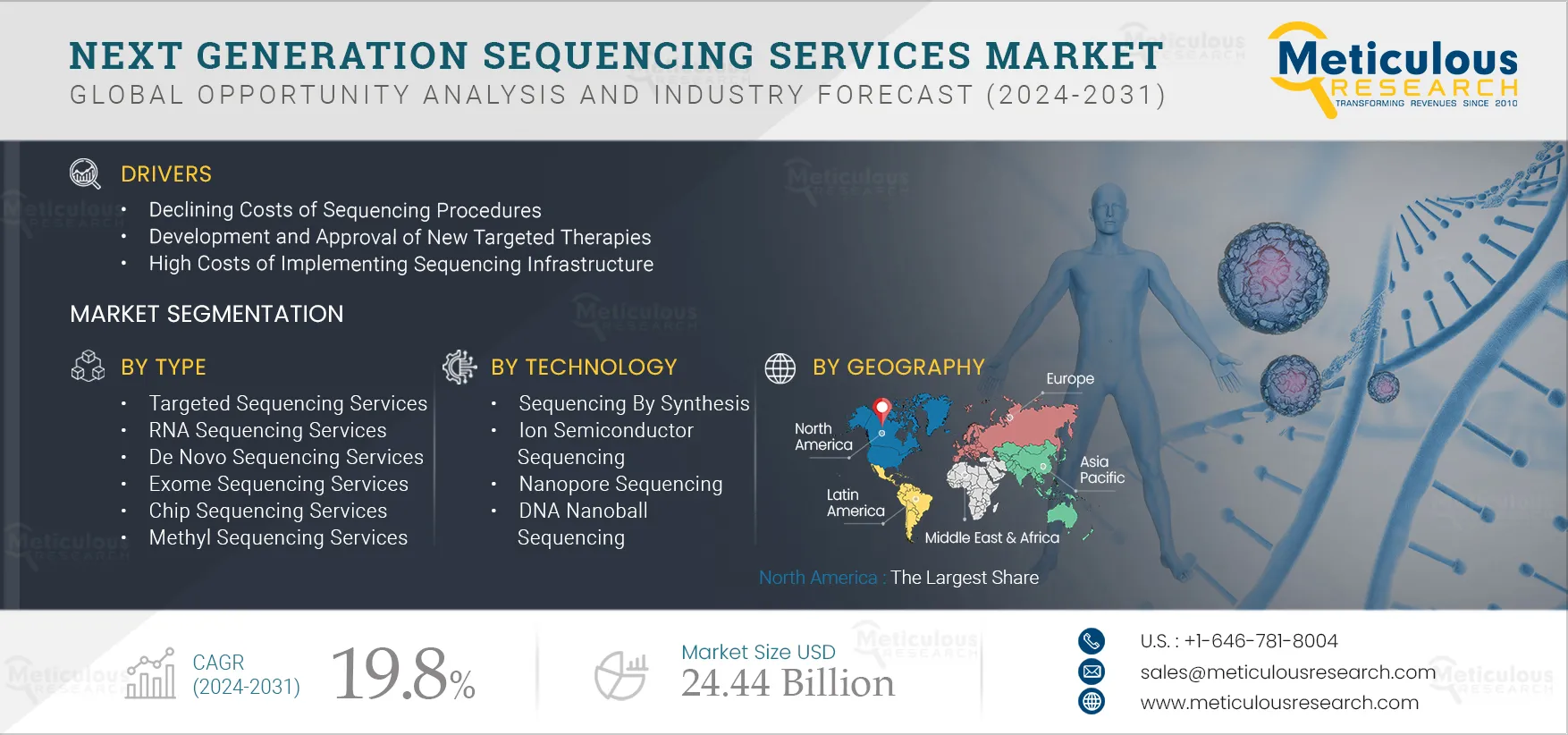

4.2. Factors Affecting Market Growth

4.2.1. Impact Analysis

4.2.2. Factor Analysis

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Buyers

4.3.2. Bargaining Power of Suppliers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Pricing Analysis

4.5. Regulatory Analysis

4.5.1. Overview

4.5.2. North America

4.5.2.1. U.S.

4.5.2.2. Canada

4.5.3. Europe

4.5.4. Asia-Pacific

4.5.4.1. China

4.5.4.2. Japan

4.5.4.3. India

4.5.5. Latin America

4.5.6. Middle East

4.6. Industry & Technology Trends

4.6.1. Installation of In-house NGS Systems to Hinder Market Growth

4.6.2. Growing Utilization of NGS Services in Disease Diagnostics and Precision Medicine

5. NGS Services Market Assessment—by Type

5.1. Overview

5.2. Targeted Sequencing Services

5.3. RNA Sequencing Services

5.4. Whole Genome Sequencing Services

5.5. De Novo Sequencing Services

5.6. Exome Sequencing Services

5.7. ChIP Sequencing Services

5.8. Methyl Sequencing Services

5.9. Other NGS Services

6. NGS Services Market Assessment—by Technology

6.1. Overview

6.2. Sequencing by Synthesis

6.3. Ion Semiconductor Sequencing

6.4. Single-molecule Real-time Sequencing (SMRT)

6.5. Nanopore Sequencing

6.6. DNA Nanoball Sequencing

7. NGS Services Market Assessment—by Application

7.1. Overview

7.2. Research Applications

7.2.1. Drug Discovery

7.2.2. Agriculture & Animal Research

7.2.3. Other Research Applications

7.3. Clinical Applications

7.3.1. Oncology

7.3.2. Reproductive Health

7.3.3. Infectious Diseases

7.3.4. Other Clinical Applications

8. NGS Services Market Assessment—by End User

8.1. Overview

8.2. Hospitals and Diagnostic Laboratories

8.3. Pharmaceutical & Biotechnology Companies

8.4. Academic Institutes & Research Centers

8.5. Other End Users

9. NGS Services Market Assessment — by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Market Share Analysis (2022)

10.4.1. Eurofins Scientific S.E.

10.4.2. Illumina, Inc.

10.4.3. Foundation Medicine, Inc. (Subsidiary of F. Hoffmann-La Roche AG) (U.S.)

10.4.4. Invitae Corporation (U.S.)

10.4.5. Beijing Genomics Institute (BGI) (China)

10.4.6. Novogene Co., Ltd. (China)

10.4.7. Perkinelmer, Inc. (U.S.)

10.5. Competitive Dashboard

10.5.1. Industry Leaders

10.5.2. Market Differentiators

10.5.3. Vanguards

10.5.4. Emerging Companies

11. Company Profiles

11.1. Illumina, Inc.

11.2. Eurofins Scientific S.E.

11.3. Invitae Corporation

11.4. Foundation Medicine, Inc. (Subsidiary of F. Hoffmann-La Roche AG)

11.5. Beijing Genomics Institute (BGI)

11.6. Novogene Co., Ltd.

11.7. Perkinelmer, Inc.

11.8. Macrogen, Inc.

11.9. QIAGEN N.V.

11.10. LGC Limited

11.11. GENEWIZ, Inc. (Subsidiary of Azenta, Inc.)

11.12. MedGenome, Inc.

11.13. DNA Link, Inc.

11.14. CD Genomics

11.15. Otogenetics Corporation

11.16. Quest Diagnostics Incorporated

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Incidence of Common Genetic Disorders

Table 2 Number of New Cancer Cases, by Type, 2020 Vs. 2030

Table 3 Biomarkers and Corresponding Targeted Therapies Currently Available

Table 4 Pricing of Key NGS Service Providers

Table 5 Regulatory Authorities Governing In vitro Diagnostics & NGS Products, by Country/Region

Table 6 NGS Services: Standards and Compliance Guidelines for Laboratories

Table 7 Biomarkers and Corresponding Targeted Therapies Currently Available

Table 8 Global NGS Services Market, by Type, 2021–2030 (USD Million)

Table 9 Global Targeted Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 10 Global RNA Sequencing Services, by Country/Region, 2021–2030 (USD Million)

Table 11 Global Whole Genome Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 12 Global De Novo Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 13 Global Exome Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 14 Global ChIP Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 15 Global Methyl Sequencing Services Market, by Country/Region, 2021–2030 (USD Million)

Table 16 Global Other NGS Services Market, by Country/Region, 2021–2030 (USD Million)

Table 17 Global NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 18 Global NGS Services Market for Sequencing by Synthesis, by Country/Region, 2021–2030 (USD Million)

Table 19 Global NGS Services Market for Ion Semiconductor Sequencing, by Country/Region, 2021–2030 (USD Million)

Table 20 Global NGS Services Market for Single-molecule Real-time Sequencing, by Country/Region, 2021–2030 (USD Million)

Table 21 Global NGS Services Market for Nanopore Sequencing, by Country/Region, 2021–2030 (USD Million)

Table 22 Global DNA Nanoball Sequencing, by Country/Region, 2021–2030 (USD Million)

Table 23 Global NGS Services Market, by Application, 2021–2030 (USD Million)

Table 24 Global NGS Services Market for Research Applications, by Type 2021–2030 (USD Million)

Table 25 Global NGS Services Market for Research Applications, by Country/Region, 2021–2030 (USD Million)

Table 26 Global NGS Services Market for Drug Discovery, by Country/Region, 2021–2030 (USD Million)

Table 27 Global NGS Services Market for Agriculture & Animal Research, by Country/Region, 2021–2030 (USD Million)

Table 28 Global NGS Services Market for Other Research Applications, by Country/Region, 2021–2030 (USD Million)

Table 29 Global NGS Services Market for Clinical Applications, by Type 2021–2030 (USD Million)

Table 30 Global NGS Services Market for Clinical Applications, by Country/Region, 2021–2030 (USD Million)

Table 31 Currently Available Targeted Therapies and Corresponding Biomarkers

Table 32 Global NGS Services Market for Oncology, by Country/Region, 2021–2030 (USD Million)

Table 33 Global NGS Services Market for Reproductive Health, by Country/Region, 2021–2030 (USD Million)

Table 34 HIV Prevalence Among Adults, by Region (2017 Vs. 2021)

Table 35 Global NGS Services Market for Infectious Diseases, by Country/Region, 2021–2030 (USD Million)

Table 36 Global NGS Services Market for Other Clinical Applications, by Country/Region, 2021–2030 (USD Million)

Table 37 Global NGS Services Market, by End User, 2021–2030 (USD Million)

Table 38 Global NGS Services Market for Hospitals and Diagnostic Laboratories, by Country/Region, 2021–2030 (USD Million)

Table 39 Global NGS Services Market for Pharmaceutical & Biotechnology Companies, by Country/Region, 2021–2030 (USD Million)

Table 40 Global NGS Services Market for Academic Institutes & Research Centers, by Country/Region, 2021–2030 (USD Million)

Table 41 Global NGS Services Market for Other End Users, by Country/Region, 2021–2030 (USD Million)

Table 42 Global NGS Services Market, by Country/Region, 2021–2030 (USD Million)

Table 43 North America: NGS Services Market, by Country, 2021–2030 (USD Million)

Table 44 North America: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 45 North America: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 46 North America: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 47 North America: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 48 North America: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 49 North America: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 50 U.S.: Key Macro & Micro Indicators

Table 51 U.S.: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 52 U.S.: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 53 U.S.: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 54 U.S.: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 55 U.S.: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 56 U.S.: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 57 Canada: Key Macro & Micro Indicators

Table 58 Canada: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 59 Canada: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 60 Canada: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 61 Canada: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 62 Canada: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 63 Canada: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 64 Europe: NGS Services Market, by Country/Region, 2021–2030 (USD Million)

Table 65 Europe: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 66 Europe: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 67 Europe: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 68 Europe: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 69 Europe: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 70 Europe: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 71 Germany: Key Macro & Micro Indicators

Table 72 Germany: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 73 Germany: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 74 Germany: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 75 Germany: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 76 Germany: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 77 Germany: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 78 France: Key Macro & Indicators

Table 79 France: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 80 France: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 81 France: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 82 France: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 83 France: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 84 France: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 85 U.K.: Key Macro & Micro Indicators

Table 86 U.K.: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 87 U.K.: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 88 U.K.: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 89 U.K.: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 90 U.K.: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 91 U.K.: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 92 Italy: Key Macro & Micro Indicators

Table 93 Italy.: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 94 Italy: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 95 Italy: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 96 Italy: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 97 Italy: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 98 Italy: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 99 Spain: Key Macro & Micro Indicators

Table 100 Spain: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 101 Spain: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 102 Spain: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 103 Spain: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 104 Spain: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 105 Spain: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 106 Estimated Number of New Cancer Cases - 2020 Vs 2030

Table 107 RoE: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 108 RoE: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 109 RoE: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 110 RoE: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 111 RoE: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 112 RoE: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 113 Asia-Pacific: NGS Services Market, by Country/Region, 2021–2030 (USD Million)

Table 114 Asia-Pacific: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 115 Asia-Pacific: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 116 Asia-Pacific: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 117 Asia-Pacific: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 118 Asia-Pacific: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 119 Asia-Pacific: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 120 China: Key Macro & Micro Indicators

Table 121 China: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 122 China: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 123 China: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 124 China: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 125 China: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 126 China: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 127 Japan: Key Macro & Micro Indicators

Table 128 Japan: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 129 Japan: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 130 Japan: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 131 Japan: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 132 Japan: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 133 Japan: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 134 India: Key Macro & Micro Indicators

Table 135 India: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 136 India: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 137 India: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 138 India: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 139 India: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 140 India: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 141 Estimated Number of New Cancer Cases - 2020 Vs 2030

Table 142 RoAPAC: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 143 RoAPAC: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 144 RoAPAC: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 145 RoAPAC: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 146 RoAPAC: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 147 RoAPAC: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 148 Latin America: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 149 Latin America: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 150 Latin America: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 151 Latin America: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 152 Latin America: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 153 Latin America: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 154 Middle East & Africa: NGS Services Market, by Type, 2021–2030 (USD Million)

Table 155 Middle East & Africa: NGS Services Market, by Technology, 2021–2030 (USD Million)

Table 156 Middle East & Africa: NGS Services Market, by Application, 2021–2030 (USD Million)

Table 157 Middle East & Africa: NGS Services Market for Clinical Applications, by Type, 2021–2030 (USD Million)

Table 158 Middle East & Africa: NGS Services Market for Research Applications, by Type, 2021–2030 (USD Million)

Table 159 Middle East & Africa: NGS Services Market, by End User, 2021–2030 (USD Million)

Table 160 Recent Developments, by Company, 2020–2023

Table 161 Key Services Offered by Companies Operating NGS Services Market: Competitive Benchmarking

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

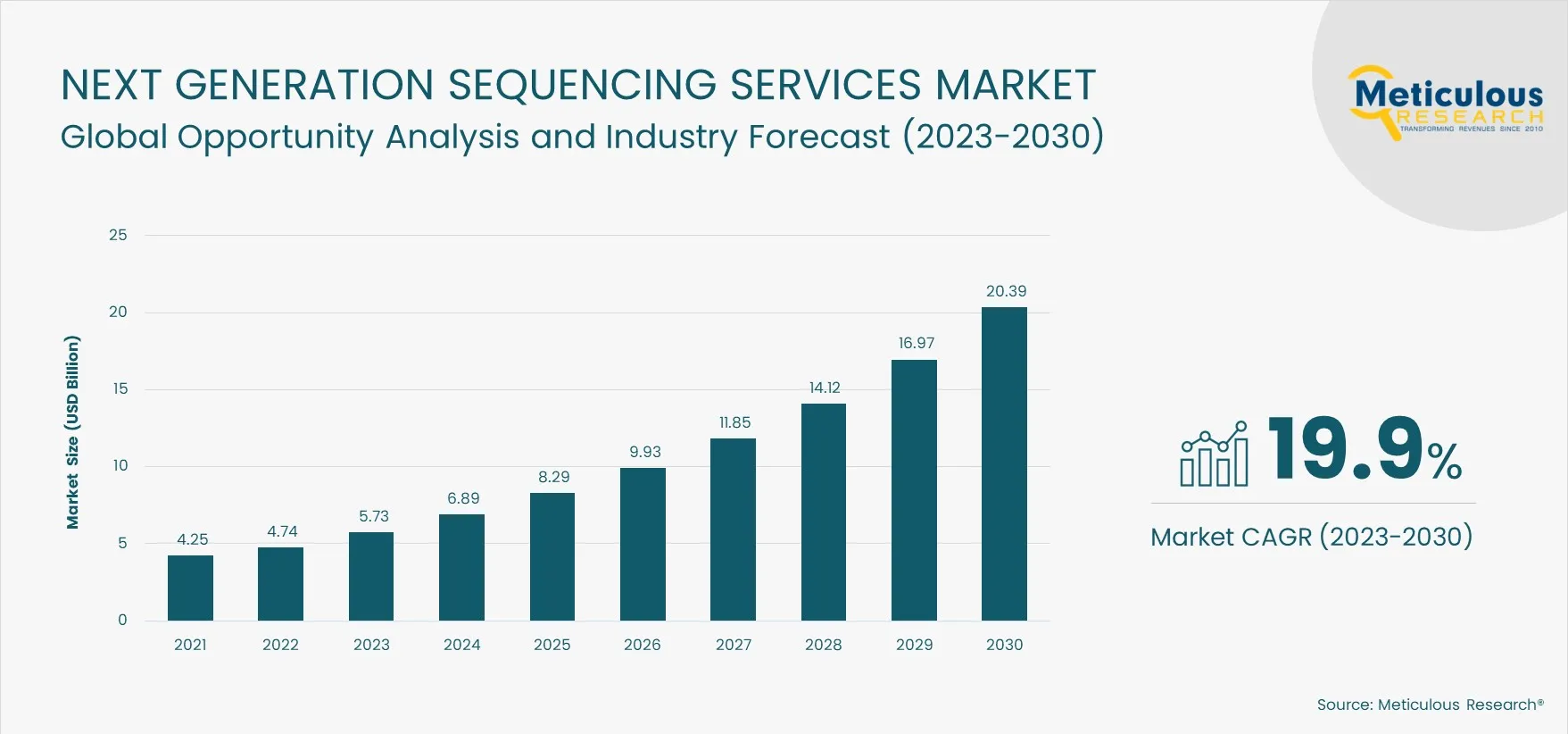

Figure 7 Global NGS Services Market, by Type, 2023 Vs 2030 (USD Million)

Figure 8 Global NGS Services Market, by Technology, 2023 Vs 2030 (USD Million)

Figure 9 Global NGS Services Market, by Application, 2023 Vs 2030 (USD Million)

Figure 10 Global NGS Services Market, by End User, 2023 Vs 2030 (USD Million)

Figure 11 Global NGS Services Market, by Geography

Figure 12 Global NGS Services Market: Impact Analysis of Market Dynamics (2023–2030)

Figure 13 Pharmaceutical R&D Expenditures in the U.S., Europe, and China, 2010 Vs. 2019 Vs. 2020 (USD Million)

Figure 14 Global Pharmaceutical R&D Expenditure, 2016–2028 (USD Billion)

Figure 15 Estimated Number of New Cancer Cases, 2020–2040 (in Million)

Figure 16 Genome Sequencing Costs, 2010–2021 (USD)

Figure 17 Porter's Five Forces Analysis

Figure 18 EU Regulatory Pathway - IVDR 2017/746

Figure 19 China: Medical Device Classification and Premarket Requirements for NGS Instruments

Figure 20 Global NGS Services Market, by Type, 2023 Vs. 2030 (USD Million)

Figure 21 Number of Manuscripts Featuring RNA Sequencing Per Year on PubMed

Figure 22 Applications of De Novo Sequencing

Figure 23 Global NGS Services Market, by Technology, 2023 Vs. 2030 (USD Million)

Figure 24 Global NGS Services Market, by Application, 2023 Vs. 2030 (USD Million)

Figure 25 U.S.: New Molecular Entity (NME) Approvals (2011–2022)

Figure 26 Estimated Number of New Cancer Cases Globally (2020–2040) (in Million)

Figure 27 Global NGS Services Market, by End User, 2023 Vs. 2030 (USD Million)

Figure 28 Global Pharmaceutical R&D Spending, 2012–2026 (USD Billion)

Figure 29 Global NGS Services Market, by Geography, 2023 Vs. 2030 (USD Million)

Figure 30 North America: NGS Services Market Snapshot

Figure 31 Pharmaceutical R&D Expenditure in the U.S. (2000-2020)

Figure 32 Pharmaceutical Industry R&D Expenditure in Europe (2020)

Figure 33 Europe: NGS Services Market Snapshot

Figure 34 Italy: Number of Biotechnology Companies, 2010-2021

Figure 35 RoE: Pharmaceutical R&D Expenditure, 2020

Figure 36 Asia-Pacific: NGS Services Market Snapshot

Figure 37 Key Growth Strategies Adopted by Leading Players, 2020–2023

Figure 38 NGS Services Market: Competitive Benchmarking, by Region

Figure 39 Global NGS Services Market Share Analysis, by Key Players, 2022 (%)

Figure 40 Competitive Dashboard: NGS Services Market

Figure 41 Illumina, Inc.: Financial Overview (2022)

Figure 42 Eurofins Scientific S.E.: Financial Overview (2022)

Figure 43 Invitae Corporation: Financial Overview (2022)

Figure 44 F. Hoffmann-La Roche AG: Financial Overview (2022)

Figure 45 Beijing Genomics Institute (BGI): Financial Overview (2022)

Figure 46 Novogene Co., Ltd.: Financial Overview (2022)

Figure 47 PerkinElmer, Inc.: Financial Overview (2022)

Figure 48 Macrogen, Inc.: Financial Overview (2022)

Figure 49 QIAGEN N.V.: Financial Overview (2022)

Figure 50 LGC Limited: Financial Overview (2022)

Figure 51 Azenta, Inc.: Financial Overview (2022)

Figure 52 DNA Link, Inc.: Financial Overview (2022)

Figure 53 Quest Diagnostics Incorporated: Financial Overview (2022)