Resources

About Us

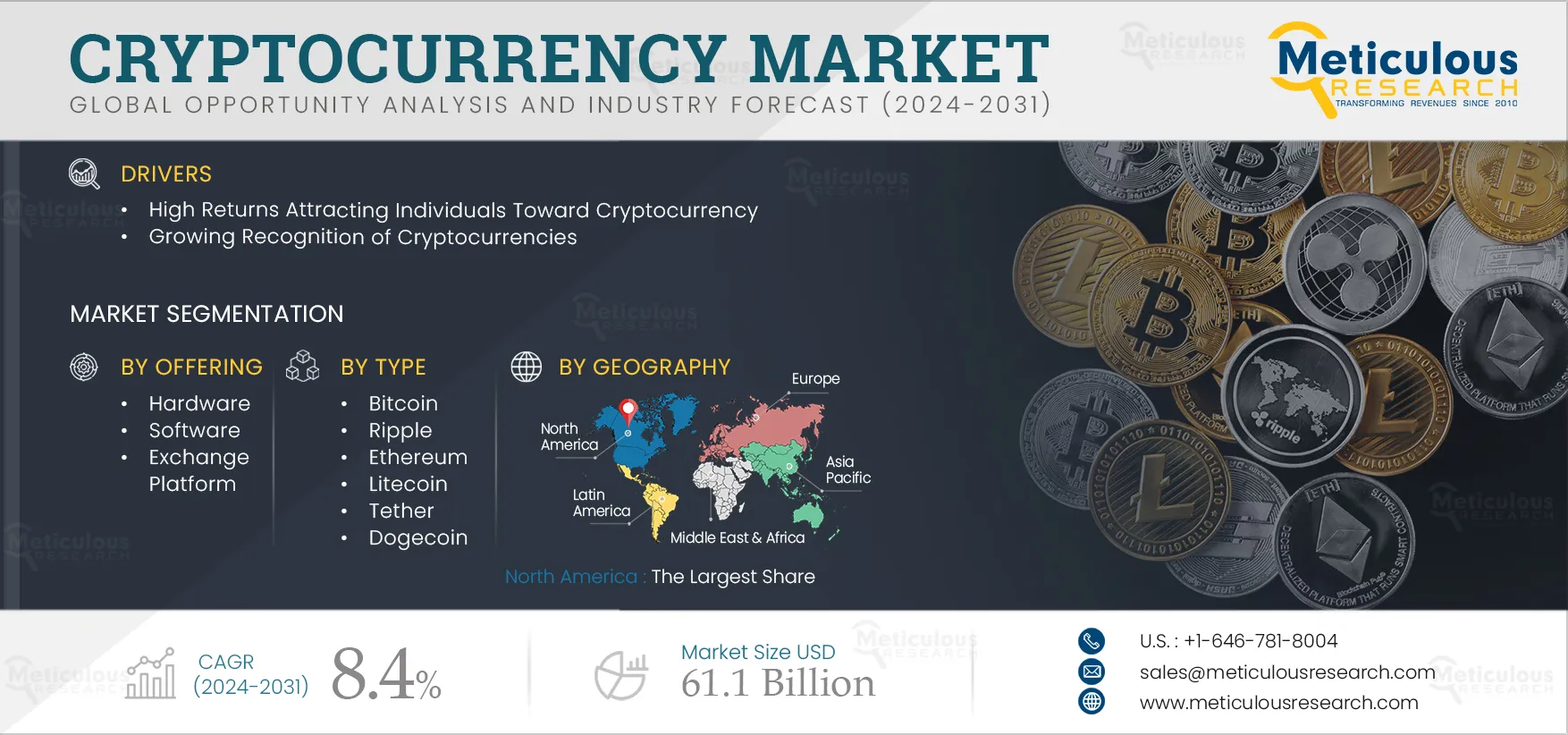

Cryptocurrency Market Size, Share, Forecast, & Trends Analysis by Offering (Hardware (ASIC, FGPA, Others), Software, Exchange Platform), Process (Mining (Pool, Cloud, Other), Transaction), Type (Bitcoin, Ripple, Ethereum, Litecoin, Tether, Others), Geography - Global Forecast to 2032

Report ID: MRICT - 1041220 Pages: 250 Jun-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the cryptocurrency market is driven by high returns attracting individuals towards cryptocurrency and growing recognition of cryptocurrencies. However, the high investments and operating costs of computational resources may restrain the growth of this market.

Furthermore, the expansion of blockchain technology and the growing interest of investors in digital assets are expected to generate growth opportunities for the stakeholders in this market. However, regulatory barriers and a lack of awareness and technical understanding regarding cryptocurrencies are major challenges impacting market growth. Additionally, increasing adoption of distributed ledger technology is a prominent trend in the cryptocurrency market.

The recent surge in cryptocurrency prices is expected to have a promising future for the cryptocurrency market. The surge in cryptocurrency prices provides high returns on the mining of cryptocurrency, due to which miners are strongly focusing on mining of cryptocurrency, which is expected to create demand for cryptocurrency mining hardware. The increase in the price of cryptocurrency has been triggered mostly by the allocation of institutional players and increased retail participation due to Spot Bitcoin ETFs and the upcoming Bitcoin Halving event. Increasing prices of cryptocurrency are also driving mainstream cryptocurrencies trade, such as Bitcoin and Ether on multiple exchanges. Hence, increasing prices of cryptocurrency and high returns on cryptocurrency mining are attracting individuals for cryptocurrency mining, which is creating the demand for the cryptocurrency market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

The increasing acceptance of cryptocurrency is driving the market, resulting from the interest shown by the institutional players. Several countries, including the U.S., European Union countries, and Canada, are supporting the use of cryptocurrency. Major financial institutions embraced digital assets, laying the foundation for cryptocurrency to see a boom in mass adoption. With regulatory clarity improving across various jurisdictions, more traditional investors are expected to enter the market. The retail industry is also showing positive signs towards cryptocurrency by allowing consumers to pay using Bitcoins and even Altcoins. Hence, relaxed regulations on the use and trade of cryptocurrency, recognition by financial institutions, and increasing use of cryptocurrency in the retail industry are driving the demand for the cryptocurrency market.

Cryptocurrency mining is a compute-intensive process. They require specialized, high-performance hardware that can solve the computational algorithms at a high speed, with accuracy and efficiency. This setup of high-performance hardware needs high investments to start mining cryptocurrencies.

In addition, cryptocurrency miners also need data centers that can handle this kind of hardware and the intensive processing requirements. Cryptocurrency mining is an energy-intensive process due to the requirement of specialized computational resources along with data centers, which surge operating costs for the miners. According to the U.S. Energy Information Administration analysis published in February 2025, electricity demand associated with U.S. cryptocurrency mining operations in the United States has grown very rapidly over the last several years. Their preliminary estimates suggest that annual electricity use from cryptocurrency mining probably represents from 0.6% to 2.3% of U.S. electricity consumption. Such high energy consumption results in high operating costs for cryptocurrency mining activities, which is expected to restrain market growth.

Bitcoin, Ethereum, and other cryptocurrency coins use blockchain technology to streamline transactions process securely. Blockchain technology makes it possible to ensure transparency and protect the financial information and identity of crypto buyers and sellers. The use of blockchain in the financial industry makes transactions more efficient. It streamlines international and domestic transactions, reduces transaction fees, and increases transparency.

Blockchain technology increases connectivity and transparency between organizations and streamlines processes. Several private stakeholders and governments are showing interest in blockchain due to its efficiency in trade processes. Hence, the expansion of blockchain technology provides opportunities for market stakeholders for international and domestic transactions with increased transparency and reduced transaction fees.

Digital assets, such as cryptocurrencies, NFTs, and tokenized securities, are being used for investment purposes in a variety of ways. Several investors buy and hold digital assets as a long-term investment, while others trade them actively on exchanges. The popularity of investing in digital assets has grown significantly in the recent few years, with many investors attracted to the potential for high returns and the expansion of blockchain technology. Several governments are focusing on framework policies for promoting the potential benefits of digital assets. For instance, in September 2022, the Biden administration (U.S.) outlined the first whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology. Hence, the growing interest of investors in digital assets and the focus of governments on promoting digital assets are expected to create opportunities for cryptocurrency market stakeholders.

Based on offering, the global cryptocurrency market is broadly segmented into hardware, software, and exchange platform. In 2025, the hardware segment is expected to account for the largest share of above 80.0% of the global cryptocurrency market. The solution segment is further segmented into FGPA, GPU, ASIC, data centers, and other hardware. The segment’s large market share is mainly attributed to factors such as the growing requirement of high computational resources for mining, the growing introduction of energy-efficient computational hardware for cryptocurrency mining, and due to high returns from cryptocurrency mining.

However, the software segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by the increasing demand for mining cryptocurrency software, the need for dedicated payment software to accept cryptocurrency payments, the rising acceptance of cryptocurrency payments by retailers, and the ability of mining software to easily switch between different cryptocurrencies.

Based on process, the global cryptocurrency market is broadly segmented into mining and transactions. In 2025, the mining segment is expected to account for a larger share of above 71.0% of the global cryptocurrency market. The mining segment is further segmented into solo mining, pool mining, and cloud mining. The segment’s large share is mainly attributed to factors such as rising cryptocurrency prices, increased focus on energy-efficient mining processes, and growing miners' approach to pool mining to increase the chances of earning rewards.

Moreover, the transaction segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by their increased efficiency, lower transaction costs, expansion in blockchain technology, increase in domestic and cross-border transactions, and growing investments of investors in digital assets such as cryptocurrency.

Based on type, the global cryptocurrency market is segmented into Bitcoin, Ripple, Ethereum, Litecoin, Tether, Dogecoin, and other types. In 2025, the Bitcoin segment is expected to account for the largest share of above 44.0% of the global cryptocurrency market. The segment’s large share is mainly attributed to its high price, highest market capitalization, and limited supply of Bitcoin.

Moreover, the Bitcoin segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by increasing demand from retail and institutional investors and the growing interest of investors in digital assets.

In 2025, North America is expected to account for the largest share of above 36.0% of the global cryptocurrency market. The large market share of this segment is attributed to the presence of large cryptocurrency mining farms, leadership in the global financial system and economic competitiveness, and increasing investments of companies developing blockchain technology and cutting-edge solutions for cryptocurrency mining.

Moreover, North America is projected to register the highest CAGR of above 9.5% during the forecast period. This region's growth is mainly driven by growing demand from consumers and businesses for crypto-enabled financial services, increased institutional activity, and rising acceptance of cryptocurrencies as payment methods.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the cryptocurrency market are Intel Corporation (U.S.), Advanced Micro Devices, Inc. (U.S.), BITMAIN Technologies Holding Company (China), NVIDIA Corporation (U.S.), BittWare (U.S.), Bitfury Group Limited (Netherlands), Ripple Labs, Inc. (U.S.), Canaan Inc. (Singapore), Coinbase (U.S.), Ledger SAS (France), Cudo Miner Ltd (U.K.), FutureBit LLC (U.S.), Binance (Malta), Payward, Inc. (U.S.), and Bybit Fintech Limited (UAE).

In February 2025, BITMAIN Technologies Holding Company (China) launched the latest KASPA miner, ANTMINER KS5 Pro and KS5. ANTMINER KS5 Pro boasts a hash rate of up to 21T with an energy efficiency of only 150 J/T, while the KS5 has a hash rate of up to 20T with an energy efficiency of 150 J/T.

In November 2024, FutureBit LLC (U.S.) launched Apollo II, a groundbreaking personal home mining device. This launch represents a significant leap in FutureBit's mission to bring efficient, powerful, and user-friendly mining products into homes. The Apollo II combines the latest 5nm ASIC technology with a sleek, intuitive design, setting a new standard in the personal Bitcoin mining sector.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.4% |

|

Market Size (Value) |

USD 61.1 Billion by 2032 |

|

Segments Covered |

By Offering

By Process

By Type

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Sweden, Switzerland, Netherlands, Norway, Austria, Denmark, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Australia, Malaysia, Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa (Israel, UAE, Rest of Middle East & Africa) |

|

Key Companies |

Intel Corporation (U.S.), Advanced Micro Devices, Inc. (U.S.), BITMAIN Technologies Holding Company (China), NVIDIA Corporation (U.S.), BittWare (U.S.), Bitfury Group Limited (Netherlands), Ripple Labs, Inc. (U.S.), Canaan Inc. (Singapore), Coinbase (U.S.), Ledger SAS (France), Cudo Miner Ltd (U.K.), FutureBit LLC (U.S.), Binance (Malta), Payward, Inc. (U.S.), and Bybit Fintech Limited (UAE) |

The cryptocurrency market study focuses on market assessment and opportunity analysis through the sales of cryptocurrency hardware and software and fee generation from crypto exchange platforms across different regions and countries. This study is also focused on competitive analysis for cryptocurrency based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Cryptocurrency Market is expected to reach $61.1 billion by 2032, at a CAGR of 8.4% from 2025 to 2032.

In 2025, the hardware segment is expected to hold the larger share of the cryptocurrency market.

The Bitcoin segment is expected to register the highest CAGR during the forecast period.

The growth of the cryptocurrency market is driven by the high returns that attract individuals to cryptocurrency and the growing recognition of cryptocurrencies. Furthermore, the expansion of blockchain technology and the growing interest of investors in digital assets are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the cryptocurrency market are Intel Corporation (U.S.), Advanced Micro Devices, Inc. (U.S.), BITMAIN Technologies Holding Company (China), NVIDIA Corporation (U.S.), BittWare (U.S.), Bitfury Group Limited (Netherlands), Ripple Labs, Inc. (U.S.), Canaan Inc. (Singapore), Coinbase (U.S.), Ledger SAS (France), Cudo Miner Ltd (U.K.), FutureBit LLC (U.S.), Binance (Malta), Payward, Inc. (U.S.), and Bybit Fintech Limited (UAE).

North America is expected to record a higher CAGR during the forecast period.

Published Date: Oct-2022

Published Date: Jun-2023

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates