Resources

About Us

Helicopter Interior Market Size, Share & Forecast 2025-2035 | Growth Analysis by Component Type, Helicopter Type, End-User & Geography

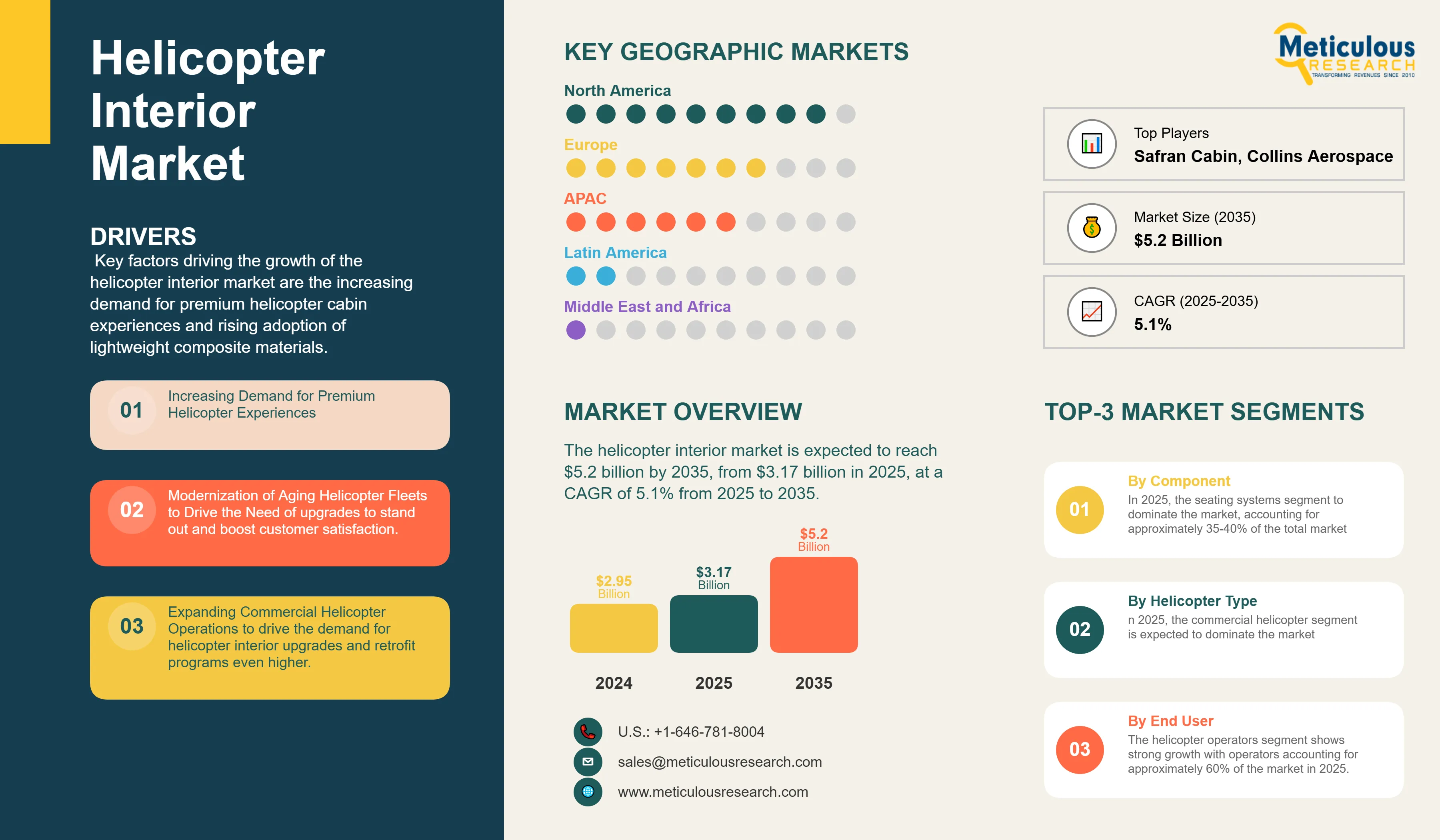

Report ID: MRAD - 1041513 Pages: 165 Jul-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the helicopter interior market are the increasing demand for premium helicopter cabin experiences, rising adoption of lightweight composite materials, growing focus on passenger comfort and safety features, expanding commercial helicopter operations, modernization of aging helicopter fleets, and increasing demand for customized luxury helicopter interiors. However, factors such as high cost of premium interior components, complex certification processes for aerospace interiors, weight restrictions limiting design flexibility, and limited standardization across helicopter models restrain the growth of this market to some extent.

This market presents significant opportunities including various advancements in smart cabin technologies and IoT integration, along with a surge in helicopter use in emerging markets. Additionally, there are retrofit and upgrade programs for existing helicopter fleets, and a growing demand for specialized medical helicopter interiors. All of these factors are creating significant growth opportunities for companies in the market. On top of that, the trend towards using sustainable interior materials and modular design approaches is gaining traction.

Increasing Demand for Premium Helicopter Experiences

The demand for helicopter interior upgrades is on the rise, fueled by a growing appetite for luxury travel experiences and a focus on passenger comfort. Today’s helicopter operators are eager to distinguish themselves by offering superior cabin experiences, which has led to an increased demand for premium seating, advanced entertainment systems, and high-quality interior finishes. The helicopter interior market is thriving as operators aim to provide the same level of comfort found in commercial airlines.

The boom in VIP and executive helicopter transportation, combined with the increasing wealth of high-net-worth individuals, is driving this trend forward. Premium helicopter interiors, featuring plush leather seating, advanced climate control, noise reduction technologies, and tailored configurations, are a hit among discerning travelers who prioritize comfort and luxury.

The luxury helicopter market has really taken off in recent years, with operators looking for sophisticated interior solutions that showcase their brand’s premium positioning while meeting the ever-evolving expectations of passengers for comfort, connectivity, and customization.

Modernization of Aging Helicopter Fleets

The modernization of aging helicopter fleets is all about enhancing the passenger experience. By upgrading the interiors, we can offer a much more enjoyable ride compared to older models. This involves using advanced materials, improving ergonomics, and incorporating modern safety features.

The process of updating things like seating systems, lighting, and cabin management not only boosts passenger satisfaction but also enhances operational efficiency. Research indicates that these modern interiors can provide better noise reduction and comfort, thanks to cutting-edge acoustic materials and smart design choices. Helicopter interiors play a crucial role in shaping the passenger experience. Features like ergonomic seating, sophisticated lighting systems, and integrated entertainment options set modern helicopters apart. They strike a balance between operational functionality and enhanced comfort and safety, making them especially appealing to commercial operators, VIP charter services, and emergency medical services.

As more research highlights the importance of interior design on passenger comfort, and with the competitive edge that modern configurations offer, operators are increasingly adopting these upgrades to stand out and boost customer satisfaction.

Expanding Commercial Helicopter Operations

Over the past few years, we have witnessed sharply rising commercial use of helicopters for purposes including emergency medical transport, offshore operations, and intra-city transportation. This has really taken flight recently, with utilization rates shooting through the roof. The part of the market dedicated to helicopter interiors is growing even more rapidly, with operators increasingly focusing on passenger comfort and operational efficiency in the way that they are configuring their aircraft.

The commercial helicopter market is being driven by the growth of offshore energy activities, an increased need for emergency medical transport, expanding interest in urban air mobility offerings, and a greater emphasis on passenger experience improvement. Helicopter interiors are increasingly seen as important operational assets that provide a variety of functional advantages, placing them in a position to capture a substantial share of this growing market.

Additionally, operators and aviation authorities are assigning more value to contemporary interior standards due to their safety and efficiency gains. This is all serving to drive the demand for helicopter interior upgrades and retrofit programs even higher.

Market Segmentation Analysis

By Component Type

Based on component type, the helicopter interior market is segmented into seating systems, cabin panels & trim, lighting systems, flooring, galley & storage, windows & transparencies, and interior electronics. In 2025, the seating systems segment is anticipated to dominate the market, accounting for approximately 35-40% of the total helicopter interior market. This is mainly attributed to their critical importance for passenger comfort, high value per unit, and frequent replacement cycles for commercial operations.

However, the interior electronics segment is projected to record the highest CAGR during the forecast period of 2025-2035. This exceptional growth is driven by increasing integration of smart cabin technologies, growing demand for connectivity solutions, expanding adoption of cabin management systems, and rising expectations for in-flight entertainment and communication capabilities.

The lighting systems segment is also experiencing robust growth due to LED technology adoption, energy efficiency requirements, and enhanced passenger experience through ambient lighting solutions.

By Helicopter Type

The helicopter interior market is segmented into commercial helicopters, military helicopters, civil helicopters, and emergency medical service helicopters. In 2025, the commercial helicopter segment is expected to dominate the market due to higher interior customization requirements, frequent cabin reconfiguration needs, and emphasis on passenger experience differentiation.

However, the civil helicopter segment is anticipated to record the highest growth rate during the forecast period, driven by increasing private helicopter ownership, growing demand for luxury helicopter experiences, rising VIP transportation requirements, and expanding helicopter tourism markets.

By End-User

Based on end-user, the helicopter interior market is segmented into helicopter operators and helicopter manufacturers (OEM). The helicopter operators segment shows strong growth with operators accounting for approximately 60% of the market in 2025. This is attributed to the retrofit and upgrade nature of many interior projects, operator focus on differentiation, and the need for periodic interior refreshing.

The market for OEM segment is primarily driven by new helicopter deliveries, integrated interior solutions, and factory-installed premium configurations for high-end helicopter models.

By Application

On the basis of application, the helicopter interior market is segmented into passenger transport, emergency medical services, offshore operations, law enforcement, VIP/executive transport, and tourism. In 2025, the passenger transport segment is expected to dominate the helicopter interior market with around 45% share, reflecting the large commercial helicopter fleet and emphasis on passenger comfort.

The VIP/executive transport segment is projected to grow with the highest CAGR of 6.8% during the forecast period of 2025-2035, driven by increasing demand for luxury helicopter experiences, growing high-net-worth individual population, and rising corporate helicopter utilization.

Regional Analysis

Based on geography, the helicopter interior market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is projected to account for the largest share of around 40% of the helicopter interior market with its large commercial helicopter fleet, established aerospace interior industry, and high demand for premium helicopter experiences.

The North America helicopter interior market is projected to grow at a CAGR of 5.5% during the forecast period of 2025-2035. This growth is fueled by fleet modernization programs, increasing emergency medical services demand, growing offshore operations, and rising demand for luxury helicopter experiences. This growth is further driven by the presence of major helicopter manufacturers, established interior suppliers, and strong regulatory framework supporting interior safety standards in the U.S.

Europe commands the second-largest share of the global helicopter interior market, driven by strong helicopter tourism, offshore wind operations, emergency medical services expansion, and presence of leading helicopter interior manufacturers. The region's focus on luxury helicopter experiences and sustainable interior materials contributes significantly to its market growth.

Asia-Pacific is emerging as the fastest-growing region for helicopter interiors, with a projected CAGR of 7.2% during 2025-2035, driven by increasing helicopter adoption in countries like China, India, and Japan, rising offshore operations, growing emergency medical services infrastructure, and expanding helicopter tourism markets.

Key Players/Compabies in the Global Helicopter Interior Market

Leading players in the global helicopter interior market are Safran Cabin, Collins Aerospace, Mecaer Aviation Group, Diehl Aviation, Aircraft Cabin Modification GmbH, Jet Aviation, Duncan Aviation, Haeco Private Jet Solutions, Recaro Aircraft Seating, Sabeti Wain Aerospace, Air Livery, SkyArt Aerospace, Rotorcorp, Premium Aircraft Interiors, Aviointeriors S.p.A, among others.

|

Particulars |

Details |

|

Number of Pages |

165 |

|

Forecast Period |

2025-2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.1% |

|

Market Size 2024 |

USD 2.95 billion |

|

Market Size 2025 |

USD 3.17 billion |

|

Market Size 2035 |

USD 5.2 billion |

|

Segments Covered |

By Component Type, Helicopter Type, End-User, Application |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Netherlands, Spain, Switzerland, and Rest of Europe), Asia-Pacific (Japan, Australia, India, China, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa) |

The helicopter interior market is projected to reach USD 5.2 billion by 2035 from USD 3.17 billion in 2025, at a CAGR of 5.1% during the forecast period.

In 2025, the seating systems segment is projected to hold the major share of the helicopter interior market.

The VIP/executive transport segment is slated to record the highest growth rate during the forecast period of 2025-2035.

Key factors driving the growth include increasing demand for premium helicopter experiences, rising adoption of lightweight materials, growing focus on passenger comfort, expanding commercial operations, fleet modernization programs, and demand for customized luxury interiors.

Major opportunities include emerging air taxi markets, smart cabin technology integration, expansion in emerging markets, retrofit programs for existing fleets, and specialized medical helicopter interior configurations.

North America leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for helicopter interior suppliers.

1. Introduction

1.1. Market Definition & Scope

1.2. Helicopter Interior Market Ecosystem

1.3. Currency and Units

1.4. Key Stakeholders in Helicopter Interior Value Chain

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Helicopter Interior Market Analysis: by Component Type

3.2.2. Helicopter Interior Market Analysis: by Helicopter Type

3.2.3. Helicopter Interior Market Analysis: by End-User

3.2.4. Helicopter Interior Market Analysis: by Application

3.3. Helicopter Interior Market, by Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Industry Insights

4.1. Overview

4.2. Helicopter Interior Design Standards

4.2.1. Commercial vs. Military Interior Requirements

4.2.2. Aviation Certification Standards and Requirements

4.3. Value Chain Analysis

4.3.1. Overview

4.3.2. Raw Material Suppliers

4.3.3. Component Manufacturing and Assembly

4.3.3.1. Key Helicopter Interior Manufacturers, by Size

4.3.3.1.1. Small-scale Specialized Manufacturers

4.3.3.1.2. Medium-scale Component Suppliers

4.3.3.1.3. Large-scale System Integrators

4.3.3.1.4. Major Aerospace Interior Manufacturers

4.3.4. Certification and Quality Control

4.3.5. Installation, Integration, and Testing

4.3.6. Distribution Channel (OEM & Aftermarket)

4.3.7. End-use Applications and Customer Base

4.4. Pricing Analysis

4.4.1. Helicopter Seating Systems

4.4.2. Cabin Panels & Trim

4.4.3. Lighting Systems

4.4.4. Interior Electronics

4.4.5. Premium Custom Interior Solutions

4.4.6. Retrofit vs. New Installation Pricing

4.5. Porter's Five Forces Analysis

4.5.1. Bargaining Power of Raw Material Suppliers

4.5.2. Bargaining Power of Helicopter Operators

4.5.3. Threat of Alternative Interior Solutions

4.5.4. Threat of New Market Entrants

4.5.5. Degree of Competition in Interior Segment

5. Market Insights

5.1. Overview

5.2. Factors Affecting Market Growth

5.2.1. Drivers

5.2.1.1. Increasing Demand for Premium Helicopter Experiences

5.2.1.2. Rising Adoption of Lightweight Composite Materials

5.2.1.3. Growing Focus on Passenger Comfort and Safety

5.2.1.4. Expanding Commercial Helicopter Operations

5.2.1.5. Modernization of Aging Helicopter Fleets

5.2.1.6. Demand for Customized Luxury Interiors

5.2.1.7. Integration of Smart Cabin Technologies

5.2.1.8. Expansion of Emergency Medical Services

5.2.2. Restraints

5.2.2.1. High Costs of Premium Interior Components

5.2.2.2. Complex Aerospace Certification Processes

5.2.2.3. Weight Restrictions Limiting Design Flexibility

5.2.2.4. Limited Standardization Across Helicopter Models

5.2.2.5. Long Development and Certification Timelines

5.2.3. Opportunities

5.2.3.1. Emerging Air Taxi and Urban Air Mobility Markets

5.2.3.2. Smart Cabin Technologies and IoT Integration

5.2.3.3. Expansion in Emerging Markets

5.2.3.4. Retrofit and Upgrade Programs

5.2.3.5. Medical Helicopter Interior Configurations

5.3. Trends

5.3.1. Adoption of Sustainable Interior Materials

5.3.2. Modular Interior Design Approaches

5.3.3. Integration of Connectivity Solutions

5.4. Standards and Regulations

5.4.1. Global Aviation Interior Standards

5.4.2. Regional Certification Requirements

5.4.2.1. North America (FAA Regulations)

5.4.2.2. Europe (EASA Requirements)

5.4.2.3. Asia-Pacific (Regional Aviation Authorities)

5.4.2.4. Latin America (Regional Standards)

5.4.2.5. Middle East & Africa (Local Regulations)

5.5. Interior Technology Adoption Trends Across Applications

6. Helicopter Interior Market Assessment - by Component Type

6.1. Overview

6.2. Seating Systems

6.3. Cabin Panels & Trim

6.4. Lighting Systems

6.5. Flooring

6.6. Galley & Storage Solutions

6.7. Windows & Transparencies

6.8. Interior Electronics & Cabin Management Systems

6.9. Others

7. Helicopter Interior Market Assessment - by Helicopter Type

7.1. Overview

7.2. Commercial Helicopters

7.3. Military Helicopters

7.4. Civil Helicopters

7.5. Emergency Medical Service Helicopters

8. Helicopter Interior Market Assessment - by End-User

8.1. Overview

8.2. Helicopter Operators

8.2.1. Commercial Operators

8.2.2. Private Operators

8.2.3. Government/Military Operators

8.3. Helicopter Manufacturers (OEM)

8.3.1. New Aircraft Production

8.3.2. Factory Installation Programs

8.3.3. Completion Centers

9. Helicopter Interior Market Assessment - by Application

9.1. Overview

9.2. Passenger Transport

9.2.1. Scheduled Passenger Services

9.2.2. Charter Operations

9.2.3. Tourism and Sightseeing

9.3. VIP/Executive Transport

9.3.1. Corporate Transportation

9.3.2. High-Net-Worth Individual Services

9.3.3. Government VIP Transport

9.4. Emergency Medical Services

9.5. Offshore Operations

9.6. Law Enforcement

9.7. Search and Rescue Operations

10. Helicopter Interior Market Assessment - by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Netherlands

10.3.6. Spain

10.3.7. Switzerland

10.3.8. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. Australia

10.4.3. India

10.4.4. China

10.4.5. South Korea

10.4.6. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. UAE

10.6.2. Saudi Arabia

10.6.3. South Africa

10.6.4. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies in Helicopter Interior Market

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Interior Market Leaders

11.4.2. Interior Innovation Companies

11.4.3. Emerging Interior Suppliers

11.4.4. Regional Interior Specialists

11.5. Market Ranking/Positioning Analysis of Key Interior Players, 2024

12. Company Profiles

12.1. Safran Cabin (France)

12.2. Collins Aerospace (USA)

12.3. Mecaer Aviation Group (Italy)

12.4. Diehl Aviation (Germany)

12.5. Aircraft Cabin Modification GmbH (Germany)

12.6. Jet Aviation (Switzerland)

12.7. Duncan Aviation (USA)

12.8. Haeco Private Jet Solutions (Hong Kong)

12.9. Recaro Aircraft Seating (Germany)

12.10. Sabeti Wain Aerospace (UK)

12.11. Air Livery (UK)

12.12. SkyArt Aerospace (USA)

12.13. Rotorcorp (Australia)

12.14. Premium Aircraft Interiors (USA)

12.15. Aviointeriors S.p.A (Italy)

12.16. Others (Note: SWOT Analysis of Top 5 Helicopter Interior Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

13.3. Aviation Certification Bodies and Standards

13.4. Glossary of Helicopter Interior Terms

List of Tables

Table 1 Commercial vs. Military Helicopter Interior Requirements Comparison

Table 2 Global Aviation Interior Certification Standards for Helicopters

Table 3 Indicative List of Helicopter Interior Suppliers and their Product Offerings

Table 4 List of Small-scale Helicopter Interior Manufacturers

Table 5 List of Medium-scale Helicopter Interior Component Suppliers

Table 6 List of Large-scale Helicopter Interior System Integrators

Table 7 List of Major Aerospace Interior Manufacturers Serving Helicopter Market

Table 8 Average Selling Prices of Helicopter Seating Systems, by Country, 2023-2035 (USD/Unit)

Table 9 Average Selling Prices of Cabin Panels & Trim, by Country, 2023-2035 (USD/Set)

Table 10 Average Selling Prices of Helicopter Lighting Systems, by Country, 2023-2035 (USD/Unit)

Table 11 Average Selling Prices of Interior Electronics, by Country, 2023-2035 (USD/Unit)

Table 12 Average Selling Prices of Premium Custom Interiors, by Country, 2023-2035 (USD/Aircraft)

Table 13 Average Selling Prices of Flooring Systems, by Country, 2023-2035 (USD/Set)

Table 14 Average Selling Prices of Galley & Storage Solutions, by Country, 2023-2035 (USD/Unit)

Table 15 Retrofit vs. New Installation Cost Comparison

Table 16 Aviation Interior Certification Requirements by Region

Table 17 Helicopter Interior Manufacturing Costs and Lead Times for Different Components

Table 18 Global: Helicopter Interior Components Approved for Commercial Use

Table 19 Global Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 20 Global Helicopter Seating Systems Market, by Country, 2023-2035 (USD Million)

Table 21 Global Cabin Panels & Trim Market, by Country, 2023-2035 (USD Million)

Table 22 Global Helicopter Lighting Systems Market, by Country, 2023-2035 (USD Million)

Table 23 Global Helicopter Flooring Market, by Country, 2023-2035 (USD Million)

Table 24 Global Galley & Storage Solutions Market, by Country, 2023-2035 (USD Million)

Table 25 Global Windows & Transparencies Market, by Country, 2023-2035 (USD Million)

Table 26 Global Interior Electronics Market, by Country, 2023-2035 (USD Million)

Table 27 Global Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 28 Global Commercial Helicopter Interior Market, by Country, 2023-2035 (USD Million)

Table 29 Global Military Helicopter Interior Market, by Country, 2023-2035 (USD Million)

Table 30 Global Civil Helicopter Interior Market, by Country, 2023-2035 (USD Million)

Table 31 Global Emergency Medical Service Helicopter Interior Market, by Country, 2023-2035 (USD Million)

Table 32 Global Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 33 Global Helicopter Interior Market for Operators, by Country, 2023-2035 (USD Million)

Table 34 Global Helicopter Interior Market for OEMs, by Country, 2023-2035 (USD Million)

Table 35 Global Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 36 Global Helicopter Interior Market for Passenger Transport, by Country, 2023-2035 (USD Million)

Table 37 Comparison of Interior Requirements by Helicopter Application

Table 38 Global Helicopter Interior Market for VIP/Executive Transport, by Country, 2023-2035 (USD Million)

Table 39 Global Helicopter Interior Market for Emergency Medical Services, by Country, 2023-2035 (USD Million)

Table 40 Global Helicopter Interior Market for Offshore Operations, by Country, 2023-2035 (USD Million)

Table 41 Global Helicopter Interior Market for Law Enforcement, by Country, 2023-2035 (USD Million)

Table 42 Global Helicopter Interior Market for Tourism, by Country, 2023-2035 (USD Million)

Table 43 Global Helicopter Interior Market, by Region, 2023-2035 (USD Million)

Table 44 Key Helicopter Interior Buyers in North America

Table 45 North America: Helicopter Interior Market, by Country, 2023-2035 (USD Million)

Table 46 North America: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 47 North America: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 48 North America: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 49 North America: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 50 U.S.: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 51 U.S.: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 52 U.S.: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 53 U.S.: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 54 Canada: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 55 Canada: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 56 Canada: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 57 Canada: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 58 Europe: Helicopter Interior Market, by Country/Region, 2023-2035 (USD Million)

Table 59 Europe: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 60 Europe: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 61 Europe: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 62 Europe: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 63 Germany: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 64 Germany: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 65 Germany: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 66 Germany: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 67 France: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 68 France: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 69 France: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 70 France: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 71 U.K.: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 72 U.K.: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 73 U.K.: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 74 U.K.: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 75 Italy: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 76 Italy: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 77 Italy: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 78 Italy: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 79 Netherlands: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 80 Netherlands: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 81 Netherlands: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 82 Netherlands: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 83 Spain: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 84 Spain: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 85 Spain: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 86 Spain: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 87 Switzerland: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 88 Switzerland: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 89 Switzerland: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 90 Switzerland: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 91 Rest of Europe: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 92 Rest of Europe: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 93 Rest of Europe: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 94 Rest of Europe: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 95 Asia-Pacific: Helicopter Interior Market, by Country/Region, 2023-2035 (USD Million)

Table 96 Asia-Pacific: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 97 Asia-Pacific: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 98 Asia-Pacific: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 99 Asia-Pacific: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 100 Japan: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 101 Japan: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 102 Japan: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 103 Japan: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 104 Australia: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 105 Australia: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 106 Australia: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 107 Australia: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 108 India: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 109 India: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 110 India: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 111 India: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 112 China: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 113 China: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 114 China: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 115 China: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 116 South Korea: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 117 South Korea: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 118 South Korea: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 119 South Korea: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 120 Rest of Asia-Pacific: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 121 Rest of Asia-Pacific: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 122 Rest of Asia-Pacific: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 123 Rest of Asia-Pacific: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 124 Latin America: Helicopter Interior Market, by Country/Region, 2023-2035 (USD Million)

Table 125 Latin America: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 126 Latin America: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 127 Latin America: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 128 Latin America: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 129 Brazil: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 130 Brazil: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 131 Brazil: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 132 Brazil: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 133 Mexico: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 134 Mexico: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 135 Mexico: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 136 Mexico: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 137 Argentina: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 138 Argentina: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 139 Argentina: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 140 Argentina: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 141 Rest of Latin America: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 142 Rest of Latin America: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 143 Rest of Latin America: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 144 Rest of Latin America: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 145 Middle East & Africa: Helicopter Interior Market, by Country/Region, 2023-2035 (USD Million)

Table 146 Middle East & Africa: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 147 Middle East & Africa: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 148 Middle East & Africa: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 149 Middle East & Africa: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 150 UAE: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 151 UAE: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 152 UAE: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 153 UAE: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 154 Saudi Arabia: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 155 Saudi Arabia: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 156 Saudi Arabia: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 157 Saudi Arabia: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 158 South Africa: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 159 South Africa: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 160 South Africa: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 161 South Africa: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

Table 162 Rest of Middle East & Africa: Helicopter Interior Market, by Component Type, 2023-2035 (USD Million)

Table 163 Rest of Middle East & Africa: Helicopter Interior Market, by Helicopter Type, 2023-2035 (USD Million)

Table 164 Rest of Middle East & Africa: Helicopter Interior Market, by End-User, 2023-2035 (USD Million)

Table 165 Rest of Middle East & Africa: Helicopter Interior Market, by Application, 2023-2035 (USD Million)

List of Figures

Figure 1 Research Process for Helicopter Interior Market

Figure 2 Secondary Sources Referenced for Helicopter Interior Study

Figure 3 Primary Research Techniques for Interior Market Analysis

Figure 4 Key Executives Interviewed in Helicopter Interior Industry

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach for Helicopter Interiors

Figure 7 In 2024, the Seating Systems Segment to Dominate the Global Helicopter Interior Market

Figure 8 In 2024, the Commercial Helicopter Segment to Dominate Interior Demand

Figure 9 In 2024, the Operator Segment to Show Higher Market Share

Figure 10 In 2024, the Passenger Transport Segment to Dominate the Helicopter Interior Market

Figure 11 North America and Europe Lead the Helicopter Interior Market Growth

Figure 12 Benefits of Premium Helicopter Interior Configurations

Figure 13 Helicopter Interior Components: System Integration Overview

Figure 14 Helicopter Interior Market: Value Chain Analysis

Figure 15 Helicopter Interior Market: Porter's Five Forces Analysis

Figure 16 Impact Analysis of Interior Market Dynamics

Figure 17 Premium vs. Standard Helicopter Interior: Feature Comparison

Figure 18 Global Helicopter Interior Market, by Component Type, 2025 Vs. 2035 (USD Million)

Figure 19 Global Helicopter Interior Market, by Component Type, 2025 Vs. 2035 (Units)

Figure 20 Global Helicopter Interior Market, by Helicopter Type, 2025 Vs. 2035 (USD Million)

Figure 21 Helicopter Interior: OEM Distribution Flow

Figure 22 Helicopter Interior: Aftermarket Distribution Flow

Figure 23 Global Helicopter Interior Market, by End-User, 2025 Vs. 2035 (USD Million)

Figure 24 Global Helicopter Interior Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 25 Impact of Interior Design on Helicopter Passenger Experience

Figure 26 Global Helicopter Interior Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 27 Global Helicopter Interior Market, by Region, 2025 Vs. 2035 (Units)

Figure 28 North America: Helicopter Interior Market Snapshot (2024)

Figure 29 Europe: Helicopter Interior Market Snapshot (2025)

Figure 30 Asia-Pacific: Helicopter Interior Market Snapshot (2025)

Figure 31 Latin America: Helicopter Interior Market Snapshot (2025)

Figure 32 Middle East & Africa: Helicopter Interior Market Snapshot (2025)

Figure 33 Key Growth Strategies Adopted by Leading Interior Players (2022-2025)

Figure 34 Global Helicopter Interior Market Competitive Benchmarking, by Application

Figure 35 Competitive Dashboard: Global Helicopter Interior Market

Figure 36 Global Helicopter Interior Market Ranking/Positioning of Key Players, 2025

Figure 37 Aircraft Interiors International: Financial Overview (2024)

Figure 38 Sabeti Wain Aerospace: Financial Overview (2024)

Figure 39 FEAM Aero: Financial Overview (2024)

Figure 40 Astronics Corporation: Financial Overview (2024)

Figure 41 Premium vs. Standard Interior: Price Analysis (2024)

Figure 42 Aviation Interior Certification Process Timeline and Costs

Figure 43 Helicopter Interior Manufacturing: Sustainability Impact Comparison

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates