1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-uUp Approach

2.3.1.2. Top-dDown Approach

2.3.1.3. Growth Forecast

2.3.2. Market Share Analysis

2.4. Assumptions for the Study

2.5. Limitations for the Study

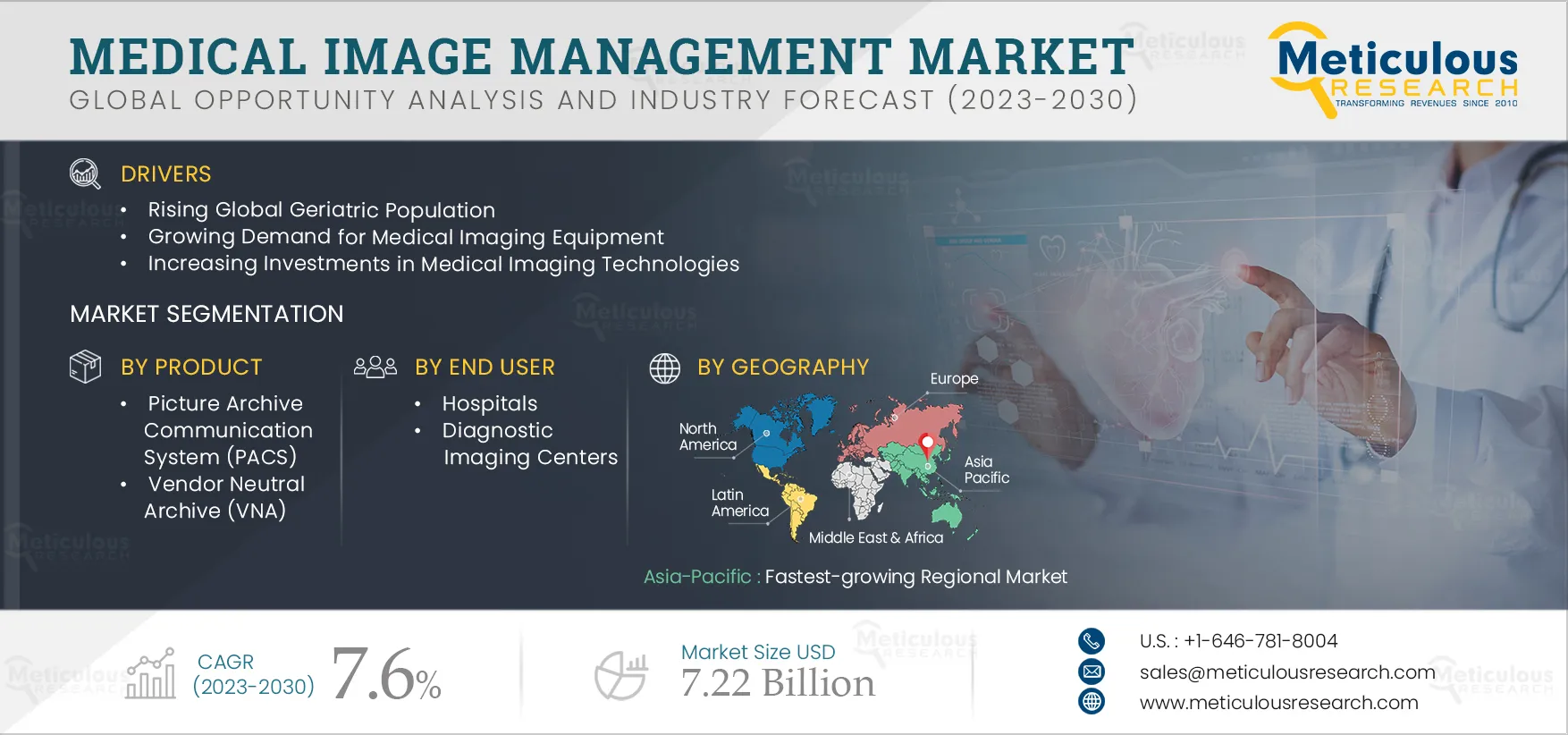

3. Executive Summary

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Rising Global Geriatric Population

4.2.2. Growing Demand for Medical Imaging Equipment

4.2.3. Increasing Investments in Medical Imaging Technologies

4.2.4. Technological Advancements in Diagnostic Imaging Modalities

4.2.5. Growing Healthcare IT & EHR Adoption

4.3. Restraints

4.3.1. Long Product Lifecycle of Vendor Neutral Archive Solutions

4.3.2. Budgetary Constraints

4.4. Opportunities

4.4.1. Integration of PACS & VNA with EMR

4.4.2. Untapped Markets in Emerging Economies

4.4.3. Penetration of Artificial Intelligence in Medical Imaging

4.4.4. Rising Adoption of Hybrid & Cloud-Based Medical Imaging Solutions

4.4.5. Growing Telehealth Market

4.4.6. Rapidly Increasing Big Data in the Healthcare Sector

4.5. Challenges

4.5.1. Data Migration

4.5.2. Lack of Interoperability

4.6. Impact of COVID-19 on the Medical Image Management Market

5. Regulatory Framework

6. Global Medical Image Management Market, by Product

6.1. Introduction

6.2. Picture Archive Communication System (PACS)

6.2.1. PACS Market, by Type

6.2.1.1. Departmental PACS

6.2.1.1.1. Radiology PACS

6.2.1.1.2. Mammography PACS

6.2.1.1.2.1. Traditional Mammography PACS

6.2.1.1.2.2. Vendor Neutral Mammography PACS

6.2.1.1.3. Cardiology PACS

6.2.1.1.4. Other Departmental PACS

6.2.1.2. Enterprise PACS

6.2.2. PACS Market, by Delivery Model

6.2.2.1. On-Premise PACS

6.2.2.2. Web/Cloud-Based PACS

6.3. Vendor Neutral Archive (VNA)

6.3.1. VNA Market, by Delivery Model

6.3.1.1. On-Premise premise VNA

6.3.1.2. Hybrid VNA

6.3.1.3. Web/Cloud-Based VNA

6.3.2. VNA Market, by Procurement Model

6.3.2.1. Enterprise VNA

6.3.2.1.1. Multi-Departmental VNA

6.3.2.1.2. Multi-Site VNA

6.3.2.2. Departmental VNA

6.3.3. VNA Market, by Vendor Type

6.3.3.1. Independent Software Vendors

6.3.3.2. PACS Vendors

6.3.3.3. Infrastructure Vendors

6.4. Application-Independent Clinical Archives (AICA)

6.4.1. AICA Market, by Vendor Type

6.4.1.1. VNA Vendors

6.4.1.2. Native AICA Vendors

6.5. Enterprise/Universal Viewer

7. Global Medical Image Management Market, by End User

7.1. Introduction

7.2. Hospitals

7.3. Diagnostic Imaging Centers

7.4. Other End Users

8. Medical Image Management Market, by Geography

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe (Roe)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. Rest of Asia-Pacific (Roapac)

8.5. Latin America

8.6. Middle East & Africa

9. Competitive Landscape

9.1. Introduction

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.3.1. Competitive Benchmarking, by Product

9.4. Market Share Analysis (2022)

9.4.1. Market Share Analysis: Picture Archiving And Communications System (PACS)

9.4.1.1. GE Healthcare (U.S.)

9.4.1.2. FUJIFILM Holdings Corporation (Japan)

9.4.1.3. Sectra AB (Sweden)

9.4.1.4. Agfa-Gevaert NV (Belgium)

9.4.2. Market Share Analysis: Vendor Neutral Archive (VNA)

9.4.2.1. GE Healthcare (U.S.)

9.4.2.2. Koninklijke Philips N.V. (Netherlands)

9.4.2.3. FUJIFILM Holdings Corporation (Japan)

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Novarad Corporation

10.2. Koninklijke Philips N.V.

10.3. INFINITT Healthcare Co., Ltd.

10.4. Siemens Healthineers AG

10.5. Hyland Software, Inc.

10.6. Agfa-Gevaert NV

10.7. GE Healthcare

10.8. Mach7 Technologies

10.9. BridgeHead Software Ltd.

10.10. FUJIFILM Holdings Corporation

10.11. Sectra AB

10.12. Change Healthcare Inc.

10.13. Merative

11. Appendix

11.1. Questionnaire

11.2. Available Customization

List of Tables

Table 1 Global Medical Image Management Market: Impact Analysis of Market Drivers (2023–2030)

Table 2 Global Medical Image Management Market: Impact Analysis of Market Restraints (2023–2030)

Table 3 Global Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 4 Global PACS Market Size, by Type, 2021–2030 (USD Million)

Table 5 Global PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 6 Global Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 7 Global Departmental PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 8 Global Radiology PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 9 Global Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 10 Global Mammography PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 11 Global Traditional Mammography PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 12 Global Vendor Neutral Mammography PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 13 Global Cardiology PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 14 Number of New Cancer Cases, by Region, 2020 Vs. 2030 (In Million)

Table 15 Global Other Departmental PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 16 Global Enterprise PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 17 Global PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 18 Global On-PremiseOn-premises PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 19 Global Web/Cloud-Based PACS Market Size, by Country/Region, 2021–2030 (USD Million)

Table 20 Global VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 21 Global VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 22 Global On-PremiseOn-premises VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 23 Global Hybrid VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 24 Global Web/Cloud-Based VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 25 Global VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 26 Global Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 27 Global Enterprise VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 28 Global Multi-Departmental departmental VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 29 Global Multi-sdSite VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 30 Global Departmental VNA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 31 Global VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 32 Global VNA Market Size for Independent Software Vendors, by Country/Region, 2021–2030 (USD Million)

Table 33 Global VNA Market Size for PACS Vendors, by Country/Region, 2021–2030 (USD Million)

Table 34 Global VNA Market Size for Infrastructure Vendors, by Country/Region, 2021–2030 (USD Million)

Table 35 Global AICA Market Size, by Country/Region, 2021–2030 (USD Million)

Table 36 Global AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 37 Global AICA Market Size for VNA Vendors, by Country/Region, 2021–2030 (USD Million)

Table 38 Global AICA Market Size for Native AICA Vendors, by Country/Region, 2021–2030 (USD Million)

Table 39 Global Enterprise/Universal Viewer Market Size, by Country/Region, 2021–2030 (USD Million)

Table 40 Global Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 41 Global Medical Image Management Market Size for Hospitals, by Country/Region, 2021–2030 (USD Million)

Table 42 Global Medical Image Management Market Size for Diagnostic Imaging Centers, by Country/Region, 2021–2030 (USD Million)

Table 43 Global Medical Image Management Market Size for Other End Users, by Country/Region, 2021–2030 (USD Million)

Table 44 Global Medical Image Management Market Size, by Country/Region, 2021–2030 (USD Million)

Table 45 North America: Medical Image Management Market Size, by Country, 2021–2030 (USD Million)

Table 46 North America: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 47 North America: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 48 North America: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 49 North America: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 50 North America: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 51 North America: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 52 North America: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 53 North America: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 54 North America: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 55 North America: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 56 North America: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 57 U.S.: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 58 U.S.: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 59 U.S.: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 60 U.S.: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 61 U.S.: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 62 U.S.: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 63 U.S.: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 64 U.S.: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 65 U.S.: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 66 U.S.: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 67 U.S.: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 68 Canada: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 69 Canada: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 70 Canada: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 71 Canada: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 72 Canada: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 73 Canada: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 74 Canada: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 75 Canada: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 76 Canada: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 77 Canada: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 78 Canada: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 79 Europe: Medical Image Management Market Size, by Country/Region, 2021–2030 (USD Million)

Table 80 Europe: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 81 Europe: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 82 Europe: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 83 Europe: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 84 Europe: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 85 Europe: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 86 Europe: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 87 Europe: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 88 Europe: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 89 Europe: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 90 Europe: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 91 Germany: Number of CT And MRI Units, 2017 Vs. 2020

Table 92 Germany: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 93 Germany: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 94 Germany: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 95 Germany: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 96 Germany: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 97 Germany: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 98 Germany: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 99 Germany: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 100 Germany: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 101 Germany: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 102 Germany: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 103 France: Number of CT and MRI Units, 2017 Vs. 2020

Table 104 France: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 105 France: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 106 France: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 107 France: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 108 France: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 109 France: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 110 France: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 111 France: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 112 France: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 113 France: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 114 France: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 115 U.K.: Current Prevalence as % of Population

Table 116 U.K.: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 117 U.K.: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 118 U.K.: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 119 U.K.: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 120 U.K.: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 121 U.K.: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 122 U.K.: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 123 U.K.: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 124 U.K.: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 125 U.K.: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 126 U.K.: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 127 Italy: Number of CT and MRI Units, 2017 Vs. 2020

Table 128 Italy: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 129 Italy: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 130 Italy: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 131 Italy: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 132 Italy: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 133 Italy: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 134 Italy: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 135 Italy: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 136 Italy: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 137 Italy: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 138 Italy: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 139 Spain: Number of CT and MRI Units, 2017 Vs. 2020

Table 140 Spain: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 141 Spain: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 142 Spain: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 143 Spain: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 144 Spain: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 145 Spain: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 146 Spain: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 147 Spain: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 148 Spain: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 149 Spain: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 150 Spain: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 151 Poland: Number of CT and MRI Units, 2017 Vs. 2020

Table 152 Bulgaria: Number of CT and MRI Units, 2017 Vs. 2020

Table 153 Austria: Number of CT and MRI Units, 2017 Vs. 2020

Table 154 Rest of Europe: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 155 Rest of Europe: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 156 Rest of Europe: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 157 Rest of Europe: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 158 Rest of Europe: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 159 Rest of Europe: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 160 Rest of Europe: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 161 Rest of Europe: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 162 Rest of Europe: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 163 Rest of Europe: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 164 Rest of Europe: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 165 Asia-Pacific: Medical Image Management Market Size, by Country/Region, 2021–2030 (USD Million)

Table 166 Asia-Pacific: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 167 Asia-Pacific: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 168 Asia-Pacific: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 169 Asia-Pacific: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 170 Asia-Pacific: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 171 Asia-Pacific: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 172 Asia-Pacific: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 173 Asia-Pacific: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 174 Asia-Pacific: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 175 Asia-Pacific: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 176 Asia-Pacific: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 177 China: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 178 China: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 179 China: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 180 China: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 181 China: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 182 China: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 183 China: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 184 China: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 185 China: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 186 China: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 187 China: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 188 Japan: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 189 Japan: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 190 Japan: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 191 Japan: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 192 Japan: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 193 Japan: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 194 Japan: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 195 Japan: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 196 Japan: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 197 Japan: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 198 Japan: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 199 India: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 200 India: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 201 India: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 202 India: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 203 India: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 204 India: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 205 India: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 206 India: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 207 India: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 208 India: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 209 India: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 210 Rest of Asia-Pacific: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 211 Rest of Asia-Pacific: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 212 Rest of Asia-Pacific: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 213 Rest of Asia-Pacific: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 214 Rest of Asia-Pacific: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 215 Rest of Asia-Pacific: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 216 Rest of Asia-Pacific: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 217 Rest of Asia-Pacific: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 218 Rest of Asia-Pacific: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 219 Rest of Asia-Pacific: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 220 Rest of Asia-Pacific: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 221 Latin America: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 222 Latin America: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 223 Latin America: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 224 Latin America: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 225 Latin America: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 226 Latin America: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 227 Latin America: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 228 Latin America: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 229 Latin America: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 230 Latin America: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 231 Latin America: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 232 Middle East & Africa: Medical Image Management Market Size, by Product, 2021–2030 (USD Million)

Table 233 Middle East & Africa: PACS Market Size, by Type, 2021–2030 (USD Million)

Table 234 Middle East & Africa: Departmental PACS Market Size, by Type, 2021–2030 (USD Million)

Table 235 Middle East & Africa: Mammography PACS Market Size, by Type, 2021–2030 (USD Million)

Table 236 Middle East & Africa: PACS Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 237 Middle East & Africa: VNA Market Size, by Delivery Model, 2021–2030 (USD Million)

Table 238 Middle East & Africa: VNA Market Size, by Procurement Model, 2021–2030 (USD Million)

Table 239 Middle East & Africa: Enterprise VNA Market Size, by Type, 2021–2030 (USD Million)

Table 240 Middle East & Africa: VNA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 241 Middle East & Africa: AICA Market Size, by Vendor Type, 2021–2030 (USD Million)

Table 242 Middle East & Africa: Medical Image Management Market Size, by End User, 2021–2030 (USD Million)

Table 243 Recent Developments, by Company (2020–2022)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Size Estimation

Figure 7 Global Medical Image Management Market Size, by Product, 2023 Vs. 2030 (USD Million)

Figure 8 Global Medical Image Management Market Size, by End User, 2023 Vs. 2030 (USD Million)

Figure 9 Global Medical Image Management Market Size, by Geography, 2023 Vs. 2030 (USD Million)

Figure 10 Market Dynamics

Figure 11 Population Aged 65 Years or Over, by Region, 2020 Vs. 2030 (In Million)

Figure 12 Global Medical Image Management Market Size, by Product, 2023 Vs. 2030 (USD Million)

Figure 13 Global Medical Image Management Market Size, by End User, 2023 Vs. 2030 (USD Million)

Figure 14 Global Medical Image Management Market Size, by Region, 2023 Vs. 2030 (USD Million)

Figure 15 North America: Medical Image Management Market Snapshot

Figure 16 U.S.: Number of People with Chronic Medical Conditions (Million) (2015–2030)

Figure 17 Canada: Number of New Cancer Cases (2020–2040)

Figure 18 Europe: Medical Image Management Market Snapshot

Figure 19 France: Estimated Number of New Breast Cancer Cases (2020–2040)

Figure 20 Asia-Pacific: Medical Image Management Market Snapshot

Figure 21 Japan: Percentage of Population Aged 65 and Above (2010–2030)

Figure 22 Key Growth Strategies Adopted by Leading Players (2020–2022)

Figure 23 Medical Image Management Market: Competitive Benchmarking

Figure 24 Market Share Analysis: Picture Archiving and Communications System (PACS) Industry (2022)

Figure 25 Market Share Analysis: Vendor Neutral Archive (VNA) Industry (2022)

Figure 26 Koninklijke Philips N.V.: Financial Overview (2021)

Figure 27 Siemens Healthineers AG: Financial Overview (2022)

Figure 28 Agfa-Gevaert NV: Financial Overview (2021)

Figure 29 General Electric Company: Financial Overview (2021)

Figure 30 Mach7 Technologies: Financial Overview (2022)

Figure 31 FUJIFILM Holdings Corporation: Financial Overview (2021)

Figure 32 Sectra AB: Financial Overview (2021)

Figure 33 Change Healthcare Inc.: Financial Overview (2021)