Resources

About Us

Digital Asset Custody Market by Asset Type (Cryptocurrencies, Security Tokens, NFTs, Stablecoins), Custody Solution (Hot Storage, Cold Storage, Warm Storage), Service Model (Self-Custody, Third-Party Custody, Multi-Signature), End User, and Distribution Model - Global Forecast to 2036

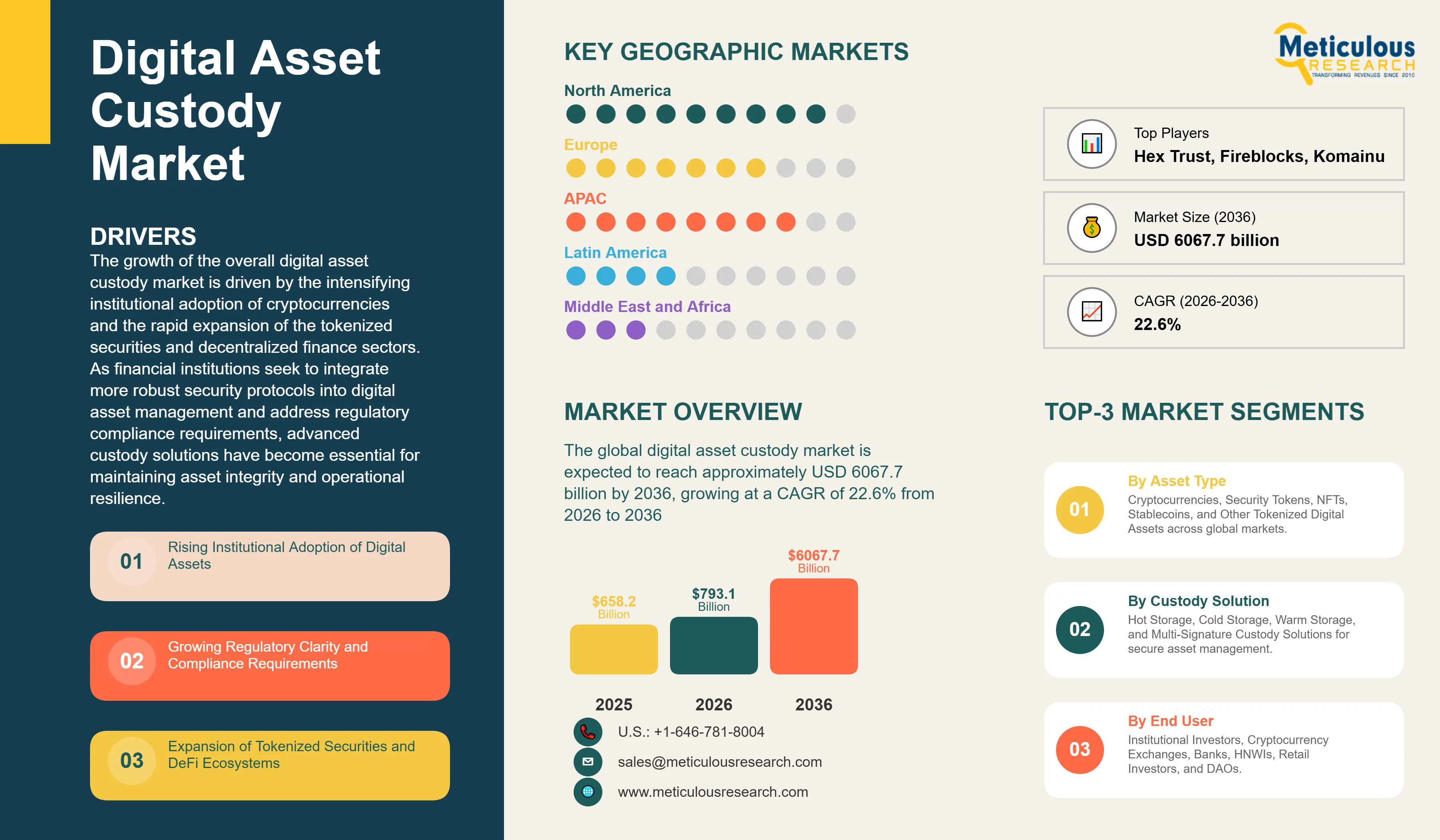

Report ID: MRICT - 1041729 Pages: 178 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global digital asset custody market was valued at USD 658.2 billion in 2025. The market is expected to reach approximately USD 6067.7 billion by 2036 from USD 793.1 billion in 2026, growing at a CAGR of 22.6% from 2026 to 2036. The growth of the overall digital asset custody market is driven by the intensifying institutional adoption of cryptocurrencies and the rapid expansion of the tokenized securities and decentralized finance sectors. As financial institutions seek to integrate more robust security protocols into digital asset management and address regulatory compliance requirements, advanced custody solutions have become essential for maintaining asset integrity and operational resilience. The rapid expansion of the blockchain infrastructure and the increasing need for high-security multi-signature systems and hardware security modules continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Digital asset custody solutions are critical infrastructure systems used to provide secure storage while enabling seamless transaction execution and regulatory compliance throughout the asset lifecycle. These systems include hot wallets, cold storage vaults, and hybrid architectures, which are designed to withstand cyber attacks and fit into diverse institutional frameworks. The market is defined by high-security protocols such as multi-signature authentication and hardware security modules, which significantly enhance asset protection and operational performance in institutional custody applications. These systems are indispensable for financial institutions seeking to optimize their digital asset infrastructure and meet aggressive security and compliance targets.

The market includes a diverse range of solutions, ranging from simple self-custody wallets for individual investors to complex multi-layered institutional platforms for enterprise-grade security and insurance coverage. These systems are increasingly integrated with advanced components such as biometric authentication and distributed key management systems to provide services such as real-time monitoring and automated compliance reporting. The ability to provide secure, high-precision custody while minimizing operational risk has made advanced digital asset custody solutions the technology of choice for industries where financial security and regulatory compliance are paramount.

The global financial sector is pushing hard to modernize custody capabilities, aiming to meet blockchain-integrated trading and institutional digital asset targets. This drive has increased the adoption of high-security vault architectures, with advanced cryptographic defense techniques helping to stabilize operational procedures for ultra-secure asset management. At the same time, the rapid growth in the tokenized securities and decentralized finance markets is increasing the need for high-reliability, institutionally-proven custody solutions.

Proliferation of Institutional-Grade Multi-Signature Systems

Financial institutions across the custody industry are rapidly shifting to enterprise-optimized architectures, moving well beyond traditional wallet designs toward high-security, low-latency transaction setups. Coinbase Custody's latest multi-signature implementations deliver significantly higher asset protection for institutional portfolios, while BitGo's recent deployments have eliminated unauthorized access incidents in operational environments. The real game-changer comes with "smart" custody featuring integrated compliance monitoring capabilities that maintain peak security even in high-frequency trading environments. These advancements make institutional-grade custody practical and cost-effective for everyone from fintech startups to global banking giants chasing operational excellence and lower insurance premiums.

Innovation in Quantum-Resistant Cryptography and Zero-Knowledge Proofs

Innovation in quantum-resistant cryptography and zero-knowledge proof systems is rapidly driving the digital asset custody market, as security protocols become more sophisticated and threat-resistant. Technology providers are now designing platforms that combine the structural integrity of traditional cold storage with the accessibility of hot wallets in a single architecture, saving valuable operational resources and simplifying institutional workflows. These systems often involve advanced key sharding and threshold signature schemes capable of handling ultra-sensitive private keys without compromising transaction speed or regulatory transparency.

At the same time, growing focus on regulatory compliance is pushing providers to develop custody solutions tailored to evolving financial frameworks. These systems help reduce compliance overhead through automated reporting processes and the integration of know-your-customer protocols. By combining high-security key management with robust regulatory performance, these new designs support both technological advancement and institutional confidence, strengthening the resilience of the broader digital asset value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 6067.7 Billion |

|

Market Size in 2026 |

USD 793.1 Billion |

|

Market Size in 2025 |

USD 658.2 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 22.6% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Asset Type, Custody Solution, Service Model, End User, Distribution Model, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Institutional Adoption and Regulatory Clarity

A key driver of the digital asset custody market is the rapid movement of the global financial industry toward blockchain-integrated, highly secure asset management. Global institutional demand for transparent protocols, insurance coverage, and audit-ready custody has created significant incentives for the adoption of professional custody platforms. The trend toward "institutional-grade" technology and the integration of digital assets into traditional portfolio management drive financial institutions toward scalable solutions that digital asset custody can uniquely provide. It is estimated that as institutional adoption of cryptocurrency trading rises and regulatory frameworks become more standardized through 2036, the need for robust, compliant custody solutions increases significantly; therefore, cold storage vaults and multi-signature systems, with their ability to ensure high-security asset protection, are considered a crucial enabler of modern digital finance strategies.

Opportunity: Tokenization of Traditional Assets and DeFi Integration

The rapid growth of the tokenized securities market and decentralized finance ecosystems provides great opportunities for the digital asset custody market. Indeed, the global surge in real estate tokenization, digital bonds, and on-chain derivatives has created a compelling demand for systems that can replace traditional custodian banks and integrate seamlessly into smart contract environments. These applications require high security, cross-chain compatibility, and the ability to handle complex regulatory requirements, all attributes that are met with advanced custody solutions. The tokenized asset market is set to expand significantly through 2036, with digital asset custody platforms poised for an expanding share as institutions seek to maximize operational efficiency and minimize counterparty risk. Furthermore, the increasing demand for yield-generating DeFi protocols and liquid staking solutions is stimulating demand for modular custody architectures that provide high-speed transaction processing and protocol flexibility.

Why Do Cryptocurrencies Lead the Market?

The cryptocurrencies segment accounts for a significant portion of the overall digital asset custody market in 2026. This is mainly attributed to the versatile use of this technology in supporting diversified portfolio allocation and complex trading strategies within institutional investment environments, such as in hedge funds and family offices. These systems offer the most comprehensive way to ensure asset liquidity across diverse high-volume applications. The institutional and retail sectors alone consume a large share of cryptocurrency custody services, with major deployments in North America and Asia Pacific demonstrating the technology's capability to handle high-value transaction requirements. However, the security tokens segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for regulatory-compliant custody in tokenized equity, debt, and real estate applications.

How Does the Cold Storage Segment Dominate?

Based on custody solution, the cold storage segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of institutional assets and the rigorous security standards required for long-term digital asset preservation. Current large-scale custody operations are increasingly specifying air-gapped cold storage architectures to ensure protection against cyber threats and compliance with institutional insurance requirements.

The warm storage segment is expected to witness the fastest growth during the forecast period. The shift toward active trading operations and the complexity of DeFi integrations are pushing the requirement for balanced custody systems that can handle frequent transactions and security protocols while ensuring absolute reliability for mission-critical financial operations.

Why Does Third-Party Custody Lead the Market?

The third-party custody segment commands the largest share of the global digital asset custody market in 2026. This dominance stems from its superior insurance coverage, regulatory compliance infrastructure, and established audit frameworks, making it the service model of choice for institutional investors and large-scale asset managers. Major deployments in traditional finance, cryptocurrency exchanges, and hedge fund operations drive demand, with qualified custodians like Coinbase Custody and BitGo enabling reliable asset protection in high-stakes environments.

However, the self-custody segment is poised for steady growth through 2036, fueled by expanding applications in retail investing and decentralized autonomous organizations. Market participants face mounting pressure to optimize custody solutions for sovereignty-focused applications, where self-custody protocols provide direct control alternatives for privacy-conscious investors.

How is North America Maintaining Dominance in the Global Digital Asset Custody Market?

North America holds the largest share of the global digital asset custody market in 2026. The largest share of this region is primarily attributed to the massive institutional capital allocation and the presence of the world's largest qualified custodians, particularly in the United States and Canada. The United States alone accounts for a significant portion of global custody assets under management, with its position as a leading hub for cryptocurrency investment driving sustained growth. The presence of leading providers like Coinbase Custody, BitGo, and Anchorage Digital, along with a well-developed blockchain infrastructure, provides a robust market for both standard and institutional-grade custody solutions.

Which Factors Support Asia Pacific and Europe Market Growth?

Asia Pacific and Europe together account for a substantial share of the global digital asset custody market. The growth of these markets is mainly driven by the need for regulatory harmonization in the cryptocurrency exchange, institutional investment, and digital banking sectors. The demand for advanced custody platforms in Asia Pacific is mainly due to its large-scale cryptocurrency trading volumes and the presence of innovators like Binance Custody and HashKey Group.

In Europe, the leadership in financial regulation and the implementation of the Markets in Crypto-Assets framework are driving the adoption of compliant custody solutions. Countries like Switzerland, Germany, and the United Kingdom are at the forefront, with significant focus on integrating institutional-grade security protocols into digital asset management and traditional banking infrastructure to ensure the highest levels of asset protection and regulatory compliance.

The companies such as Coinbase Custody, BitGo Holdings Inc., Fireblocks Ltd., and Anchorage Digital Bank lead the global digital asset custody market with a comprehensive range of institutional and retail custody solutions, particularly for large-scale asset management and high-security storage applications. Meanwhile, players including Gemini Trust Company, Fidelity Digital Assets, Copper Technologies, and Ledger Enterprise focus on specialized cold storage and enterprise-grade platforms targeting the institutional investor and cryptocurrency exchange sectors. Emerging providers and integrated platforms such as Paxos Trust Company, Bakkt Holdings, and Komainu are strengthening the market through innovations in regulated custody and tokenized asset management.

The global digital asset custody market is expected to grow from USD 793.1 billion in 2026 to USD 6067.7 billion by 2036.

The global digital asset custody market is projected to grow at a CAGR of 22.6% from 2026 to 2036.

Cryptocurrencies are expected to dominate the market in 2026 due to their superior ability to support diversified institutional portfolios and high-volume trading operations. However, security tokens are projected to be the fastest-growing segment owing to their increasing adoption in tokenized securities, real estate, and regulatory-compliant investment products where institutional-grade custody is required.

Tokenization and DeFi are transforming the custody landscape by demanding higher security protocols, lower counterparty risk, and improved regulatory transparency. These technologies drive the adoption of advanced solutions like multi-signature wallets and hardware security modules, enabling custody providers to support the complex architectural requirements and high-frequency transaction demands of next-generation digital finance.

North America holds the largest share of the global digital asset custody market in 2026. The largest share of this region is primarily attributed to the massive institutional investment flows and the presence of the world's largest qualified custodians in the United States and Canada. Asia Pacific and Europe together account for a substantial share, driven by high-volume applications in cryptocurrency exchanges and regulatory-compliant institutional custody.

The leading companies include Coinbase Custody, BitGo Holdings Inc., Fireblocks Ltd., Anchorage Digital Bank, and Gemini Trust Company.

Published Date: Feb-2026

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Apr-2023

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates