Resources

About Us

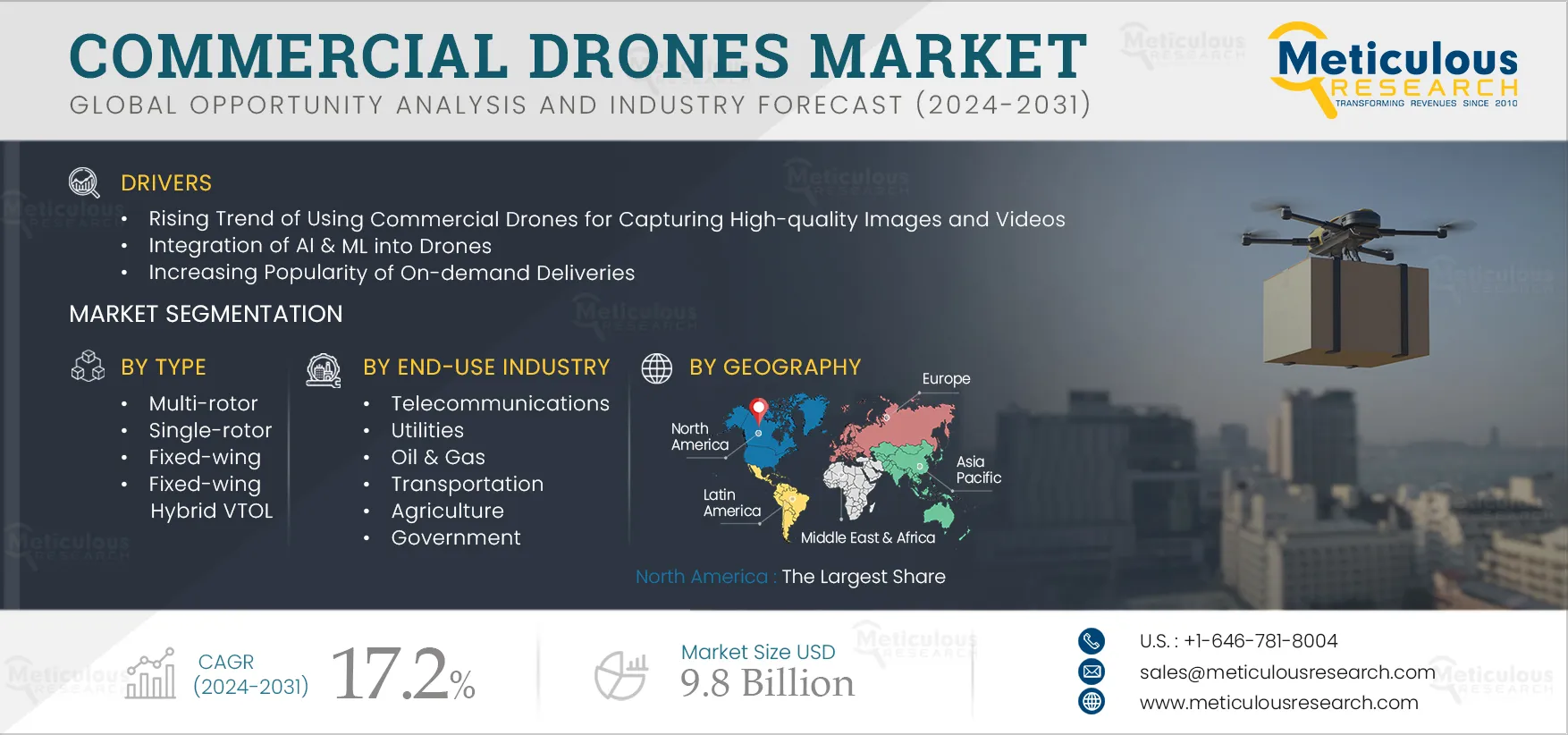

Commercial Drones Market by Type (Single-rotor, Multi-rotor, Fixed-wing, Fixed-wing Hybrid VTOL), Payload (Up to 2kg, 2kg to 10kg, 10kg to 25kg, More than 25kg), Application, End-use Industry, and Geography - Global Forecast to 2032

Report ID: MRAUTO - 1041085 Pages: 300 Aug-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportThe Commercial Drones Market is projected to reach $9.8 billion by 2032, at a CAGR of 17.2% from 2025 to 2032. The growth of the commercial drones market is driven by the rising trend of using commercial drones for capturing high-quality images and videos, the integration of Artificial Intelligence (AI) & Machine Learning (ML) into drones, and the increasing popularity of on-demand deliveries. However, drones’ limited battery life and flight duration and the lack of qualified personnel required to operate and maintain drones restrain the growth of this market.

The increasing demand for BVLOS (Beyond Visual Line Of Sight) drones among enterprise customers is expected to generate significant growth opportunities for the players operating in the commercial drones market.

However, unclear regulatory frameworks for drone adoption and operation are a major challenge impacting market growth.

Click here to: Get Free Sample Pages of this Report

In recent years, BVLOS (Beyond Visual Line Of Sight) technology has emerged as a key driver for the adoption of commercial drones as it offers extended operational capabilities to enterprises. BVLOS technology can expand the operational range of drones, bringing new opportunities to various sectors, including agriculture, infrastructure inspection, and delivery services. BVLOS drones enable more efficient data collection and monitoring over large areas. In industries such as agriculture, these drones can cover extensive fields, providing farmers with real-time data on crop health, irrigation needs, and pest control.

The rise of e-commerce has boosted the utilization of BVLOS drones for package delivery applications. Companies are exploring the feasibility of using drones to deliver goods over longer distances. BVLOS drones enhance surveillance capabilities for security purposes. They can patrol large areas, monitor borders, and support emergency response teams in disaster-stricken areas.

Regulatory bodies are recognizing the potential benefits of BVLOS drones and are working to establish clear guidelines for their safe integration into airspace operations. With regulatory frameworks becoming more supportive, enterprises are gaining confidence in deploying BVLOS drones for various applications. For instance, the European Union Aviation Safety Agency (EASA) has formulated regulations for supporting BVLOS drone operations. The EASA requires operators to fly drones within a defined geographic zone to ensure that the drones remain within a well-defined and controlled operating area to reduce the risk of collision with other aircraft, people, and hazards. Geographic zones may include restrictions on altitude, flight paths, and operational hours. Likewise, authorization from relevant authorities to operate within the geographic zone must be obtained, including clearance to fly in any controlled airspace and compliance with all regulatory requirements, such as those related to remote pilot licensing, insurance, and real-time monitoring. Further, BVLOS drones must be able to detect and avoid air traffic, maintain reliable communication links with ground control, and comply with the relevant air traffic control regulations.

Based on type, the commercial drones market is segmented into single-rotor, multi-rotor, fixed-wing, and fixed-wing hybrid VTOL. In 2025, the multi-rotor segment is expected to account for the largest share of the commercial drones market. The segment’s large share is attributed to multi-rotor drones’ high maneuverability, affordability, better control during flight, ability to fly extremely close to structures & buildings, and increased operational efficiency due to their ability to carry multiple payloads per flight.

Based on payload, the commercial drones market is segmented into up to 2kg, 2kg to 10kg, 10kg to 25kg, and more than 25kg. In 2025, the up to 2kg segment is expected to account for the largest share of the commercial drones market. The segment’s large share is attributed to easy portability, less stringent regulatory compliances, cost-effectiveness, quicker deployment, and low operational risks of drones with up to 2kg payload capacity.

Based on geography, the commercial drones market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of the commercial drones market. The region’s large share is attributed to the high adoption of drones for delivery applications, policy support for the adoption of commercial drones, and the increasing adoption of drones among businesses in the U.S. to bolster their competitive positions in the global market, reduce operational costs, and increase safety.

The key players operating in the commercial drones market include 3D Robotics, Inc. (U.S.), Aeronavics Ltd. (New Zealand), AeroVironment Inc. (U.S.), Autel Robotics (China), Wing Aviation LLC (U.S.), Guangzhou EHang Intelligent Technology Co. Ltd (China), Red Cat Holdings (Puerto Rico), AgEagle Aerial Systems Inc. (U.S.), Parrot Drone SAS (France), PrecisionHawk, Inc. (U.S.), Skydio, Inc. (U.S.), ideaForge Technology Ltd. (India), Garuda Aerospace Pvt. Ltd. (India), DELAIR SAS (France), and SZ DJI Technology Co., Ltd. (China).

|

Particulars |

Details |

|

Number of Pages |

300 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2022 |

|

CAGR |

17.2% |

|

Estimated Market Size (Value) |

$9.8 Billion by 2032 |

|

Segments Covered |

By Type

By Payload

By Application

By End-use Industry

|

|

Regions/Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, South Korea, Taiwan, RoAPAC), Latin America, and the Middle East & Africa. |

|

Companies Profiled |

3D Robotics, Inc. (U.S.), Aeronavics Ltd. (New Zealand), AeroVironment Inc. (U.S.), Autel Robotics (China), Wing Aviation LLC (U.S.), Guangzhou EHang Intelligent Technology Co. Ltd (China), Red Cat Holdings (Puerto Rico), AgEagle Aerial Systems Inc. (U.S.), Parrot Drone SAS (France), PrecisionHawk, Inc. (U.S.), Skydio, Inc. (U.S.), ideaForge Technology Ltd. (India), Garuda Aerospace Pvt. Ltd. (India), DELAIR SAS (France), and SZ DJI Technology Co., Ltd. (China) |

The commercial drones market is projected to reach $9.8 billion by 2032, at a CAGR of 17.2% during the forecast period.

The growth of the commercial drones market is driven by the rising trend of using commercial drones for capturing high-quality images and videos, the integration of AI & ML into drones, and the increasing popularity of on-demand deliveries.

The key players operating in the commercial drones market include 3D Robotics, Inc. (U.S.), Aeronavics Ltd. (New Zealand), AeroVironment Inc. (U.S.), Autel Robotics (China), Wing Aviation LLC (U.S.), Guangzhou EHang Intelligent Technology Co. Ltd (China), Red Cat Holdings (Puerto Rico), AgEagle Aerial Systems Inc. (U.S.), Parrot Drone SAS (France), PrecisionHawk, Inc. (U.S.), Skydio, Inc.(U.S.), ideaForge Technology Ltd. (India), Garuda Aerospace Pvt. Ltd. (India), DELAIR SAS (France), and SZ DJI Technology Co., Ltd. (China).

The multi-rotor segment is expected to account for the largest share of the commercial drones market.

The up to 2kg segment is expected to account for the largest share of the commercial drones market.

The photography & videography segment is expected to account for the largest share of the commercial drones market.

The media & entertainment segment is expected to account for the largest share of the commercial drones market.

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Aug-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates