Resources

About Us

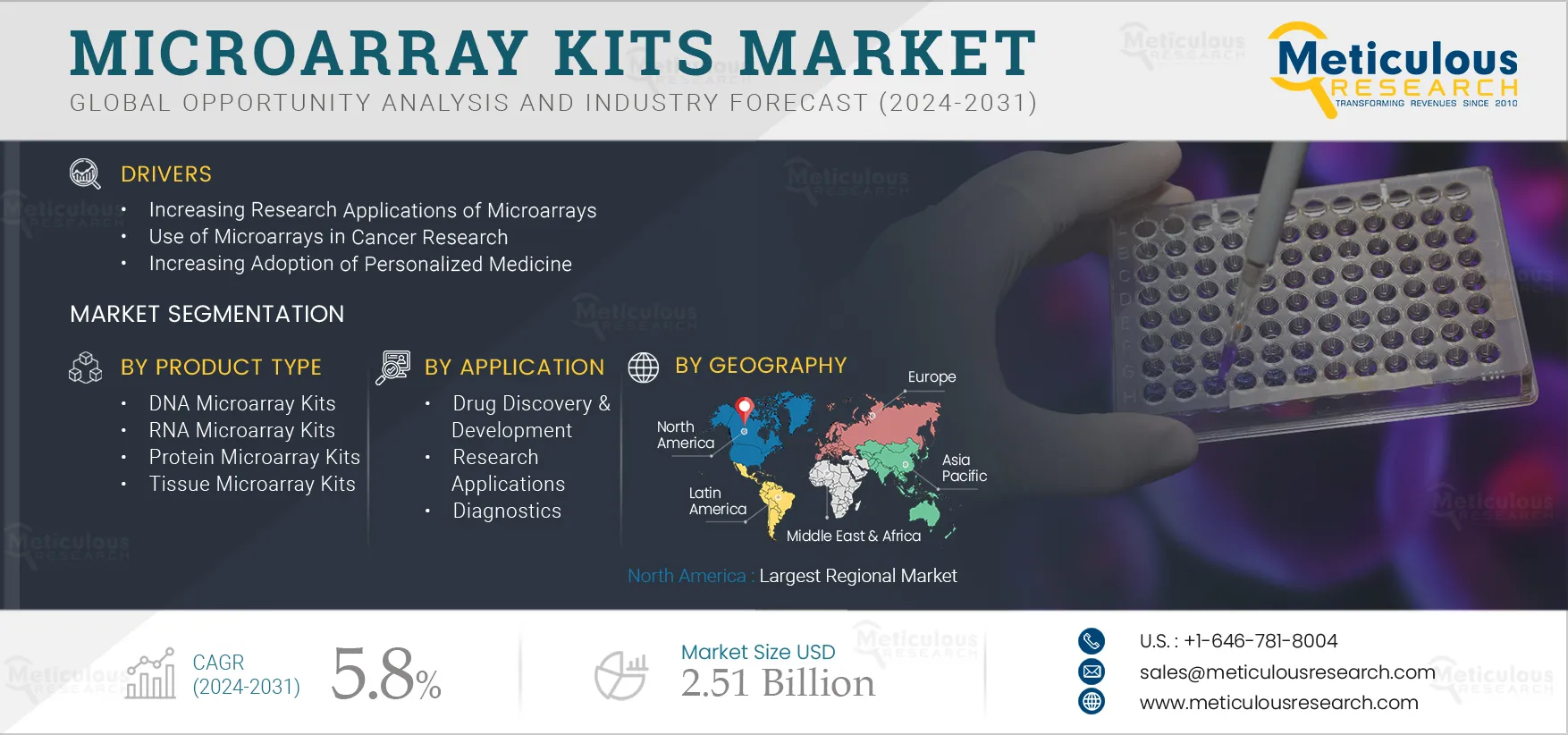

Microarray Kits Market by Product Type (DNA [cDNA, Oligo, BAC, SNP], RNA, Protein, Tissue), Application (Drug Discovery & Development, Research, Diagnostic), End User (CRO, Pharma & Biotech, Academic, Hospital & Diagnostic Lab) – Global Forecast to 2032

Report ID: MRHC - 1041094 Pages: 220 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportMicroarray kits are used in the detection and quantification of a large number of nucleic acids from biological samples, such as cells, tissues, or bodily fluids. The commercially available microarray kits are deployed in the assessment of protein families, probing serum for diagnostic information, profiling expression in response to drugs, and profiling cells treated with certain stimulators or transfected with a given gene.

The growth of the microarray kits market is driven by several factors, including the increasing research applications of microarrays, the use of microarrays in cancer research, the increasing adoption of personalized medicine, and the growing R&D expenditure in the pharmaceutical and biotechnology industries. Factors such as technological advancements in microarray technology and emerging economies are a few of the opportunities for market growth. Lack of sensitivity and accuracy is challenging the market growth. However, the higher costs of microarrays, as compared to other genetic methods, restrain the growth of the market.

Microarray is a laboratory technique used in the high-throughput analysis of many biological molecules, such as DNA, RNA, proteins, or antibodies, in a single experiment. Microarrays are powerful tools that can assess the presence, abundance, or activity of multiple molecules within a complex biological sample. Microarrays are used in various fields of research, such as genomics and molecular biology, detection, and quantification of proteins, antibodies, or other biomolecules, and cancer research, among others.

Some of the recent advances in the microarray techniques are as follows:

Such developments in the field of microarray technology provide several benefits, such as personalized services for patients as per their condition, rapid and accurate results, and high-quality data. These advancements can be applied in various aspects of the research and diagnostic field, such as clinical trials, research studies, drug discovery, biomarker discovery, and diagnosis and treatment of diseases, supporting market growth.

Click here to: Get Free Sample Pages of this Report

Microarray technology refers to the approach that involves the binding of an array of millions of nucleic acid fragments to a solid surface, which is generally referred to as a chip. A DNA or RNA sample is then added to the chip in order to initiate complementary base pairing when the immobilized fragments on the chip produce light through fluorescence that is detected using a specialized device. Microarray technology allows genomic analysis without sequencing and also greatly reduces the cost of performing experiments across the fields of biology and biomedicine. Initially, microarray technology was only used to measure gene expression or quantify certain small molecules. However, due to new and innovative advancements, modern microarray technology is a fast and reliable solution for a variety of other fields, such as biomarker and drug discovery.

Research applications include clinical trials and drug discoveries using microarray technologies for various purposes, such as gene expression, detection of DNA sequences, studying gene mutations, and incidence of certain biomarkers as well. It can be used as a genomic tool to study and compare different features of the genome based on different diseases and conditions. Due to the study of genomics and data acquired using the technology, population-based studies can also be carried out easily.

In January 2025, Thermo Fisher Scientific, Inc. (U.S.) launched the Axiom PangenomiX Array, which is used for research applications and combines four assays in one test: SNP genotyping, whole-genome copy number variant detection, fixed copy number discovery, and blood and HLA typing. Some of the research areas where it is used include genome-wide association studies (GWAS), population health initiatives, polygenic risk score research and development, and clinical research for trials in drug discovery.

This technology is also used in pharmacogenomics by facilitating the analysis of gene expression patterns and genetic variations to understand how individuals respond to drugs. It is also used to identify which genes are activated or deactivated in response to specific drugs. Comparing gene expression profiles between individuals, researchers can predict variations in drug response. There has been a significant rise in the use of microarrays in pharmacogenomic programs. For instance, the Pharmacogenomic Resource for Enhanced Decisions in Care and Treatment (PREDICT) program was implemented by the Vanderbilt University Medical Center (U.S.). It utilizes panel-based genotyping to identify specific SNPs associated with drug responses, enabling tailored clinical decision support for each participant. This highlights the crucial role of microarray technologies in advancing personalized approaches within pharmacogenomics.

Among product types, in 2025, the DNA microarray kits segment is expected to account for the largest share of the market. DNA microarrays, also known as DNA chips or gene chips, are used in genomics and molecular biology for the simultaneous analysis of thousands to millions of DNA sequences, typically genes or oligonucleotide probes, on a small, solid support surface. The large market share of the segment is attributed to factors such as increasing incidence of cancer, wide application areas of microarray technology, rising funding for genomic R&D, and growing research for personalized medicine. For instance, the Genomics Research and Development Initiative (GDRI) (Canada) receives close to USD 20 million from the Government of Canada annually, to carry out vital genomics research.

Among applications, in 2025, the drug discovery & development segment is expected to account for the largest share of the market. The large share of the segment is attributed to factors such as the growing public and private investments for pharmaceutical and biotech research & development, initiatives by the pharmaceutical and biotech companies to expand their research capabilities by opening new research centers, and launches of new and innovative microarray kits and technologies. In December 2024, the National Institutes of Health (NIH) (U.S.) awarded USD 6.4 million to fund research at colleges and universities that have not received significant funding from the NIH recently in order to establish Diversity Centers for genome research. This will increase the number of research centers, which will increase the biomedical research being conducted, therefore, increasing the use of innovative technologies such as microarrays, driving the growth of the segment.

Among end users, in 2025, the pharmaceutical & biotechnology companies’ segment is expected to account for the largest share of the market. The large share of the segment is attributed to factors such as high pharmaceutical R&D expenditure, rising demand for new drug discovery & development, increasing funding, grants, and investments for genomic research, and growing focus on increasing overall productivity. The rising demand for drug discovery coupled with the rising R&D expenditure will increase the demand for techniques such as microarray technology that offer accurate results and provide better and vast information.

The largest share of the segment is primarily due to the availability of advanced infrastructure for genomic research, the presence of key players, the presence of key pharmaceutical companies and research institutes, availability of funding for life science research. The presence of key players in the market improves the accessibility to advanced microarray technology resources, including kits.

The key players profiled in the microarray kits market report are Thermo Fisher Scientific, Inc. (U.S.), Illumina, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), Edvotek, Inc. (U.S.), Sakura Finetek USA, Inc. (U.S.), Dextra Laboratories Ltd. (U.K.), and GeneCopoeia, Inc. (U.S.).

The report includes a competitive landscape based on an extensive assessment of the market based on product type, application, and end user. The report also provides insights into the presence of major market players and their key growth strategies in the last three to four years.

|

Particular |

Details |

|

Page No |

~220 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

5.8% |

|

Market Size (Value) |

$2.51 billion by 2032 |

|

Segments Covered |

By Product Type

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Thermo Fisher Scientific, Inc. (U.S.), Illumina, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), Edvotek, Inc. (U.S.), Sakura Finetek USA, Inc. (U.S.), Dextra Laboratories Ltd. (U.K.), and GeneCopoeia, Inc. (U.S.). |

This market study covers the market sizes & forecasts of the microarray kits based on product type, application, end user, and geography. This market study also provides the value analysis of various segments and sub-segments of the global microarray kits market at country levels.

The microarray kits market is projected to reach $2.51 billion by 2032, at a CAGR of 5.8% during the forecast period.

The DNA microarray kits segment is expected to account for the largest share of the market in 2025. Factors such as wide application areas of microarrays, rising funding for genomic R&D, and the growing research for personalized medicine and the use of microarrays for the same.

The drug discovery & development segment is expected to account for the largest share of the microarray kits market in 2025. The largest share of this segment is attributed to factors such as growing public and private investments in pharmaceutical and biotech research & development and initiatives by the pharmaceutical and biotech companies to expand their research capabilities by opening new research centers and launching new and innovative microarray kits and technologies.

The pharmaceutical & biotechnology companies’ segment is expected to account for the largest share of the microarray kits market. The largest share of this segment is attributed to factors such as high pharmaceutical R&D expenditure, rising demand for new drug discovery & development, and growing focus on increasing overall productivity.

The growth of the microarray kits market is driven by several factors, including the increasing research applications of microarrays, the use of microarrays in cancer research, the increasing adoption of personalized medicine, and the growing R&D expenditure in pharmaceutical & biotechnology industries. Furthermore, technological advancements in microarray technology and emerging economies serve as major opportunities for the existing market players and new entrants in the microarray kits market.

The key players profiled in the microarray kits market report are Thermo Fisher Scientific, Inc. (U.S.), Illumina, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), Edvotek, Inc. (U.S.), Sakura Finetek USA, Inc. (U.S.), Dextra Laboratories Ltd. (U.K.), and GeneCopoeia, Inc. (U.S.).

Published Date: Sep-2024

Published Date: Jan-2024

Published Date: Nov-2019

Published Date: Feb-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates