1. Introduction

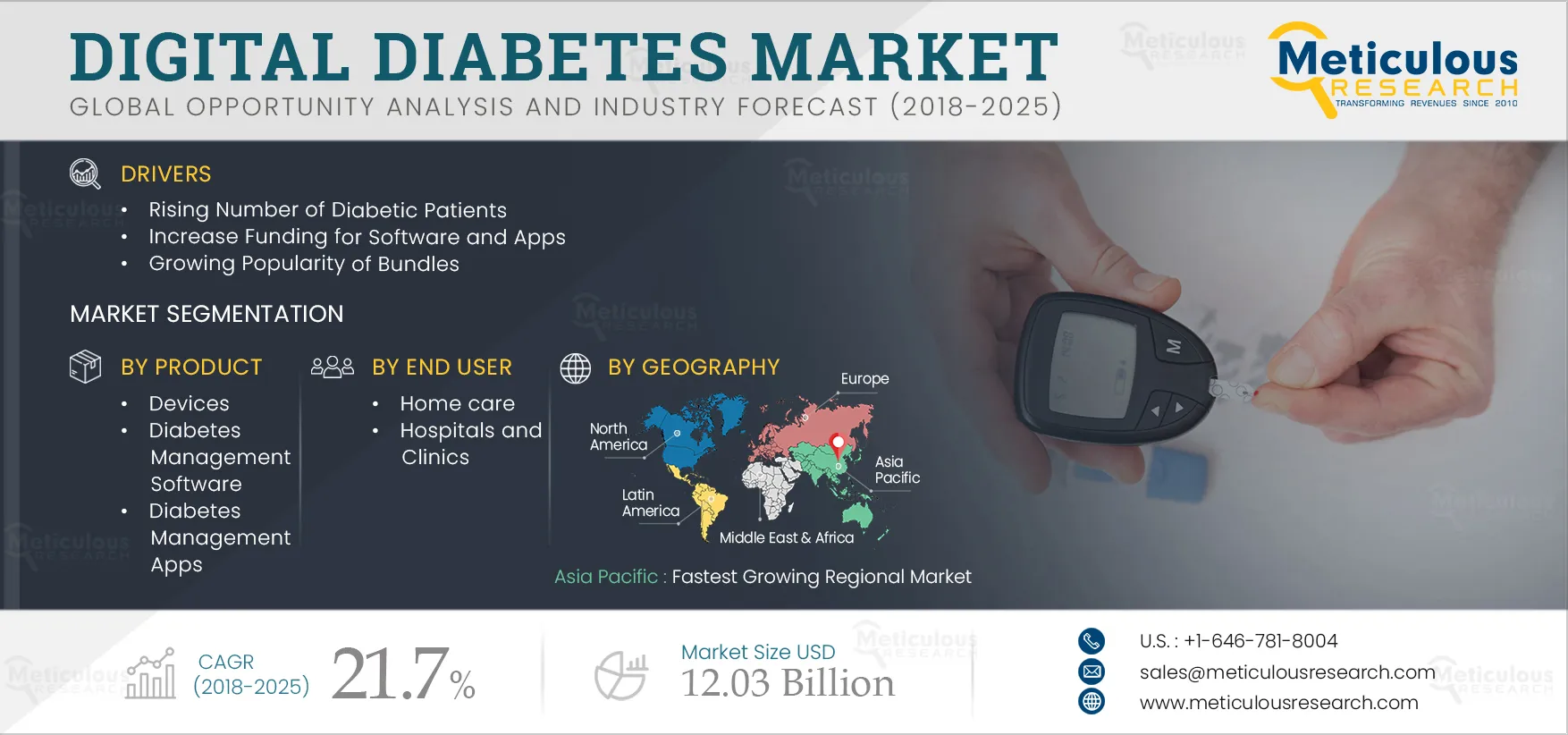

1.1. Market Definition

1.2. Market Segmentation

1.3. Currency

1.4. Limitations

1.5. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.1.1. Secondary Research

2.1.2. Primary Research

2.1.3. Market Size Estimation

3. Executive Summary

3.1. Introduction

3.2. Market Dynamics

3.3. Product Segment Analysis

3.4. End User Segment Analysis

3.5. Regional Analysis

3.6. Competitive Analysis

4. Market Overview

4.1. Introduction

4.2. Drivers

4.2.1. Rising Number of Diabetic Patients

4.2.2. Increase Funding for Software and Apps

4.2.3. Growing Popularity of Bundles

4.2.4. Increase in Penetration of Smartphone & Advance Device-Agonistic Feature

4.3. Restraints

4.3.1. High Cost of Devices and Lack of Proper Reimbursement

4.4. Opportunities

4.4.1. Pipeline Products

4.4.2. High Growth in Emerging Countries

5. Industry Analysis

5.1. Diabetes Statistics

5.2. Evolution of Diabetes Management

5.3. Technology Evolution/Overview

6. Global Digital Diabetes Market, by Product

6.1. Introduction

6.2. Diabetes Management Devices

6.2.1. Smart Insulin Pumps

6.2.1.1. Traditional Insulin Pumps

6.2.1.2. Tubeless/Patch Pumps

6.2.1.3. Threshold Suspend Device System & Close Loop Pumps

6.2.2. Continuous Glucose Monitoring (CGM) Systems

6.2.3. SMBG Systems

6.2.4. Smart Insulin Pens

6.3. Diabetes Management Software

6.4. Diabetes Management Apps

7. Global Digital Diabetes Market, by End User

7.1. Introduction

7.2. Hospitals and Clinics

7.3. Homecare

8. Digital Diabetes Market, by Geography

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. U.K.

8.3.3. France

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. Rest of APAC

8.5. Latin America

8.6. Middle East & Africa

9. Competitive Landscape

9.1. Introduction

9.2. Market Share Analysis

9.3. Competitive Situations and Trends

9.3.1. Approvals

9.3.2. Agreement and Collaborations

9.3.3. Acquisitions

9.3.4. Product Launch

9.3.5. Other Developments

10. Company Profiles (Business Overview, Financial Overview, Product & Service Portfolio, Strategic Developments)

10.1. LifeScan, Inc.

10.2. Roche AG

10.3. Medtronic

10.4. Ascensia Diabetes Care.

10.5. Tandem Diabetes Care, Inc.

10.6. Dexcom, Inc.

10.7. SocialDiabetes

10.8. One Drop.

10.9. H2 Inc.

10.10. Dottli

10.11. Abbott Laboratories

10.12. Ypsomed Holding AG

10.13. ARKRAY, Inc.

10.14. Insulet Corporation

10.15. ACON Laboratories, Inc.

11. Appendix

11.1. Questionnaire

11.2. Available Customization

List of Tables

Table 1 Currency Conversion Rates for USD

Table 2 Emerging Countries: Diabetes Statistics, 2017

Table 3 Top Ten Countries/Territories for Diabetes Prevalence (20-79 Years), 2017-2045

Table 4 Global Diabetes Prevalence (20-79 Years), 2017-2045

Table 5 Technology Innovators

Table 6 Global Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 7 Digital Diabetes Market Size, by Country, 2016-2025 ($Million)

Table 8 Global Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 9 Global Insulin Pump Market Size, by Type, 2016-2025 ($Million)

Table 10 Insulin Pump Market Size, by Country/Region, 2016-2025 ($Million)

Table 11 Global Traditional Insulin Pump Market Size, by Country, 2016-2025 ($Million)

Table 12 Tubeless/Patch Pump Market Size, by Country, 2016-2025 ($Million)

Table 13 Close Loop Pump Market Size, by Type, 2016-2025 ($Million)

Table 14 Current Status of Global Real-Time Continuous Glucose Monitoring Coverage and Reimbursement

Table 15 Continuous Glucose Monitoring Market Size, by Country/Region, 2016-2025 ($Million)

Table 16 Key Smart SMBG Systems

Table 17 Self Monitoring Blood Glucose Systems Market, by Country, 2016-2025 ($Million)

Table 18 Smart Insulin Pen Market, by Country/Region, 2016-2025 ($Million)

Table 19 Key Diabetes Management Software

Table 20 Digital Diabetes Management Software Market Size, by Country/Region, 2016-2025 ($Million)

Table 21 Key Diabetes Management Apps

Table 22 Digital Diabetes Management Apps Market, by Country/Region, 2016-2025 ($Million)

Table 23 Global Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 24 Hospital & Clinical Market Size, by Country/Region, 2016-2025 ($Million)

Table 25 Home Care Market Size, by Country/Region, 2016-2025 ($Million)

Table 26 Digital Diabetes Market Size, by Region, 2016-2025 ($Million)

Table 27 North America: Digital Diabetes Market Size, by Country, 2016-2025 ($Million)

Table 28 North America: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 29 North America: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 30 North America: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 31 North America: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 32 U.S.: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 33 U.S.: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 34 U.S.: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 35 U.S.: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 36 Canada: Diabetes Statistics, 2016 Vs 2026

Table 37 Canada: Cost of Diabetes, $Million (2010 Vs 2020)

Table 38 Canada: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 39 Canada: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 40 Canada: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 41 Canada: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 42 Europe: Diabetes Statistics, 2017-2045

Table 43 Top 5 European Countries: Diabetes Statistics (18-99 Years), 2017

Table 44 Europe: Digital Diabetes Market Size, by Country, 2016-2025 ($Million)

Table 45 Europe: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 46 Europe: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 47 Europe: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 48 Europe: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 49 Germany: Diabetes Statistics (2017)

Table 50 Germany: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 51 Germany: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 52 Germany: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 53 Germany: Digital Diabetes Market, by End User, 2016-2025 ($Million)

Table 54 U.K.: Diabetes Statistics (2017)

Table 55 U.K.: Key Diabetes Apps

Table 56 U.K.: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 57 U.K.: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 58 U.K.: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 59 U.K.: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 60 France: Diabetes Statistics (2017)

Table 61 France: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 62 France: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 63 France: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 64 France: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 65 Italy: Diabetes Statistics (2017)

Table 66 Italy: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 67 Italy: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 68 Italy: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 69 Italy: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 70 Spain: Diabetes Statistics (2017)

Table 71 Spain: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 72 Spain: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 73 Spain: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 74 Spain: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 75 Key RoE Countries: Diabetes Statistics (18-99 Years), 2017

Table 76 Rest of Europe: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 77 Rest of Europe: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 78 Rest of Europe: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 79 Rest of Europe: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 80 Top 5 Asia-Pacific Countries: Diabetes Statistics, 2017

Table 81 Asia-Pacific: Digital Diabetes Market Size, by Country, 2016-2025 ($Million)

Table 82 Asia-Pacific: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 83 Asia-Pacific: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 84 Asia-Pacific: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 85 Asia-Pacific: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 86 China: Diabetes Statistics (2017)

Table 87 China: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 88 China: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 89 China: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 90 China: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 91 India: Diabetes Statistics (2017)

Table 92 India: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 93 India: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 94 India: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 95 India: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 96 Japan: Diabetes Statistics (2017)

Table 97 Japan: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 98 Japan: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 99 Japan: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 100 Japan: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 101 RoAPAC: Diabetes Statistics (2017)

Table 102 Rest of APAC: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 103 Rest of APAC: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 104 Rest of APAC: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 105 Rest of APAC: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 106 Latin America: Diabetes Statistics (2017)

Table 107 Per Capita Diabetes Expenditure in Latin America, by Country, 2015

Table 108 Latin America: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 109 Latin America: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 110 Latin America: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 111 Latin America: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Table 112 Middle East & Africa: Diabetes Statistics, by Country (2017)

Table 113 Per Capita Diabetes Expenditure in Middle East, by Country, 2015

Table 114 Middle East & Africa: Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Table 115 Middle East & Africa: Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Table 116 Middle East & Africa: Insulin Pumps Market Size, by Type, 2016-2025 ($Million)

Table 117 Middle East & Africa: Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

List of Figures

Figure 1 Scope of Global Digital Diabetes Market

Figure 2 Key Stakeholders of Global Digital Diabetes Market Size

Figure 3 Research Process

Figure 4 Key Executives Interviewed

Figure 5 Primary Research Techniques

Figure 6 Market Size Estimation

Figure 7 Global Digital Diabetes Market Size, by Product, 2018-2025 ($Million)

Figure 8 Global Digital Diabetes Market Size, by Product, (2018-2025)

Figure 9 Digital Diabetes Management Devices Market Size, by Type, 2018-2025 ($Million)

Figure 10 Digital Diabetes Management Devices Market Share, by Type, (2018)

Figure 11 Insulin Pumps Market Size, by Type, 2018-2025 ($Million)

Figure 12 Insulin Pumps Market Share, by Type, (2018)

Figure 13 Digital Diabetes Market Size, by End User, 2018-2025 ($Million)

Figure 14 Digital Diabetes Market Size, by End User, 2018

Figure 15 Digital Diabetes Market Size, by Region, 2018-2025 ($Million)

Figure 16 Digital Diabetes Market Size, by Region, 2018-2025

Figure 17 Global Digital Diabetes Market Size, by Product, 2016-2025 ($Million)

Figure 18 Global Digital Diabetes Devices Market Size, by Type, 2016-2025 ($Million)

Figure 19 Global Insulin Pump Market Size, by Type, 2016-2025 ($Million)

Figure 20 Global Digital Diabetes Market Size, by End User, 2016-2025 ($Million)

Figure 21 Digital Diabetes Market Size, by Region, 2016-2025 ($Million)

Figure 22 Market Share Analysis: Insulin Pumps

Figure 23 Market Share Analysis: CGM Systems

Figure 24 Roche AG: Financial Overview (2015-2017)

Figure 25 Medtronic: Financial Overview (2015-2017)

Figure 26 Dexcom, Inc.: Financial Overview (2015-2017)

Figure 27 Abbott Laboratories: Financial Overview (2015-2017)

Figure 28 Insulet Corporation: Financial Overview (2015-2017)