Resources

About Us

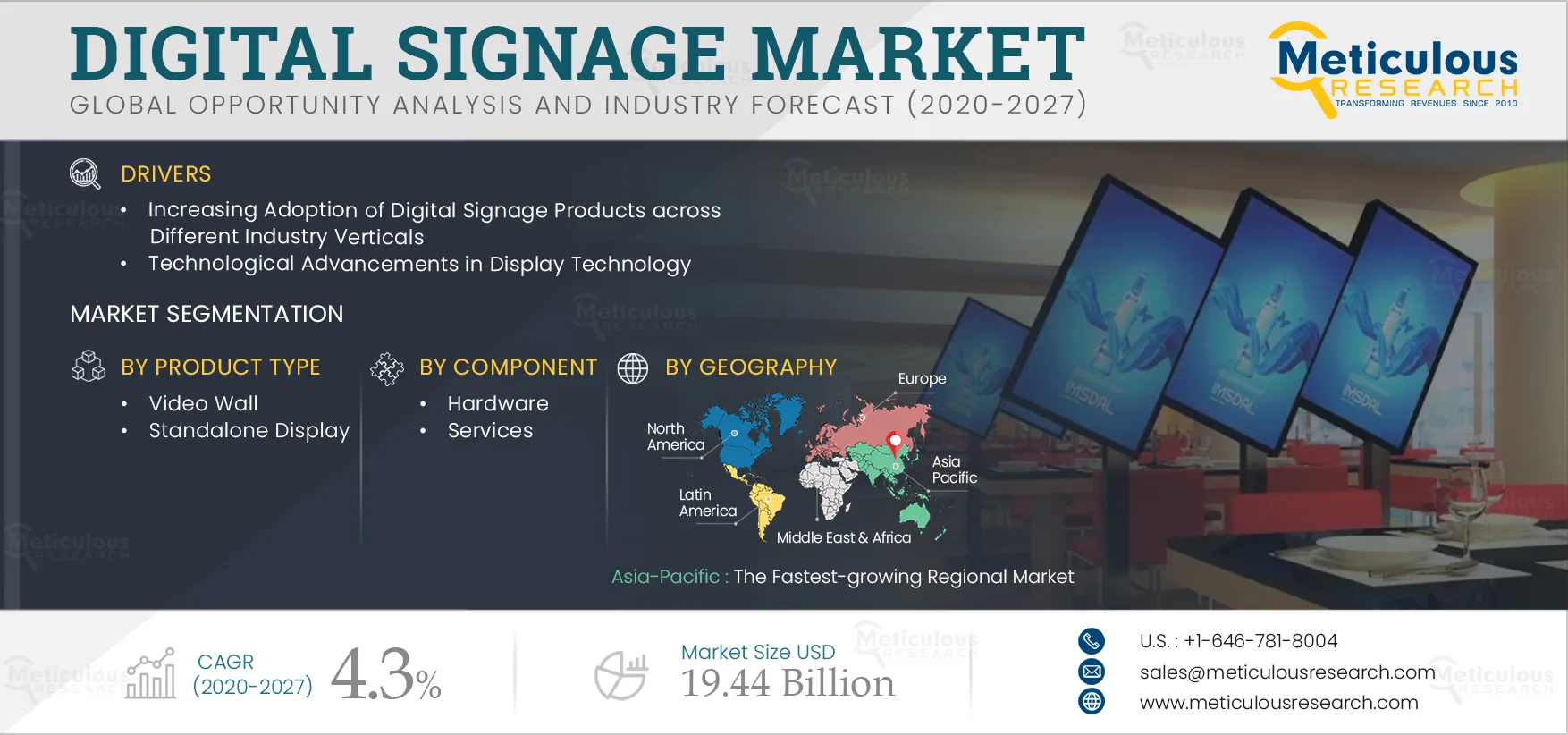

Digital Signage Market Product Type (Videowall, Kiosk, Menu boards and Billboards) Component (Hardware (LCD, LED and OLED)), Services), Application, Industry Vertical (Retail, Hospitality, Entertainment, Transportation, Healthcare) - Global Forecast to 2027

Report ID: MRICT - 104391 Pages: 206 Jun-2020 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Digital Signage Market is expected to reach $19.44 billion by 2027, at a CAGR of 4.3% during the forecast period of 2020 to 2027. Rising adoption of digital signage products in commercial vertical, rapid digitization in emerging countries and technological advancement in display technology are the key factors driving the growth of the overall digital signage market. Besides, proliferation of smart cities offers significant opportunities for the growth of the digital signage market. However, increasing trend of online advertisement obstructs the growth of this market to some extent.

The ongoing COVID-19 outbreak has adversely affected the display industry with manufacturing operations temporarily suspended across major manufacturing hubs, leading to a substantial slowdown in the production. Due to increasing restrictions on public gatherings and travel, people are becoming far more isolated as well. Players operating in the digital signage market are also feeling the impact of the COVID-19 pandemic due to supply chain disruptions and stock market volatility. Some of the key display manufacturers including Samsung, LG Display, and Xiaomi among others have suspended their manufacturing operations in China, India, South Korea, and European countries. In addition to the impact on production activities, the ongoing pandemic has taken a toll on the consumer demand as well for display integrated devices, likely exacerbated by the lockdown imposed across major countries.

The uncertainty regarding the possible length of lockdown and supply chain disruptions has made it even more difficult for industry players to anticipate the resurgence in the displays and digital signage industry. During the COVID-19 outbreak many industry players have deployed digital signage products to help combat the coronavirus pandemic. For instance, NoviSign Digital Signage has introduced a digital signage hand sanitizer kiosk that features an auto-dispenser that supports gel, foam or liquid sanitizer along with a 21.5-inch display that supports NoviSign's digital signage software. In addition, according to CEO of BrightSign, the stock market volatility as a result of coronavirus fears may cause budget reductions and approval delays that could impact demand for digital signage solutions in the near-term.

Furthermore, due to COVID-19 pandemic, many industry sectors may decrease marketing and advertising spending this year as a result of slower sales and profits which is expected to obstruct the growth of digital signage market. MAGNA a manufacturing company expects the COVID-19 impact on revenues to be severe for the travel and restaurant industries, moderate for retail and automotive, mild for consumer packaged goods (CPG/FMCG), and potentially positive for e-commerce and home entertainment (SVOD).

Rising adoption of digital signage products in commercial vertical to fuel the growth

Retailers can create an enriching shopping environment by implementing market to entice information-driven consumers to pause, look, and purchase products and services. With the help of digital signage, retailers can project images and videos to showcase products and capture viewer interest, as well as they can arrange displays and compose content to create an artistic and dynamic atmosphere. Owing to increasing digitization, consumers increasingly depend on online content to find information, get deals, discover new ideas, and become inspired before making a purchase. According to the Cisco IBSG study, over 40 percent of shoppers say that digital displays, such as video walls, can change what they buy. By using digital signage to provide relevant information to an audience near the point of purchase, retailers have generated higher brand awareness and sales uplift.

The hospitality industry started recognizing the importance of digital communication to ensure guest satisfaction and reinforce their brand’s differentiating factors. Digital signage for the hospitality industry creates an integrated and dynamic system, linking the operations and marketing aspects of the hotel to create an efficient system that benefits their guest as well as hotel staff. Several players in this industry already started adopting digital signage as a way to attract guests and improve their experience. For instance, The Hyatt Regency Chicago is one of the many hotel chains that have embraced the signage technology. The Hyatt’s installed 40-inch NEC Multi Sync LCD4010 and32-inch NEC Multi Sync LCD3210 displays to cover the public areas and 228,000 square feet of meeting space at the Hyatt. Thus, increasing adoption of digital signage products in commercial verticals is driving the growth of this market.

Click here to: Get Free Request Sample Copy of this report

Standalone display to command the largest share through 2027

The standalone display segment is estimated to command the largest share of the overall digital signage market in 2020. The large share of this segment is mainly attributed to growing transport networks, public infrastructure, and new commercial buildings particularly in developing economies along with the integration of interactive displays such as touch screens, movement detection, and active image capture devices.

Digital signage hardware segment is estimated to dominate the overall digital signage market in 2020

Based on the component, the hardware segment is estimated to command the largest share of the overall digital signage market in 2020. This growth is driven by growing digital signage market adoption in commercial verticals, increasing retail space, and growing infrastructural developments in emerging economies. Besides, growing number of innovative display technologies such as 1080p, 4K, and 8K display and newer technologies such as fine-pixel LED and OLED are expected to further propel demand for hardware components in the next few years. However, the advancements in digital signage software technology and increasing demand for better data analysis and content management will result in the software segment emerging as the fastest-growing segment during the forecast period.

In 2020, indoor signage segment to hold the largest share of the digital signage market

Based on the application, indoor signage segment is estimated to command the largest share of the overall digital signage market in 2020. The growth of this market is driven by the usage of immersive and highly interactive display technologies in sports stadiums, indoor arenas, airports, bus/rail stations, retail stores, schools, hotels, restaurants, and so on. The indoor signage is generally based on LCD, OLED, or fine-pixel LED technology and requires no additional protective features to make them waterproof and operational at high temperatures. Besides, the demand for outdoor signage is expected to rise owing to the growing transportation sector in developing countries.

Retail vertical to dominate the digital signage market

Based on industry vertical, the retail segment is estimated to account for the largest share of the overall digital signage market in 2020. The segment is predicted to maintain its market position over the forecast period and exhibit growth at a considerable pace due to consistent demand.

Asia-Pacific: The fastest-growing regional market

North America region is estimated to command the largest share of the global digital signage market in 2020, followed by Europe, Asia Pacific, Latin America, and the Middle East and Africa. However, Asia-Pacific region is expected to witness rapid growth during the forecast period. Asia-Pacific region is expected to witness rapid growth during the forecast period. The region has a large number of young and tech-savvy population which is the target population for digital signage. With increasing disposable incomes, this population is increasingly embracing the new technologies made available in the market. Owing to this, Asia-Pacific is ranked as the fastest-growing regional market in the global digital signage market. Japan, China, and India are the major revenue generating countries in the APAC digital signage market on account of technological advancements and infrastructural development.

Key Players

The report includes the competitive landscape based on extensive assessment of the key strategic developments adopted by the leading market participants in the digital signage industry over last four years. The key players profiled in the global digital signage market are LG Electronics, Inc. (South Korea), Samsung Electronics Co., Ltd. (South Korea), Shanghai Goodview Electronics Co., Ltd. (China), Intel Corporation (U.S.), Hewlett Packard Company (U.S.), Cisco Systems, Inc. (U.S.), NEC Corporation (Japan), Sony Corporation (Japan), Hitachi, Ltd. (Japan), Panasonic Corporation (Japan), Sharp Corporation (Japan), AU Optronics Corporation (Taiwan), Leyard Optoelectronics Co., Ltd. (U.S.), Delta Electronics, Inc. (Taiwan), and Barco NV (U.S.).

Scope of the report

Digital Signage Market, by Product Type

Digital Signage Market, by Component

Digital Signage Market, by Application

Digital Signage Market, by Industry Vertical

Digital Signage Market, by Geography

Key questions answered in the report:

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Apr-2023

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates