Resources

About Us

High Dynamic Range Market Size, Share & Forecast 2025-2035: Market Size and Growth Analysis by Product Type, HDR Format, Application, End-User & Regional Markets

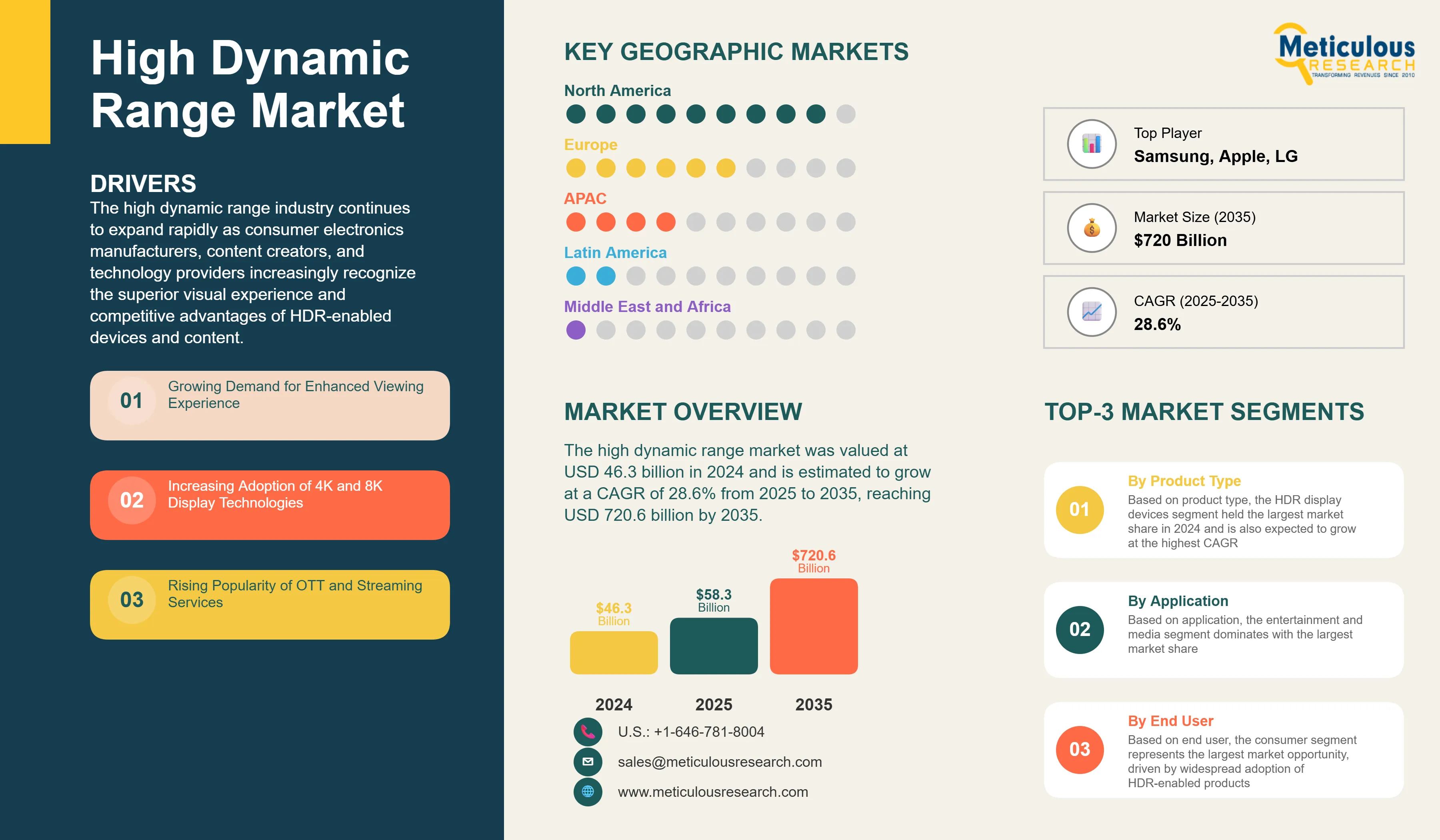

Report ID: MRSE - 1041516 Pages: 268 Jun-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe high dynamic range market was valued at USD 46.3 billion in 2024 and is estimated to grow at a CAGR of 28.6% from 2025 to 2035, reaching USD 720.6 billion by 2035.

The high dynamic range industry continues to expand rapidly as consumer electronics manufacturers, content creators, and technology providers increasingly recognize the superior visual experience and competitive advantages of HDR-enabled devices and content. With growing consumer demand for enhanced viewing experiences across televisions, smartphones, gaming consoles, and streaming platforms, the adoption of HDR technologies is driving unprecedented market growth. The integration of HDR10, HDR10+, Dolby Vision, and other advanced formats across entertainment, gaming, and professional applications is creating substantial opportunities across the value chain.

For instance, the increasing adoption of 4K and 8K display technologies, combined with the rising popularity of OTT and streaming services, is accelerating HDR content creation and consumption. Major streaming platforms like Netflix, Amazon Prime Video, and Disney+ have significantly expanded their HDR content libraries as HDR viewing becomes increasingly mainstream.

The industry is experiencing significant technological transformation through AI-enhanced HDR processing, real-time HDR streaming capabilities, and integration with emerging technologies like virtual and augmented reality. Leading technology companies are investing heavily in next-generation HDR solutions to improve content quality, reduce processing latency, and enhance user experiences across multiple device categories. These technological advances are enabling content creators and device manufacturers to deliver more immersive visual experiences while maintaining competitive pricing and energy efficiency.

In 2024, major semiconductor companies introduced next-generation processing technologies designed to enhance HDR performance while significantly improving power efficiency. These advancements reflect the industry's ongoing commitment to sustainable innovation, delivering better brightness, color accuracy, and overall visual experience in a more energy-efficient manner.

High Dynamic Range Market Trends and Insights

High Dynamic Range Market Trends

HDR Display Devices Segment Projected to Showcase the Largest Growth During the Forecast Period

HDR display devices are projected to show significant growth during the forecast period, representing the largest segment of the total high dynamic range market. This segment includes televisions, monitors and computer displays, projectors, mobile displays, and automotive displays. The complexity and sophistication of HDR display technologies continue to increase as manufacturers compete to deliver superior visual experiences and support multiple HDR formats.

"Growth in HDR display devices is largely driven by rising consumer expectations for premium viewing experiences. HDR capability is now a standard feature among new high-end television models, and consumers are willing to pay more for devices that deliver superior color accuracy, brightness, and immersive visuals. Leading manufacturers—including Samsung, LG, Sony, and TCL—have aggressively expanded their HDR TV portfolios, spanning technologies like OLED, QLED, Mini‑LED, and LCD. Meanwhile, the integration of AI-based upscaling and adaptive HDR processing across multiple price segments further underscores the industry’s push toward delivering high-quality visual experiences."

Asia-Pacific Region to Exhibit the Highest Growth During the Forecast Period

The Asia-Pacific region is estimated to show remarkable growth during the forecast period, driven by rapid technological adoption, growing middle-class populations, and favorable manufacturing ecosystems. Countries like China, Japan, South Korea, and India are experiencing unprecedented demand for HDR-enabled devices as consumer preferences shift toward premium entertainment experiences and advanced display technologies.

China leads the region with the world's largest consumer electronics market and significant investments in HDR technology development and manufacturing. The country's HDR market is projected to grow at a CAGR exceeding 30% through 2035, driven by domestic demand and export opportunities. Japan and South Korea follow closely with advanced HDR technology development and early adoption of next-generation display formats.

The region's growth is also supported by major technology investments and strategic partnerships. For instance, In recent years, leading Asian technology companies—including Samsung, Huawei, BOE, Xiaomi, and various Taiwanese research institutes—have significantly increased their investments in HDR and advanced display technologies. This expanded R&D encompasses mobile HDR, automotive cockpit displays, and professional content-creation tools. Major manufacturers have also established dedicated display innovation centers across Asia to support new technology development, such as microLED, flexible OLED, and AI-based image enhancement, reflecting a clear industry commitment to accelerating HDR capabilities and market adoption.

High Dynamic Range Market Analysis

The high dynamic range industry faces challenges from standardization complexities across multiple HDR formats, content creation and post-production requirements, and power consumption concerns in mobile applications. Compatibility issues between different HDR standards (HDR10, HDR10+, Dolby Vision, HLG) create complexity for content creators and device manufacturers. The limited availability of HDR content in certain markets and the high costs of HDR-compatible devices continue to impact adoption rates in price-sensitive segments.

Despite these constraints, the market offers substantial growth opportunities through technological advancements in display and camera technologies, expansion in emerging markets, and integration with AI and machine learning capabilities. The adoption of next-generation HDR formats and real-time processing technologies is helping manufacturers deliver superior visual experiences while reducing costs and power consumption. Government initiatives supporting digital transformation and smart city development provide sustainable growth pathways for HDR technology adoption across multiple applications.

Based on product type, the high dynamic range market is segmented into HDR display devices, HDR capture devices, HDR processing solutions, and HDR accessories and components. The HDR display devices segment held the largest market share in 2024 and is expected to grow at the highest CAGR, driven by consumer demand for enhanced viewing experiences.

Based on HDR format, the market is segmented into HDR10, HDR10+, Dolby Vision, Hybrid Log-Gamma (HLG), Advanced HDR by Technicolor (SL-HDR), 4K HDR, 8K HDR, and others. The HDR10 segment maintains significant market share due to its open standard nature, while Dolby Vision is experiencing rapid growth in premium applications.

Based on application, the market serves entertainment and media, gaming, automotive, security and surveillance, healthcare and medical imaging, education and training, and other specialized applications. The entertainment and media segment dominates with the largest market share, reflecting consumer preferences for premium content experiences.

Based on end user, the market is segmented into consumers, professional creators, enterprises, and others. The consumer segment represents the largest market opportunity, driven by widespread adoption of HDR-enabled televisions, smartphones, and streaming services.

Regional Market Analysis

North America leads the high dynamic range market with significant adoption of premium HDR devices and strong content creation ecosystems. The region's mature entertainment industry and high consumer spending on technology products drive continued HDR market expansion. Major streaming services and content creators based in North America are pioneering HDR content development and driving industry standards.

Europe continues to expand its HDR technology adoption across diverse markets with varying consumer preferences and regulatory environments. The region's focus on sustainability and energy efficiency is driving innovation in power-efficient HDR technologies. European manufacturers are increasingly focusing on automotive HDR applications and professional content creation solutions.

Asia-Pacific demonstrates the strongest growth potential in HDR technology adoption, with rapidly expanding consumer electronics markets and significant manufacturing capabilities. The region's large population of tech-savvy consumers and growing disposable income levels support premium HDR device adoption. Major technology companies in the region are investing heavily in next-generation HDR innovations.

Latin America focuses on expanding HDR technology access through affordable device options and localized content development. The region's growing middle class and increasing internet penetration create opportunities for HDR streaming services and mobile HDR applications.

Middle East & Africa represents emerging opportunities for HDR technology adoption, particularly in urban markets with growing technology infrastructure and consumer spending power.

High Dynamic Range Market Share

Major players like Samsung Electronics, Apple Inc., LG Electronics, Sony Corporation, and TCL Technology Group compete strongly in the high dynamic range industry. These companies focus on strategic partnerships, technology innovations, and comprehensive product portfolios to strengthen their market positions and expand across multiple HDR applications. As demand grows for HDR capabilities across consumer electronics, automotive, and professional markets, companies invest heavily in research and development, manufacturing capacity, and ecosystem partnerships.

Leading manufacturers are forming strategic alliances with content creators, streaming services, and technology platform providers to create integrated HDR ecosystems. These collaborations enable better content optimization, improved device compatibility, and enhanced user experiences across multiple HDR formats and applications. The market is also witnessing increased investment in HDR technology startups and specialized solution providers focused on emerging applications like automotive displays and mobile HDR processing.

High Dynamic Range Market Companies

Major players operating in the high dynamic range industry include:

High Dynamic Range Industry News

April 2025: Samsung Electronics announced its smart TVs and monitors will now support Netflix shows and movies in HDR10+.1 With HDR10+, viewers can enjoy richer contrast, deeper colors and stunning visual depth. This integration will help viewers to experience enhanced realism and depth across a growing library of HDR10+ content.

July 2024: Canon India recently launched EOS R1 & EOS R5 Mark II, marking a major leap in hybrid imaging technology with new DIGIC Accelerator + DIGIC X processing, stacked CMOS sensors, and deep learning autofocus and stabilization systems.

High Dynamic Range Industry Segmentation

The high dynamic range market includes display devices, capture equipment, processing solutions, and supporting technologies that enable enhanced visual experiences with greater brightness range and color accuracy. The report covers HDR technologies across consumer, professional, and enterprise applications while excluding legacy display technologies and non-HDR imaging solutions.

The high dynamic range market is segmented by product type, HDR format, application, end user, and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). By product type, the market includes HDR display devices, HDR capture devices, HDR processing solutions, and HDR accessories and components. By HDR format, the market covers HDR10, HDR10+, Dolby Vision, Hybrid Log-Gamma (HLG), and other emerging formats. The report provides comprehensive market analysis and forecasts for each segment.

|

Particulars |

Details |

|

Number of Pages |

268 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

28.6% |

|

Market Size (Value)in 2025 |

USD 58.2 Billion |

|

Market Size (Value) in 2035 |

USD 720.6 Billion |

|

Segments Covered |

By Product Type

By HDR Format

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Samsung Electronics Co., Ltd., Apple Inc., LG Electronics Inc., Sony Corporation, TCL Technology Group Corporation, Hisense Group Holdings Co., Ltd., Panasonic Corporation, Canon Inc., Nikon Corporation, VIZIO, Inc., Philips (Koninklijke Philips N.V.), Sharp Corporation, OmniVision Technologies, Inc., Fujifilm Holdings Corporation, Olympus Corporation, Dolby Laboratories, Inc., RED Digital Cinema, LLC, Blackmagic Design Pty. Ltd., GoPro, Inc., NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), MediaTek Inc. |

The High Dynamic Range Market size is expected to reach USD 58.2 billion in 2025 and grow at a CAGR of 28.6% to reach USD 720.6 billion by 2035.

In 2025, the High Dynamic Range Market size is expected to reach USD 58.2 billion.

Samsung Electronics Co., Ltd., Apple Inc., LG Electronics Inc., Sony Corporation, and TCL Technology Group Corporation are the major companies operating in the High Dynamic Range Market.

The Asia-Pacific region is estimated to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, HDR display devices account for the largest market share in the High Dynamic Range Market.

In 2024, the High Dynamic Range Market size was estimated at USD 46.3 billion. The report covers historical market size data and forecasts through 2035.

Published Date: Oct-2024

Published Date: Jun-2024

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates