Resources

About Us

Directed Energy Weapons Market Size, Share, Forecast & Trends by Technology (High Energy Laser Technology, High Power Microwave Technology), By Lethality (Lethal and Non-Lethal), By Platform (Land-based DEW, Airborne-based DEW), By Application (Defense and Homeland Security) – Global Forecast to 2035

Report ID: MRAD - 1041593 Pages: 250 Sep-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportDirected Energy Weapons Market Expands Rapidly as High-Energy Lasers, Microwave Systems, and Counter-Drone Needs Drive Global Adoption

Market Summary

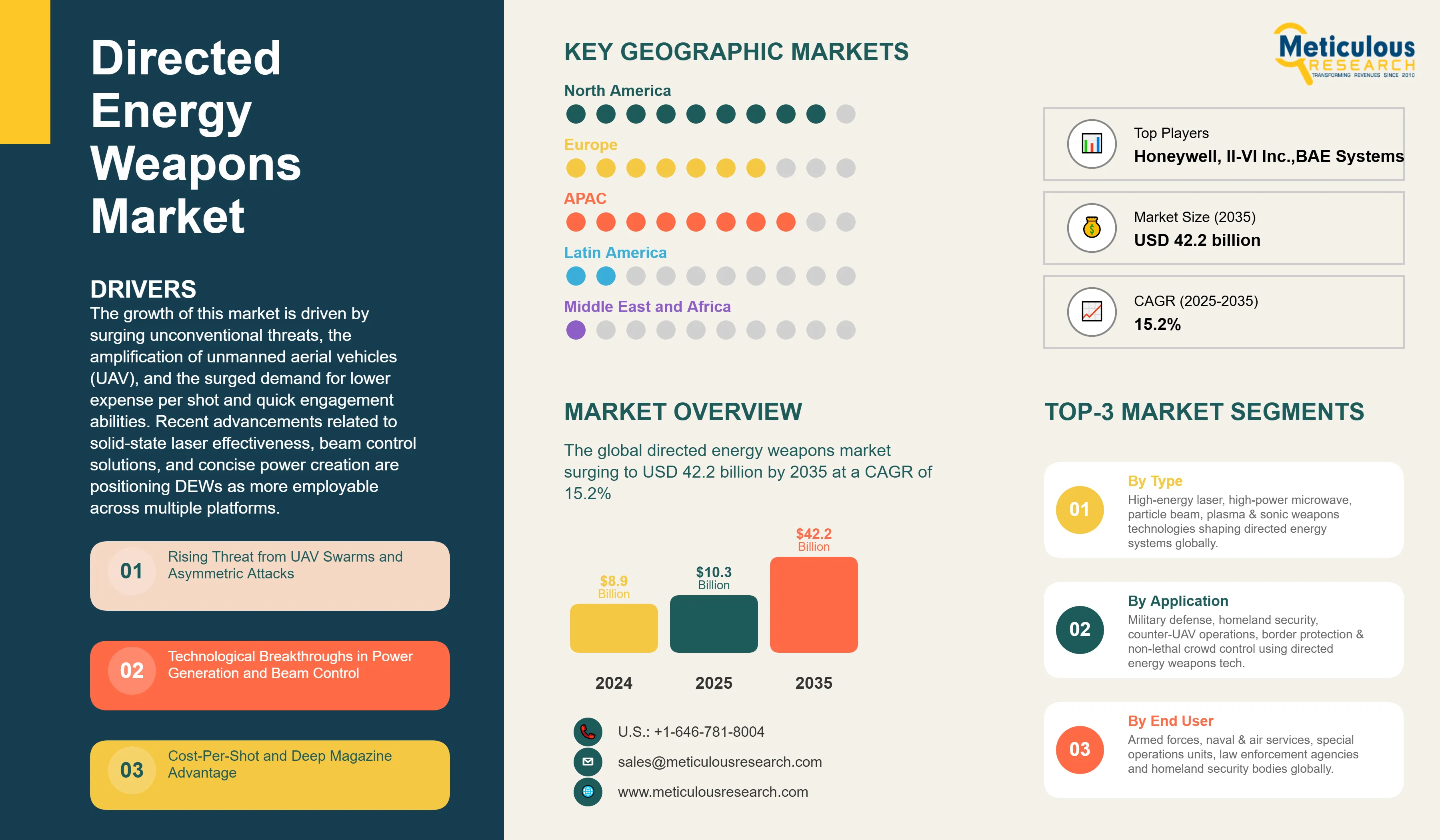

The global directed energy weapons (DEW) market was valued at USD 8.9 billion in 2024 and is projected to reach USD 10.3 billion in 2025, surging to USD 42.2 billion by 2035 at a CAGR of 15.2%. The growth of this market is driven by surging unconventional threats, the amplification of unmanned aerial vehicles (UAV), and the surged demand for lower expense per shot and quick engagement abilities. Recent advancements related to solid-state laser effectiveness, beam control solutions, and concise power creation are positioning DEWs as more employable across multiple platforms. National initiatives such as the U.S. Army’s Directed Energy Maneuver-Short Range Air Defense (DE M-SHORAD), the U.S. Navy’s HELIOS laser, and the UK’s DragonFire project are fuelling operational fielding.

Moreover, high-energy lasers (HELs) and microwave solutions are increasingly incorporated into naval systems, ground modules, and airborne systems. In 2024, the U.S. Department of Defense sanctioned USD 1.1 billion toward advancements in DEW, reporting a 22% surge as compared to 2022. NATO and Indo-Pacific geographies investing in these modalities, with India and Japan introducing national DEW initiatives. The industry is shifting from research & development to procurement, with functional consistency, power scalability, and platform incorporation being key emphasis.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The industry is substantially consolidated, with a combination of reinstated defense stalwarts, focused laser and microwave solution manufacturers, and evolving innovators competing for defense contracts. Leading players include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies (RTX), BAE Systems, and Rheinmetall AG, all of which have active high-energy laser and high-power microwave programs. The competitive edge lies in power output, beam control, and platform adaptability, with firms racing to meet military requirements for mobile, scalable, and cost-efficient DEW systems.

Recent Developments

Raytheon Secures U.S. Army Contract to Advance Directed Energy Wireless Power Beaming Technology

Thales Australia Partners with University of Adelaide to Develop Ultra-Short Pulse Laser Directed Energy Weapon

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting Global Directed Energy Weapons Market (2025–2035)

Base CAGR: 15.2%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Rising threat from UAV swarms and asymmetric attacks |

Accelerates procurement of HEL and HPM systems |

Integration into layered defense architectures across multiple domains |

▲ +2.8% |

|

|

2. Technological breakthroughs in power generation and beam control |

Enables mobile and naval platform deployment |

Expands DEW use into tactical and strategic roles |

▲ +2.4% |

|

Restraints |

1. Power Supply Limitations Restrict Deployment on Mobile Platforms |

Limits adoption for nations with smaller defense budgets |

Slows scaling across all service branches |

▼ −1.6% |

|

|

2. Limited all-weather and battlefield reliability |

Requires redundant kinetic systems |

Drives ongoing R&D investment in adaptive optics and atmospheric compensation |

▼ −1.3% |

|

Opportunities |

1. Counter-hypersonic missile interception |

Early-stage R&D programs gaining funding |

Potential game-changer for strategic missile defense |

▲ +1.7% |

|

|

2. Non-lethal DEWs for crowd control and asset protection |

Expands market into law enforcement and border security |

Creates dual-use export opportunities |

▲ +1.4% |

|

Trends |

1. AI-enabled autonomous target acquisition |

Faster and more accurate engagement decisions |

Fully integrated autonomous DEW platforms |

▲ +1.5% |

|

Challenges |

1. Energy storage and power supply limitations |

Limits portability and continuous operation |

Pushes innovation in compact, high-capacity power systems |

▼ −0.9% |

Regional Analysis

North America Leads in Deployment and Funding for Directed Energy Weapons

North America leads the global DEW market. This dominance is driven by the U.S.’s dominant defense spending and rapid transition of DEW programs from prototypes to fielded systems. According to the U.S. Department of Defense, in 2024, North America accounted for over 50% of global DEW funding, with the Pentagon allocating USD 1.2 billion toward development and deployment. The U.S. Navy, Army, and Air Force are actively integrating DEWs into operational platforms, including destroyers, Stryker vehicles, and AC-130 aircraft. Moreover, according to the U.S. Congressional Research Service, in 2024, the U.S. expanded DEW integration across multiple platforms, including the Army’s DE M-SHORAD system, the Navy’s HELIOS, and the Air Force’s airborne laser trials. The DE M-SHORAD system was deployed on Stryker vehicles and demonstrated successful drone neutralization during live-fire exercises. The Pentagon aims to operationalize DEWs across all services by 2026, with emphasis on interoperability and power scalability.

Canada is also investing in DEW research through its Defence Research and Development Canada (DRDC) program, focusing on non-lethal applications for border security. The region benefits from strong public-private partnerships, with firms like Lockheed Martin, Raytheon, and Epirus leading innovation. Joint exercises have validated DEW performance in real-world scenarios, accelerating procurement timelines.

Asia-Pacific Accelerates Indigenous DEW Programs Amid Regional Tensions

Asia-Pacific is the fastest-growing DEW market, rising with 17.8% CAGR, driven by rising regional tensions, UAV proliferation, and an increasing focus on indigenous defense technologies. According to the Asia-Pacific Security Studies Journal, in 2023, DEW investments in Asia-Pacific rose by majority of share, driven by rising tensions in the South China Sea and border disputes. India’s Defence Research and Development Organisation (DRDO) initiated trials of a 25-kilowatt laser system for drone defense, while Japan’s Ministry of Defense tested microwave-based DEWs for naval applications. China continues to develop high-power laser systems under its PLA Strategic Support Force, with satellite imagery confirming installations on mobile platforms. Regional governments are prioritizing indigenous capabilities to reduce reliance on Western defense systems, with DEWs seen as strategic assets for asymmetric warfare. The region's strategic focus on indigenous development capabilities is evident through substantial government funding for DEW research and development. Growing collaboration between regional governments and international defense contractors accelerates technology transfer and local manufacturing capabilities, boosting the market growth.

China Develops High-Power Laser Systems for Strategic Deterrence

In 2025, China dominated the Asia Pacific regional market with a market share of over 40%. China is aggressively developing DEWs for counter-drone, missile defense, and anti-satellite missions, integrating them into its A2/AD strategy. According to the South China Morning Post, in 2023, China’s PLA deployed high-power laser systems for satellite blinding and drone interception, with installations confirmed in Xinjiang and Tibet. The systems are part of China’s broader strategy to counter U.S. space and aerial dominance. The PLA’s Strategic Support Force is leading DEW development, with emphasis on mobility and integration with radar systems.

China's space program expansion, including completion of its space station in 2022, incorporates directed energy technologies as symbols of power projection capabilities. The nation's significant defense budget allocation enables large-scale research and development initiatives across high-energy laser systems, high-power microwaves, and particle beam technologies. The investment in DEWs reflects its focus on non-kinetic deterrence and asymmetric capabilities. Domestic production capacity and government investment accelerate deployment cycles, while export potential is growing in markets across Africa, the Middle East, and Southeast Asia.

Germany Focuses on Non-Lethal Dews for Crowd Control and Border Security

According to the German Federal Ministry of Defence, in 2022, Germany initiated trials of non-lethal DEWs for crowd control and border security, including microwave-based systems for area denial. The Bundeswehr partnered with Rheinmetall to develop portable DEWs for riot control, with successful tests conducted in Berlin. The country's defense sector demonstrates increasing adoption of directed energy technologies, exemplified by deployment of MLG 27 light laser systems and high-energy laser guns on naval vessels operating in international waters. German defense spending exceeds NATO's 2% GDP requirement, enabling substantial investments in advanced weapon systems and research programs. The nation's approach to DEW development emphasizes precision engineering, reliability, and integration with existing military platforms, reflecting Germany's reputation for technological excellence. Additionally, Germany’s focus is on compliance with EU humanitarian standards, positioning DEWs as tools for law enforcement and peacekeeping rather than battlefield use.

Segmental Analysis

High Energy Laser (HEL) Dominates While High Power Microwave (HPM) Leads in Growth

The high-energy laser (HEL) systems section is expected to grow at 16% CAGR during the forecast period. HELs are being integrated into naval vessels, ground vehicles, and airborne platforms, with power outputs ranging from 20 to 100 kilowatts. Lockheed Martin’s HELIOS and Northrop Grumman’s Solid-State Laser Technology Maturation (SSL-TM) programs have demonstrated successful drone and missile interception. The U.S. Navy reported a 70% success rate in HEL engagements during live-fire trials, validating their operational readiness. HEL systems demonstrate exceptional precision, capable of hitting targets as small as a coin from kilometer distances, as evidenced by the UK's DragonFire laser system trials. The technology's ability to engage multiple targets sequentially at the speed of light provides significant tactical advantages over conventional kinetic weapons. HEL systems are expected to dominate future procurement due to their adaptability and low logistical footprint. Thus, the growing proliferation of aerial threats, particularly drone swarms and precision-guided munitions, positions HEL technology as the optimal solution for modern battlefield requirements, ensuring continued segment leadership throughout the forecast period.

Non-lethal DEWs Gain Traction for Law Enforcement and Peacekeeping Missions

Non-lethal DEWs is expected to witness fastest growth at a CAGR of 18% during the forecast period, particularly for crowd control, disabling vehicles, and protecting critical infrastructure. According to the United Nations Institute for Disarmament Research (UNIDIR), in 2022, non-lethal DEWs saw increased adoption for law enforcement, border control, and peacekeeping operations. Microwave-based systems and dazzlers are being used for area denial, crowd dispersion, and vehicle immobilization. The U.K. Home Office deployed portable dazzlers for riot control, while Germany and France initiated trials of microwave DEWs for border security. These systems offer reduced risk of fatality and comply with international humanitarian standards. Adoption is growing among police forces and UN peacekeeping units, with demand expected to rise amid urban unrest and migration pressures. The segment benefits from reduced regulatory constraints compared to lethal weapons systems, facilitating faster approval processes and broader adoption. Technological advancements in beam control and power modulation enhance precision and reduce collateral effects, addressing ethical concerns while maintaining operational effectiveness in diverse security scenarios.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 10.3 billion |

|

Revenue forecast in 2035 |

USD 42.2 billion |

|

CAGR (2025-2035) |

15.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

By Technology (High Energy Laser Technology, High Power Microwave Technology, Particle Beam Weapons, Plasma Weapons, and Sonic Weapons), By Lethality (Lethal and Non-Lethal), By Platform (Land-based DEW, Airborne-based DEW, Ship-based DEW, and Space-based DEW), By Application (Defense and Homeland Security), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Diehl Defense GmbH & Co. KG, Elbit Systems Ltd., Honeywell International Inc., II-VI Inc., BAE Systems Plc, Kord Technologies, L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Rafael Advanced Defense Systems Ltd., Raytheon Technologies Corporation, Rheinmetall AG, Thales Group, The Boeing Company |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The Directed Energy Weapons Market size is estimated to be USD 10.3 billion in 2025 and grow at a CAGR of 15.2% to reach USD 42.2 billion by 2035.

In 2024, the Directed Energy Weapons Market size was estimated at USD 8.9 billion, with projections to reach USD 10.3 billion in 2025.

Lockheed Martin Corporation, Raytheon Technologies (RTX), Northrop Grumman Corporation, BAE Systems, and Rheinmetall AG are the major companies operating in the Directed Energy Weapons Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025–2035), driven by rising defense budgets, indigenous DEW development programs.

The High Energy Laser (HEL) segment holds the largest share in the Directed Energy Weapons Market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Directed Energy Weapons Market, by Technology

3.2.2. Directed Energy Weapons Market, by Lethality

3.2.3. Directed Energy Weapons Market, by Platform

3.2.4. Directed Energy Weapons Market, by Application

3.2.5. Directed Energy Weapons Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Threat from UAV Swarms and Asymmetric Attacks

4.2.1.2. Technological Breakthroughs in Power Generation and Beam Control

4.2.1.3. Cost-Per-Shot and Deep Magazine Advantage

4.2.2. Restraints

4.2.2.1. High Development and Integration Costs

4.2.2.2. Limited All-Weather and Battlefield Reliability

4.2.3. Opportunities

4.2.3.1. Counter-hypersonic Missile Interception

4.2.3.2. Non-lethal DEWs for Crowd Control and Asset Protection

4.2.4. Trends

4.2.4.1. AI-enabled Autonomous Target Acquisition

4.2.4.2. Integration of DEWs into Multi-Domain Command and Control Networks

4.2.5. Challenges

4.2.5.1. Energy Storage and Power Supply Limitations

4.2.5.2. Performance Degradation in Adverse Weather and Obscured Battlefield Conditions

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on the Directed Energy Weapons Market

4.4.1. Advancements In Laser Power Scaling

4.4.1.1. Development Of 300+ Kw-Class Solid-State and Fiber Lasers for Extended Range and Higher Lethality

4.4.1.2. Compact, Ruggedized HEL Systems Enabling Deployment on Mobile and Airborne Platforms

4.4.2. High Power Microwave (HPM) Innovation

4.4.2.1. Enhanced Pulse Generation and Beam Shaping for Wide-Area Electronic Disruption

4.4.2.2. Miniaturized HPM Units for Integration into Tactical Vehicles and Unmanned Systems

4.4.3. Beam Control and Targeting Systems

4.4.3.1. Adaptive Optics and Atmospheric Compensation to Maintain Beam Quality in Adverse Weather

4.4.3.2. AI-Driven Tracking Algorithms for Engaging Maneuvering and Swarm Threats

4.4.4. Power Generation and Thermal Management

4.4.4.1. High-Density Energy Storage Solutions Reducing Size, Weight, And Power (Swap) Constraints

4.4.4.2. Advanced Cooling Systems Enabling Sustained, Continuous DEW Operation in Combat Conditions

5. Impact of Sustainability on Directed Energy Weapons Market

5.1. Energy-Efficient Beam Generation to Reduce Operational Carbon Footprint

5.2. Use of Recyclable and Lightweight Composite Materials in DEW Components

5.3. Lifecycle Extension Through Modular Upgrades and Refurbishment

5.4. Reduction of Hazardous Materials in Power and Cooling Systems

5.5. ESG-Compliant Procurement Policies Driving Supplier Selection

5.6. Sustainable Manufacturing Practices to Lower Waste and Emissions

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Directed Energy Weapons Market Assessment—By Technology

7.1. Overview

7.2. High Energy Laser Technology

7.3. High Power Microwave Technology

7.4. Particle Beam Weapons

7.5. Plasma Weapons

7.6. Sonic Weapons

8. Directed Energy Weapons Market Assessment—By Lethality

8.1. Overview

8.2. Lethal

8.3. Non-Lethal

9. Directed Energy Weapons Market Assessment—By Platform

9.1. Overview

9.2. Land-based DEW

9.3. Airborne-based DEW

9.4. Ship-based DEW

9.5. Space-based DEW

10. Directed Energy Weapons Market Assessment—By Application

10.1. Overview

10.2. Defense

10.3. Homeland Security

11. Directed Energy Weapons Market Assessment—By Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Netherlands

11.3.5. Switzerland

11.3.6. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. South Korea

11.4.4. Taiwan

11.4.5. India

11.4.6. Singapore

11.4.7. Australia

11.4.8. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. UAE

11.6.2. Saudi Arabia

11.6.3. Israel

11.6.4. South Africa

11.6.5. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. Diehl Defense GmbH & Co. KG

12.2. Elbit Systems Ltd.

12.3. Honeywell International Inc.

12.4. II-VI Inc.

12.5. BAE Systems Plc

12.6. Kord Technologies

12.7. L3Harris Technologies Inc.

12.8. Leonardo S.p.A.

12.9. Lockheed Martin Corporation

12.10. Northrop Grumman Corporation

12.11. Rafael Advanced Defense Systems Ltd.

12.12. Raytheon Technologies Corporation

12.13. Rheinmetall AG

12.14. Thales Group

12.15. The Boeing Company

12.16. Others

13. Appendix

13.1. Available Customization

13.2. Related Reports

Published Date: Sep-2025

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates