Resources

About Us

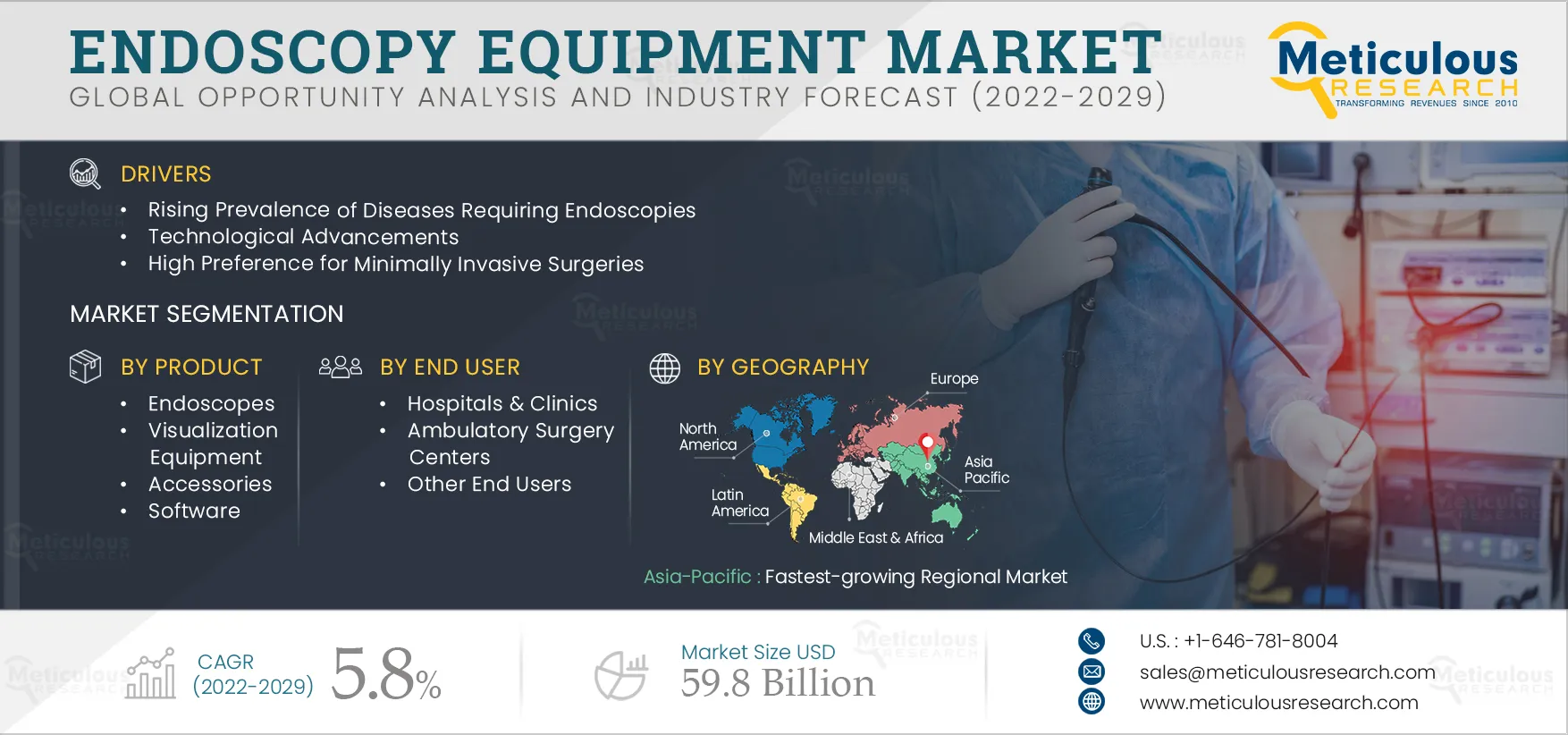

Endoscopy Equipment Market by Type (Endoscope [Flexible, Rigid, Capsule], Visualization System, Accessories [Insufflators, Mouthpieces], Software), Application (Colonoscopy, Arthroscopy, Bronchoscopy, Laryngoscopy), End User - Global Forecast to 2029

Report ID: MRHC - 104273 Pages: 230 Nov-2022 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportEndoscopy procedures are minimally invasive procedures used to examine a patient’s internal organs or tissue. These devices are either placed into the body through natural openings or cavities (such as mouth and anus) or through incisions, especially in the case of arthroscopy. During the endoscopy procedure, equipment and tools, including procedure-specific scopes, video monitors, imaging devices, light sources, monitoring equipment, endoscope cabinets, insufflators, video processors, and endoscopy trolleys or carts are used to ensure a safe and successful procedure.

Endoscopy equipment is primarily used by gynecologists, neurologists, gastroenterologists, nephrologists, hepatologists, cardiologists, and liver transplant surgeons. The endoscopy equipment market is growing due to the rising prevalence of diseases which require endoscopies, technological advancements, and a high preference for minimally invasive procedures. Additionally, emerging economies are expected to provide significant market growth opportunities.

Endoscopy procedures are non-invasive surgeries performed through one or more microscopic incisions with the help of tiny cameras, tubes, and surgical tools. As it is a minimally invasive procedure, it has several benefits, including minimal pain, fewer difficulties with pre-treatment and post-operative treatment, and reduced duration needed for recovery, resulting in shorter hospital stays. As a result, minimally invasive endoscopies are preferred over conventional open surgeries.

The growing prevalence of diseases requiring endoscopic treatments, including cancer and gastrointestinal disorders, drives the market’s growth. According to GLOBOCAN 2020 data, 1.14 million new cancer cases were diagnosed globally, positively impacting the demand for endoscopies. According to data from the Lancet Commission on Global Surgery, almost 80% of cancer cases require surgery. Thus, the rising incidence of cancer drives the demand for endoscopic treatments and devices.

Click here to: Get Free Sample Copy of this report

The high preference for minimally invasive surgeries, the rising prevalence of target diseases, the recurrent use and purchase of endoscopes compared to other equipment, and the moderately higher prices of endoscopes contribute to the large market share of this segment.

Based on Application, in 2022, the Upper Gastrointestinal (GI) Endoscopy Segment is Estimated to Account for the Largest Share of the Market

Based on application, the market is segmented into upper gastrointestinal (GI) endoscopy, colonoscopy, obstetrics/gynecology endoscopy, arthroscopy, urology endoscopy, bronchoscopy, laryngoscopy, and other applications. Upper gastrointestinal (GI) endoscopy is used to diagnose and treat various conditions such as ulcers, cancers, and celiac diseases. Thus, the high prevalence of diseases that require target therapies contributes to the large market share of this segment.

Factors driving the growth of this segment include the increase in the prevalence of diseases that require targeted therapies, such as cancer, gastrointestinal disorders, and other chronic diseases, the availability of reimbursements for surgeries, and preference for hospitals & clinics for any primary care. Furthermore, the availability of highly qualified healthcare professionals and advanced equipment at hospitals contributes to the large market share of this segment.

The growth in this market is attributed to factors such as the growing awareness about the importance of early disease diagnosis, the increase in healthcare spending, advancements in healthcare infrastructure, the rising number of hospitals, and the growing geriatric population with chronic diseases.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between last three years. The key players profiled in the global endoscopy equipment market report are Boston Scientific Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), Richard Wolf GmbH (Germany), FUJIFILM Holdings Corporation (Japan), Olympus Corporation (Japan), Stryker Corporation (U.S.), Medtronic Private Limited (Ireland), Nipro Corporation (Japan), MEDIVATORS B.V. (Germany), HOYA CORPORATION (Japan), and The Cooper Companies, Inc. (U.S.).

This study offers a detailed assessment of the market sizes & forecasts of the endoscopy equipment market based on type, application, and end user. The endoscopy equipment market study also involves the value analysis of the market at the regional and country levels.

The global endoscopy equipment market is projected to reach $59.8 billion by 2029, at a CAGR of 5.8% during the forecast period.

Based on type, the endoscopes segment is estimated to hold the largest share in 2022, owing to the high volume of endoscopies conducted globally.

The growth of the endoscopy equipment market is attributed to factors such as the rising prevalence of diseases that require endoscopies, technological advancements, and the higher preference for minimally invasive procedures. Furthermore, emerging economies are expected to provide significant opportunities for the growth of this market.

The key players profiled in the global endoscopy equipment market study are Boston Scientific Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), Richard Wolf GmbH (Germany), FUJIFILM Holdings Corporation (Japan), Olympus Corporation (Japan), Stryker Corporation (U.S.), Medtronic Private Limited (Ireland), Nipro Corporation (Japan), MEDIVATORS B.V. (Germany), HOYA CORPORATION (Japan), and The Cooper Companies, Inc. (U.S.).

Emerging economies such as China and India are projected to offer significant growth opportunities to the market players due to the rising prevalence of chronic diseases and the technological advancement of endoscopes in these countries.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates