Resources

About Us

Next Generation Sequencing Services Market by Type (Targeted, RNA, De Novo, WES, WGS), Technology (Sequencing by Synthesis, Ion Semiconductor, SMRT, Nanopore), Application (Research, Clinical [Oncology, Reproductive]), End User – Global Forecast to 2031

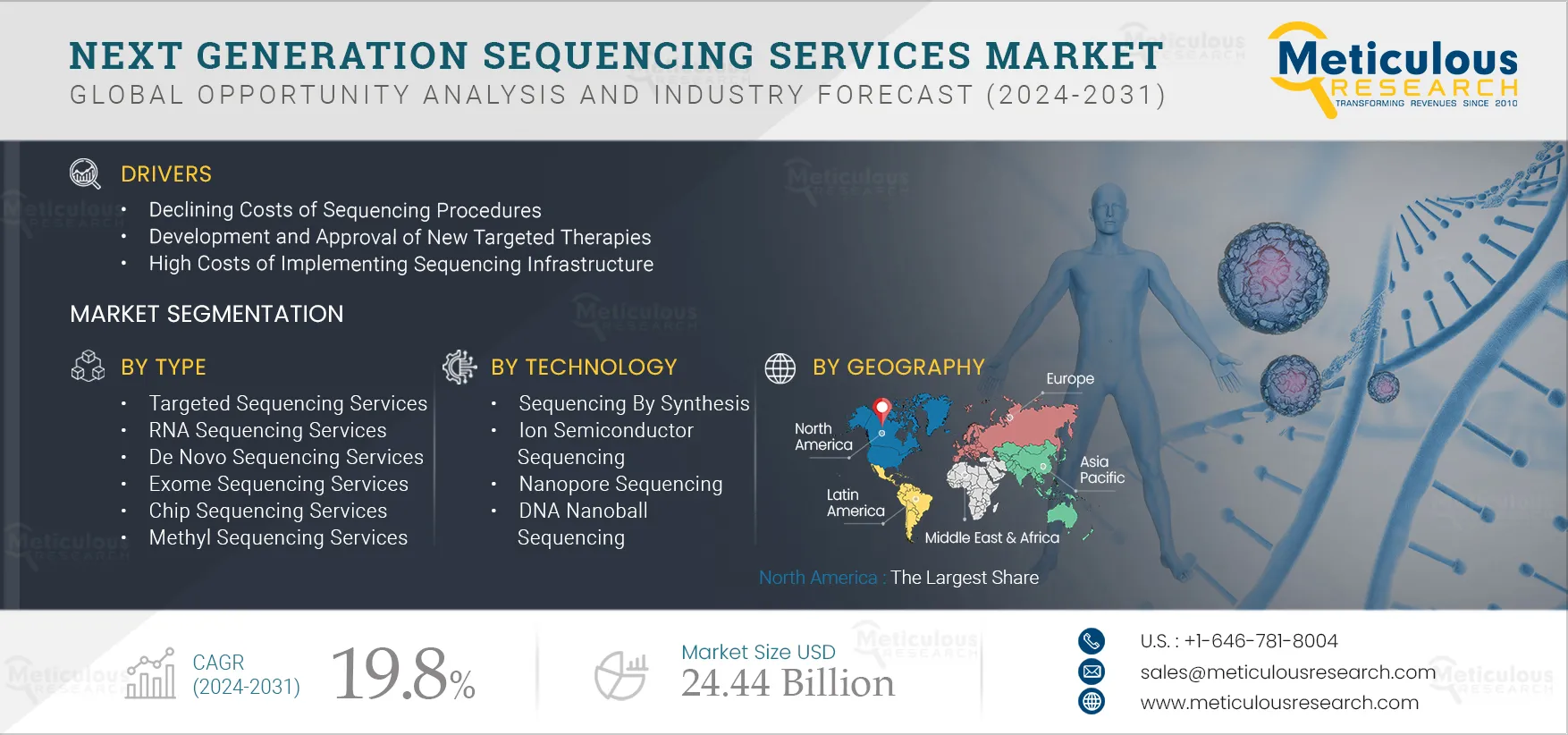

Report ID: MRHC - 104341 Pages: 284 Jun-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe Next Generation Sequencing Services Market is expected to register a CAGR of 19.8% from 2024 to 2031 to reach $24.44 billion by 2031. The growth of this market is mainly driven by the declining costs of sequencing procedures, the development & approval of new targeted therapies, the rising prevalence of cancer, partnerships between NGS service providers & pharmaceutical companies, the high cost of implementing sequencing infrastructure, and technological advancements in NGS. Furthermore, the increasing applications of NGS in cancer & agri-genomics research and advancements in sequencing data analytics are expected to generate market growth opportunities. However, regulatory & standardization concerns in diagnostic testing, the installation of in-house NGS facilities in large hospitals & research institutes, and the ethical issues & costs related to non-invasive prenatal genetic testing are major challenges for the stakeholders in this market.

Recent advancements in genomics research have substantially reduced the costs of genome sequencing procedures. In the past few years, the availability of advanced NGS technologies has lowered sequencing costs and significantly reduced the time required for DNA sequencing. According to the National Human Genome Research Institute (NHGRI), the cost of sequencing a human genome decreased from USD 29,092 in 2010 to USD 562 in 2021.

As the cost of sequencing is declining, the adoption of NGS services has increased rapidly. NGS has enabled the discovery of genetically targeted drugs and blood tests that can detect cancer at early stages. It has also enabled diagnosis for people with rare diseases. The declining cost of sequencing has increased its adoption in clinical applications. Thus, the declining sequencing costs are expected to drive the growth of the NGS services market.

Cancer poses a huge burden globally, leading to a decrease in the quality of life and even mortality. There is a high prevalence of cancer, accounting for 159.8 million cancer cases in 2022. Advancements in next-generation sequencing (NGS) technology are changing the way doctors diagnose and treat cancer. New targeted cancer treatments that use genomic data to provide patient-specific treatments are known as precision oncology. It is a rapidly developing field that has already entered mainstream clinical practices. Precision oncology involves the molecular profiling of cancer cells to identify targetable alterations, also known as biomarkers. NGS services are increasingly being used for genomic profiling in targeted cancer therapy applications due to the decreasing costs and turnaround times of NGS, improvements in bioinformatics analyses, and the harmonization of knowledge bases to facilitate the clinical interpretation of genomic results.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

The advantages of NGS and the plummeting costs of NGS procedures have led to the installation of in-house NGS systems. Various large hospital chains and academic & research institutes are increasingly setting up in-house NGS facilities for their sequencing needs. These in-house facilities help healthcare professionals by reducing turnaround times for test results, enabling them to effectively plan personalized treatments for their patients. These in-house facilities help researchers improve research efficiency by reducing turnaround times and retaining sample quality. They also help organizations improve their revenue channels, adversely affecting the revenues of core NGS service providers.

Thus, the increasing installation of in-house sequencing platforms and facilities among large-scale hospitals and academic & research institutes may hamper the revenues of NGS service providers, affecting the growth of the NGS services market.

NGS is widely used for cancer testing and is available in many diagnostic laboratories. Apart from cancer, NGS technologies are also increasingly utilized for diagnosing various other diseases. NGS can be used to diagnose a wide range of diseases, from novel microbial agents that cause epidemics to heterogeneous mutations that cause complex inherited disorders. NGS is the best method for diagnosing complex diseases involving multiple genes. Autism, connective tissue disorders, cardiomyopathies, and disorders of sex development are a few such diseases.

The utilization of NGS for the molecular detection and genotyping of infectious disease pathogens has been growing. It is also being used for public health surveillance. Isolated pathogens can be identified using NGS directly from the samples. However, the implementation of NGS in medical practice has been slow due to its high costs and the availability of cheaper alternative methods. However, the advantages of NGS in terms of time and accuracy have led to the widespread utilization of NGS in disease diagnosis. Also, in some cases, NGS is the only available method of diagnosis. NGS services are being rapidly adopted, especially for noninvasive prenatal testing to detect fetal aneuploidies in high-risk pregnancies.

The increasing global population has put extreme pressure on land and animal resources to meet the growing food needs. Improvements in agricultural technologies, irrigation, inputs, and pricing policies have further outgrown the pressure to increase production. Due to this increasing demand, sequencing procedures have been used in animal and plant breeding to derive products with desired traits.

There is an increasing need to breed novel crops that produce higher yields, are heat and drought-tolerant, and require lesser pesticide use due to the rapidly growing world population and the increasing environmental pressure caused by climate change. Genomic advancements have made it possible to accelerate the development of crops with favorable agronomic traits. Agriculture genomics refers to the use of genetics in agriculture to increase crop and livestock productivity and sustainability. The traditional plant-breeding practices for producing new crop varieties were time-consuming and could result in biodiversity loss. Therefore, the popularity of high-throughput next-generation sequencing (NGS) technologies is growing as they can help identify causal genetic factors by sequencing a species' whole genome and transcriptome.

Based on type, the NGS services market is segmented into targeted sequencing services, whole genome sequencing services, RNA sequencing services, exome sequencing services, de novo sequencing services, ChIP sequencing services, methyl sequencing services, and other NGS services. In 2024, the targeted sequencing services segment is expected to account for the largest share of 43.9% of the NGS services market. The large share of this segment is attributed to the increased use of targeted sequencing in precision medicine, its higher cost efficiency compared to other sequencing services, the increased number of clinical applications for diagnosing diseases and monitoring patient health, its rapid turnaround time, and its growing importance in cancer research and drug discovery.

However, the whole genome sequencing services segment is slated to register the highest CAGR of 20.3% during the forecast period of 2024-2031. The wide applications of whole genome sequencing, growing genomic research, declining costs of sequencing, and favorable initiatives by governments and private institutions for genomic research to explore its clinical applications drive the segment growth.

Whole genome sequencing has several applications, including in the analysis of tumors, causes and progression of diseases, selection of plants and animals for agricultural breeding programs, and analysis of common genetic variations among populations. It also enables the identification of known virulence factors and deriving a comprehensive resistance profile of pathogens toward antibiotic drugs. Whole genome sequencing has been used to identify genes linked to cancer, diabetes, immune disorders, and other diseases. Numerous novel genetic aberrations and related potential therapeutic targets have been discovered in several cancers using whole genome (or whole-exome) sequencing.

Based on technology, the NGS services market is segmented into sequencing by synthesis (SBS), ion semiconductor sequencing (IOS), single-molecule real-time sequencing (SMRT), nanopore sequencing, and DNA nanoball sequencing. In 2024, the sequencing by synthesis (SBS) segment is expected to account for the largest share of 62.9% of the NGS services market. The large share of this segment is attributed to its benefits, including higher yield of error-free throughput, base call values exceeding Q30, and superior accuracy in DNA sequencing compared to other sequencing technologies.

SBS provides the most accurate data across a broad range of applications, with the highest yield of error-free reads and a base call value above Q30, which helps researchers reach strong biological conclusions. This is one of the key factors contributing to the large share of SBS among all sequencing technologies. Further, due to the ability of SBS to generate several gigabases of DNA sequence per run, large mammalian genomes can be sequenced in a week using this technology. SBS is gradually eliminating the need for gel-based size-fractionation by providing much higher throughput than other sequencing technologies.

The nanopore sequencing segment is expected to register the highest CAGR of 20.9% during the forecast period. The benefits offered by nanopore sequencing technology, such as inexpensive sample preparation, label-free ultra-long reads, high throughput, and lower material requirements compared to other sequencing technologies, drive the growth of this segment.

The technique is used in cancer diagnosis and treatment by detecting and accurately quantifying MicroRNA, a cancer biomarker. Hence, it is used in cancer diagnosis, staging, progression, prognosis, and treatment response. In addition, this technology produces fast results and is also used to detect infectious diseases. For instance, MinION (by Oxford Nanopore Technologies) was used to detect and confirm Ebola samples in Africa in under 15 minutes.

Based on application, the NGS services market is segmented into research applications and clinical applications. In 2024, the research applications segment is expected to account for the largest share of the NGS services market. This large segmental share is mainly attributed to the increasing demand for gene-based medicines, growing investments in drug research and development activities, and increasing research programs for personalized medicine, leading to an increase in the approval for molecule-based therapies (molecular entities). For instance, the number of new molecular entities (NMEs) approved by the U.S. FDA increased from 30 in 2011 to 50 in 2021 in the U.S.

However, the clinical applications segment is expected to register the highest CAGR during the forecast period of 2024 to 2031. The growth of this segment is attributed to factors such as the growing adoption of next-generation sequencing for oncology applications, the increasing demand for precision medicine in cancer therapy, and the rising need for specific cancer gene-targeting diagnostic tests.

With an increasing number of cancer patients globally, there is a growing need for efficient & advanced methods for cancer diagnosis and effective targeted treatment. The adoption of NGS technology in medicine is expected to improve diagnostic accuracy and reduce overall treatment costs. The extensive research conducted in oncology is expected to lead to the development and launch of cancer gene-targeting tests, driving the adoption of NGS services for clinical applications during the forecast period.

Based on end user, the NGS services market is segmented into hospitals & clinics, pharmaceutical & biotechnology companies, academic institutes & research centers, and other end users. In 2024, the hospitals & clinics segment is estimated to account for the largest share of the NGS services market. The large share of this segment is attributed to factors such as high capital requirements for building in-house NGS capabilities in hospitals & clinics, the rising prevalence of cancer and other chronic diseases, the growing demand for advanced medical treatments, and the rising number of biomarker-based therapies.

However, the pharmaceutical & biotechnology industry segment is slated to register the highest CAGR during the forecast period of 2024-2031. Growing R&D activities and investments, rising prevalence of chronic diseases, growing adoption of NGS services by the pharma and biopharma companies for identification of biomarkers to develop new therapies, and growing use of the NGS services for in bioprocess development to improve the efficiency and yield of bioproduction drives the segment growth.

NGS also plays an important role in biomarker discovery. Pharmaceutical & biotechnology companies are employing NGS services to identify and validate biomarkers that can be used in developing new diagnostic tests and therapies. Biomarkers are measurable indicators of a biological state or process that can be used to diagnose, monitor, or predict the progression of a disease. NGS-based biomarker discovery typically involves using transcriptomics, genomics, or epigenomics approaches to identify changes in gene expression, genetic variations, or epigenetic modifications associated with a particular disease or condition. NGS enables the simultaneous analysis of thousands or even millions of genes, making it a powerful tool for identifying biomarkers that other methods might not detect.

In 2024, North America is expected to account for the largest share of 45.5% of the NGS services market. The large share of North America in the NGS services market is primarily attributed to the presence of leading NGS service providers in the region, favorable government initiatives for genomics research, growing applications of NGS-based research, declining cost of sequencing coupled with the rising awareness of NGS, increasing research investments by pharmaceutical and biopharmaceutical companies, increasing cancer prevalence, and favorable reimbursement scenario in the region.

However, the Asia-Pacific region is slated to register the highest CAGR of 23.2% during the forecast period of 2024-2031. Growing healthcare and pharmaceutical sectors due to growing investments and supporting initiatives, the growing prevalence of chronic diseases coupled with rising healthcare expenditures are the major factors attributed to this region's growth.

Countries like China, Japan, India, and Singapore aim to become competitive in the global biotech market, paving the way for many research and development activities in this domain. India and China have established themselves well in the global biotech outsourcing industry. Compared to Western countries, a large, skilled, and affordable workforce has given these countries an added advantage to further the growth in the biotech industry. This has attracted a lot of investments from foreign players. Such investments are pushing the demand for NGS services across Asia-Pacific.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that market participants adopted over the past four years. The key players profiled in the next generation sequencing services market report include Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), PerkinElmer, Inc. (U.S.), Eurofins Scientific S.E. (Luxembourg), Macrogen, Inc. (South Korea), LGC Limited (U.K.), GENEWIZ, Inc. (U.S.), Beijing Genomics Institute (China), MedGenome, Inc. (U.S.), DNA Link, Inc. (South Korea), Novogene Co., Ltd. (China), CD Genomics (U.S.), SeqLL, Inc. (U.S.), Otogenetics Corporation (U.S.), Foundation Medicine, Inc. (U.S.), Quest Diagnostics Incorporated (U.S.), and Invitae Corporation (U.S.).

|

Particulars |

Details |

|

Number of Pages |

284 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

19.8% |

|

Market Size (Value) |

USD 24.44 Billion by 2031 |

|

Segments Covered |

By Type

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Ireland, Netherlands, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Animal Genetics, Inc. (U.S), Zoetis Inc. (U.S), Mars Petcare (Part of Mars, Incorporated) (U.S.), Embark Veterinary, Inc. (U.S.), Neogen Corporation (U.S.), Basepaws Inc., LABOKLIN GMBH & CO.KG (Germany), Generatio GmbH (Germany), Vetgen LLC (U.S.), FarmLab Diagnostics (Ireland) and EasyDNA (Part of Genetic Technologies Limited) (U.S.). |

The next generation sequencing services market covers the market size & forecasts the various NGS services used by hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies, academics & research institutes, and other end users for clinical and research applications. The next generation sequencing services market studied in this report involves the value analysis of various segments and sub-segments of NGS services at regional and country levels.

The next generation sequencing services market is projected to reach $24.44 billion by 2031, at a CAGR of 19.8% during the forecast period.

Based on type, the target sequencing services segment is estimated to account for the largest share of the next generation sequencing services market in 2024. This segment's large share is mainly attributed to its relatively lower cost, faster turnaround time, and accurate and easy-to-interpret results for studies of disease-related genes.

The sequencing by synthesis segment is estimated to register the fastest CAGR during the forecast period. Factors such as the high adoption of Illumina's NGS platforms, its broad range of research and clinical applications, high reliability, and high demand for high-throughput sequencing at lower costs are driving the growth of this technology in the NGS services market.

The decreasing cost of NGS sequencing procedures, development, and approval of new targeted therapies, rising prevalence of cancer, partnerships between NGS service providers & pharma companies, high cost of sequencing infrastructure, and technological advancements in NGS services have been considered to have a positive impact on the next generation sequencing services market. In addition, the increasing application of NGS in cancer and agri-genomics research and advancements in sequencing data analytics provide significant opportunities for the next generation sequencing service providers.

Key companies operating in the next generation sequencing services market are Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), PerkinElmer, Inc. (U.S.), Eurofins Scientific S.E. (Luxembourg), Macrogen, Inc. (South Korea), LGC Limited (U.K.), GENEWIZ, Inc. (U.S.), Beijing Genomics Institute (China), MedGenome, Inc. (U.S.), DNA Link, Inc. (South Korea), Novogene Co., Ltd. (China), CD Genomics (U.S.), SeqLL, Inc. (U.S.), Otogenetics Corporation (U.S.), Foundation Medicine, Inc. (U.S.), Quest Diagnostics Incorporated (U.S.), and Invitae Corporation (U.S.).

Emerging economies like China and India are projected to offer significant growth opportunities for players in this market. Improvement in the healthcare infrastructure, rising research & development activities, and the growing number of patients suffering from gene-associated disorders are the factors that will offer significant growth opportunities in this region.

Published Date: Aug-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates