Resources

About Us

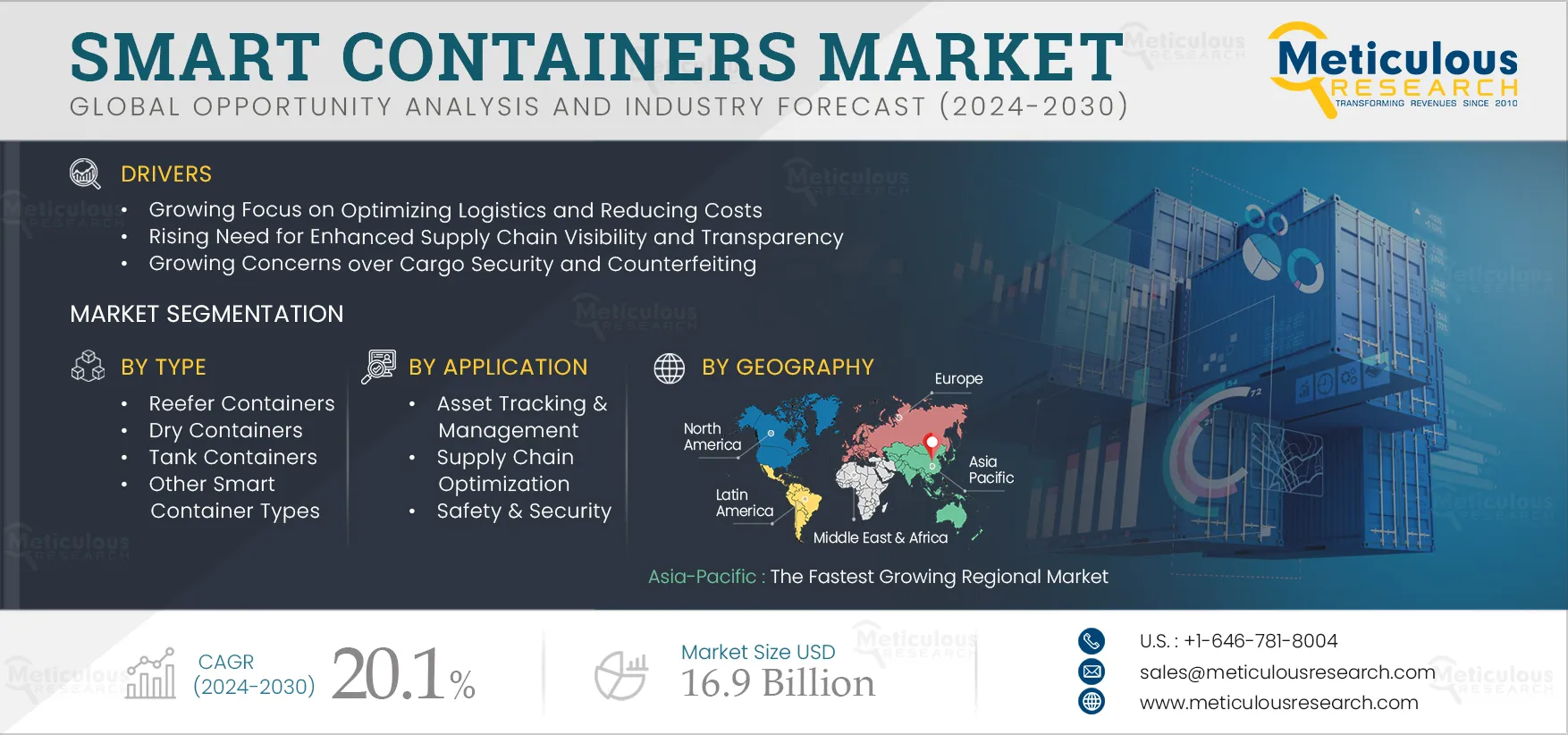

Smart Containers Market by Offering (Hardware, Software, Services), Type (Reefer, Dry), Size (20, 40), Technology (AI, Blockchain, IoT), Application (Asset Tracking & Management, Supply Chain Optimization), Sector, and Geography - Global Forecast to 2032

Report ID: MRICT - 104834 Pages: 330 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe Smart Containers Market is projected to reach $16.9 billion by 2032, at a CAGR of 20.1% during the forecast period 2025–2032. The growth of this market is driven by the rising need for enhanced supply chain visibility and transparency, growing focus on optimizing logistics and reducing costs, and growing concerns over cargo security and counterfeiting. The growing applications of smart container technologies in the healthcare and agriculture sectors and the growing adoption of cloud-based platforms for smart container management are expected to create market growth opportunities. However, the high implementation cost of smart container technologies restrains the growth of this market. Infrastructure and connectivity issues in remote locations are major challenges for the players operating in this market.

Additionally, the integration of advanced technologies such as blockchain and AI into smart container solutions is a prominent trend in the market.

Supply chains employ various transportation modes, including trucks, ships, airplanes, and rail. Each mode has its own tracking and monitoring mechanism, making it challenging to have a consolidated view of shipment status across multiple modes. Additionally, international shipments involve customs procedures, regulatory requirements, and various transportation modes. Coordinating, managing, and tracking shipments across different geographies, time zones, and legal frameworks are complex processes and could be challenging. Smart containers address this need by providing real-time visibility into the location, status, and condition of shipments throughout the supply chain. Its visibility helps companies identify bottlenecks, delays, or potential disruptions, allowing for proactive measures to ensure smooth operations. Also, it helps ensure compliance with various industry regulations and standards, including EPCglobal, Food Safety Modernization Act (FSMA), General Data Protection Regulation (GDPR), Hazard Analysis Critical Control Point (HACCP), and Transported Asset Protection Association (TAPA). Companies are using smart containers to enable proactive measures to mitigate risks, reduce lead times, optimize supply chain and inventory levels, provide better visibility of containers, reduce stockouts or overstocking situations, and improve overall operational efficiency.

Such developments, and the increasing need to optimize logistics operations and improve supply chain visibility, are driving the growth of the smart containers market.

Click here to: Get a Free Sample Copy of this report

Based on offering, the global smart containers market is broadly segmented into hardware, software, and services. The software segment is further segmented into tracking & monitoring software, connectivity & integration software, security & compliance software, and data analytics & reporting software. The services segment is further segmented into installation & implementation, maintenance & support. In 2025, the software segment is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the increasing demand for value-added services such as predictive analytics, route optimization, forecasting, and compliance management, increasing demand for data analytics and insights for enhance efficiency and improve decision-making, growing use of cloud-based platforms and connectivity for data storage, processing, and accessibility, and increasing need to manage and process a vast amount of data transmitted by IoT devices within smart containers. This segment is also projected to register the highest CAGR during the forecast period.

Based on type, the global smart containers market is broadly segmented into reefer containers, dry containers, tank containers, and other smart container types. In 2025, the dry containers segment is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the growth of the e-commerce sector, increasing demand for general cargo transportation, including consumer goods, electronics, textiles, and non-perishable items, and the growing need for easy integration with existing logistics and supply chain networks.

However, the reefer containers segment is projected to register the highest CAGR during the forecast period due to the increasing need to maintain product quality and freshness throughout the supply chain, expansion of the pharmaceutical 7 healthcare industries requiring temperature-controlled transportation, stringent regulations and quality standards for maintaining product integrity and safety and advancements in refrigeration technology and temperature monitoring systems.

Based on size, the global smart containers market is broadly segmented into 20-foot containers and 40-foot containers. In 2025, the 40-foot containers segment is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the increasing use of 40-foot containers in various industries for ensuring that the goods are transported within specified conditions, the growing need to ship goods from manufacturers and suppliers to distribution centers and retail stores, increasing need to transport a wide range of general cargo and handle project cargo, that includes oversized or specialized equipment for industries like oil and gas, renewable energy, infrastructure development, and heavy machinery. This segment is also projected to register the highest CAGR during the forecast period.

Based on technology, the global smart containers market is broadly segmented into artificial intelligence, blockchain, cloud computing, internet of things (IoT), geolocation technology, and connectivity technology. In 2025, the internet of things (IoT) technology segment is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the increasing need for real-time container monitoring to monitor the performance and health of container systems, the increasing need for IoT-generated data to extract meaningful insights, the growing need to ensure the integrity & security of the cargo during transportation, and the growing demand for remote asset tracking and asset management, efficient inventory management, and identifying potential issues or maintenance requirements in containers.

However, the blockchain technology segment is projected to register the highest CAGR during the forecast period due to the increasing need to facilitate efficient cargo insurance processes, the growing need to assure authenticity and provenance of goods inside containers, the increasing need for enhanced traceability and visibility of goods, the growing need for smart contracts to automate and streamline contractual agreements and transactions, and the increasing need to ensure the integrity and authenticity of container-related documents including bills of lading, certificates of origin, and customs documents.

Based on application, the global smart containers market is broadly segmented into asset tracking & management, supply chain optimization, safety & security, and other applications. In 2025, the asset tracking & management segment is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the increasing need to optimize container utilization, minimize downtime, and ensure timely delivery, increasing demand for real-time visibility into the location, status, and condition of container assets throughout the supply chain, increasing need to reduce costs associated with container loss, theft, or misplacement, and growing need to streamline operational processes.

However, the supply chain optimization segment is projected to register the highest CAGR during the forecast period due to the growing need to identify bottlenecks, optimize inventory levels and transportation routes, streamline logistics operations, improve overall supply chain efficiency, and reduce idle container time at ports or warehouses.

Based on sector, the global smart containers market is broadly segmented into pharmaceutical & healthcare, food & beverage, chemicals & hazardous materials, retail & e-commerce, oil & gas, automotive, agriculture, and other sectors. In 2025, the retail & e-commerce sector is expected to account for the largest share of the global smart containers market. The large market share of this segment is attributed to the growing need for inventory optimization and order fulfillment, the increasing need to enable real-time tracking and monitoring of container goods, transparency and traceability of shipments throughout the supply chain, and the growing need to minimize delivery delays, and loss of packages.

However, the food & beverage sector is projected to register the highest CAGR during the forecast period due to the increasing use of smart containers to enable better inventory management, accurate tracking of product shelf life, maintain the quality, freshness, and safety of perishable goods during transportation, and increasing need to ensure optimal storage conditions for sensitive food & beverage products.

Based on geography, the global smart containers market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR during the forecast period due to the strong presence of industries such as electronics, automotive, and consumer goods, the region's commitment to green logistics and eco-friendly operations, increasing use of smart containers for real-time tracking, optimization logistics operations and improve supply chain visibility, stringent regulatory requirements in pharmaceuticals and food & beverage for traceability and compliance. Moreover, the growing need to manage the complexities of urban logistics, optimize delivery routes, and ensure accurate inventory control in densely populated areas are also contributing to the growth of the smart containers market in Asia-Pacific.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market players in the smart containers market in the past few years. The key players profiled in the smart containers market report are CMA CGM Group (France), Sealand - A Maersk Company (U.S.), China International Marine Containers (Group) Co., Ltd. (China), ORBCOMM (U.S.), TRAXENS (France), Globe Tracker, ApS (Denmark), Emerson Electric Co. (U.S.), ZIM Integrated Shipping Services Ltd. (Israel), MSC Mediterranean Shipping Company S.A (Switzerland), Berlinger & Co. AG (Switzerland), Hapag-Lloyd AG (Germany), Ocean Network Express Pte. Ltd. (Singapore), Nexxiot AG (Switzerland), Thinxtra Ltd (Australia), SAVVY Telematic Systems AG (Switzerland), Sensolus (Belgium), Panasonic Industry Co., Ltd. (Japan), ZillionSource Technologies (U.S.), and SkyCell AG (Switzerland).

Key questions answered in the report:

The Smart Containers Market focuses on technology-enhanced containers that improve supply chain visibility, efficiency, and security. These containers utilize IoT and other technologies for real-time tracking and monitoring.

The Smart Containers Market is projected to reach approximately $16.9 billion by 2032, reflecting significant growth driven by technological advancements and increasing demand for supply chain optimization.

The market is expected to grow at a robust CAGR of 20.1% during the forecast period from 2025 to 2032, driven by rising demand for transparency, security, and logistics optimization in various industries.

As of 2024, the Smart Containers Market size is growing rapidly, with forecasts indicating it will reach $16.9 billion by 2032, fueled by advancements in technology and increased applications across sectors.

Key players include CMA CGM Group, Maersk, China International Marine Containers, ORBCOMM, and Emerson Electric, among others, focusing on innovation and smart logistics solutions.

The market is trending towards integrating advanced technologies like blockchain and AI for improved efficiency, security, and real-time data management, enhancing overall supply chain operations.

Drivers include rising needs for enhanced supply chain visibility, cost reduction, logistics optimization, and security against cargo theft and counterfeiting, significantly impacting market growth.

The market segments include hardware, software, and services; types like dry and reefer containers; sizes such as 20-foot and 40-foot containers; and technologies including IoT and blockchain.

The global outlook is optimistic, with significant growth expected, particularly in Asia-Pacific, due to increasing industrial activity, regulatory pressures, and a focus on efficient logistics solutions.

The Smart Containers Market is experiencing substantial growth, projected to reach $16.9 billion by 2032, fueled by advancements in container technologies and the need for efficient supply chain management.

The Smart Containers Market is projected to grow at a CAGR of 20.1% from 2025 to 2032, driven by the increasing demand for enhanced visibility and efficiency in supply chain operations.

North America currently holds the highest market share, but Asia-Pacific is expected to be the fastest-growing region due to its strong industrial presence and commitment to supply chain optimization.

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jul-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates