Resources

About Us

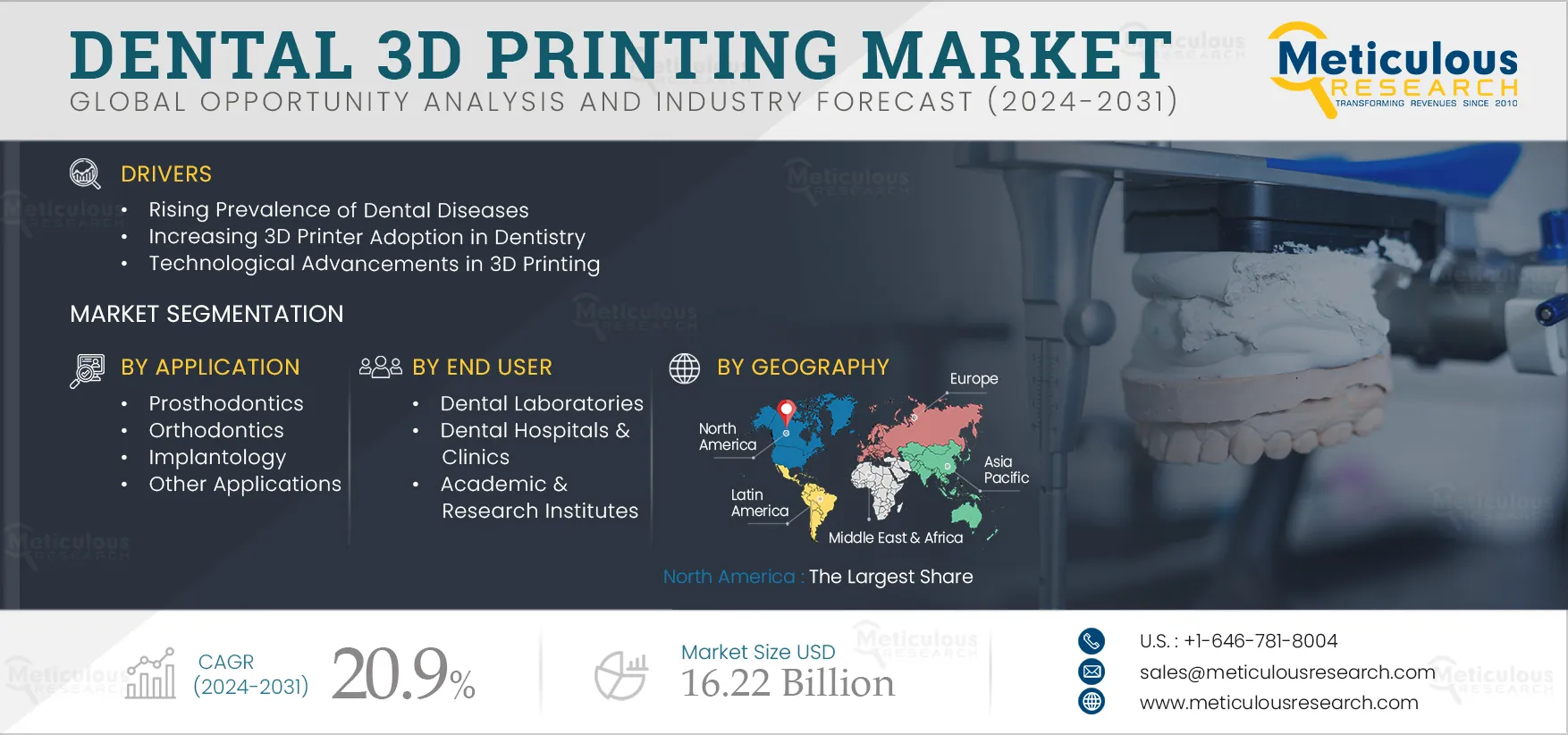

Dental 3D Printing Market by Product (Service, Printer, Scanner, Material [Polymer, Metal, Zirconia, Alumina]) Technology (Polyjet, FDM, SLS, Vat Photopolymerization) Application (Orthodontics, Prosthodontics, Implant) End User—Global Forecast to 2032

Report ID: MRHC - 104803 Pages: 175 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportIn dentistry, 3D printing is recognized for its high quality and dependability. It is used to replace or repair damaged teeth, design orthodontic models, make crowns, bridges, and caps, and build surgical tools. The use of 3D printing streamlines operations and decreases time and labor requirements. It also reduces errors and improves cost efficiency.

The increasing acceptance of 3D printing in dentistry, technological improvements, and the rising frequency of dental diseases all contribute to the market's growth. Furthermore, the rising adoption of CAD/CAM technology and increased use of resins for dental 3D printing are offering opportunities for market growth.

The growing edentulous population and increased demand for dental treatments are driving the use of 3D printing in dentistry. Edentulism is primarily caused by chronic oral disorders such as advanced tooth caries, severe periodontal disease, or trauma.

According to the World Health Organization (WHO), as of November 2022, the global prevalence of edentulism was approximately 7% among individuals aged 20 years and older. For those aged 65 years and above, the prevalence increased to an estimated 23% worldwide. In 2021, a significant proportion of individuals aged 65 and older opted for tooth replacement procedures.

According to The Healthy Journal, there is also a growing preference for tooth replacement procedures among adults aged 20 to 65. Consequently, the increasing edentulous population combined with the rising demand for tooth replacement is driving the need for dental 3D printers.

Click here to: Get Free Sample Pages of this Report

Digital dentistry is transforming the 3D printing market by optimizing and improving dental care processes. The integration of 3D printing in dentistry facilitates the accurate production of dental implants, crowns, bridges, and orthodontic devices directly from digital scans, thereby reducing both turnaround time and costs. This technology provides customized solutions that enhance patient comfort and treatment outcomes. Moreover, it enables the creation of complex geometries and high-quality, biocompatible materials essential for dental applications. As digital workflows become increasingly embedded in dental practices, the demand for 3D printing technology in dentistry is expanding, fueling innovation and market growth.

A consolidation trend is emerging in the dental 3D printing industry, with larger companies acquiring smaller private firms or laboratories to leverage their ability to invest in new technologies. As the dental labs market consolidates, larger laboratories, which typically operate multiple systems and are more inclined to invest in high-end machinery, are leading the way. These acquisitions are expected to enhance the distribution coverage of newly acquired products, thereby boosting sales of both machinery and printing materials. Some of the consolidations among the players are mentioned below:

Computer-aided design/computer-aided manufacturing (CAD/CAM) systems are extensively utilized in dentistry for creating inlays, crowns, fixed partial dentures, and implant prostheses. Additionally, CAD/CAM technology has been adapted for the production of complete dentures, providing numerous benefits for both dentists and patients. This technology reduces the number of appointments required and allows for the storage of digital data, facilitating the quick availability of replacement dentures.

The dental industry has been using subtractive manufacturing or milling, but it does not consider the internal structure and does not reproduce complex models. However, CAD software, intricate algorithmic designs, and artificial intelligence help in modeling objects to reproduce them as desired. This technology is highly prevalent in large laboratories in developed countries.

Technological advancements and the availability of hardware/software alternatives are accelerating the adoption of CAD/CAM systems, and even smaller dental clinics are moving ahead with the adoption. The dental CAD/CAM materials also offer higher quality, user-friendliness, and enhanced aesthetics.

Based on offering, the dental 3D printing market is segmented into services, systems, materials, and accessories. In 2025, the services segment is expected to account for the largest share of 51.3% of the dental 3D printing market. This segment’s large market share is attributed to the increased outsourcing for product design in dentistry and competitive pricing offered by the service providers of dental 3D printing. Dental laboratories outsource dental product design services due to advantages such as the generation of rapid prototypes, less equipment and human resources, and reduced production costs.

Similarly, the services segment is estimated to register the highest CAGR of 21.1% during the forecast period. This segmental growth is attributed to the rising demand for high-quality dental prosthetics in developing countries, technological advancements in 3D printing, and the growing adoption of custom products and 3D printing services offered by the players operating in the market. The companies offer customized dental 3D printed products as per the customer's requirements. This results in providing suitable dental prosthetics and dental implants to patients based on their preference for design, materials, and quality of dental products.

Based on application, the dental 3D printing market is segmented into prosthodontics, orthodontics, implantology, and other applications. In 2025, the prosthodontics segment is expected to account for the largest share of 39.9% of the dental 3D printing market. This segment’s major market share is due to the high prevalence of edentulism and the surge in demand for prosthodontics such as crowns & bridges.

However, the orthodontics segment is expected to register the highest CAGR of 22.1% during the forecast period. The increasing demand for clear aligners, the rising adoption of 3D printing technology for clear aligners by both companies and dental professionals, and a growing awareness of personal appearance drive this segment's growth.

Based on end user, the dental 3D printing market is segmented into dental laboratories, dental hospitals & clinics, and academic & research institutes. In 2025, the dental laboratories segment is expected to account for the largest share of the dental 3D printing market. An increase in the number of dental laboratories, expansion of dental laboratories in developing economies, and rapid adoption of advanced technologies by dental laboratories are some factors supporting this segment's large market share.

However, the dental hospitals and clinics segment is expected to grow at the highest CAGR during the forecast period. This growth is attributed to the growing demand for same-day dental restorations, the rising adoption of chair-side dentistry, and the growing adoption of CAD/CAM and 3D printing by dentists in their places of practice.

CAD/CAM and 3D printing technologies have gained significant traction in dentistry. CAD/CAM systems enhance the precision and efficiency of producing dental restorations such as crowns, bridges, and veneers. Meanwhile, 3D printing has transformed prosthodontics by enabling dentists to fabricate customized dental prosthetics directly in their offices, reducing reliance on dental laboratories for less complex cases.

Based on geography, the dental 3D printing market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 33.3% of the dental 3D printing market. The major factors driving the substantial share of this market include the widespread adoption of cosmetic dentistry, significant spending on oral care, a high prevalence of tooth loss and dental caries, the presence of leading market players, and the burden of an aging population.

However, Asia-Pacific is poised to register the highest CAGR of 23.5% during the forecast period. Emerging markets such as China and India present lucrative opportunities for market players due to increasing awareness of dental health and the expanding penetration of digital dentistry. Moreover, rising disposable incomes are leading to greater adoption of dental procedures, while the demand for higher-quality dental prosthetics is further driving the adoption of dental 3D printing in these countries.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants in the last three to four years. The key players profiled in the dental 3D printing market report are 3D Systems Corporation (U.S.), DENTSPLY SIRONA Inc. (U.S.), Stratasys Ltd. (Israel), Straumann Holding Ag (U.S.), Shandong Huge Dental Materials Corporation (China), Ultradent Products, Inc. (U.S.), SLM Solutions Group AG (Germany), Formlabs Inc. (U.S.), (Desktop Metal, Inc. ) a subsidiary of EnvisionTec Inc. (U.S.), Keystone Industries (U.S.), 3M Company (U.S.), and DWS S.r.l. (Italy).

In February 2022, Desktop Metal, Inc. (U.S.) launched the Einstein series of 3D printers along with Flexcera Smile Ultra+, a dental resin designed to provide precise 3D printable smiles.

|

Particular |

Details |

|

Page No |

175 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

20.9% |

|

Market Size (Value) |

$16.22 billion by 2032 |

|

Segments Covered |

By Offering

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Sweden, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

3D Systems Corporation (U.S.), DENTSPLY SIRONA Inc. (U.S.), Stratasys Ltd. (Israel), Straumann Holding AG (U.S.), Shandong Huge Dental Materials Corporation (China), Ultradent Products, Inc. (U.S.), SLM Solutions Group AG (Germany), Formlabs Inc. (U.S.), (Desktop Metal, Inc.) a subsidiary of EnvisionTec Inc. (U.S.), Keystone Industries (U.S.), 3M Company (U.S.), and DWS S.r.l. (Italy) |

This study covers the market size and forecasts for various dental 3D printing services and systems, such as dental 3D printers and scanners, materials, and accessories offered by key companies. These products can be used in dental laboratories, dental hospitals and clinics, and academic and research institutes.

The dental 3D printing market is expected to reach $16.22 billion by 2032, at a CAGR of 20.9% during the forecast period.

Based on offering, the services segment is expected to account for the largest share of the dental 3D printing market in 2025.

Based on application, the orthodontics segment is projected to register the highest CAGR over the forecast period. Technological advancements in orthodontic devices and the wide use of 3D printing in orthodontics support its growth.

Based on end user, in 2025, the dental laboratories segment is expected to account for the largest share of the dental 3D printing market. An increase in the number of dental laboratories, expansion of dental laboratories in developing economies, and rapid adoption of advanced technologies by dental laboratories are the factors supporting this segment's large market share.

Based on geography, North America is projected to account for the largest share of the market in 2025. This large share is attributed to the high burden of the aging population, the high incidence of tooth loss and dental caries, the presence of leading market players, and high spending on oral care.

The growth of this market is driven by the increasing adoption of 3D printing in dentistry, technological advancements, and the rising prevalence of dental diseases. In addition, the rising adoption of CAD/CAM technology and increased use of resins for dental 3D printing are offering opportunities for the growth of this market.

The key players profiled in the dental 3D printing market report are 3D Systems Corporation (U.S.), DENTSPLY SIRONA Inc. (U.S.), Stratasys Ltd. (Israel), Straumann Holding Ag (U.S.), Shandong Huge Dental Materials Corporation (China), Ultradent Products, Inc. (U.S.), SLM Solutions Group AG (Germany), Formlabs Inc. (U.S.), Desktop Metal, Inc. (a subsidiary of EnvisionTec Inc.) (U.S.), Keystone Industries (U.S.), 3M Company (U.S.), and DWS S.r.l. (Italy).

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Published Date: Nov-2024

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates