Resources

About Us

CubeSat Market by Type (1U, 2U, 3U, 6U, 12U and Above), Application (Earth Observation & Remote Sensing, Communication, Technology Demonstration, Scientific Research), End-User (Commercial, Government & Military, Academic & Research), and Orbit Type (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit) -- Global Forecast to 2036

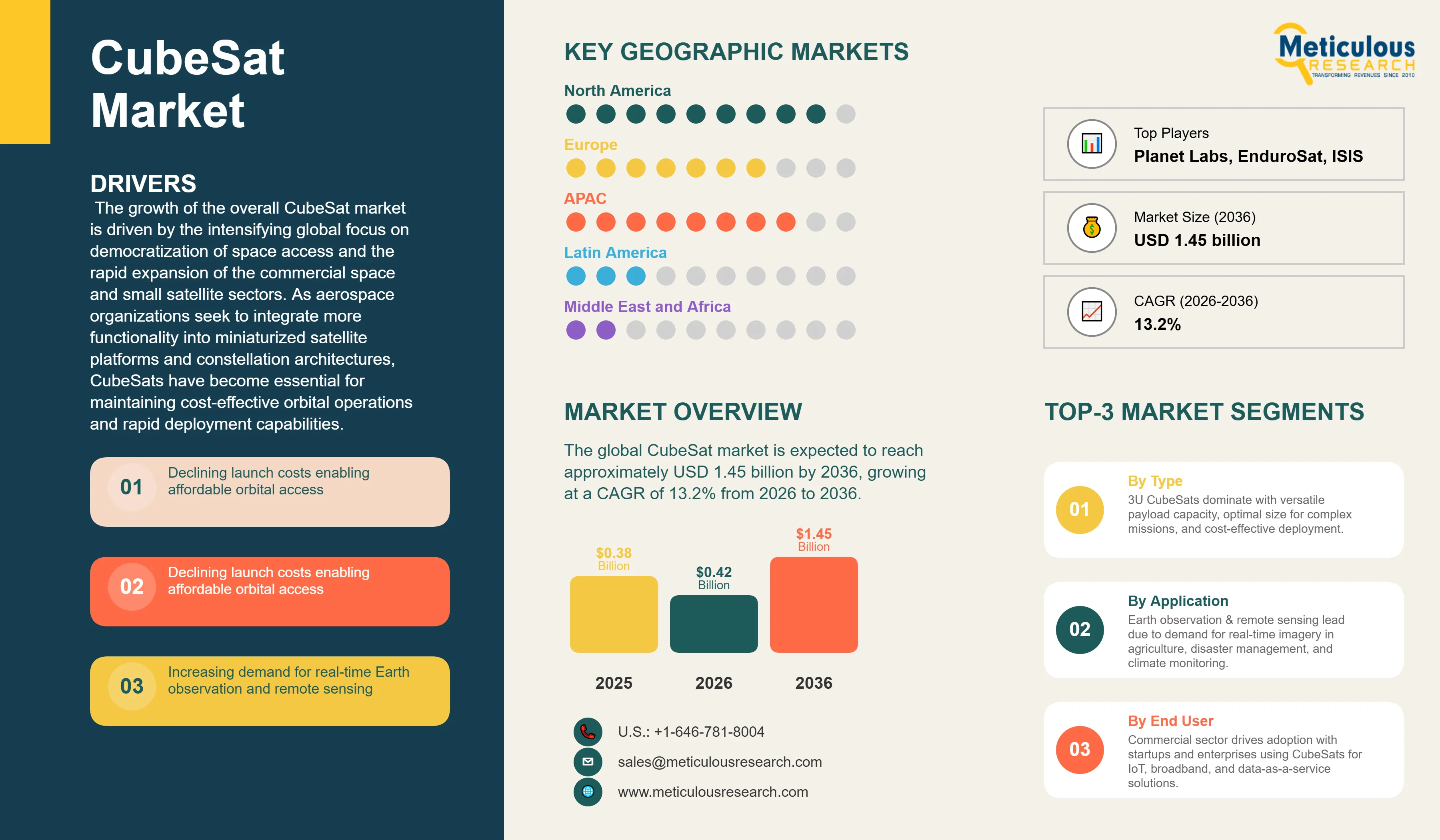

Report ID: MRAD - 1041716 Pages: 278 Feb-2026 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global CubeSat market was valued at USD 0.38 billion in 2025. The market is expected to reach approximately USD 1.45 billion by 2036 from USD 0.42 billion in 2026, growing at a CAGR of 13.2% from 2026 to 2036. The growth of the overall CubeSat market is driven by the intensifying global focus on democratization of space access and the rapid expansion of the commercial space and small satellite sectors. As aerospace organizations seek to integrate more functionality into miniaturized satellite platforms and constellation architectures, CubeSats have become essential for maintaining cost-effective orbital operations and rapid deployment capabilities. The rapid expansion of Earth observation services and the increasing need for affordable satellite communication infrastructure in emerging economies continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

CubeSats are critical miniaturized satellite platforms that leverage standardized designs to provide optimized space-based services and improved mission capabilities through cost-effective deployment infrastructure. These systems include integrated communication payloads, imaging sensors, and scientific instruments designed to automate data collection and enhance orbital operations across the space services continuum. The market is defined by high-efficiency technologies such as advanced propulsion systems and software-defined radio communications, which significantly enhance mission precision and resource utilization in high-complexity orbital environments. These systems are indispensable for space program administrators seeking to optimize their operational budgets and meet aggressive satellite deployment and data collection targets.

The market includes a diverse range of solutions, ranging from simple 1U educational satellites for basic technology demonstration to complex 12U+ platforms and constellation architectures. These systems are increasingly integrated with advanced components such as AI-powered onboard processing and inter-satellite laser communications to provide services such as real-time Earth observation and global IoT connectivity. The ability to provide stable, high-precision orbital operations while minimizing launch costs has made CubeSat technology the choice for organizations where mission flexibility and economic efficiency are paramount.

The global space sector is pushing hard to democratize orbital access, aiming to meet satellite-as-a-service targets and distributed architecture goals. This drive has increased the adoption of high-reliability miniaturized solutions, with advanced rideshare launch networks helping to stabilize deployment costs for ultra-compact satellite constellations. At the same time, the rapid growth in the commercial Earth observation and satellite communications markets is increasing the need for high-reliability, scalable satellite solutions.

Proliferation of Mega-Constellations and Commercial Space Networks

Space organizations across the industry are rapidly shifting to constellation-optimized architectures, moving well beyond traditional single-satellite missions toward distributed and networked setups. SpaceX's Starlink platforms deliver significantly higher global coverage, while Planet Labs' installations have slashed the barrier between research-grade imaging and commercial applications. The real game-changer comes with "swarm" satellite systems featuring integrated mesh networking that maintains peak communication efficiency even in high-density orbital environments. These advancements make large-scale satellite constellations practical and cost-effective for everyone from telecommunications giants to Earth observation providers chasing excellence in data refresh rates and lower per-satellite costs.

Innovation in Propulsion Systems and Extended Mission Capabilities

Innovation in electric propulsion and autonomous navigation is rapidly driving the CubeSat market, as orbital maneuvers become more precise and mission durations more extended. Component suppliers like Accion Systems are now designing units that combine the functionality of station-keeping with the intelligence of collision avoidance in a single platform, saving valuable mass budgets and simplifying spacecraft logistics. These systems often involve advanced ion thrusters and AI-powered guidance capable of handling complex orbital transfers without compromising satellite reliability or power consumption.

At the same time, growing focus on space sustainability is pushing manufacturers to develop CubeSat solutions tailored to debris mitigation and end-of-life deorbit principles. These systems help reduce orbital pollution through automated deorbit maneuvers and the use of drag-augmentation or tether components. By combining high-precision orbital control with robust environmental performance, these new designs support both technological advancement and space debris remediation, strengthening the resilience of the broader orbital infrastructure value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 1.45 Billion |

|

Market Size in 2026 |

USD 0.42 Billion |

|

Market Size in 2025 |

USD 0.38 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 13.2% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Application, End-User, Orbit Type, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Declining Launch Costs and Rise of Commercial Space Economy

A key driver of the CubeSat market is the rapid movement of the global space industry toward affordable, democratized orbital access models. Global demand for seamless satellite deployment, real-time data updates, and cost-optimized mission planning has created significant incentives for the adoption of CubeSat infrastructure. The trend toward rideshare launches and the integration of multiple satellites into unified deployment platforms drive organizations toward scalable solutions that CubeSat technology can uniquely provide. It is estimated that as commercial adoption of small satellite services rises and launch vehicle capacity becomes more accessible through 2036, the need for robust, standardized satellite platforms increases significantly; therefore, miniaturized payloads and high-efficiency power systems, with their ability to ensure cost-effective orbital operations, are considered a crucial enabler of modern space service delivery strategies.

Opportunity: Expansion of IoT Connectivity and Global Broadband Coverage

The rapid growth of the satellite IoT market and global broadband initiatives provides great opportunities for the CubeSat market. Indeed, the global surge in connected device deployment has created a compelling demand for systems that can handle massive data throughput and provide ultra-low latency for remote communications. These applications require high reliability, signal integrity, and the ability to handle high-bandwidth data transmission, all attributes that are met with advanced CubeSat constellation solutions. The satellite communications market is set to expand significantly through 2036, with CubeSats poised for an expanding share as operators seek to maximize orbital coverage and minimize ground infrastructure costs. Furthermore, the increasing demand for AI-driven Earth analytics and autonomous satellite operations is stimulating demand for modular orbital platforms that provide high-speed data downlink and operational flexibility.

Why Does the 3U Segment Lead the Market?

The 3U segment accounts for a significant portion of the overall CubeSat market in 2026. This is mainly attributed to the versatile use of this form factor in supporting diverse payloads, constellation architectures, and complex mission requirements. The 3U standard (30 cm × 10 cm × 10 cm) offers optimal balance between available volume for instruments and subsystems while maintaining compatibility with standard deployers and rideshare launch opportunities. Additionally, organizations seeking mission flexibility and cost optimization are increasingly deploying 3U platforms, particularly in Earth observation, technology demonstration, and scientific research applications where payload capacity and power generation requirements exceed 1U/2U capabilities but don't justify larger 6U or 12U platforms.

Why Does Earth Observation & Remote Sensing Dominate?

The Earth observation & remote sensing segment holds the dominant position in the CubeSat market in 2026. This leadership is primarily driven by the growing demand for high-frequency, affordable satellite imagery across agriculture, forestry, disaster management, and environmental monitoring applications. CubeSat constellations enable unprecedented temporal resolution—capturing images of the same location multiple times daily—which is critical for precision agriculture, rapid disaster response, and climate change monitoring. Companies like Planet Labs operate fleets of over 200 CubeSats providing daily global coverage at 3-5 meter resolution, revolutionizing traditional remote sensing economics. The democratization of Earth observation data through CubeSat platforms has opened new commercial opportunities in crop yield prediction, infrastructure monitoring, maritime tracking, and insurance risk assessment, driving sustained investment in imaging CubeSat deployments.

Why Does the Commercial Segment Lead Adoption?

The commercial segment represents the largest end-user category in the CubeSat market in 2026, driven by the explosive growth of the NewSpace economy and venture capital investment in satellite startups. Commercial players leverage CubeSats for Earth observation services (Planet Labs, Capella Space), IoT connectivity (Swarm Technologies, Astrocast), maritime tracking (Spire Global), and broadband communications (Kepler Communications). The economic advantages of CubeSats—launch costs of $100,000-$500,000 versus tens of millions for traditional satellites—enable rapid iteration, constellation deployment, and business model experimentation that traditional satellite operators cannot match. Private sector innovation in miniaturized sensors, software-defined payloads, and AI-powered onboard processing has transformed CubeSats from educational tools into commercial assets generating revenue through data-as-a-service, satellite-as-a-service, and connectivity-as-a-service business models, attracting billions in private investment and establishing commercial entities as primary market drivers.

Why Does Low Earth Orbit (LEO) Dominate Deployment?

Low Earth Orbit (LEO), particularly sun-synchronous orbits (SSO) at 400-800 km altitude, represents the overwhelmingly dominant deployment environment for CubeSats in 2026. LEO offers fundamental advantages for small satellite operations: lower launch costs due to reduced energy requirements, higher-resolution Earth imaging due to proximity to surface, reduced communication latency and power requirements for ground contact, and natural orbital decay providing passive deorbiting for space debris mitigation. Sun-synchronous orbits—which maintain consistent local time of day for imaging—are especially valuable for Earth observation missions requiring consistent lighting conditions for multi-temporal analysis. The concentration of rideshare launch opportunities in LEO, particularly through SpaceX's Transporter missions and Rocket Lab's Electron dedicated small satellite launches, creates robust infrastructure supporting LEO CubeSat deployment. While some advanced missions explore Medium Earth Orbit (MEO) for navigation augmentation or Geostationary Orbit (GEO) for communications, the technical challenges of radiation hardening, propulsion requirements, and launch costs currently limit non-LEO CubeSat deployment to specialized applications.

North America holds the dominant position in the global CubeSat market, primarily driven by the strong presence of established aerospace manufacturers and robust government space programs. The United States, in particular, leads in CubeSat development with NASA's CubeSat Launch Initiative providing launch opportunities for educational and research institutions, Department of Defense investment in rapid-response space capabilities, and thriving commercial ecosystem including Planet Labs, Spire Global, and emerging startups. The region benefits from advanced launch infrastructure, established rideshare programs through SpaceX and Rocket Lab, and significant venture capital investment in commercial space applications.

In Asia-Pacific, the leadership in government space initiatives and the push for indigenous satellite manufacturing capabilities are driving the adoption of high-reliability CubeSat solutions. Countries like China, India, and Japan are at the forefront, with significant focus on integrating advanced remote sensing into agricultural workflows and disaster management systems to ensure the highest levels of data quality and mission success.

In Europe, the leadership in space technology innovation and the push for sustainable orbital operations are driving the adoption of high-precision miniaturized solutions. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating advanced propulsion into CubeSat platforms and European Space Agency support for constellation missions to ensure the highest levels of performance and reliability.

The companies such as Planet Labs PBC, Spire Global, Inc., GomSpace Group AB, and NanoAvionics lead the global CubeSat market with a comprehensive range of satellite platforms and mission solutions, particularly for large-scale constellation applications and high-frequency Earth observation. Meanwhile, players including Tyvak Nano-Satellite Systems, Inc., Blue Canyon Technologies (Raytheon), EnduroSat, and AAC Clyde Space focus on specialized component manufacturing, propulsion systems, and ground station infrastructure targeting the commercial and academic sectors. Emerging manufacturers and integrated players such as Rocket Lab USA, Inc., Astro Digital U.S., Inc., and Kepler Communications Inc. are strengthening the market through innovations in launch services and modular satellite architectures.

The global CubeSat market is expected to grow from USD 0.42 billion in 2026 to USD 1.45 billion by 2036

The global CubeSat market is projected to grow at a CAGR of 13.2% from 2026 to 2036

3U is expected to dominate the market in 2026 due to its superior ability to support diverse payloads and mission flexibility. However, the 6U segment is projected to be the fastest-growing segment owing to the increasing need for advanced propulsion capabilities and larger payload accommodations in constellation environments

AI and advanced propulsion are transforming the CubeSat landscape by demanding higher mission autonomy, improved orbital maneuverability, and enhanced onboard processing. These technologies drive the adoption of advanced platforms like electric propulsion systems and autonomous collision avoidance, enabling satellite operators to support the complex orbital mechanics and extended mission durations of next-generation satellite constellation

North America holds the largest share of the global CubeSat market in 2026. The largest share of this region is primarily attributed to NASA's extensive CubeSat programs and the presence of leading commercial satellite manufacturers in the United States. Asia-Pacific is expected to witness the fastest growth, driven by massive investments in government space programs

The leading companies include Planet Labs PBC, Spire Global, Inc., GomSpace Group AB, NanoAvionics, and Tyvak Nano-Satellite Systems, Inc

Published Date: Feb-2026

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates