Resources

About Us

Hypersonic Weapons Market Size, Share & Forecast by Type (Hypersonic Missiles, Gliding Vehicles), Domain (Land, Naval, Airborne), Range (Short, Medium, Long), Subsystem (Guidance, Propulsion, Warheads) - Global Forecast to 2035

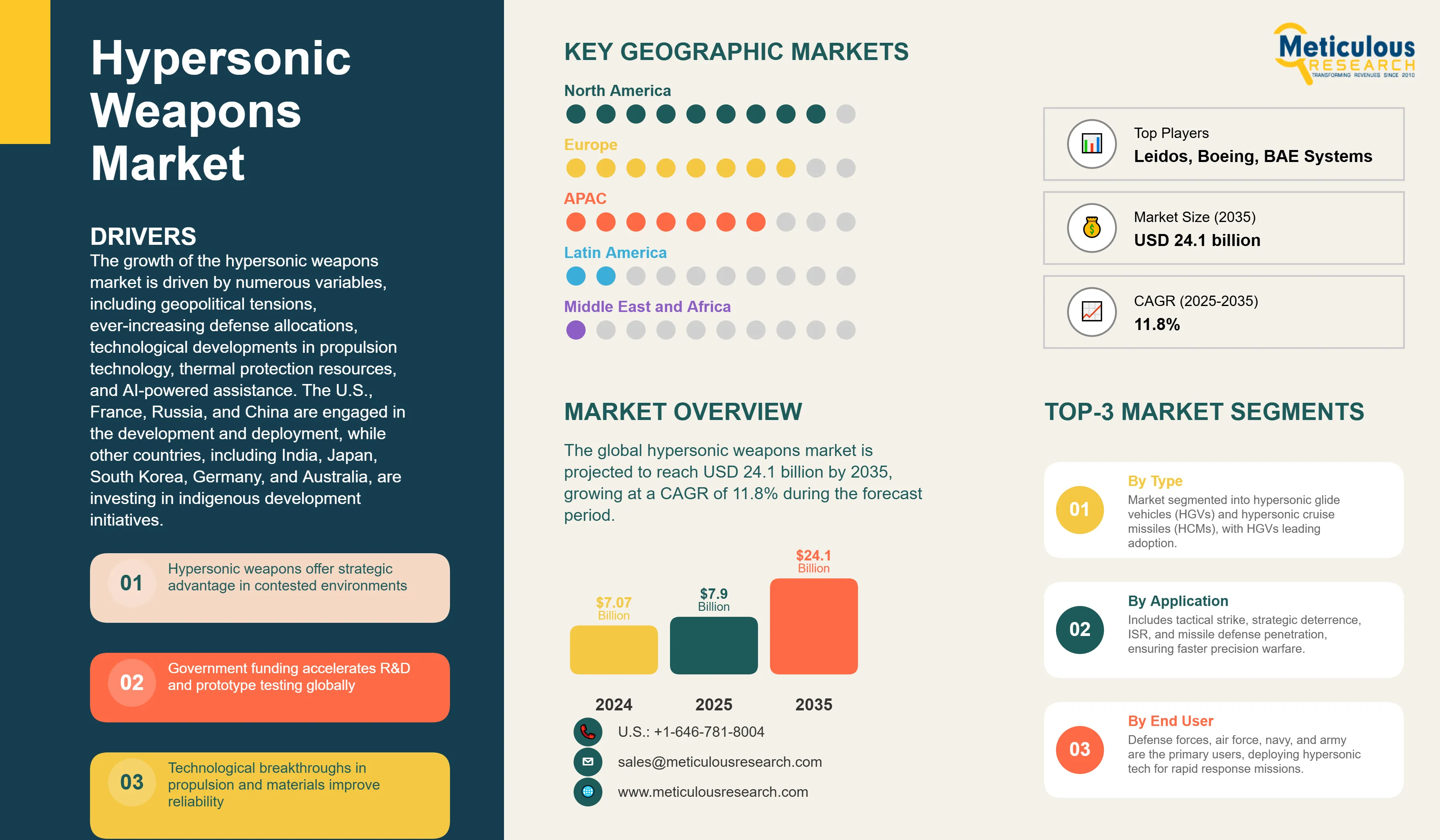

Report ID: MRAD - 1041587 Pages: 198 Sep-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global hypersonic weapons market was valued at USD 7.9 billion in 2025 and is projected to reach USD 24.1 billion by 2035, growing at a CAGR of 11.8% during the forecast period.

The growth of the hypersonic weapons market is driven by numerous variables, including geopolitical tensions, ever-increasing defense allocations, technological developments in propulsion technology, thermal protection resources, and AI-powered assistance. The U.S., France, Russia, and China are engaged in the development and deployment, while other countries, including India, Japan, South Korea, Germany, and Australia, are investing in indigenous development initiatives. As per the U.S. Congressional Research Service, in 2023, more than 15 countries were proactively pursuing the development of advanced hypersonic weapon systems.

Hypersonic weapon platforms are envisioned as crucial for next-generation dissuasion and accurate strike capabilities. In 2024, the Pentagon attested that hypersonic systems were incorporated into joint force preparation, with more than USD 4.7 billion sanctioned to associated research & development and testing. Moreover, as per SIPRI, worldwide armed forces spending touched USD 2.72 trillion in 2024, with a surging share focused on high accuracy and long-range precision strikes. On the other hand, China steered several glide vessel tests under its DF-ZF initiative, demonstrating functional maturity. The industry is propelled by the demand for pivotable, rapid weapons that possess the ability to evade conventional counter-missile systems. As of 2025, hypersonic weapons are shifting from the investigational phase to the pre-operational phase, with acquisition plans spanning across multiple geographies.

Competitive Scenario of Hypersonic Weapons Market and Insights

Click here to: Get Free Sample Pages of this Report

The global hypersonic weapons market is moderately consolidated, with defense primes such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing, BAE Systems, and L3Harris Technologies dominating R&D and production. Lockheed Martin’s AGM-183A ARRW underwent final testing in 2023, while Raytheon partnered with Northrop to develop scramjet-powered systems under the HAWC program. China’s DF-17 and Russia’s Avangard systems entered limited deployment, reflecting strategic prioritization. Competitive advantage lies in propulsion efficiency, thermal shielding, and guidance accuracy, with firms investing in AI-enabled flight control and composite materials.

Recent Developments

U.S. Air Force Completes Final Test of ARRW Hypersonic Missile

The last planned end-to-end test of the AGM-183A Air-Launched Rapid Response Weapon (ARRW) was carried out by the U.S. Air Force on March 17, 2024. From a B-52 bomber over the Pacific, the crew made a successful launch, and the test was basically a check of the missile's overall abilities. The test has provided extremely valuable data for future hypersonic programs; however, the details of the separation of the glide vehicle and the flight trajectory have not been released. The developmental program of ARRW reached several important milestones, but the project was not promoted to an operational deployment stage, and it is currently not planned to integrate B-52 platforms by late 2025. The legacy of the program is a big contribution to the hypersonic technology maturation efforts that are happening now.

Lockheed Martin Corporation Secures $756 Million Contract for LRHW System Enhancement

In May 2024, the US Army awarded Lockheed Martin Corporation a USD 756 million contract to improve the Long-Range Hypersonic Weapon (LRHW) system. The contract entails providing additional LRHW battery equipment, systems, software engineering support, and logistics.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Hypersonic weapons offer strategic advantage in contested environments |

High funding allocation to R&D programs |

Full-scale deployment and mass production |

▲ +2.5% |

|

2. Breakthroughs in Propulsion & Materials |

Accelerates prototype readiness |

Expands mission profiles |

▲ +1.8% |

|

|

Restraints |

1. High Development & Production Costs |

Limits participation to major defense primes |

Supply chain bottlenecks |

▼ −1.4% |

|

2. Thermal Management and Guidance Remain Technical Challenges |

Restricts international sales |

Encourages indigenous programs |

▼ −0.9% |

|

|

Opportunities |

1. Allied Cooperative Programs |

Tech-sharing accelerates capability building |

Multinational systems integration |

▲ +1.6% |

|

2. AI-Enhanced Guidance Systems |

Improves targeting in contested environments |

Expands commercial spin-offs |

▲ +1.3% |

|

|

Trends |

1. Shift Toward Dual-Use Hypersonic Platforms |

Enables ISR & strike missions |

Broadens procurement base |

▲ +1.0% |

|

Challenges |

1. Counter-Hypersonic Defense Development |

Reduces deterrence value over time |

Spurs next-gen innovation |

▼ −0.8% |

Regional Analysis

North America Dominates the Hypersonic Weapons Market Due to Advanced R&D and Strategic Edge

North America dominated the hypersonic weapons market in 2025, owing primarily to significant defense R&D investments, advanced technological capabilities, and a strong military infrastructure. The United States leads the world in development and deployment, with programs like the Air-Launched Rapid Response Weapon (ARRW) and Long-Range Hypersonic Weapon (LRHW) receiving billions of dollars in funding for research, testing, and operational integration. These initiatives are supported by advances in scramjet propulsion, thermal-resistant materials, and precision guidance systems, which improve reliability and strategic applicability. The region's dominance is bolstered by well-known defense contractors, strong government support, and a focus on maintaining a strategic advantage over potential adversaries. Collectively, these factors place North America as the largest and most technologically advanced market for hypersonic weapons, accounting for the vast majority of global investments and deployments in this sector.

Asia-Pacific’s Rapid Rise Owing to Indigenous Programs, and Multilateral Collaboration Drives Regional Leadership

According to the Asia-Pacific Security Studies Journal, hypersonic weapons programs in the Asia-Pacific are expected to increase owing to strategic competition in the South China Sea and Taiwan Strait. China's DF-17 and DF-ZF systems are now operational, and India's DRDO is constructing the HSTDV scramjet demonstrator. Japan launched feasibility studies for indigenous hypersonic systems as part of its 2022 defense modernization strategy. Similarly, the SCIFiRE program is a collaboration between Australia and the United States to develop air-launched hypersonic missiles. Thus, regional governments are focusing on hypersonic capabilities for deterrent, quick strike, and anti-access/area denial (A2/AD) measures.

The market expansion is further fueled by the strategic imperative to counter emerging threats, particularly drone swarms and advanced missile defense systems. Advancements in scramjet propulsion, thermal protection materials, and AI-driven guidance systems enable sustained hypersonic flight capabilities exceeding Mach 5 speeds. Also, regional defense budgets continue expanding to support hypersonic weapons as critical enablers of strategic deterrence and precision strike capabilities. The presence of multiple military powers in proximity intensifies competitive dynamics, ensuring the Asia Pacific remains the fastest-growing segment for hypersonic weapons development and deployment.

China Operationalizes Hypersonic Glide Vehicles for Regional Deterrence

China’s hypersonic program encompasses comprehensive development of boost-glide vehicles, cruise missiles, and anti-ship variants designed to penetrate advanced missile defense systems. China's strategic approach prioritizes indigenous development through state-owned enterprises and defense research institutions, reducing dependence on foreign technologies while advancing asymmetric warfare capabilities. The country's hypersonic arsenal includes multiple operational systems capable of delivering conventional and nuclear payloads at speeds exceeding Mach 5 with enhanced maneuverability compared to traditional ballistic missiles. According to China Aerospace Science and Industry Corporation (CASIC), China's DF-ZF hypersonic glide vehicle will complete numerous flight tests in 2023 and be deployed in limited numbers by the PLA Rocket Force. The system is intended for precision strikes against naval assets and command centers, with maneuverability that rivals conventional missile defense. China's 14th Five-Year Plan involves increased financing for hypersonic research and development, with a focus on AI-enabled guiding and thermal.

Segmental Analysis

Hypersonic Missiles Dominate Market Demand Across Strategic Strike Missions

The hypersonic missiles segment accounts for the highest revenue share in 2025 and is set to continue its market dominance through 2035. This market dominance is owing to the demand for long-range, precision-guided strike capabilities. These missiles are being integrated into air, sea, and land platforms, with the US ARRW, China's DF-17, and Russia's Zircon leading the way.

Hypersonic missiles provide rapid response, low interception risk, and strategic deterrence value. The US Navy's CPS system is intended for submarine launch, whilst the Army's LRHW allows for transportable ground deployment. Demand is increasing across NATO and the Indo-Pacific, with procurement projects speeding up as geopolitical tensions rise.

Countries worldwide invest in hypersonic missile capabilities to maintain competitive military advantages and strengthen deterrence strategies, with development programs spanning conventional and nuclear payload options across multiple launch platforms.

Short-range Hypersonic Systems Gain Traction for Tactical Battlefield Use

According to the Center for Strategic and Budgetary Assessments (CSBA), short-range hypersonic systems will see a significant rise in development interest, notably for tactical applications like anti-ship, anti-air, and battlefield interdiction. These systems are primarily built for fast deployment and agility and have a range of 500-1,000 kilometers.

China's DF-17 and Russia's Kinzhal are examples of short-range hypersonic platforms designed for regional deterrence. The United States Army is looking into short-range LRHW variants for mobile forces, while India's DRDO is developing tactical scramjet demonstrators. These devices are gaining importance in A2/AD situations and contested zones where speed and precision are essential.

Industry growth is sustained by evolving military doctrines that emphasize rapid engagement of regional threats and the increasing availability of hypersonic technologies through international cooperation programs.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 7.9 billion |

|

Revenue forecast in 2035 |

USD 24.1 billion |

|

CAGR (2025-2035) |

11.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

By Type (Hypersonic Missiles, Hypersonic Gliding Vehicles), By Domain (Land, Naval, Airborne) By Range (Short-range, Medium-range, Long-range) By Subsystem (Guidance System, Propulsion Systems, Warheads) Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Lockheed Martin Corporation, L3Harris Technologies Inc., General Dynamics Corporation, BAE Systems, Raytheon Technologies Corporation, Leidos, Boeing, Northrop Grumman Corporation, Thales Group, Israel Aerospace Industries |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The Hypersonic Weapons Market size is estimated to be USD 7.9 billion in 2025 and grow at a CAGR of 11.8% to reach USD 24.1 billion by 2035.

In 2024, the Hypersonic Weapons Market size was estimated at USD 7.2 billion, with projections to reach USD 7.9 billion in 2025.

Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing, BAE Systems, L3Harris Technologies Inc. are the major companies operating in the Hypersonic Weapons Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025–2035), driven by rapid capability expansion in China, indigenous hypersonic development programs in India, Japan’s long-range strike modernization, and multilateral collaborations.

The hypersonic missiles segment holds the largest share in the Hypersonic Weapons Market, driven by widespread deployment across air, naval, and land platforms, mature development programs in the U.S., Russia, and China, and their versatility in both tactical and strategic strike missions.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Hypersonic Weapons Market, by Type

3.2.2. Hypersonic Weapons Market, by Domain

3.2.3. Hypersonic Weapons Market, by Range

3.2.4. Hypersonic Weapons Market, by Subsystem

3.2.5. Hypersonic Weapons Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Hypersonic weapons offer strategic advantage in contested environments

4.2.1.2. Government funding accelerates R&D and prototype testing globally

4.2.1.3. Technological breakthroughs in propulsion and materials improve reliability

4.2.2. Restraints

4.2.2.1. Thermal management and guidance remain technical challenges

4.2.2.2. High development costs limit access for smaller defense budgets

4.2.3. Opportunities

4.2.3.1. Allied Cooperative Programs

4.2.3.2. AI-Enhanced Guidance Systems

4.2.4. Trends

4.2.4.1. Shift Toward Dual-Use Hypersonic Platforms

4.2.4.2. Rising adoption of dual-use hypersonic platforms for both strike and ISR missions

4.2.5. Challenges

4.2.5.1. Counter-Hypersonic Defense Development

4.2.5.2. Accelerating counter-hypersonic defense development eroding offensive advantages

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on the Hypersonic Weapons Market

4.4.1. Advanced Propulsion and Thermal Protection Technologies

4.4.1.1. Scramjet and hybrid propulsion systems enabling sustained Mach 5+ flight with greater fuel efficiency

4.4.1.2. Ultra-high-temperature ceramics and composite materials improving heat resistance and structural integrity

4.4.2. Digital Simulation and Integrated Design Environments

4.4.2.1. High-fidelity computational fluid dynamics (CFD) and digital twins for accelerated design validation

4.4.2.2. AI-driven trajectory optimization and mission planning for enhanced maneuverability and precision

4.4.3. Advanced Guidance, Navigation, and Control (GNC) Systems

4.4.3.1. Multi-sensor fusion (satellite, radar, IR) for resilient targeting in GPS-denied environments

4.4.3.2. Adaptive flight control algorithms maintaining stability at extreme speeds and dynamic maneuvers

5. Impact of Sustainability on Hypersonic Weapons Market

5.1. Defense Sector Decarbonization Goals Influencing Manufacturing Practices

5.2. Transition to Sustainable and Recyclable Advanced Materials

5.3. Certification and Compliance with Environmental and Safety Standards

5.4. Land Use, Noise, and Ecological Impact of Testing Ranges

5.5. ESG-Driven Investment in Low-Impact Defense Infrastructure

5.6. Water, Waste, and Emissions Management in Production and Testing

5.7. Sustainable Innovation in Hypersonic Subsystem Design

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Hypersonic Weapons Market Assessment—By Type

7.1. Overview

7.2. Hypersonic Missiles

7.3. Hypersonic Gliding Vehicles

8. Hypersonic Weapons Market Assessment—By Domain

8.1. Overview

8.2. Land

8.3. Naval

8.4. Airborne

9. Hypersonic Weapons Market Assessment—By Range

9.1. Overview

9.2. Short-range

9.3. Medium-range

9.4. Long-range

10. Hypersonic Weapons Market Assessment—By Sub-system

10.1. Overview

10.2. Guidance System

10.3. Propulsion Systems

10.4. Warheads

11. Hypersonic Weapons Market Assessment—By Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Netherlands

11.3.5. Switzerland

11.3.6. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. South Korea

11.4.4. Taiwan

11.4.5. India

11.4.6. Singapore

11.4.7. Australia

11.4.8. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. UAE

11.6.2. Saudi Arabia

11.6.3. Israel

11.6.4. South Africa

11.6.5. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. Lockheed Martin Corporation

12.2. Raytheon Technologies Corporation

12.3. Boeing Company

12.4. Northrop Grumman Corporation

12.5. General Dynamics Corporation

12.6. BAE Systems plc

12.7. MBDA

12.8. Thales Group

12.9. Leonardo S.p.A.

12.10. Saab AB

12.11. Rheinmetall AG

12.12. Aerojet Rocketdyne (L3Harris Technologies)

12.13. Hermeus Corporation

12.14. Reaction Engines Limited

12.15. Hypersonix Launch Systems

12.16. Venus Aerospace

12.17. Destinus SA

12.18. Dawn Aerospace

12.19. China Aerospace Science and Technology Corporation (CASC)

12.20. NPO Mashinostroyeniya (Russia)

12.21. Tactical Missiles Corporation (Russia)

12.22. Defence Research and Development Organisation (DRDO) - India

12.23. Israel Aerospace Industries (IAI)

12.24. Hanwha Systems (South Korea)

12.25. Other Key Players

13. Appendix

13.1. Available Customization

13.2. Related Reports

Published Date: Sep-2025

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates