Resources

About Us

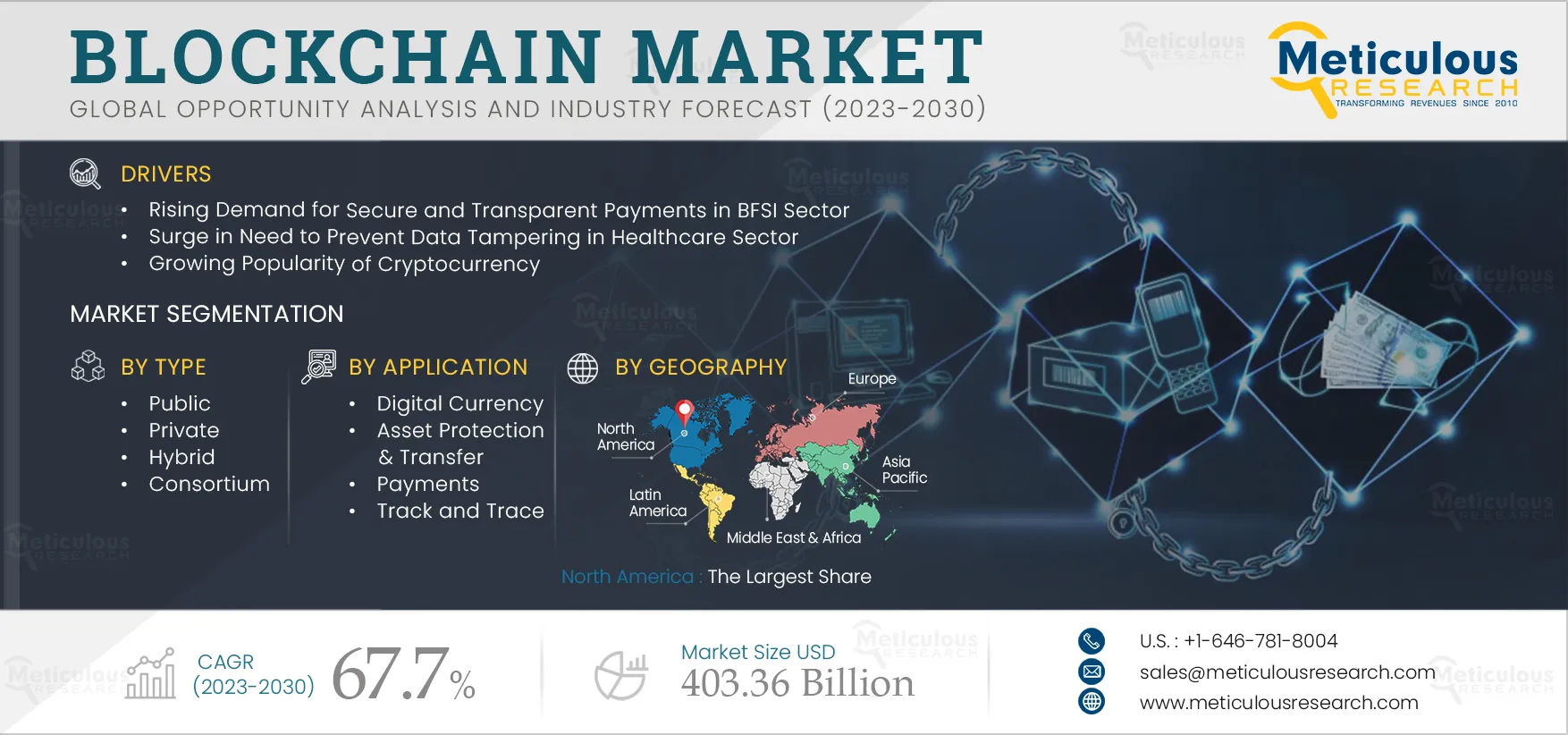

Blockchain Market by Type (Public, Private, Hybrid, Consortium), Platform (Ethereum, Hyperledger, Polygon, Solana), Organization, Sector (BFSI, Government, Healthcare, Professional Services, Manufacturing), and Geography - Global Forecast to 2030

Report ID: MRICT - 104843 Pages: 268 Jun-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is attributed to the rising demand for secure and transparent payments in the BFSI sector, the increasing need to prevent data tampering in the healthcare sector, and the growing popularity of cryptocurrency. Furthermore, the increasing adoption of blockchain among SMEs and retailers is expected to create significant opportunities for this market.

However, the high implementation costs hamper the growth of this market. In addition, regulatory uncertainty and lack of interoperability between blockchain ecosystems are major challenges to the growth of blockchain market. In addition, regulatory uncertainty and lack of interoperability between blockchain ecosystems are major challenges to the growth of this market.

The global blockchain market is segmented based on type, platform, organization size, application, sector, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

Financial institutes and banks face various issues associated with traditional cross-border payment systems, such as extra processing fees, the risk of fraud in payment pathways, security breaches, and increasing failure points. Also, sending a global payment through established banking channels is a complex and multistep process due to the involvement of several intermediaries. Blockchain-based payment systems provide a faster, more secure, and cheaper payment system by streamlining the transaction process and storing every transaction in a secure distributed ledger. Furthermore, the growing demand for international trade and e-commerce transactions, the rising need for cross-border asset management, a huge demand for effective global investment flows, and the growing demand for migrant money transactions via international remittances encourage faster, more efficient, and secured growth of payment systems.

Leading fintech blockchain solution providers have implemented low-cost and secure payment systems for the banking industry, consequently driving transparent transactions. For instance, in 2020, Siam Commercial Bank (Thailand) implemented low-cost cross-border payment systems using SCB's easy application from Ripple (U.S.). Many consumers seek a superior payment experience to provide effective payment solutions for individual and commercial operations. Thus, the growing need for secure and transparent transactions is driving the growth of the blockchain market.

Click here to: Get a Free Sample Copy of this report

Based on Type, the Public Segment is Expected to Dominate the Blockchain Market

Based on type, the global blockchain market is segmented into public, private, hybrid, and consortium. In 2023, the public segment is expected to account for the largest share of the market. The large market share of this segment is attributed to its open-source network nature that encourages new participants to join and validate transactions, provides complete decentralization and transparency, and enhances the power of users regarding works and ideas due to no central authority maintaining the network. However, the private segment is projected to register the highest CAGR during the forecast period.

Based on Platform, the Ethereum Segment is Expected to Dominate the Blockchain Market

Based on platform, the global blockchain market is segmented into Ethereum, Hyperledger, R3 Corda, Polygon, Solana, BSC, Terra, and other platforms. In 2023, the Ethereum segment is expected to account for the largest share of the market. The large market share of this segment is attributed to its smart contract capabilities, which enable the development of decentralized applications on the blockchain, reduce programming time, quick launch of projects, and increase application in various industries, including finance, gaming, and others. However, the Hyperledger segment is projected to register the highest CAGR during the forecast period.

Based on organization size, the global blockchain market is segmented into large enterprises and small & medium-sized enterprises. In 2023, the large enterprises segment is expected to account for the larger share of the blockchain market. The large market share of this segment is attributed to the increasing demand for smart invoicing and automated payments systems and blockchain’s capability to securely store transaction records or sensitive information. However, the small & medium-sized enterprises segment is projected to register the highest CAGR during the forecast period.

Based on Application, the Payments Segment is Expected to Dominate the Blockchain Market

Based on application, the global blockchain market is segmented into digital currency, asset protection & transfer, identity protection, payments, data reconciliation & sharing, track & trace, certification, and other applications. In 2023, the payments segment is expected to account for the largest share of the blockchain market. This segment is also projected to register the highest CAGR during the forecast period. The large market share of this segment is attributed to the growing demand for secure and reliable transactions, the increasing demand for secure and effective payment processing platforms, and the need to reduce the role of intermediaries.

Based on Sector, the BFSI Segment is Expected to Dominate the Blockchain Market

Based on sector, the global blockchain market is segmented into BFSI, government organizations, healthcare & life sciences, retail & e-commerce, energy & utility professional services, media & entertainment, manufacturing, and other sectors. In 2023, the BFSI segment is expected to account for the largest share of the blockchain market. The large share of this segment is attributed to the growing need for faster & cheaper cross-border payment systems, the rising need for regulated trading platforms, and a surge in demand for KYC verification on blockchain platforms. However, the healthcare & life sciences segment is projected to register the highest CAGR during the forecast period.

In 2023, North America is Expected to Dominate the Blockchain Market

Based on geography, the global blockchain market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest share of the blockchain market. North America’s major market share is attributed to the well-established financial service sector, the preference for digital payment systems among millennials, the adoption of blockchain technology in banking and financial services, and the increasing acceptance of cryptocurrencies in the region. However, Asia-Pacific is projected to register the highest CAGR during the forecast period.

Key Players:

The key players profiled in the global blockchain market study include International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Amazon Web Services, Inc. (U.S.), Infosys Limited (India), Accenture plc (Ireland), Wipro Limited (India), Blockchain.com (U.K.), Circle Internet Financial Limited (U.S.), Ripple (U.S.), Tata Consultancy Services Limited (India), Intel Corporation (U.S.), Chainalysis Inc. (U.S.), Coinbase (U.S.), and BitGo (U.S.).

Scope of the Report:

Blockchain Market Assessment, by Type

Blockchain Market Assessment, by Platform

Blockchain Market Assessment, by Organization Size

Blockchain Market Assessment, by Application

Blockchain Market Assessment, by Sector

Blockchain Market Assessment, by Geography

Key Questions Answered in the Report:

The global blockchain market is segmented based on type, platform, organization size, application, sector, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

The global blockchain market is projected to reach $403.36 billion by 2030, at a CAGR of 67.7% from 2023 to 2030.

Based on type, in 2023, the public segment is expected to account for the largest share of the blockchain market.

Based on sector, in 2023, the BFSI segment is expected to account for the largest share of the global blockchain market.

The growth of this market is attributed to the rising demand for secure and transparent payments in the BFSI sector, a surge in the need to prevent data tampering in the healthcare sector, and the growing popularity of cryptocurrency. Furthermore, leveraging blockchain among SMEs and the increasing adoption of blockchain by online retailers are expected to create significant opportunities for this market.

The key players profiled in the global blockchain market study include International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Amazon Web Services, Inc. (U.S.), Infosys Limited (India), Accenture plc (Ireland), Wipro Limited (India), Blockchain.com (U.K.), Circle Internet Financial Limited (U.S.), Ripple (U.S.), Tata Consultancy Services Limited (India), Intel Corporation (U.S.), Chainalysis Inc. (U.S.), Coinbase (U.S.), and BitGo (U.S.).

The Asia-Pacific is expected to register the highest CAGR during the forecast period and offer significant growth opportunities for players operating in this market.

Published Date: Jan-2025

Published Date: Oct-2022

Published Date: Jun-2019

Published Date: Aug-2024

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates