Resources

About Us

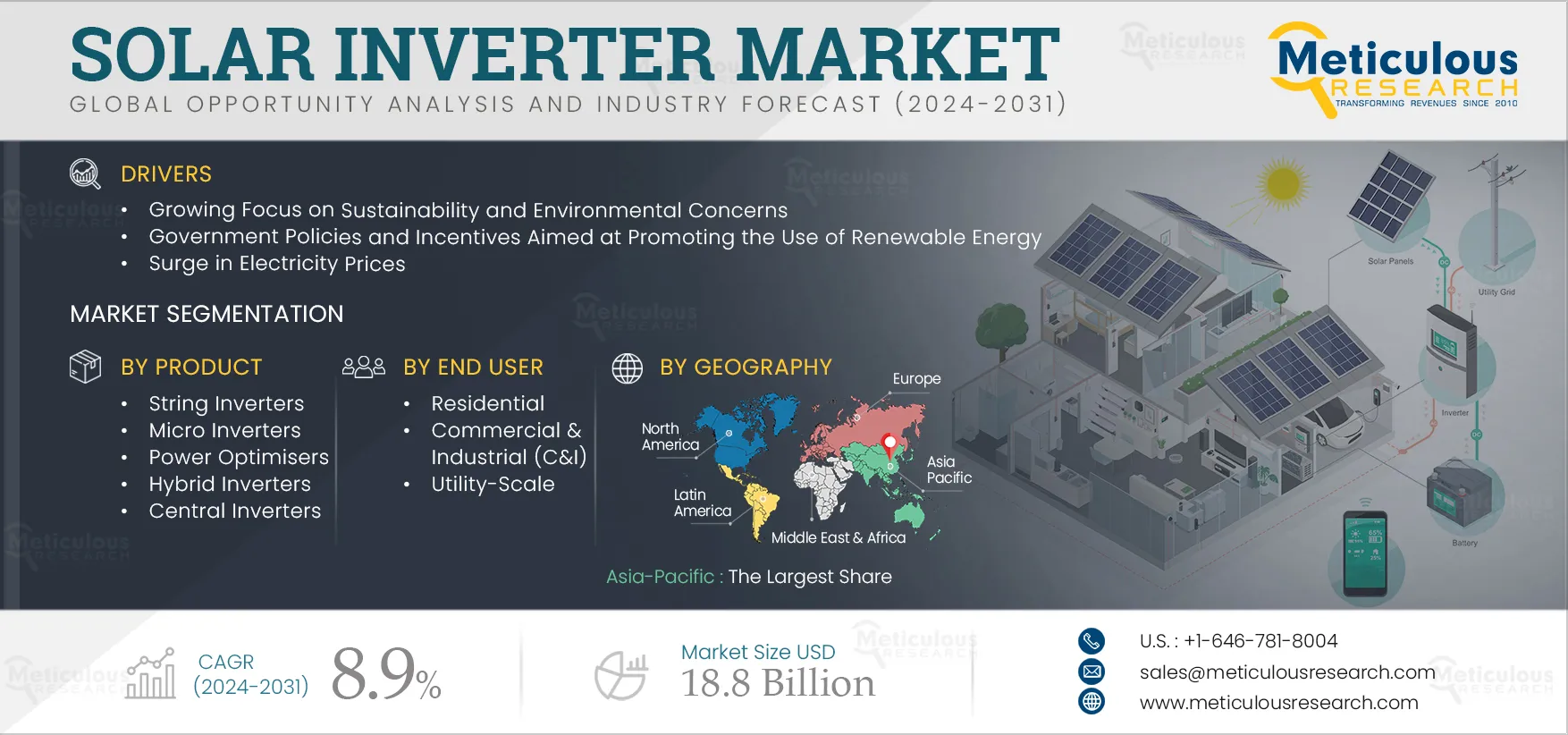

Solar Inverter Market Size, Share, Forecast, & Trends Analysis by Product (String, Micro, Power, Hybrid, Central), Grid (On-grid, Off-grid), Phase (Single, Three), End User (Residential, Commercial & Industrial, Utility-Scale) - Global Forecast to 2032

Report ID: MROTH - 1041146 Pages: 210 Sep-2024 Formats*: PDF Category: Others Delivery: 24 to 72 Hours Download Free Sample ReportThe Solar Inverter Market is expected to reach $18.8 billion by 2032, at a CAGR of 8.9% from 2025 to 2032. The growth of this market is driven by the growing focus on sustainability and environmental concerns, government policies and incentives aimed at promoting the use of renewable energy, and the surge in electricity prices. Furthermore, the integration of solar inverters with energy storage systems and the adoption of smart grid technologies are expected to create market growth opportunities. However, the high installation costs of solar inverters may restrain market growth. Additionally, issues related to the integration of solar power into existing electrical grids pose challenges to the market's growth. Additionally, the integration of digital technologies and Internet of Things (IoT) capabilities into solar inverters is a prominent trend in this market.

Sustainability entails meeting present needs without compromising the ability of future generations to meet their own. Environmental concerns encompass issues like climate change, air & water pollution, habitat destruction, and natural resource depletion. Growing public awareness regarding these issues, including air & water pollution, deforestation, and biodiversity loss, has heightened pressure on governments, businesses, and individuals to adopt sustainable practices and technologies. The adoption of solar energy plays a significant role in addressing sustainability and environmental concerns by reducing reliance on fossil fuels, mitigating climate change, enhancing air quality, and reducing dependence on resources such as coal, oil, and natural gas. Solar inverters act as the interface between solar panels and the electrical grid. They facilitate the integration of clean and sustainable solar energy into the electrical grid. Additionally, solar inverters offer rapid and flexible deployment, rendering them suitable for diverse applications ranging from small-scale residential installations to utility-scale solar farms.

Governments are also directing their efforts towards introducing new initiatives and policies aimed at enhancing the overall efficiency and performance of inverters, thereby promoting energy savings and reducing electricity consumption. For instance, in March 2025, The Bureau of Energy Efficiency under the Ministry of Power, Government of India, launched the Standards and Labeling Program for Grid-Connected Solar Inverters. This program aims to assist consumers in making informed choices by considering the cost-effectiveness and energy performance of various energy-consuming appliances, ultimately enabling them to save energy, reduce electricity consumption, and contribute to a greener planet. The Program will facilitate consumers in acquiring better-quality inverters that can be seamlessly integrated into solar rooftop systems.

Major players in the market are launching initiatives to integrate clean and sustainable solar energy, attract environmentally conscious customers, and reduce operational costs through energy efficiency measures. For instance, in March 2025, CleanMax Enviro Energy Solutions Pvt. Ltd. (India) partnered with Apple Inc. (U.S.) to bolster renewable energy projects across India, marking a significant milestone in the nation's green energy landscape. Under this partnership, Clean Max successfully installed 14.4 MW of rooftop solar installations across six industrial sites in India. These installations are projected to mitigate approximately 207,000 tons of CO2 emissions throughout their operational life. These initiatives, coupled with increasing government policies, incentives, and regulations aimed at accelerating the transition to a low-carbon economy, are expected to drive the market's growth during the forecast period.

Click here to: Get Free Sample Pages of this Report

Electricity serves as a vital energy source for various modern applications, encompassing lighting, heating, cooling, communication, and industrial processes. However, various factors, such as the rising demand and consumption of electricity, aging infrastructure, fuel price volatility, and regulatory constraints, contribute to the increasing cost of electricity. Households, businesses, and industries grapple with financial strain due to mounting operational expenses. As a result, there is a growing inclination towards alternative energy sources like solar power to alleviate the impact of high electricity prices. Solar energy emerges as a sustainable and cost-effective solution to tackle the challenge of rising electricity prices. Solar inverters play a crucial role in solar energy systems by converting the direct current (DC) electricity generated by solar panels into usable alternating current (AC) electricity. Therefore, the rising demand for solar energy, coupled with the declining costs of solar technology, is expected to drive the growth of the solar inverter market in the coming years.

Companies are integrating digital technologies such as artificial intelligence (AI), machine learning (ML), and data analytics into solar inverters to facilitate real-time monitoring, predictive maintenance, and optimization of solar PV systems. AI algorithms analyze data from various sensors to continually evaluate the performance of solar panels and inverters. Furthermore, ML algorithms empower solar inverters to adapt and optimize their operations in response to changes in environmental conditions. These intelligent solar inverters can dynamically adjust parameters such as voltage and frequency to ensure optimal energy production while maintaining grid stability.

The integration of IoT capabilities into solar inverters facilitates proactive fault detection and troubleshooting, reducing downtime while enabling remote monitoring, control, and management of PV systems. Major market players are actively investing in digital technologies and IoT capabilities to enhance their product offerings and gain a competitive edge. For instance, in May 2024, Huawei Technologies Co., Ltd. (China) launched the FusionSolar Smart PV&ESS Solution, which delivers low-levelized cost of electricity (LCOE), high reliability, and comprehensive digitalization. This solution operates in both on-grid and off-grid scenarios, offering 40% higher renewable power capacity and 30% lower LCOE than conventional solutions. Its 5+4 multi-level safety design ensures comprehensive protection from PV to ESS, covering components to systems, and provides robust cybersecurity. Its comprehensive digitalization enables end-to-end sensing of each component in a power plant. Such advancements, coupled with the increasing need to enhance overall energy production and system reliability, are driving the growth of the solar inverter market.

Smart grids are electricity networks that leverage digital technologies, sensors, and software to optimize the matching of electricity supply and demand in real time, thereby minimizing costs and upholding grid stability and reliability. They contribute to enhancing power quality, transmission reliability, distribution efficiency, and conservation while reducing costs for electric utilities. One key application of smart grid technologies is integrating renewable energy sources, such as solar power, into the grid by enabling bidirectional energy flow and dynamic grid management. Solar inverters play a crucial role in this process by providing essential grid support functions, including voltage regulation and power quality management, to ensure optimal energy production and grid stability. Additionally, they ensure that solar power aligns with the grid's AC infrastructure, facilitating efficient energy distribution and utilization. These factors, combined with the growing demand for solar inverters equipped with grid support functionalities, are expected to offer significant market growth opportunities.

Based on product, the global solar inverter market is broadly segmented into string inverters, micro inverters, power optimizers, hybrid inverters, and central inverters. In 2025, the central inverters segment is expected to account for the largest share of 40.0% of the solar inverter market. The large market share of this segment can be attributed to the increasing demand for cost-effective inverters with high conversion efficiencies, the widespread adoption of central inverters in utility-scale solar farms for connecting large arrays of solar panels, and the increasing utilization of these inverters in commercial and industrial solar projects, such as rooftop installations on warehouses and factories, as well as in solar power plants and microgrid installations.

However, the hybrid inverters segment is projected to register the highest growth rate during the forecast period of 2025 to 2032. The growth of this segment is driven by the growing integration of energy storage systems with solar PV installations, the rising need to reduce reliance on the grid and achieve energy independence, and the continuous technological advancements in energy storage systems.

Based on grid type, the global solar inverter market is broadly segmented into on-grid, off-grid, and hybrid. In 2025, the on-grid segment is expected to account for the largest share of 70.0% of the solar inverter market. The large market share of this segment is attributed to its simplicity, cost-effectiveness, and compatibility with existing grid infrastructure. Additionally, the rising need to reduce reliance on traditional fossil fuel-based electricity generation drives the demand for on-grid solar inverters in residential, commercial, and utility-scale solar PV installations.

However, the hybrid segment is projected to register the highest growth rate during the forecast period of 2025 to 2032. The growth of this segment is driven by the increasing demand for systems capable of operating in both grid-tied and off-grid modes to maximize the self-consumption of solar energy and reduce reliance on grid-supplied electricity. Additionally, the rising utilization of hybrid solar inverters for remote or off-grid applications, particularly in areas where access to the utility grid is limited or unavailable, contributes to the growth of this segment.

Based on phase, the global solar inverter market is broadly single-phase solar inverters and three-phase solar inverters. In 2025, the three-phase solar inverters segment is expected to account for the largest share of 75.0% of the solar inverter market. The large market share of this segment can be attributed to the increasing utilization of three-phase solar inverters in commercial and industrial sectors due to their capacity to handle higher power loads and deliver higher efficiency compared to single-phase solar inverters. Additionally, the rising adoption of three-phase solar inverters in utility-scale solar projects due to their scalability and compatibility with the grid contributes to the significant market share of this segment.

Moreover, the three-phase solar inverters segment is projected to register the highest growth rate during the forecast period of 2025 to 2032. This growth is driven by the increasing initiatives by market players to expand their product portfolios and enhance the capabilities of their existing products. For instance, in March 2022, Delta Electronics, Inc. (Taiwan) launched its new M100A Flex three-phase inverter. With a power range of 15 to 250kW, these inverters are suitable for residential and commercial rooftop PV projects. Featuring a robust IP66 enclosure and compact design for easy transport, they are suitable for both indoor and outdoor installations across various commercial and industrial applications.

Based on end user, the global solar inverter market is broadly segmented into residential, commercial & industrial (C&I), utility-scale, and other end users. In 2025, the utility-scale segment is expected to account for the largest share of 52.0% of the solar inverter market. The large market share of this segment can be attributed to the rising deployment of large-scale solar projects globally aimed at expanding renewable energy capacity and curbing greenhouse gas emissions, supportive policies and regulations from governments encouraging the development of utility-scale solar projects, and the increasing demand for large-scale solar PV installations to generate electricity for distribution to the utility grid.

Moreover, the utility-scale segment is projected to register the highest growth rate during the forecast period of 2025 to 2032.

Based on geography, the global solar inverter market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of 60.0% of the solar inverter market, followed by Europe, North America, Latin America, and the Middle East & Africa. Moreover, the market in Asia-Pacific is projected to register the highest CAGR of 10.0% during the forecast period. The growth of this regional market can be attributed to various factors, including supportive government policies and regulatory frameworks, increasing investments in green energy resources, increasing deployment of solar energy projects, capacity expansion initiatives in power generation plants, rising sustainability and environmental concerns, and the comparatively lower costs of solar energy compared to conventional fossil fuel-based electricity generation.

The report offers a competitive analysis based on an extensive assessment of the leading players' product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the solar inverter market are Siemens AG (Germany), Schneider Electric SE (France), Hitachi Hi-Rel Power Electronics Pvt. Ltd. (India), Sungrow Power Supply Co., Ltd. (China), Huawei Technologies Co., Ltd. (China), Ginlong Technologies Co., Ltd. (China)m Growatt (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (U.S.), FIMER S.p.A. (Italy), TMEIC (U.S.), SolarEdge Technologies Inc. (Israel), Sineng Electric Co., Ltd. (China), ABB Ltd (Switzerland), Luminous Power Technologies Pvt. Ltd. (India), Nexus Solar Energy (India), Waaree Energies Ltd. (India), Delta Electronics, Inc. (Taiwan), Enphase Energy Inc. (U.S.), Fuji Electric Co., Ltd. (Japan), and Havells India Ltd. (India).

In April 2025, Huawei Digital Power Technologies Co., Ltd. (a subsidiary of Huawei Technologies Co., Ltd. (China)) launched the SUN2000-150K-MG0 inverter with an ultra-high efficiency of 98.8% and active safety features for the Commercial & Industrial (C&I) market in the Middle East region.

In March 2025, Luminous Power Technologies Pvt. Ltd. (India) opened a state-of-the-art solar panel manufacturing factory named "Solar Panel Factory" in India. The factory has a production capacity of 250MW, expandable up to 1GW nameplate capacity, for designing and developing all components of solar power generation systems.

|

Particulars |

Details |

|

Number of Pages |

210 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.9% |

|

Market Size (Value) |

USD 18.8 Billion by 2032 |

|

Segments Covered |

By Product

By Grid Type

By Phase

By End User

|

|

Countries Covered |

Europe (Germany, U.K., Italy, France, Spain, Russia, Netherlands, and Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Thailand, Singapore, and Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Argentina, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa) |

|

Key Companies |

Siemens AG (Germany), Schneider Electric SE (France), Hitachi Hi-Rel Power Electronics Pvt. Ltd. (India), Sungrow Power Supply Co., Ltd. (China), Huawei Technologies Co., Ltd. (China), Ginlong Technologies Co., Ltd. (China), Growatt (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (U.S.), FIMER S.p.A. (Italy), TMEIC (U.S.), SolarEdge Technologies Inc. (Israel), Sineng Electric Co., Ltd. (China), ABB Ltd (Switzerland), Luminous Power Technologies Pvt. Ltd. (India), Nexus Solar Energy (India), Waaree Energies Ltd. (India), Delta Electronics, Inc. (Taiwan), Enphase Energy Inc. (U.S.), Fuji Electric Co., Ltd. (Japan), and Havells India Ltd. (India). |

This study focuses on market assessment and opportunity analysis by analyzing the sales of solar inverters across various regions and countries. This study also offers a competitive analysis of the solar inverter market based on an extensive assessment of the leading players' product portfolios, geographic presence, and key growth strategies.

The global solar inverter market is projected to reach $18.8 billion by 2032, at a CAGR of 8.9% during the forecast period.

In 2025, the three-phase solar inverters segment is expected to account for the largest share of 75.0% of the solar inverter market. The large market share of this segment can be attributed to the increasing utilization of three-phase solar inverters in commercial and industrial sectors due to their capacity to handle higher power loads and deliver higher efficiency compared to single-phase solar inverters. Additionally, the rising adoption of three-phase solar inverters in utility-scale solar projects due to their scalability and compatibility with the grid contributes to the significant market share of this segment.

The hybrid segment is projected to register the highest growth rate during the forecast period of 2025 to 2032. The growth of this segment is driven by the growing integration of energy storage systems with solar PV installations, the rising need to reduce reliance on the grid and achieve energy independence, and the continuous technological advancements in energy storage systems.

The growth of this market is driven by the growing focus on sustainability and environmental concerns, government policies and incentives aimed at promoting the use of renewable energy, and the surge in electricity prices. Furthermore, the integration of solar inverters with energy storage systems and the adoption of smart grid technologies are expected to create market growth opportunities.

The key players operating in the solar inverter market are Siemens AG (Germany), Schneider Electric SE (France), Hitachi Hi-Rel Power Electronics Pvt. Ltd. (India), Sungrow Power Supply Co., Ltd. (China), Huawei Technologies Co., Ltd. (China), Ginlong Technologies Co., Ltd. (China)m Growatt (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (U.S.), FIMER S.p.A. (Italy), TMEIC (U.S.), SolarEdge Technologies Inc. (Israel), Sineng Electric Co., Ltd. (China), ABB Ltd (Switzerland), Luminous Power Technologies Pvt. Ltd. (India), Nexus Solar Energy (India), Waaree Energies Ltd. (India), Delta Electronics, Inc. (Taiwan), Fuji Electric Co., Ltd. (Japan), Enphase Energy Inc. (U.S.), and Havells India Ltd. (India).

Asia-Pacific is anticipated to offer substantial growth opportunities for vendors in the solar inverter market during the analysis period. Countries like China, Japan, India, and Singapore are undergoing rapid urbanization and industrialization, resulting in high energy demand. As a result, the region is witnessing an increase in renewable energy infrastructure investments to meet the rising energy needs.

Published Date: Jan-2026

Published Date: Apr-2025

Published Date: Mar-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates