Resources

About Us

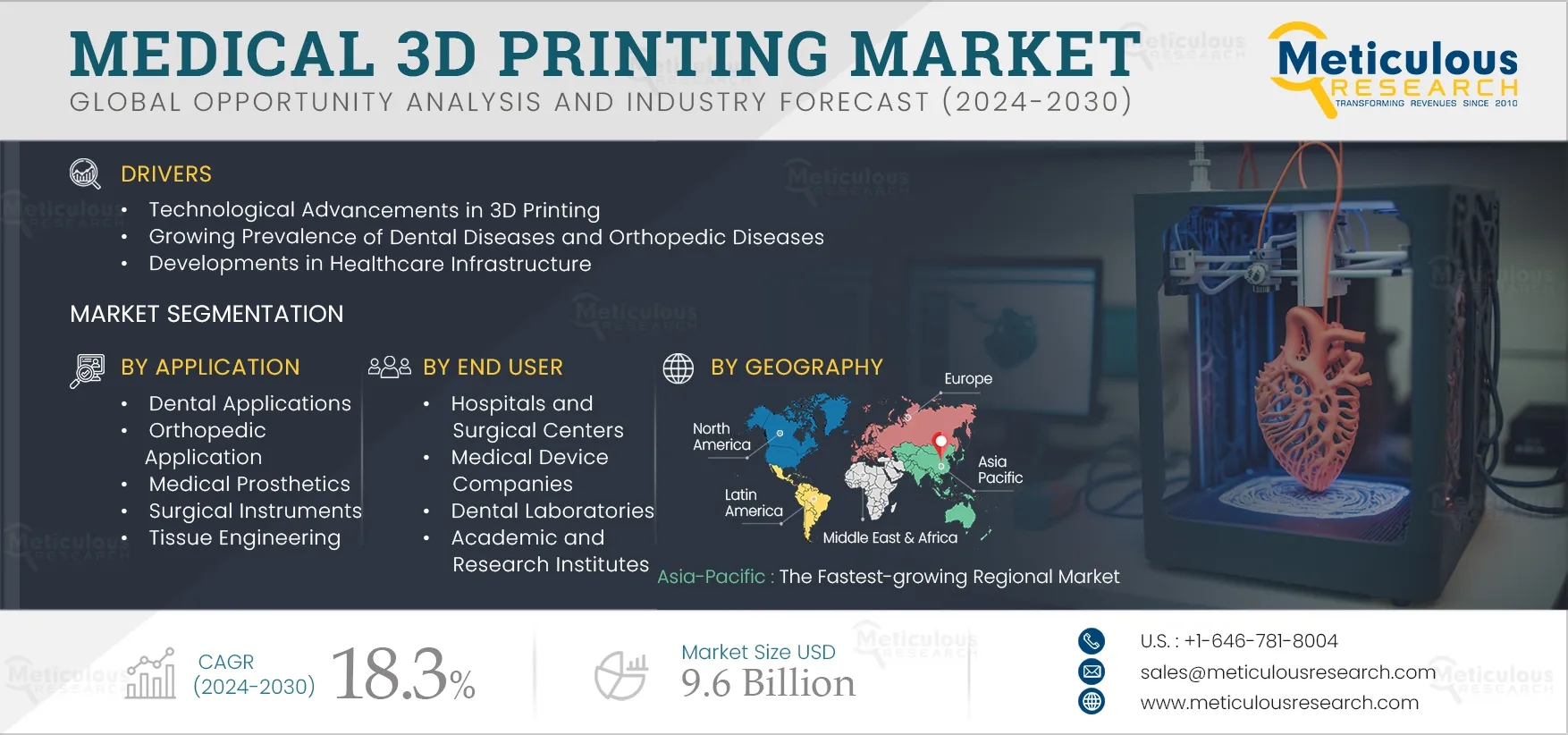

Medical 3D Printing Market by Product (Printer, Material (Polymers, Metals, Ceramics), Software) Application (Dental, Orthopedic, Prosthetic, Surgical) Technology (Photopolymerization, Laser Beam, Electron Beam Melting) End User - Global Forecast to 2032

Report ID: MRHC - 104823 Pages: 255 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Medical 3D Printing Market is projected to reach $9.6 billion by 2032, at a CAGR of 18.3% from 2025 to 2032. Medical 3D printing technology plays a crucial role in helping healthcare professionals understand the pathological and anatomical functions in clinical and therapeutic environments. 3D printing technology is used to produce dental implants, prosthetics, and surgical instruments. The 3D printing process involves depositing successive layers of different materials, such as ceramics, plastics, elastomers, and paper, to create 3D-printed objects. These models help point-of-care organizations and hospitals prepare for treatments and facilitate learning and comprehension of intricate medical concepts.

Furthermore, 3D printing technology allows surgeons to improve the success rate of complex procedures. This technology has also revolutionized preclinical drug testing by enabling animal-free drug trials.

The growth of this market is driven by factors such as technological advancements in 3D printing, the growing prevalence of dental & orthopedic diseases, the development of healthcare infrastructure, and the rising number of surgical procedures. However, the high costs associated with 3D printing and the lack of skilled professionals are restraining the market’s growth.

Furthermore, the rising adoption of computer-aided design (CAD)/computer-aided manufacturing (CAM) technologies and the increasing demand for artificial 3D-printed organs are expected to offer significant market growth opportunities. However, the less accuracy and repeatability of 3D printing than traditional methods pose a major challenge to the market’s growth.

Click here to: Get a Free Sample Copy of this report

Oral diseases result from various modifiable risk factors such as sugar consumption, tobacco use, alcohol consumption, and poor oral hygiene. According to the World Health Organization (WHO), in 2022, approximately 3.5 billion people worldwide, accounting for 45% of the global population, suffered from oral diseases, with 2 billion people having caries of permanent teeth. Furthermore, the majority of affected individuals, three out of four, were from middle-income and low-income countries.

Additionally, according to World Health Organization (WHO), as of July 2022, approximately 1.71 billion people worldwide were affected by orthopedic conditions, which include osteoporosis, osteoarthritis, osteopenia, associated fragility fractures, and other related conditions.

The increasing prevalence of dental and orthopedic diseases has led to a rise in the adoption of medical 3D printing. This technology enables the creation of various medical devices such as orthodontic models, surgical tools, surgical guides, prosthetics, orthotics, implants, dental crowns, medical models, and long-term biocompatible dental products such as dentures or splints.

In the case of orthopedic diseases, 3D-printed models aid medical teams in accurately identifying problems, planning operations, and making necessary arrangements for equipment and implants. These benefits are driving the adoption of medical 3D printing systems worldwide.

Increasing Demand for Artificial 3D Printed Organs Creates Market Growth Opportunities

Organ transplantation is a crucial and often life-saving procedure for patients in need. With advancements in medical technology, it is now possible to complete this procedure without relying on human donors. According to the Global Observatory on Donation and Transplantation, there were 144.302 organ transplantations carried out globally in 2021. In 2022, 104,234 men, women, and children were on the organ transplant waiting list. Lack of education and resources for organ donation in the U.S. has led to over 6,000 deaths annually among those waiting for an organ transplant, resulting in a loss of up to 17 lives each day. (Source: U.S. Health Resources and Services Administration (HRSA), 2025, Report)

Medical 3D printing has the potential to address the growing demand for organs for transplantation, which is currently limited by the shortage of organ donors and high rates of organ failure. Factors such as high tobacco consumption, sedentary lifestyles, accidents, and chronic diseases have increased the incidence of organ failures, further driving the need for organ transplantation.

Based on Product, the Medical 3D printing systems Segment is Expected to Account for the Largest Share of the Market

Based on product, in 2025, the medical 3D printer segment is expected to account for the largest share of the medical 3D printing market. Medical 3D printing systems provide a better understanding of patient anatomy before treatment. The widespread use of medical 3D systems for clinical and research applications in medical settings and technological advancements in medical 3D printing also support the growth of this market. Furthermore, prices for 3D printers used in medical applications can range from USD 5,000 to USD 50,000, depending on technology complexity, printing process, material requirements, and technological sophistication. Due to the high cost of these systems, this segment's revenue share is higher than that of other products.

In 2025, the Dental Applications Segment is Expected to Account for the Largest Share of the Market

Based on application, in 2025, the dental applications segment is expected to account for the largest share of the medical 3D printing market. The large market share of this segment is the increasing prevalence of dental disorders and the consequent rise in the adoption of 3D printing for dental applications. According to World Health Organization (WHO), in 2022, approximately 3.5 billion people had oral diseases. Additionally, in 2020, about 46% of all U.S. adults aged 30 years had gum disease, and 26% of people had tooth decay or untreated cavities. (Source: Centers for Disease Control and Prevention [CDC]). Therefore, the growing number of dental procedures for treating these conditions contributes to this segment's growth.

In 2025, the Laser Beam Melting Segment is Expected to Account for the Largest Share of the Market

Based on technology, in 2025, the laser beam melting segment is expected to account for the largest share of the medical 3D printing market. The large market share of this segment is attributed to the increasing application of laser beam technology in the dental industry and for manufacturing implants, bridges, and crowns for minimally invasive surgery. The laser beam melting technology generates current and adjoining layers simultaneously, thereby crafting solid organs with high efficiency.

In 2025, the Hospitals and Surgical Centers Segment is Expected to Account for the Largest Share of the Market

Based on end user, in 2025, the hospitals and surgical centers segment is expected to account for the largest share of the medical 3D printing market. The large market share of this segment is attributed to the high prevalence of dental and orthopedic diseases and the high awareness of advanced 3D printing technology among healthcare professionals.

Asia-Pacific: Fastest-growing Regional Market

The increasing government spending on healthcare in countries such as China, India, Singapore, and South Korea, rising technological advancements in medical 3D printing, and increasing government initiatives to promote awareness are driving the growth of the medical 3D printing market in Asia-Pacific. Furthermore, government initiatives towards the development of healthcare facilities and increasing medical tourism are also boosting the growth of this regional market.

Key Players

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them in the last three to four years. The key players profiled in the medical 3D printing market report are Stratasys Ltd. (Israel and U.S.), 3D Systems Corporation (U.S.), Desktop Metal, Inc. (U.S.), General Electric Company (U.S.), Materialise NV (Belgium), Renishaw plc (U.K.), Autodesk Inc. (U.S.), SLM solutions group AG (Germany), Proto Labs, Inc. (U.S.), Formlabs Inc. (U.S.), and DWS S.r.l. (Italy).

Scope of the Report:

Medical 3D Printing Market Size & Trend Analysis, by Product

Medical 3D Printing Market Size & Trend Analysis, by Application

Medical 3D Printing Market Size & Trend Analysis, by Technology

Medical 3D Printing Market Size & Trend Analysis, by End User

Medical 3D Printing Market Size & Trend Analysis, by Geography

Key questions answered in the report:

This study offers a detailed assessment of the medical 3D printing market and analyzes the market sizes & forecasts based on product, application, technology, and end user. This report also involves the value analysis of various segments and subsegments of the medical 3D printing market at the regional and country levels.

The medical 3D printing market is projected to reach $9.6 billion by 2032, at a CAGR of 18.3% during the forecast period.

The medical 3D printing systems segment is expected to account for the largest share of the market in 2025. The large market share of this segment is attributed to the increasing deployment of medical 3D systems for clinical and research applications in medical settings, the high costs of 3D printing systems, and technological advancements in medical 3D printing.

The laser beam melting segment is expected to hold the largest share of the market in 2025. The large market share of this segment is attributed to the benefits of this technology, such as the ability to quickly produce larger 3D parts, making it an attractive option for commercial organizations.

The growth of this market is driven by factors such as technological advancements in 3D printing, the growing prevalence of dental diseases and orthopedic diseases, the development of healthcare infrastructure, and the rising number of surgical procedures.

Furthermore, the rising adoption of computer-aided design (CAD)/computer-aided manufacturing (CAM) technologies and the increasing demand for artificial 3D-printed organs are expected to offer significant market growth opportunities.

The key players profiled in the medical 3D printing market study are Stratasys Ltd. (Israel and U.S.), 3D Systems Corporation (U.S.), Desktop Metal, Inc. (U.S.), General Electric Company (U.S.), Materialise NV (Belgium), Renishaw plc (U.K.), Autodesk Inc. (U.S.), SLM solutions group AG (Germany), Proto Labs, Inc. (U.S.), Formlabs Inc. (U.S.), and DWS S.r.l. (Italy).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the increasing adoption of new technologies in these countries.

Published Date: Jan-2025

Published Date: Oct-2013

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates