Resources

About Us

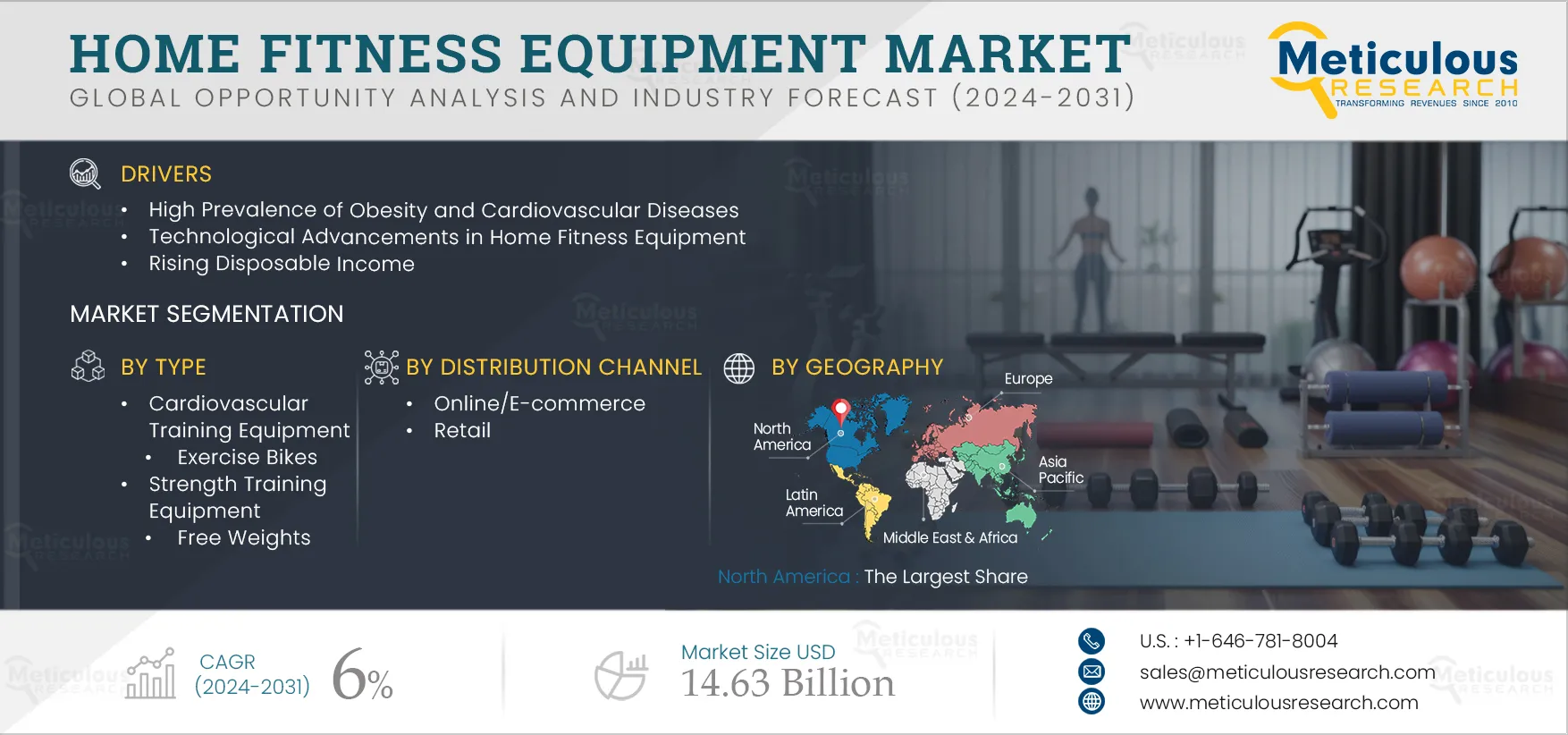

Home Fitness Equipment Market Size, Share, Forecast, & Trends Analysis by Type (Cardio [Exercise Bike, Rower, Treadmill, Ellipticals] Strength Training [Dumbbells, Free Weight, Power Racks]) Distribution Channel (Online, Retailer), Price - Global Forecast to 2032

Report ID: MRHC - 1041205 Pages: 260 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportHome fitness equipment are fitness instruments used in the home/residence to achieve health and fitness goals. The growth of this market is attributed to the high prevalence of obesity and cardiovascular diseases, technological advancements in home fitness equipment, rising disposable income, and increasing health awareness and benefits of regular exercise among people. Furthermore, lack of guidance from a personal trainer or fitness instructor and space requirements for home fitness equipment are restraining the market growth.

The convenience and ease of access propelling the shift to home fitness are expected to offer significant growth opportunities for market players. Moreover, alternative fitness routines and the high cost and maintenance of home fitness equipment are challenges to the market's growth. Also, AI-powered home fitness training sessions are a growing trend in the home fitness equipment market.

According to the World Health Organization (WHO) March 2025 report, in 2022, one in eight individuals were living with obesity globally. Furthermore, in 2022, 2.5 billion adults aged 18 and older were overweight, out of which 890 million were living with obesity. Various factors including obesogenic environments, genetic variants, and psychosocial factors, are reasons for obesity. This phenomenon has also led to an increase in cardiovascular diseases and other diseases such as diabetes, hypertension, and dyslipidemia. The increasing cases of obesity have led to the increasing use of home fitness equipment.

Click here to: Get a Free Sample Copy of this Report

Click here to: Get a Free Sample Copy of this Report

The availability of advanced fitness apps with digital content has brought significant changes in the fitness industry. Advanced home fitness equipment can track almost every aspect of health, from diet, sleep, movements, and metabolism. These equipment are integrated with sensors to collect user information such as heart rate, step count, distance covered, and running speed. These equipment can also connect with mobile or computers and store data easily, perform weekly/monthly analysis, and prepare further exercise plans based on users’ performance. Such advancements in home fitness equipment are expected to drive the market.

AI is making waves in the field of fitness by using machine learning algorithms, data analytics, and advanced technology sensors to enhance outcomes and optimize workouts and training sessions. One of the main advantages of the integration of AI in fitness applications is its ability to provide customized and personalized experiences according to one’s needs. Traditional workout patterns that follow a one-size-fits-all approach, lack at considering individual differences relating to goals, fitness levels, and preferences. AI gathers data from several sources, such as fitness applications, wearable fitness devices, and individual inputs, thereby creating tailored exercise plans according to individual needs. Thus, AI-powered home fitness applications are a rising trend in the market.

The rise of the middle-class population in the world is one of the most significant demographics and social trends. Increasing wealthier middleclass consumers is projected to rise over the next 15 years, especially in Asia-Pacific. For instance, according to the Asian Development Bank, developing economies grew by 5.2% in 2022 and 5.3% in 2024 due to an increase in domestic demand and continued expansion. The rising disposable income among the middle class boosts the purchase of advanced homecare equipment such as cardiovascular and strength training equipment. Other factors, such as the increasing prevalence of diseases such as diabetes and hypertension, have caused people to spend more on healthcare. Thus, rising disposable income and accessibility to fitness equipment are expected to drive the home fitness equipment market.

The COVID-19 pandemic brought about a shift in focus of the fitness industry from outdoor workouts to indoor workouts. Due to movement restrictions, many individuals began working out of home with new activities to keep fit. This trend continued even after the COVID-19 pandemic.

People are becoming more aware and cautious of their health, making extra efforts to enhance their fitness goals, build habits, and be active. This has led to the practice of working out at home, as home workouts help save time and are more advantageous. Owing to this, major market players are promoting and developing products to facilitate affordable and convenient fitness at home. This significant shift from gym to home workout is expected to positively impact the market in the future.

Based on type, the home fitness equipment market is segmented into cardiovascular training equipment, strength training equipment, and other equipment and accessories. In 2025, the cardiovascular training equipment segment is expected to account for the largest share of above 54.5% of the home fitness equipment market. Cardiovascular training promotes heart and lung health and reduces the risk of obesity, high blood pressure, and diabetes. The large market share of this segment is attributed to the rising awareness and preference for cardiovascular training and the wide availability of cardiovascular training equipment in the market.

However, the strength training equipment segment is projected to witness the highest growth rate of above 6.6% during the forecast period of 2025–2032. The increasing affordability of advanced strength training equipment, the availability of various price ranges in strength training, and the integration of AI in these equipment for customized and personalized exercises are leading to the highest growth rate of this segment.

Based on price, the home fitness equipment market is segmented into low, medium, and high. In 2025, the medium price segment is expected to account for the largest share of above 52.2% of the home fitness equipment market. The large market share of this segment is attributed to the availability of advanced features in medium-price equipment, the availability of quality equipment in the mid-range segment, and increasing expenditure on fitness due to a rise in disposable income. The products sold in this mid-priced category target a wide range of users who can purchase reliable equipment without paying premium prices.

Based on distribution channel, the home fitness equipment market is segmented into online/e-commerce, and retail. In 2025, the retail segment is expected to account for the largest share of the home fitness equipment market. The large market share of this segment is attributed to the easy and wide accessibility to retail stores, easy installation services from retail stores, and fear of receiving damaged products from online/e-commerce. The fitness equipment for home use are heavy and bulky, have higher shipping costs, and their assembly is challenging. The retail sellers provide complementary services, including installation or assembly, from technical experts. Thus, buyers highly prefer retail channels over e-commerce.

In 2025, North America is expected to account for the largest share of above 38.6% of the home fitness equipment market. North America's significant market share is attributed to the high affordability and out-of-pocket expenditure for fitness, the presence of key players with well-established distribution channels globally, and rising awareness for health among individuals. As per data released by the consumer analytics platform based in the U.S., 52% of U.S. adults exercise regularly at home compared to gyms due to high convenience, low cost, and privacy concerns.

However, the market in Asia-Pacific is slated to register the highest growth rate of above 7.0% during the forecast period. The countries in Asia-Pacific, including China and India, are projected to offer significant growth opportunities for the vendors in this market. The large market share of this segment is attributed to increasing potential in the region and availability of home fitness equipment, increasing out-of-pocket expenditure, and an increase in adoption of home fitness equipment. Expanding chains of fitness brands in the countries in Asia-Pacific also support market growth. For instance, in March 2025, a renowned sports brand, Decathlon (France), announced investments in India to ramp up production and enhance its retail presence in India. Thus, growing awareness and wide accessibility to fitness equipment in the countries in Asia-Pacific is supporting the market growth.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years (2020–2025). The key players operating in the global home fitness equipment market are BowFlex Inc. (U.S.), Peloton Interactive, Inc. (U.S.), Cybex International, Inc. (U.S.), Johnson Health Tech. Co., Ltd. (U.S.), ControllerTechnogym S.p.A. (Italy), Dyaco International Inc. (Taiwan), Decathlon SA (France), Precor Incorporated (U.S.), Hammer Sport AG (Germany), Tonal Systems, Inc. (U.S), HOIST Fitness Systems, Inc. (U.S.), and NordicTrack (U.S.).

|

Particulars |

Details |

|

Number of Pages |

260 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

6% |

|

Estimated Market Size (Value) |

$14.63 billion by 2032 |

|

Segments Covered |

By Type

By Price

By Distribution Channel

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Ireland, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

The key players operating in the global home fitness equipment market are Peloton Interactive, Inc. (U.S.), Cybex International, Inc. (U.S.), Johnson Health Tech. Co., Ltd. (U.S.), ControllerTechnogym S.p.A. (Italy), Dyaco International Inc. (Taiwan), Decathlon SA (France), Precor Incorporated (U.S.), Hammer Sport AG (Germany), Tonal Systems, Inc. (U.S), HOIST Fitness Systems, Inc. (U.S.), and NordicTrack (U.S.). |

The global home fitness equipment market report covers the qualitative analysis and market sizing based on type, price, and distribution channel. This report involves the analysis of various segments of home fitness equipment at the regional and country level. The report also provides insights on factors impacting market growth, related market analysis, pricing analysis, and Porter’s five forces analysis.

The global home fitness equipment market is projected to reach $14.63 billion by 2032 at a CAGR of 6.0% from 2025 to 2032.

Among all the types studied in this report, in 2025, the cardiovascular segment is expected to account for the largest share of the home fitness equipment market. This large share is attributed to the increasing demand for home cardio training equipment for exercise, the availability of low-, medium—and high-priced cardio equipment as per affordability, and the increase in awareness about cardiovascular health among individuals.

Among all the distribution channels studied in this report, in 2025, the retail segment is expected to account for the largest share of the home fitness equipment market. The large share of the segment is attributed to the guarantee and discount offered by retailers offering home fitness equipment, low maintenance cost, and a wide range of varieties for choice available at retail stores.

The growth of this market can be attributed to various factors, such as the high prevalence of obesity and cardiovascular diseases, technological advancements in home fitness equipment, rising disposable income, and increasing health awareness and the benefits of regular exercise among people.

The key players operating in the global home fitness equipment market are Peloton Interactive, Inc. (U.S.), Cybex International, Inc. (U.S.), Johnson Health Tech. Co., Ltd. (U.S.), ControllerTechnogym S.p.A. (Italy), Dyaco International Inc. (Taiwan), Decathlon SA (France), Precor Incorporated (U.S.), Hammer Sport AG (Germany), Tonal Systems, Inc. (U.S), HOIST Fitness Systems, Inc. (U.S.), and NordicTrack (U.S.).

China and India are projected to offer significant growth opportunities for the vendors in this market. The increasing number of people focusing on fitness activities, increasing awareness about physical activities, and expansion of global players in the fitness market in the countries in Asia-Pacific are supporting the market growth. Additionally, the increasing focus of major players on providing low—and medium-range home fitness equipment and increasing out-of-pocket expenditure are further supporting the market growth.

Published Date: Jun-2024

Published Date: Jun-2023

Published Date: Feb-2023

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates