Resources

About Us

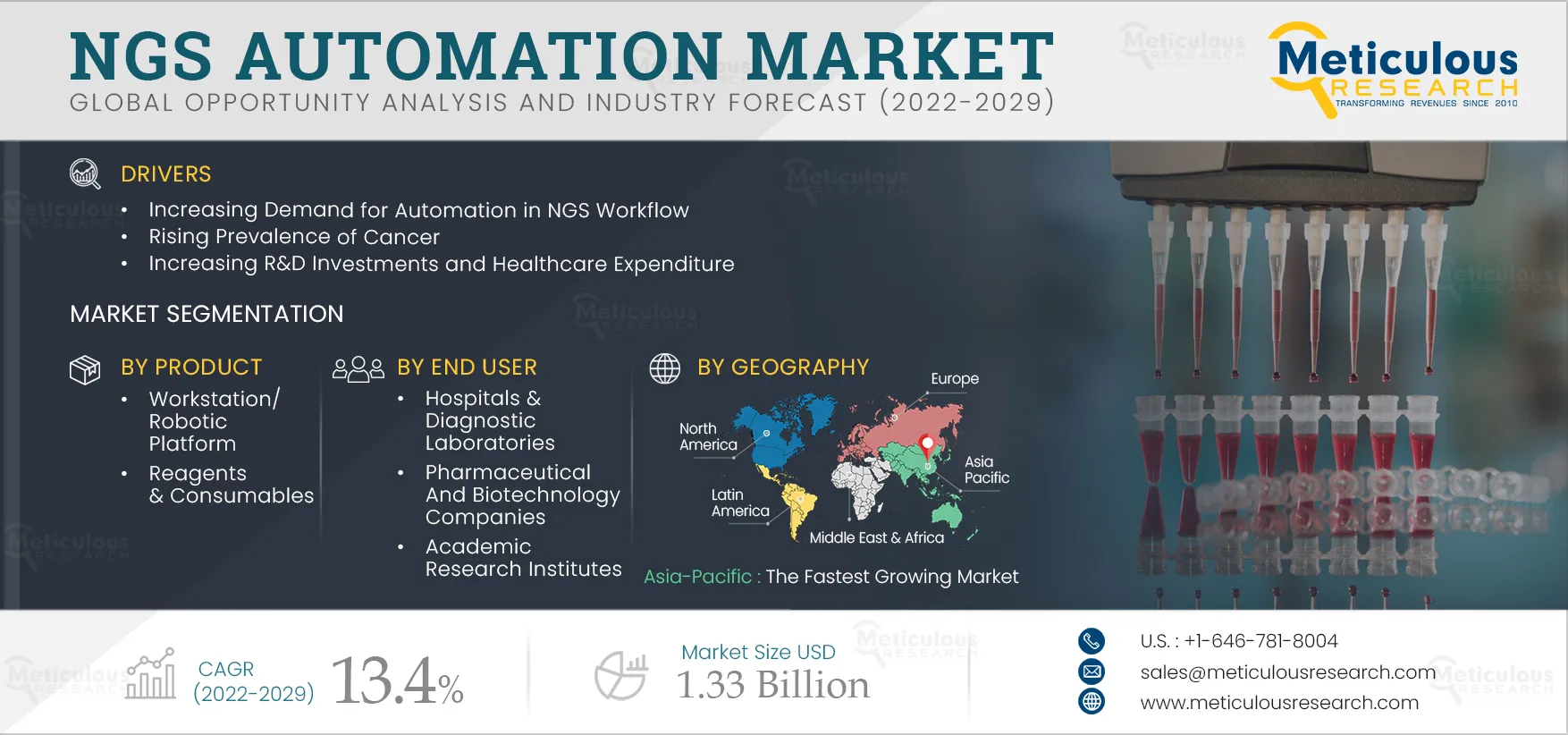

NGS Automation Market by Product (Platform, Consumables), Sequencing Type (Whole Genome, Exome, Targeted), Application (Drug Discovery, Diagnostics), End User (Hospitals, Diagnostic Laboratories, Pharmaceutical, Academic) - Global Forecast to 2029

Report ID: MRHC - 104585 Pages: 172 Jun-2022 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe NGS Automation Market is expected to grow at a CAGR of 13.4% from 2022–2029 to reach $1.33 billion by 2029. NGS automation workstations are automated liquid handling instruments that automate the NGS library preparation. Automation enables researchers to improve their library quality by generating consistent, reliable, and reproducible NGS data. NGS lab automation also enhances cost-efficiency and reduces the duration of the process. Additionally, NGS automation reduces the risk of contamination by limiting manual interaction with the reagents and samples.

Manual NGS library preparation is highly labor-intensive; hence, there has been a rising demand for NGS workflow automation to increase efficiency and reduce errors.

The growth of this market is attributed to factors such as the increasing demand for automation in NGS workflow, and the increasing R&D investments and healthcare expenditure. In addition, the increasing applications of next-generation sequencing and the rising number of collaborations between companies to develop NGS library preparation protocols are expected to provide significant growth opportunities for this market.

However, the high cost of automation workstations is expected to restrain the growth of this market to a notable extent. In addition, factors such as regulatory & standardization concerns in diagnostic testing and the requirement of high-skilled personnel for operating automation software are the major challenges to the growth of this market.

Click here to: Get Free Request Sample Copy of this report

Increasing Applications of Next-Generation Sequencing Technology is Expected to Offer Significant Growth Opportunities for the NGS Automation Market

NGS technology has revolutionized the field of genetic disease diagnostics with rapid, high-throughput, and cost-effective approaches. NGS can simultaneously analyze hundreds of genes, the whole exome, and even the whole genome, enabling researchers to gain a deeper understanding of the genetic heterogeneity of rare diseases. NGS technologies allow for understanding unknown species and complex diseases. The technology has recently gained much traction in diagnosing infectious diseases, immunological disorders, and hereditary disorders. It is also widely used for non-invasive prenatal diagnosis and therapeutic decision-making for somatic cancers.

Next-generation sequencing (NGS) technologies, including DNA and RNA sequencing, provide ‘omics’ approaches to understanding the genomic, transcriptomic, and epigenomic landscapes of individual cancers. NGS has great potential to enhance cancer diagnosis and care. With the use of NGS technology, a variety of genomic aberrations can be screened simultaneously, such as common and rare variants, structural variations (e.g., insertions and deletions), copy-number variations, and fusion transcripts.

Additionally, the use of NGS testing for companion diagnostics is also increasing rapidly. With the increased prevalence and incidence of cancer, precision or personalized medicine is gaining traction in oncology, and developing effective therapies is becoming critical for researchers. Precision medicine is being used to treat certain tumors to help determine which tests and treatments can be the most effective. Precision medicine is sometimes utilized for individuals who have certain cancers or are at a higher risk of getting specific cancers. Precision medicine for cancer uses the unique genetic makeup of individual patients and genetic information from the patient’s tumors to discover and determine an appropriate and effective course of treatment.

Thus, the increasing applications of NGS technology are expected to create growth opportunities for the players operating in the NGS automation market.

Increasing Pharmaceutical R&D Investments and Healthcare Expenditures Driving the Market’s Growth

One of the major applications of NGS is in the drug discovery processes of pharmaceutical and biotechnology companies. Pharmaceutical companies constantly focus on R&D as it is a core aspect of drug development processes. The biotechnology industry also continues to witness substantial growth due to increased investments in R&D to cater to the growing demand for innovation and new medical breakthroughs. The importance of R&D is evident due to the rising number of drug approvals. For instance, in 2020, the FDA’s Center for Drug Evaluation and Research (CDER) approved 53 novel drugs, an increase from 48 novel drugs approved in 2019. High R&D investments in the pharmaceutical and biotechnology industries are expected to drive the NGS automation market due to the importance of NGS automation in the drug discovery process.

The rising global healthcare expenditure is expected to increase the demand for NGS automation for clinical diagnostic applications. According to the World Bank, the global healthcare expenditure per capita increased from USD 993.9 in 2015 to USD 1,121.7 in 2019. Thus, growing healthcare expenditures are also expected to drive the demand for NGS workflow automation, mainly for clinical diagnostic applications.

Key Findings of the NGS Automation Market Study:

Workstation/Robotic Platform Segment to Dominate Market

In 2022, the workstation/robotic platform segment is estimated to account for the largest share of 73% NGS automation market. The large share of this segment is attributed to the benefits offered by NGS workstations during library preparation (such as high efficiency, low turnaround time, reduction in per sample cost, and high reproducibility) and the increasing demand for the automation of NGS by pharmaceutical and biotechnology companies. NGS workstations are primarily used for liquid handling or pipetting. Using NGS protocols, these workstations are preconfigured for library preparation. The NGS workstations offer a connection to instruments, such as detection devices or heater-cooler units. These workstations are usually used in very large sequencing centers and feature high levels of parallel sequencing.

Drug Discovery Segment to Dominate Market

In 2022, the drug discovery segment is estimated to account for the largest share of the NGS automation market. The large share of this segment is attributed to the increasing utilization of NGS for identifying novel drug targets and developing therapeutic techniques that target specific genes and proteins, such as targeted therapies, gene therapies, and oligonucleotide therapies. The pharmaceutical industry has adopted NGS technologies in diverse stages of drug development. Traditionally, the development of new therapies and drugs usually takes a long time and requires considerable patient pools. The adoption of NGS automation has cut down the cost of drug development and time due to its potential to improve workflow efficiency.

Whole Genome Sequencing Segment to Dominate Market

In 2022, the whole genome sequencing segment is estimated to account for the largest share of the NGS automation market. The large market share of this segment is attributed to factors such as the increasing need for automation in WGS to reduce per sample cost and the increasing applications of WGS in the identification of inherited disorders, characterization of the mutations that drive cancer progression, and tracking the outbreaks of diseases.

Pharmaceutical & Biotechnology Companies Segment to Dominate Market

In 2022, the pharmaceutical & biotechnology companies segment is estimated to account for the largest share of 54% of the NGS automation market. The large share of this segment is attributed to factors such as the increasing pharmaceutical & biotechnology R&D expenditure, growing demand for new drug discovery, and the increasing adoption of advanced NGS automation workstations by pharmaceutical & biotechnology companies.

Asia-Pacific: Fastest-growing Regional Market

Asia-Pacific is slated to register the highest growth rate of 14.7% in the NGS automation market during the forecast period. The high market growth in Asia-Pacific is attributed to the increasing prevalence of various chronic & infectious diseases, increasing government focus on sequencing projects in the region, a large number of patients with gene-associated disorders, and growing research activities for the development of personalized medicines.

Key Players

The report includes a competitive landscape based on an extensive assessment of product portfolio, application, sequencing type, end user, geographic presence, and the key growth strategies adopted by leading market players in the industry over the past four years (2019–2022).

The key players profiled in the NGS automation market are Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Eppendorf AG (Germany), Hamilton Company (U.S.), PerkinElmer, Inc. (U.S.), Tecan Group Ltd. (Switzerland), PRIMADAG SAS (France), BRAND GMBH + CO KG (Germany), Hudson Robotics (U.S.), SPT Labtech (U.K.), Thermo Fisher Scientific Inc. (U.S.), and F. Hoffmann-La Roche AG (Switzerland).

Major companies in the NGS automation market have implemented various strategies over the years to expand their product offerings and global footprints and augment their market shares. The key strategies followed by most companies in the NGS automation market were product launches, agreements, collaborations, partnerships, and acquisitions. Product launches were the most preferred growth strategy, accounting for a 50%-55% share of total strategic developments by key players between 2019 and 2022. This strategy enabled companies to broaden their product portfolios, advance the capabilities of their existing products, cater to the changing demands of users, and ensure a competitive edge in the NGS automation market. The leading players actively involved in product launches were Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), SPT Labtech (U.K.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), and Tecan Group Ltd. (Switzerland).

Scope of the Report:

NGS Automation Market—by Product

NGS Automation Market—by Application

NGS Automation Market—by Sequencing Type

NGS Automation Market—by End User

NGS Automation Market—by Geography

Key questions answered in the report:

The NGS automation market report covers the market sizes & forecasts based on product, application, sequencing type, end user, and geography. The NGS automation market studied in this report involves the value analysis of various segments and subsegments of NGS automation at the regional and country levels.

The NGS automation market is projected to reach $1.33 billion by 2029, at a CAGR of 13.4% during the forecast period of 2022–2029.

Based on type, the NGS automation market is segmented into workstation/robotic platform and reagents & consumables. In 2022, the workstation/robotic platform segment is estimated to account for the largest share of the NGS automation market.

Based on application, the NGS automation market is segmented into drug discovery, clinical diagnostics, and other applications. In 2022, the drug discovery segment is estimated to account for the largest share of the NGS automation market.

Based on sequencing type, the NGS automation market is segmented into whole genome sequencing, whole exome sequencing, targeted genome sequencing, and other sequencing types. In 2022, the whole genome sequencing segment is estimated to account for the largest share of the NGS automation market.

Based on end user, the NGS automation market is segmented into hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies, academic & research institutes, and other end users. In 2022, the pharmaceutical & biotechnology companies segment is estimated to account for the largest share of the NGS automation market.

The growth of this market is attributed to factors such as the increasing demand for NGS workflow automation, the rising incidences of cancer, and the increasing R&D investments and healthcare expenditure. In addition, the increasing applications of next-generation sequencing and the rising number of collaborations between companies to develop NGS library preparation protocols are expected to provide significant growth opportunities for this market.

The high cost of automation workstations is expected to hinder the growth of this market to a notable extent. In addition, factors such as regulatory & standardization concerns in diagnostic testing and the requirement of high-skilled personnel for operating automation software are the major challenges to the growth of this market.

The key players operating in the NGS automation market are Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Eppendorf AG (Germany), Hamilton Company (U.S.), PerkinElmer, Inc. (U.S.), Tecan Group Ltd. (Switzerland), PRIMADAG SAS (France), BRAND GMBH + CO KG (Germany), Hudson Robotics (U.S.), SPT Labtech (U.K.), Thermo Fisher Scientific Inc. (U.S.), and F. Hoffmann-La Roche AG (Switzerland).

China and India are expected to offer lucrative growth opportunities for market growth. India holds a high growth potential in the field of the life sciences industry as it is among the top 12 biotech destinations in the world and ranks third in the Asia-Pacific region. The Government of India formed the Department of Biotechnology (DBT) and other government-funded institutions, such as the National Biotechnology Board (NBTB), which are working together to develop India as a global hub for biotech research and business excellence.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates