Resources

About Us

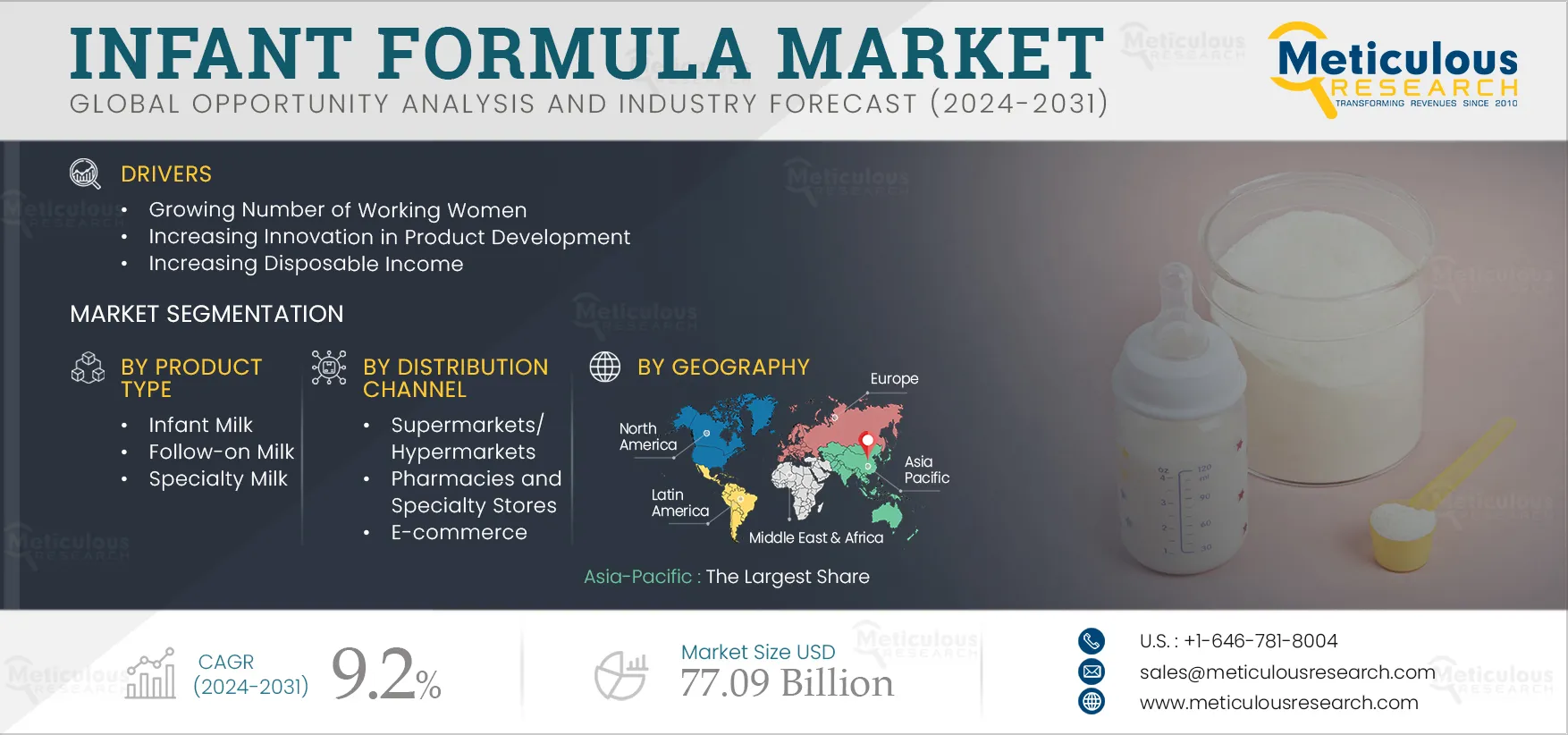

Infant Formula Market Size, Share, Forecast, & Trends Analysis by Product Type (Infant Milk, Specialty Milk), Nature (Inorganic, Organic), Form (Powder, Ready-to-Feed), Distribution Channel (Supermarkets/Hypermarkets, Online) - Global Forecast to 2032

Report ID: MRFB - 1041261 Pages: 350 Jun-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Infant Formula Market is expected to reach $77.09 billion by 2032, at a CAGR of 9.2% from 2025 to 2032. This market's growth can be attributed to the growing number of working women, rising consumer awareness regarding the importance of early nutrition for infants, increasing innovation in product development, and increasing disposable income. However, stringent regulations regarding infant formula, the risk of product contamination, and frequent product recalls may restrain market growth.

Moreover, growing demand for organic and plant-based products and rising investment in the research & development of novel products by key players are expected to create market growth opportunities. However, the complex registration process and promotion of breastfeeding by healthcare professionals pose a significant challenge to the market’s growth.

Additionally, human milk oligosaccharides (HMO)-based infant formula, clean-label products, and consumer preference for online channels are prominent trends in the infant formula market.

In recent years, a notable shift has been observed in the participation of women in the workforce. According to UN Women, labor force participation rates for women aged 25-54 increased from 61.4% in 2022 to 70.1% in 2024 across the globe. For instance, according to the Ministry of Labour and Employment India, the total percentage of females of working age (15 years and above) increased from 23.3% in 2018 to 32.8% in 2022, registering a surge of 9.5% between 2018 to 2022. This transformation reflects not only changes in societal structures but also the evolving needs and preferences of modern families. As more women pursue careers outside their homes, their purchasing patterns and consumption habits are reshaping the landscape of infant nutrition.

With dual-income households becoming increasingly prevalent, the demand for convenient, nutritious, and time-saving solutions for infant feeding has soared. This shift in consumer behavior has led to a significant expansion of the infant formula market, with a particular emphasis on products catering to the needs of busy, working mothers.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Parents are increasingly recognizing the significance of providing proper nutrition to their infants during the early stages of growth and development. The early years of life, especially infancy, is a critical period for brain development, immune system maturation, and overall growth. Nutrition during this time significantly impacts cognitive function, physical growth, and future health outcomes. Adequate nutrition in early childhood can help prevent malnutrition, stunted growth, and micronutrient deficiencies. As information becomes accessible and widespread, parents are becoming educated about the importance of balanced nutrition in the early stages of a child's development.

This awareness is bolstered by a growing body of scientific research underscoring the crucial role of nutrients such as DHA and ARA in brain development, as well as the importance of iron, vitamins, and minerals in overall growth and immunity. Additionally, the market is seeing innovation in the form of organic and natural ingredient-based products, catering to parents' preferences for healthier and safer options for their infants.

Human milk is considered the gold standard in infant nutrition as it provides ideal nourishment, supporting health, growth, and development in infants. It contains many distinct bioactive compounds that help in the development of the immune system and support the growth of beneficial microbes in the gut.

Infant formula products are a substitute for breast milk and undergo continuous innovation. Increasing knowledge regarding the science of human milk is driving the evolution of infant formula products, bringing them closer to breast milk – both in composition and function. To offer premium formulas that closely resemble breast milk in terms of functionality, key market players have started developing innovative products incorporating bio-active ingredients, including Lactoferrin, prebiotics, probiotics, Oleic-Palmitic-oleic (OPO), Human Milk Oligosaccharides (HMOs), and Omega 3 and Omega 6 fatty acids.

Technological advancements have allowed for the incorporation of HMOs in infant formulas, and research on formulas supplemented with HMOs is underway in order to understand how they may positively influence infant health. With a few HMO-based infant formulas already available on the market, this product category is expected to account for the largest number of new products launched in the coming years.

Online shopping offers convenience, allowing parents to browse and purchase infant formula products from the comfort of their homes/offices, often with doorstep delivery. Online platforms offer a vast array of infant formula options, including organic, allergen-free, and specialty products. This gives consumers more choices than what may be available in traditional brick-and-mortar stores. Online channels provide easy access to product information, customer reviews, and recommendations from other parents. This helps parents make informed decisions about which infant formula products to purchase.

Many online retailers offer subscription services for baby food, allowing parents to set up recurring deliveries based on their baby's consumption needs. This feature adds convenience and ensures a consistent supply of infant formula. As online purchasing of infant formula continues to gain popularity, it's expected to drive further expansion in the infant formula market.

The increasing demand for organic and plant-based infant formula products reflects a growing trend toward healthier and more natural options for babies. Parents are becoming more conscious of what they feed their infants, seeking products that are free from synthetic additives, pesticides, and genetically modified ingredients. Organic infant formula offers assurances of quality and purity, meeting the standards set by organic certification bodies. As parents become increasingly concerned about the effects of childhood obesity, allergies, and long-term health consequences, they are looking for alternatives that are healthier and more natural for their children.

The demand for organic and plant-based infant formula is driven by a preference for natural and healthy nutrition for infants, increased awareness among consumers about the importance of health and the environment, and rising product launches in this space. For instance, in July 2022, Danone S.A. (France) launched dairy and plant-blend baby formula to meet parents’ desire for more plant-based foods. This product is suitable for vegetarian, flexitarian, and plant-based diets while meeting their baby’s specific nutritional requirements. Furthermore, in April 2022, Nestlé's (Switzerland) Gerber brand infant formula brand launched a plant-based baby food called Plant-tastic. The line includes organic toddler pouches, snacks, and bowls made with beans, whole grains, vegetables, legumes, and fruit.

Based on product type, the infant formula market is segmented into infant milk, follow-on milk, and specialty milk. In 2025, the infant milk segment is expected to account for the largest share of above 53.6% of the infant formula market. The large market share of this segment can be attributed to the decreasing infant mortality rate, the only substitute for breast milk, and growing awareness about the importance of infant formula for growth and development. Infant milk is specially designed to meet the growing needs of babies under six months of age who are not breastfed or partially breastfed.

However, the follow-on milk segment is projected to witness the highest growth rate during the forecast period of 2025–2032. This segment's rapid growth is mainly attributed to the rapid growth of working women, increasing product availability, and growing awareness about the importance of baby nutrition.

Based on nature, the infant formula market is segmented into inorganic and organic. In 2025, the inorganic segment is expected to account for the largest share of the infant formula market. The large market share of this segment is mainly attributed to the high availability of products at a lower cost. However, the organic segment is projected to register a higher CAGR during the forecast period of 2025–2032. The fast growth of this segment is mainly attributed to the increasing demand for free-from products and the increasing demand for certified organic products with the rising trend of clean-label products. The trend of clean-label products is growing as consumers opt for natural products, which have fewer chemicals and additives, driving the growth of the global organic infant formula market.

Based on the form, the infant formula market is segmented into powder, liquid concentrate, and ready-to-feed. In 2025, the powder segment is expected to account for the largest share of the infant formula market. The large market share of this segment is mainly attributed to ease of storage and convenience, ease of handling, and comparatively lower costs than other forms of infant formula.

Based on distribution channel, the infant formula market is segmented into supermarkets/hypermarkets, pharmacies and specialty stores, convenience stores, E-commerce, and other distribution channels. In 2025, the supermarkets/hypermarkets segment is expected to account for the largest share of above 42.7% of the infant formula market. The large market share of this segment can be attributed to several factors, such as the availability of a wide variety of products under one roof, a growing number of modern groceries offering high-quality products, and consumer preference for shopping offline due to the enhanced shopping experience offered by these channels. In addition, infant formula products are strategically placed in dedicated sections within supermarkets and hypermarkets. This strategic placement ensures visibility and accessibility, making it easy for parents to locate and purchase infant formula during shopping trips.

However, the E-commerce segment is expected to witness rapid growth during the forecast period. This growth can be attributed to the advantages of providing convenience and choice to consumers, cost-effectiveness, the availability of greater discounts compared to offline stores, and the increasing penetration of the internet and smartphones. In addition, Innovative business models, such as slotted or express delivery and on-demand or subscription delivery models, being introduced by these platforms are also encouraging consumers to opt for online shopping.

Based on geography, the infant formula market is divided into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of above 43.8% of the infant formula market, followed by North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific’s major market share is mainly attributed to the rising women's workforce and fast-paced lifestyle, increasing disposable income, high birth rates, expansion of retail infrastructure, increasing awareness about the importance of nutrition for infants, and declining infant mortality rate.

However, the market in the North America region is projected to register the highest CAGR during the forecast period. The growth of this regional market can be attributed to heightened awareness and availability of infant formula, growing demand for organic infant food products, strong growth in dual-income families, and increasing innovation and new product development. The region has been at the forefront of research and development in terms of launching novel yet effective and safe baby formula.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3 to 4 years. Some of the key players operating in the infant formula market are Nestle S.A. (Switzerland), Danone S.A. (France), Reckitt Benckiser Group PLC (U.K.), Abbott Laboratories (U.S.), The Kraft Heinz Company (U.S.), HiPP Gmbh & Co. Vertrieb KG (Germany), Perrigo Company plc (Ireland), Royal FrieslandCampina N.V. (Netherlands), Arla Foods Group (Denmark), Hain Celestial Group (U.S.), Mead Johnson Nutrition (U.S.), Beingmate Group (China), Bellamy's Organic (Australia), Synutra International, Inc. (U.S.), and Meiji Holdings Co. Ltd. (Japan).

|

Particulars |

Details |

|

Number of Pages |

350 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value) |

$77.09 Billion by 2032 |

|

Segments Covered |

By Product Type

By Nature

By Form

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (United Arab Emirates, South Africa, Saudi Arabia, and Rest of Middle East & Africa). |

|

Key Companies |

Nestle S.A. (Switzerland), Danone S.A. (France), Reckitt Benckiser Group PLC (U.K.), Abbott Laboratories (U.S.), The Kraft Heinz Company (U.S.), HiPP Gmbh & Co. Vertrieb KG (Germany), Perrigo Company plc (Ireland), Royal FrieslandCampina N.V. (Netherlands), Arla Foods Group (Denmark), Hain Celestial Group (U.S.), Mead Johnson Nutrition (U.S.), Beingmate Group (China), Bellamy's Organic (Australia), Synutra International, Inc. (U.S.), and Meiji Holdings Co. Ltd. (Japan). |

This market study primarily provides a detailed market assessment and valuable insights into the infant formula market segmented based on product type, nature, form, and distribution channel. This study also assesses the market at the regional and country levels.

Infant formula is intended to replace or supplement breast milk and is designed to meet the nutritional needs of babies and infants under 12 months. It is typically made from milk or soy and fortified with essential nutrients such as vitamins, minerals, and fats to mimic the nutritional composition of breast milk as closely as possible. Infant formula provides essential nourishment for infants who are not breastfed.

The infant formula market is projected to reach $77.09 billion by 2032, at a CAGR of 9.2% during the forecast period 2025–2032.

The infant milk segment is expected to hold the major share of the market in 2025.

The organic segment is projected to record a higher growth rate during the forecast period 2025–2032.

The powder segment is expected to hold the major share of the market in 2025.

The e-commerce segment is projected to record a higher growth rate during the forecast period 2025–2032.

¡ Drivers

o Growing Number of Working Women

o Rising Consumer Awareness Regarding the Importance of Early Nutrition for Infants

o Increasing Innovation in Product Development

o Increasing Disposable Income

¡ Opportunities

o Growing Demand for Organic and Plant-based Products

o Rising Investment in the Research & Development of Novel Products by the Key Players

The key players operating in the infant formula market are Nestle S.A. (Switzerland), Danone S.A. (France), Reckitt Benckiser Group PLC (U.K.), Abbott Laboratories (U.S.), The Kraft Heinz Company (U.S.), HiPP Gmbh & Co. Vertrieb KG (Germany), Perrigo Company plc (Ireland), Royal FrieslandCampina N.V. (Netherlands), Arla Foods Group (Denmark), Hain Celestial Group (U.S.), Mead Johnson Nutrition (U.S.), Beingmate Group (China), Bellamy's Organic (Australia), Synutra International, Inc. (U.S.), and Meiji Holdings Co. Ltd. (Japan).

The market in North America is projected to register the highest CAGR during the forecast period and offer significant growth opportunities for vendors operating in the market. The growth of this regional market can be attributed to heightened awareness and availability of infant formula, growing demand for organic infant food products, strong growth in dual-income families, and increasing innovation and new product development. The region has been at the forefront of research and development in terms of launching novel yet effective and safe baby formula.

Published Date: May-2023

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates