Resources

About Us

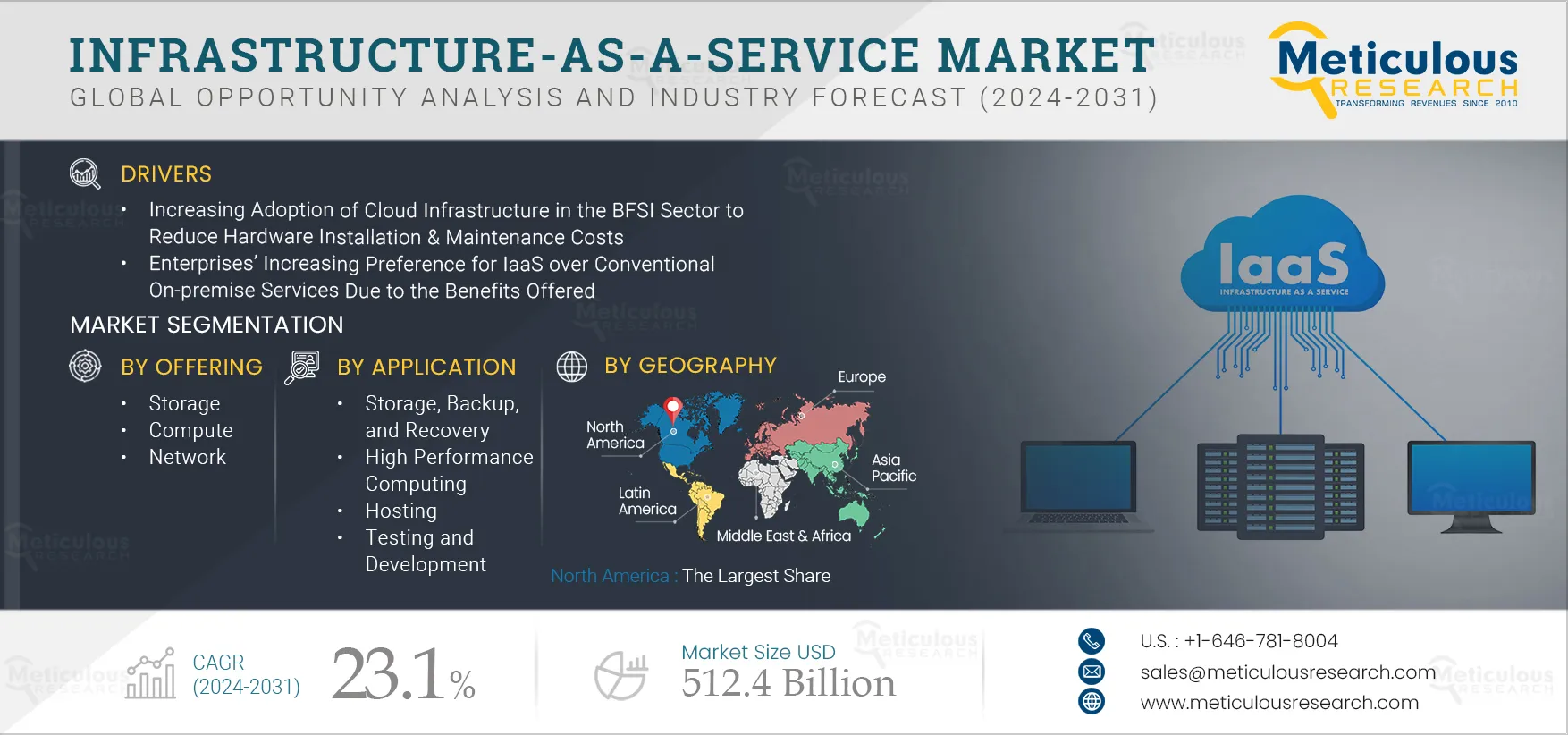

Infrastructure-as-a-Service Market Size, Share, Forecast, & Trends Analysis by Offering (Compute, Storage, Others), Deployment (Public, Private, Hybrid), Organization Size, Application (Hosting, Others), Sector (IT & Telecommunications, BFSI, Others), and Geography - Global Forecast to 2031

Report ID: MRICT - 104764 Pages: 211 Jul-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Infrastructure-as-a-Service Market is expected to reach $512.4 billion by 2031, at a CAGR of 23.1% from 2024 to 2031. The growth of this market is attributed to the growing adoption of cloud infrastructure in the BFSI sector and enterprises’ increasing preference for IaaS over conventional on-premise services. Moreover, the growing adoption of cloud technologies among SMEs and the increasing focus on customized and managed cloud services are expected to offer growth opportunities for the players operating in this market.

Increasing Adoption of Cloud Infrastructure in the BFSI Sector to Reduce Hardware Installation & Maintenance Costs

Cloud technology is being increasingly adopted across the BFSI sector as modern-day banks and financial institutions are exploring innovative ways to reduce costs and increase operational efficiencies. According to a survey by IBM Corporation (U.S.), in 2020, 91% of financial institutions actively used cloud services. Additionally, the COVID-19 pandemic highlighted the fact that banks could no longer rely on their existing legacy systems to fulfill consumer expectations.

According to a survey conducted by Google Cloud (a cloud platform developed by Google LLC, U.S.) and The Harris Poll, LLC. (U.S.), 83% of respondents associated with the BFSI sector stated that their companies used cloud services in some capacity. Most BFSI organizations (38%) preferred a hybrid approach, as it combines the superior security and control of private clouds and the flexibility and scalability of public clouds. Cloud infrastructure is becoming increasingly important in migrating existing IT systems to the cloud to gain actionable insights, drive business growth, and focus on infrastructure and digital banking application modernization. Cloud infrastructure helps reduce hardware installation & maintenance costs and offers cloud services that can be accessed from anywhere. All these benefits are boosting the adoption of the IaaS model in the BFSI sector, driving the growth of this market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Enterprises’ Increasing Preference for IaaS over Conventional On-premise Services Due to the Benefits Offered

Cloud computing is a disruptive technology that offers the ability to remotely process, transmit, and store data, making it increasingly important in the delivery of public and private services. Cloud IaaS provides access to cloud service providers’ infrastructure resources, such as servers, virtual machines, networking resources, and storage. IaaS helps to eliminate the complexity and costs associated with building and maintaining physical infrastructure in on-premise data centers.

In the IaaS model, the cloud service provider (CSP) manages and maintains the infrastructure, allowing enterprises to concentrate on software installation, configuration, management, and data security. IaaS providers also offer additional services, such as detailed billing management, logging, monitoring, storage resiliency, and security. The IaaS model works on a pay-as-you-go basis, allowing customers to only pay for the services or resources required. Also, consumers can easily increase or decrease resources, allowing them to pay less when needed or instantly provision and scale out resources to meet new demands. Such advantages are boosting the adoption of IaaS, driving the growth of this market.

Storage-as-a-Service (STaaS)

Modern-day IaaS providers offer storage-as-a-service (STaaS) solutions, including scalable storage solutions, such as cloud data storage management, built-in data protection, and interoperable S3-API compatibility. Service providers also support multi-tenancy with native QoS and billing. Using STaaS is comparatively more efficient than building private storage infrastructure. Therefore, end users, including small & medium-sized businesses, home offices, and individuals, can benefit from using the cloud for multimedia storage, data repositories, data backup and recovery, and disaster recovery. IaaS providers also offer high-tier services under STaaS, such as database-as-a-service and cloud storage security services. All these benefits of STaaS are encouraging enterprises to adopt cloud managed services.

Leading STaaS providers in this market include Google, Inc. (U.S.), Oracle Corporation (U.S.), Amazon Web Services, Inc. (U.S.), Microsoft Corporation (U.S.), and International Business Machines Corporation (U.S.). Additionally, companies such as Zadara (U.S.), Bell Integrator (U.S.), DataBank, Ltd. (U.S.), Quantum Corporation (U.S.), Henry Schein One, LLC (U.S.), Hitachi Vantara Corporation (U.S.), CDW UK (U.K.), and NetApp, Inc. (U.S.) also provide storage-as-a-service solutions.

Growing Adoption of Cloud Technologies to Boost the Need for IaaS Solutions Among SMEs

The digital transformation trend is not limited only to large enterprises; small and medium-sized enterprises are also transitioning to digital technologies. Many small businesses have plans to digitally transform in order to migrate their workloads to the cloud, as cloud service providers offer affordable and secure business infrastructure solutions. According to Microsoft Corporation (U.S.), 59% of SMBs using cloud services experienced significant productivity benefits from IT compared to just 30% of SMBs not yet transitioned to the cloud. Also, 82% of SMBs reported reduced costs because of adopting cloud technology, and 70% are reinvesting the saved money back into their business.

The installation & maintenance of on-premise infrastructure requires high expenditure, and SMEs have limited IT budgets that restrict spending on new technologies. The IaaS model eliminates the need for physical servers and infrastructure by virtualizing storage, networking, and computing operations. IaaS reduces infrastructure installation, maintenance, and upgradation costs and provides SMEs access to advanced technologies such as AI and big data. These factors are expected to generate growth opportunities for the players operating in the IaaS market.

Based on offering, the infrastructure-as-a-service market is segmented into compute, network, storage, and other offerings. In 2024, the compute segment is expected to account for the largest share of above 42% of the infrastructure-as-a-service market. The large market share of this segment is attributed to the increasing use of virtualized computing resources by SMEs due to limited IT budgets and increasing digital transformation by various sectors to transfer their workload to the cloud.

However, the storage segment is projected to register the highest CAGR during the period. This segment's growth is driven by the increasing volume of data in large enterprises and the increasing demand for storage solutions to reduce the installation and maintenance costs of data centers.

Based on deployment mode, the infrastructure-as-a-service market is segmented into public cloud, private cloud, and hybrid cloud. In 2024, the public cloud segment is expected to account for the largest share of above 50% of the infrastructure-as-a-service market. The large market share of this segment is attributed to the increasing use of the public cloud by small and medium-sized enterprises due to the lower cost of subscription-based or pay-per-usage pricing models in the public cloud.

However, the hybrid cloud segment is projected to register the highest CAGR during the period. This segment's growth is driven by organizations' increasing deployment of hybrid cloud to improve performance and security, modernize existing infrastructure, reduce cost, and use both public and private clouds according to company requirements.

Based on organization size, the infrastructure-as-a-service market is segmented into large enterprises and small & medium-sized enterprises. In 2024, the large enterprises segment is expected to account for the larger share of above 55% of the infrastructure-as-a-service market. The large market share of this segment is attributed to the growing adoption of advanced technologies such as cloud computing, AI, and blockchain, and the rapid migration of IT infrastructure in the cloud.

However, the small & medium-sized enterprises segment is projected to register the highest CAGR during the period. The growth of this segment is driven by the growing digital transformation, growing adoption of public cloud services, and benefits related to IaaS solutions such as low cost, security, and better computing processes.

Based on application, the infrastructure-as-a-service market is segmented into testing and development, hosting, storage, backup, and recovery, high performance computing, and other applications. In 2024, the storage, backup, and recovery segment is expected to account for the largest share of above 38% of the infrastructure-as-a-service market. The large market share of this segment is attributed to the increasing use of cloud storage applications in large enterprises due to the increasing volume of data and growing demand across SMEs to avoid the complexity of storage management, the lack of skilled professionals, and reduce cost.

Moreover, the storage, backup, and recovery segment is also projected to register the highest CAGR during the period. This segment's growth is driven by the increasing digital transformation and migration of workloads to the cloud and the increasing volume of data in large enterprises.

Based on sector, the infrastructure-as-a-service market is segmented into IT & telecommunications, BFSI, healthcare, retail & e-commerce, government & defense, manufacturing, transportation & logistics, and other sectors. In 2024, the IT & telecommunications segment is expected to account for the largest share of above 32% of the infrastructure-as-a-service market. The large market share of this segment is attributed to the increasing adoption of advanced technologies, including cloud computing, and the increasing use of the IaaS model to reduce data centers and increase storage capacity. Telecommunications operators are migrating to cloud infrastructure to decrease operational costs and increase deployment times. For instance, Deutsche Telekom AG (Germany) is using Amazon Web Services, Inc. (U.S.) and Microsoft Corporation (U.S.) cloud infrastructure to reduce its data centers from 89 to 13 across the globe and increase computing and storage capacity by around 25%.

However, the retail & e-commerce segment is projected to register the highest CAGR during the period. The growth of this segment is driven by the increasing need to automate workflows and online transactions, the need for data integrity in the retail & e-commerce industry, and the increasing use of cloud infrastructure to store data and offer insights regarding customer preferences.

In 2024, North America is expected to account for the largest share of above 46% of the infrastructure-as-a-service market. The market growth in North America is driven by the increasing government initiatives for the implementation of cloud computing technologies, the presence of major technology companies in the region, the high acceptance & extensive adoption of cutting-edge technologies in the region, and growing cloud adoption to manage security, infrastructure, network, business continuity, mobility, and regulatory standards within the cloud infrastructure. Companies are increasingly adopting cloud infrastructure to improve business productivity and decision-making capabilities by migrating their on-premise workload to the cloud. For instance, in April 2022, Amazon Web Services, Inc. (U.S.) extended its partnership with Boeing (U.S.), the leading manufacturer of airplanes, rotorcraft, rockets, satellites, and telecommunications equipment, to migrate Boeing’s applications from on-premises data centers to AWS cloud to strengthen their engineering and manufacturing processes.

However, Asia-Pacific is projected to record the highest CAGR of above 24.5% during the forecast period. The region’s growth is attributed to the growing adoption of IaaS by small and medium-sized enterprises to reduce maintenance costs, the increasing proliferation of cloud computing services in China and Japan, and the presence of well-established IaaS providers in China. Increasing investments by major players, such as IBM Corporation (U.S.) and Google LLC (U.S.), to strengthen cloud computing services and the growing adoption of managed cloud data center services in China, Japan, and India are supporting the growth of the IaaS market in Asia-Pacific.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the Infrastructure-as-a-Service market are Amazon Web Services, Inc. (U.S.), Microsoft Corporation (U.S.), Alibaba Cloud (China), Google LLC (U.S.), Huawei Technologies Co., Ltd. (China), Oracle Corporation (U.S.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), VMware, Inc. (U.S.), Rackspace Technology, Inc. (U.S.), DigitalOcean LLC (U.S.), Hewlett Packard Enterprise Company (U.S.), Tencent Cloud (China), Linode LLC (U.S.), NTT Communications Corporation (Japan), Utho (India), and Vultr (U.S.).

|

Particulars |

Details |

|

Number of Pages |

211 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

23.1% |

|

Market Size (Value) |

USD 512.4 Billion by 2031 |

|

Segments Covered |

By Offering

By Deployment Mode

By Organization Size

By Application

By Sector

|

|

Countries Covered |

North America (U.S., Canada), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Europe (U.K., Germany, Italy, Spain, France, Rest of Europe), Latin America and the Middle East & Africa |

|

Key Companies |

Amazon Web Services, Inc. (U.S.), Microsoft Corporation (U.S.), Alibaba Cloud (China), Google LLC (U.S.), Huawei Technologies Co., Ltd. (China), Oracle Corporation (U.S.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), VMware, Inc. (U.S.), Rackspace Technology, Inc. (U.S.), DigitalOcean LLC (U.S.), Hewlett Packard Enterprise Company (U.S.), Tencent Cloud (China), Linode LLC (U.S.), NTT Communications Corporation (Japan), Utho (India), and Vultr (U.S.) |

The infrastructure-as-a-service market study focuses on market assessment and opportunity analysis through the sales of infrastructure-as-a-service solutions across different regions and market segmentations. This study is also focused on competitive analysis for infrastructure-as-a-service based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The infrastructure-as-a-service market is projected to reach $512.4 billion by 2031, at a CAGR of 23.1% during the forecast period.

In 2024, the compute segment is expected to account for the largest share of above 42% of the infrastructure-as-a-service market.

Based on sector, the retail & e-commerce segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the growing adoption of cloud infrastructure in the BFSI sector and enterprises’ increasing preference for IaaS over conventional on-premise services. Moreover, the growing adoption of cloud technologies among SMEs and the increasing focus on customized and managed cloud services are expected to offer growth opportunities for the players operating in this market.

The key players operating in the infrastructure-as-a-service market are Amazon Web Services, Inc. (U.S.), Microsoft Corporation (U.S.), Alibaba Cloud (China), Google LLC (U.S.), Huawei Technologies Co., Ltd. (China), Oracle Corporation (U.S.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), VMware, Inc. (U.S.), Rackspace Technology, Inc. (U.S.), DigitalOcean LLC (U.S.), Hewlett Packard Enterprise Company (U.S.), Tencent Cloud (China), Linode LLC (U.S.), NTT Communications Corporation (Japan), Utho (India), and Vultr (U.S.).

Asia-Pacific is projected to register the highest CAGR of above 24.5% during the forecast period.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jun-2023

Published Date: May-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates