Resources

About Us

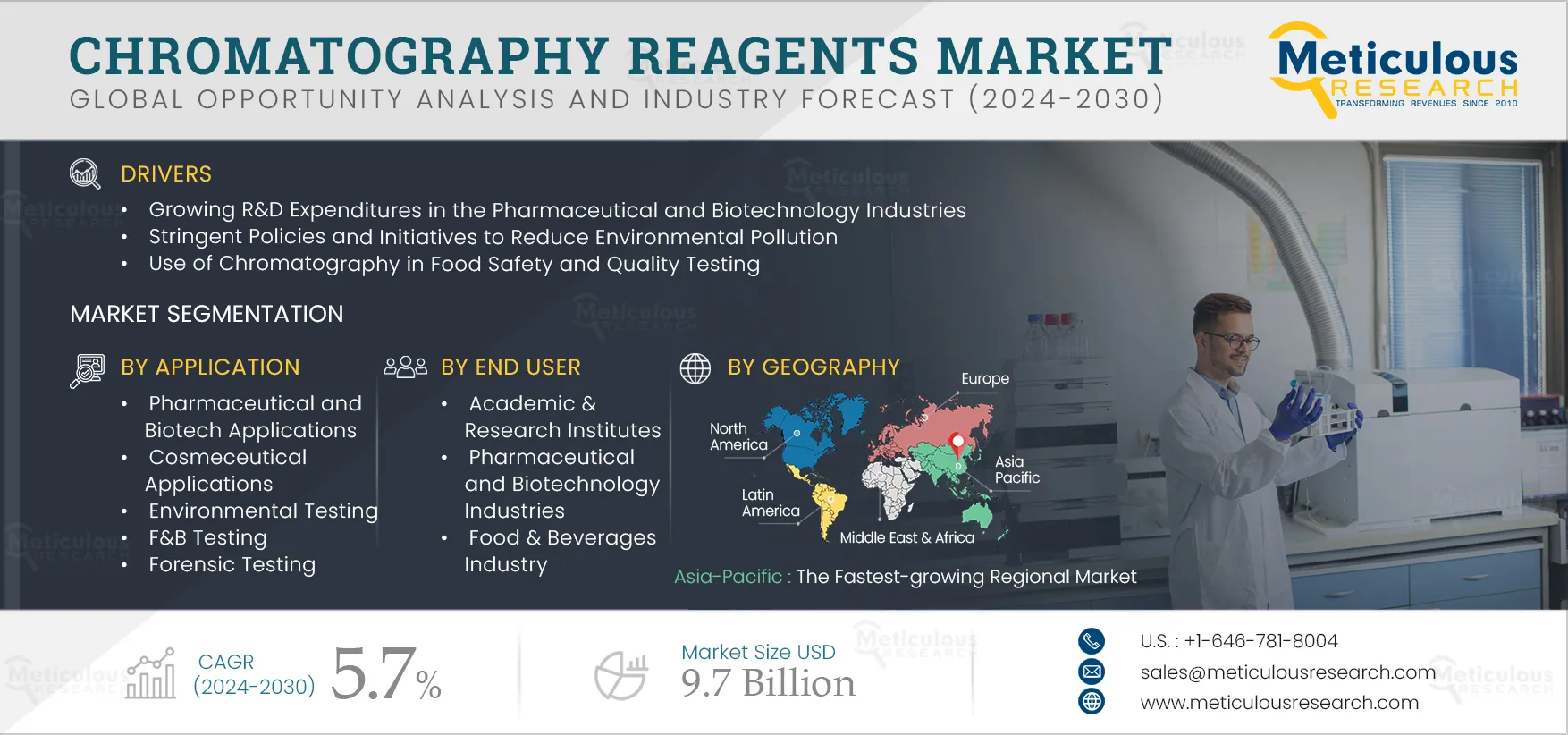

Chromatography Reagents Market by Type (GC, LC, TLC), Product (Solvents, Buffers, Reagents), Separation (Adsorption, Partition, Affinity), Application (Pharma, Forensic, Environmental, Cosmeceuticals, Diagnostics, QC), End User - Global Forecast to 2032

Report ID: MRHC - 104819 Pages: 190 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Chromatography Reagents Market is projected to reach $9.7 billion by 2032, at a CAGR of 5.7% from 2025 to 2032. Chromatography reagents, also known as analytical reagents, are compounds used for qualitative and quantitative testing of chromatography samples. The choice of reagents varies depending on the type of chromatography technique. The commonly used reagents for chromatography include solvents, buffers, derivatization agents, and additives.

The growth of this market is driven by several factors, including the growing R&D expenditure in pharmaceutical and biotechnology industries, policies and initiatives to reduce environmental pollution, the use of chromatography in food safety regulations and quality testing, and the growing biopharmaceuticals market. However, the high cost of chromatography reagents and the safety risks associated with the use of flammable reagents restrain this market’s growth.

Environmental pollution has been a long-standing issue that continues to worsen with the increasing population. Addressing and improving these conditions requires environmental initiatives and policies. Recently, the spectrum of these policies and initiatives has been broadening to address the growing environmental concerns.

In 2019, the World Health Organization (WHO) started the Clean Air Initiative on the national and subnational government level to commit to achieving safe quality air for citizens and to align climate change and air pollution policies by 2032. The organization aims to achieve this goal by implementing air quality and climate change policies and conducting analyses on collected samples to maintain ambient air quality per WHO guidelines. Such testing requires analytical techniques like chromatography to separate and identify

In September 2021, the Central Pollution Control Board (CPCB) of India executed a nationwide program called the National Air Quality Monitoring Programme (NAMP) to monitor the quality of ambient air in the environment. Under this program, sulfur dioxide (SO2), oxides of nitrogen (NO2), respirable suspended particulate matter (RSPM), and fine particulate matter have been identified as air pollutants that need to be monitored at all locations. The monitoring was done for 24 hours with a 4-hour sampling of gaseous samples and an 8-hour particulate matter sampling. This particulate matter collected was then separated or identified using ion chromatography.

Such initiatives and policies to reduce pollution are driving the usage of chromatography, thereby increasing the use of chromatography reagents and their market.

Click here to: Get a Free Sample Copy of this report

Growing R&D Expenditure in Pharmaceutical and Biotechnology Industries

Chromatography is a widely used technique for separating various components from a mixture by distributing them between two phases: the mobile and stationary phases. It is a preferred analytical technique with several advantages, such as high efficiency, low sample requirements, and precise separation. It is used extensively in food quality testing, drug discovery and development, R&D, and environmental monitoring.

Pharmaceutical companies are heavily investing in research and development (R&D) to expand their manufacturing facilities to meet the growing market demand for drugs. This increased investment in R&D is expected to lead to the commercialization of new drugs. According to the Organization for Economic Co-operation and Development, the pharmaceutical sector is highly R&D intensive and currently ranks second in terms of R&D expenditure across all sectors. The industry spends nearly 12% of its expenditure on R&D across OECD countries. Chromatography reagents are used at every step of the process for various reasons. High-end projects require high-grade or reagent-grade chemicals, boosting the demand for high-quality chromatography reagents.

The Liquid Chromatography (LC) Segment is Expected to Account for the Largest Share of the Market in 2025

Based on chromatography type, in 2025, the liquid chromatography segment is expected to account for the largest share of the market. The high dependency on LC for various applications across all sectors has contributed to the segment’s large share. Liquid chromatography is being widely used for various applications in pharmaceuticals, forensics, food sciences, and environmental monitoring. Newer improvements are being made in the classic HPLC process to introduce advanced techniques such as rapid resolution liquid chromatography (RRLC) and ultra-fast liquid chromatography (UFLC), which are largely being used for applications in agriculture, drug discovery, and pharmacokinetic studies. Liquid chromatography is increasingly being paired with Artificial Intelligence (AI) in the food industry to improve food quality worldwide. This integration of technologies is expected to further increase the demand for liquid chromatography reagents.

The Solvents Segment is Expected to Account for the Largest Share of the Market in 2025

Based on product type, in 2025, the solvents segment is expected to account for the largest share of the market. Chromatography solvents play a crucial role as carriers in dissolving, extracting and transporting samples from one phase to another without altering the sample’s chemical structure. The increasing demand for solvents in end-user industries is the primary reason for this segment's largest market share. Moreover, researchers are increasingly exploring the use of less volatile solvents, such as a combination of propylene carbonate, ethanol and water, which are both cost-effective and less harmful to the environment. Such approaches in the usage of solvents are driving the market’s growth.

Adsorption Segment is Projected to Register the Highest CAGR Over the Forecast Period

Based on the separation method, the adsorption segment is projected to register for the highest CAGR during the forecast period. Adsorption is a separation technique commonly used for isolating amino acids, identifying antibodies, and ensuring food quality assurance. It is particularly useful for separating smaller components from a mixture. With the increasing need to identify contaminants in small quantities, environmental laboratories increasingly turn to adsorption methods. This technique has made it easier to detect trace amounts of substances such as polychlorinated biphenyls (PCBs) in wastewater, waste oils, and pesticides.

In 2025, the Pharmaceutical and Biotechnology Application Segment is Expected to Account for the Largest Share of the Market

Based on application, in 2025, the pharmaceutical & biotechnology industries segment is expected to account for the largest share of the market. The significant share of this segment is attributed to several factors, including the growing number of clinical research studies, increased research and development for new therapies, the high prevalence of infectious diseases, and the mounting pressure on pharmaceutical companies to reduce the costs of drug production. Chromatography techniques such as HPLC ensure the cost advantage in manufacturing drugs, which drives their adoption in drug development.

Additionally, market players are collaborating with other organizations and companies to provide patients with better and faster outcomes. For instance, in May 2022, Agilent Technologies, Inc. (U.S.) announced a collaboration with APC Ltd. (Ireland), a small and large molecule process design and process development solutions company, to combine the expertise of both companies to provide workflows that support automated process analysis via liquid chromatography (LC).

The Academic & Research Institutes Segment is Expected to Register the Fastest Growth Rate Over the Forecast Period

Based on end user, the academic & research institutes segment is expected to register the highest CAGR over the forecast period. The increasing focus of research institutes on driving innovation in pharmaceuticals, agriculture, food sciences, and petroleum is driving the demand for reagents across academic and research institutions. Additionally, academic institutions are increasingly focusing on developing courses and incorporating technical, practical training in the field of analytical techniques. For instance, the Illinois Institute of Technology in Chicago is one such institute, which has a program called the Certificate of Chromatography, where students are taught about the fundamentals of chromatography and similar analytical techniques using state-of-the-art LC/GC instrumentation and analysis. This certificate from the course also allows the students to apply for further studies in the field of analytical science. Such programs and courses contribute to the growth of this segment.

Asia-Pacific: Fastest-growing Regional Market

The growth of this market is primarily driven by the increasing investments in pharmaceutical and biotechnology research, favorable government initiatives promoting research and development, enhancements in the research infrastructure within the region, and the growing focus on implementing food quality regulations in the region.

Key Players

The key players profiled in the chromatography reagents market report are Bio-Rad Laboratories, Inc. (U.S.), Waters Corporation (U.S.), Santa Cruz Biotech, Inc. (U.S.), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Regis Technologies, Inc. (U.S.), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), Avantor Performance Materials, Inc. (U.S.), Honeywell International, Inc. (U.S.), Tokyo Chemicals Industry Co., Ltd (Japan) and, Loba Chemie Pvt. Ltd. (India).

Scope of the Report:

Chromatography Reagents Market, by Chromatography Type

Chromatography Reagents Market, by Product Type

Chromatography Reagents Market, by Separation Method

Chromatography Reagents Market, by Application

Chromatography Reagents Market, by End User

Chromatography Reagents Market, by Geography

Key questions answered in the report:

The chromatography reagents market study covers the market sizes & forecasts for various chromatography reagents used in multiple sectors. The report includes the value analysis of various segments of the chromatography reagents market at the regional and country levels.

The chromatography reagents market is projected to reach $9.7 billion by 2032, at a CAGR of 5.7% during the forecast period.

The solvents segment is expected to account for the largest share of the market in 2025. The significant market share of this segment is attributed to the benefits offered by solvents, such as precise separation, ease of elution of separated components from the chromatography system, and the ability to maintain the chemical structure of the sample or mixture.

The adsorption chromatography segment is slated to register the highest CAGR during the forecast period. The growth of this segment can be attributed to the advantages of the technique over other separation methods. These advantages include its ability to easily separate complex mixtures, the use of fewer number of equipment for the process compared to other methods, and the ease of separation of molecules.

Based on end users, the academic and research institutes segment is expected to register the highest CAGR.

The growth of the chromatography market is driven by several factors, including the growing R&D expenditure in pharmaceutical and biotechnology industries, policies and initiatives to reduce environmental pollution, the use of chromatography in food safety regulations and quality testing, and the growing biopharmaceuticals market.

Furthermore, emerging economies and the growing proteomics and metabolomics market serve as major opportunities for the existing market players and new entrants in the chromatography reagents market.

The key players profiled in the chromatography reagents market are Bio-Rad Laboratories, Inc. (U.S.), Waters Corporation (U.S.), Santa Cruz Biotech, Inc. (U.S.), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Regis Technologies, Inc. (U.S.), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), Avantor Performance Materials, Inc. (U.S.), Honeywell International, Inc. (U.S.), Tokyo Chemicals Industry Co., Ltd (Japan), and Loba Chemie Pvt. Ltd. (India).

Emerging economies from Asia-Pacific, such as China and India, are projected to offer significant growth opportunities for vendors operating in this market due to rising investments in research & development by the pharmaceutical industry and the growing food & beverage sector in this region.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates