What is the Biosurfactants Market Size?

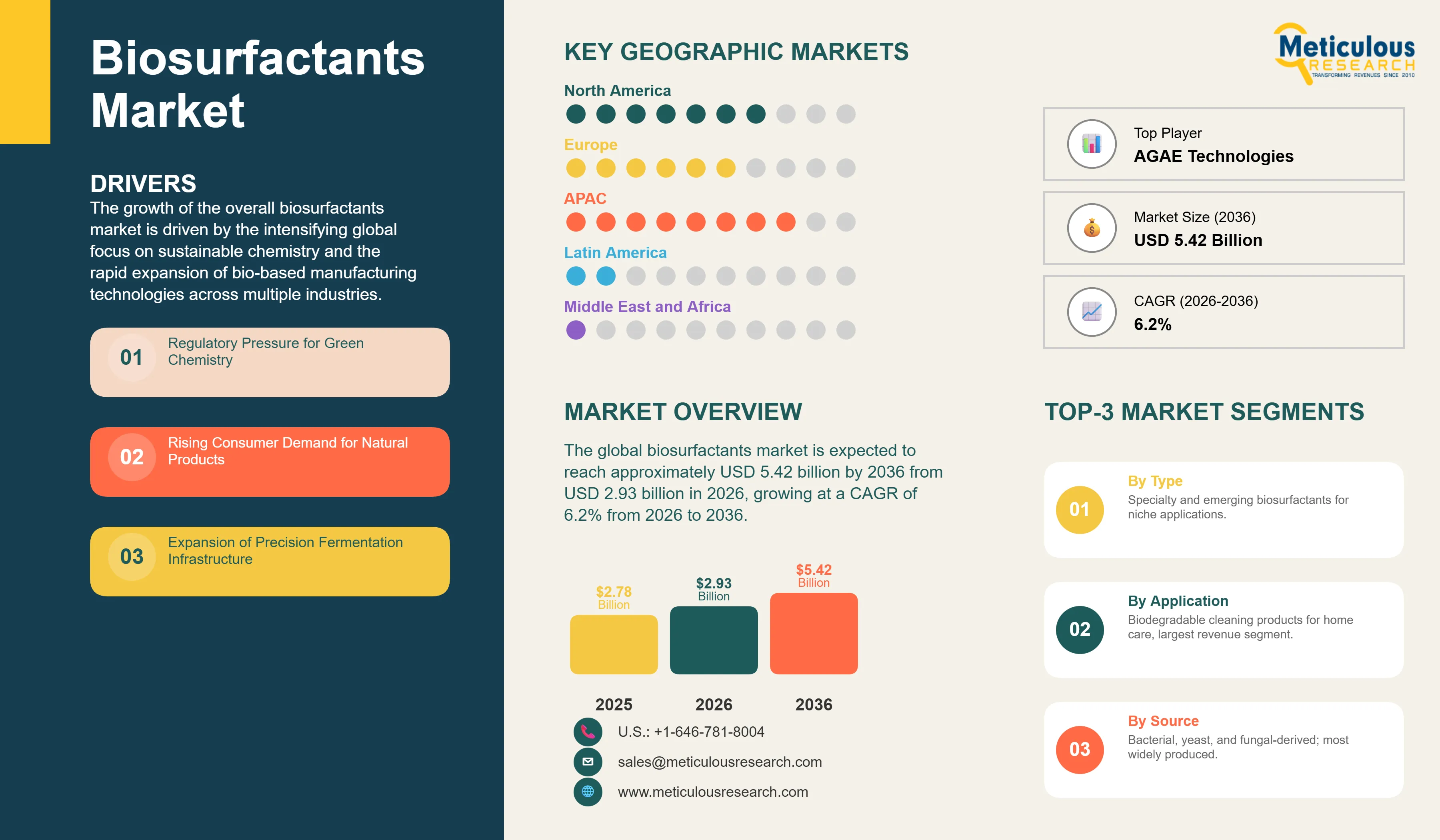

The global biosurfactants market was valued at USD 2.78 billion in 2025. The market is expected to reach approximately USD 5.42 billion by 2036 from USD 2.93 billion in 2026, growing at a CAGR of 6.2% from 2026 to 2036. The growth of the overall biosurfactants market is driven by the intensifying global focus on sustainable chemistry and the rapid expansion of bio-based manufacturing technologies across multiple industries. As chemical manufacturers and consumer goods companies seek to integrate more environmentally responsible ingredients into product formulations and reduce carbon footprints, biosurfactant infrastructure has become essential for maintaining regulatory compliance and meeting consumer expectations for green products. The rapid expansion of precision fermentation infrastructure and the increasing need for biodegradable alternatives in household and industrial cleaning applications continue to fuel significant growth of this market across all major geographic regions.

Market Highlights: Global Biosurfactants Market

- In terms of revenue, the global biosurfactants market is projected to reach USD 5.42 billion by 2036.

- The market is expected to grow at a CAGR of 6.3% from 2026 to 2036.

- Europe dominates the global biosurfactants market with the largest market share in 2026, driven by stringent environmental regulations and the presence of leading chemical innovators in Germany, Belgium, and the United Kingdom.

- Asia-Pacific is expected to witness the fastest growth during the forecast period, supported by massive investments in bio-manufacturing infrastructure and the rapid adoption of green chemistry solutions in China, India, and Japan.

- By type, the glycolipids segment holds the largest market share in 2026, particularly driven by rhamnolipids and sophorolipids in household and personal care applications.

- By application, the household detergents segment holds the largest market share in 2026, due to the rising demand for biodegradable cleaning products and the increasing consumer preference for sustainable home care solutions.

- By source, the microbial biosurfactants segment holds the largest share of the overall market in 2026.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Biosurfactants are important compounds that use biological production methods to deliver effective cleaning and better environmental profiles through naturally made molecular structures. These systems include integrated fermentation processes, purification technologies, and formulation capabilities aimed at replacing petrochemical surfactants while improving sustainability throughout the product lifecycle. The market features high-efficiency glycolipid molecules such as rhamnolipids and sophorolipids, along with specific lipopeptide variants that greatly enhance biodegradability and lower aquatic toxicity in effective cleaning and personal care settings. These systems are essential for formulators looking to improve their product sustainability and meet strict safety and regulatory standards.

The market offers a wide range of solutions, from basic single-strain fermentation systems for glycolipid production to complex multi-organism setups and integrated biorefinery ideas. These systems increasingly use advanced components like continuous fermentation reactors and membrane-based purification to ensure cost-effective production while maintaining product purity and consistent quality. The ability to provide stable, high-performance surfactancy with minimal environmental impact has made biosurfactant technology the preferred choice for manufacturers focused on sustainability and regulatory acceptance.

The global chemical and consumer goods sectors are actively working to switch to renewable ingredients, intending to meet bio-based content targets and carbon neutrality goals. This push has led to a rise in the use of precision fermentation solutions, with strain engineering and process optimization helping to stabilize the economics of commercial-scale biosurfactant manufacturing. Meanwhile, the rapid growth in the green cleaning and natural personal care markets is increasing the demand for high-purity, certified sustainable surfactant solutions.

What are the Key Trends in the Biosurfactants Market?

Scale-Up of Rhamnolipid and Sophorolipid Production

Chemical manufacturers are quickly moving to large-scale biosurfactant platforms, advancing from pilot fermentation to commercial production facilities. Evonik's industrial rhamnolipid plant in Slovakia offers significantly greater production volumes at competitive prices. Companies like AGAE Technologies and Holiferm have also announced major capacity expansions. A key advancement is the use of continuous fermentation systems with integrated downstream processing, which maintain peak production efficiency in high-volume environments. These developments make high-purity biosurfactant production practical and cost-effective for everyone from specialty chemical suppliers to global consumer goods manufacturers focused on sustainability and lower environmental impact.

Integration of Waste Stream Fermentation and Circular Economy Models

Innovation in how substrates are used and circular production is rapidly advancing the biosurfactants market as manufacturers aim to lower raw material costs and enhance environmental credentials. Equipment suppliers now design fermentation systems that make use of agro-industrial waste streams, such as glycerol from biodiesel, food processing residues, and lignocellulosic biomass on a single platform. This reduces feedstock costs and simplifies supply chain logistics. These systems often involve advanced microbial strain engineering and adaptable fermentation control that can manage varying substrate compositions without sacrificing product quality or production reliability.

Simultaneously, the increased focus on lifecycle sustainability urges manufacturers to create biosurfactant solutions that support zero-waste production principles. These systems help lower environmental impact through integrated biorefinery concepts and the valorization of fermentation co-products. By combining high-density fermentation efficiency with strong environmental performance, these new designs promote both commercial success and corporate sustainability goals, bolstering the resilience of the broader green chemistry value chain.

Market Summary

|

Parameter

|

Details

|

|

Market Size by 2036

|

USD 5.42 Billion

|

|

Market Size in 2026

|

USD 2.93 Billion

|

|

Market Size in 2025

|

USD 2.78 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 6.3%

|

|

Dominating Region

|

Europe

|

|

Fastest Growing Region

|

Asia-Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Type, Application, Source, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Regulatory Pressure for Green Chemistry and Consumer Demand for Natural Products

A key driver of the biosurfactants market is the rapid movement of the global chemical industry toward sustainable, bio-based ingredient platforms. Global demand for biodegradable formulations, reduced aquatic toxicity, and renewable carbon content has created significant incentives for the adoption of biosurfactant infrastructure. The trend toward "green label" certification and the integration of bio-based surfactants into unified formulation platforms drive manufacturers toward scalable solutions that biosurfactants can uniquely provide. It is estimated that as regulatory frameworks for chemical safety tighten and consumer adoption of eco-labeled products rises through 2036, the need for robust, certified sustainable surfactants increases significantly; therefore, advanced glycolipid molecules and optimized fermentation processes, with their ability to ensure high-performance cleaning with minimal environmental impact, are considered a crucial enabler of modern sustainable chemistry strategies.

Opportunity: Precision Fermentation Scale-Up and Agricultural Applications Expansion

The rapid growth of the precision fermentation industry and expanded use cases in agriculture provide great opportunities for the biosurfactants market. Indeed, the global surge in bio-manufacturing capacity has created a compelling demand for systems that can handle diverse substrate streams and provide consistent product quality for agricultural adjuvants and biopesticide applications. These applications require high stability, crop safety, and the ability to enhance agrochemical efficacy, all attributes that are met with advanced biosurfactant formulations. The agricultural chemicals market is set to expand significantly through 2036, with biosurfactants poised for an expanding share as manufacturers seek to replace synthetic ethoxylates and meet organic certification standards. Furthermore, the increasing demand for enhanced oil recovery applications and industrial degreasing is stimulating demand for specialty biosurfactant solutions that provide high-temperature stability and superior emulsification performance.

Type Insights

Why Does the Glycolipids Segment Lead the Market?

The glycolipids segment accounts for a significant portion of the overall biosurfactants market in 2026. This is mainly attributed to the versatile use of these molecules in supporting high-performance cleaning, excellent foaming characteristics, and superior mildness profiles within modern household and personal care formulations. These systems offer the most comprehensive way to ensure regulatory compliance across diverse application requirements. The household detergents and personal care sectors alone consume a large share of glycolipid biosurfactants, with major commercial launches in Europe and North America demonstrating the technology's capability to handle demanding performance specifications. However, the lipopeptides segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for antimicrobial functionality and specialized agricultural applications in crop protection and soil enhancement.

Application Insights

How Does the Household Detergents Segment Dominate?

Based on application, the household detergents segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of cleaning product formulations and the rigorous performance standards required for effective soil removal and fabric care. Current large-scale consumer goods manufacturers are increasingly specifying bio-based surfactant platforms to ensure compliance with global environmental standards and consumer expectations for sustainable household products.

The personal care segment is expected to witness the fastest growth during the forecast period. The shift toward natural beauty formulations and the complexity of multi-functional cosmetic systems are pushing the requirement for advanced biosurfactant solutions that can handle varied formulation chemistries and deliver gentle cleansing while ensuring absolute safety for skin contact applications.

Source Insights

Why Do Microbial Biosurfactants Lead the Market?

The microbial biosurfactants segment holds the largest share of the global biosurfactants market in 2026. This leadership comes from the effective scalability of fermentation-based production, the ability to achieve high product yields, and the established regulatory acceptance of ingredients derived from microbes. This makes it the preferred method for producing biosurfactants on a large scale. The demand for rhamnolipid and sophorolipid production drives large-scale operations. Companies like Evonik Industries and Jeneil Biotech provide advanced fermentation platforms that ensure reliable performance in commercial settings.

However, the plant-based biosurfactants segment is expected to grow steadily through 2036. This growth is driven by an increase in applications for food-grade formulations and a rising consumer preference for plant-based ingredients. Manufacturers are under pressure to enhance extraction and purification processes for high-volume applications. Plant-based saponins and lecithins offer a natural alternative for food emulsification and pharmaceutical uses.

Regional Insights

How is Europe Maintaining Dominance in the Global Biosurfactants Market?

Europe holds the largest share of the global biosurfactants market in 2026. This dominance is mainly due to strict environmental regulations, advanced fermentation infrastructure, and the presence of top chemical innovators, especially in Germany, Belgium, and the United Kingdom. The European Union accounts for a significant portion of global biosurfactant production. Its role as a leading adopter of bio-based chemistry and circular economy principles supports continuous growth. Leading manufacturers like BASF, Evonik Industries, and Solvay, along with a strong green chemistry supply chain, create a solid market for both commodity and specialty biosurfactant solutions.

What Factors Support Asia-Pacific and North America Market Growth?

Asia-Pacific and North America together make up a large share of the global biosurfactants market. The growth in these regions mainly results from the need for sustainable chemical alternatives in consumer goods and industrial cleaning. In Asia-Pacific, the demand for advanced biosurfactant systems is largely due to the expansion of large-scale manufacturing capabilities and the growth of bio-manufacturing clusters in China, India, and South Korea.

In North America, leadership in precision fermentation technology and the drive for bio-based chemical innovations encourage the use of high-performance biosurfactant solutions. The United States and Canada are leading the way, focusing on incorporating sustainable surfactant solutions into consumer products and advanced industrial cleaning systems. This ensures strong environmental performance and meets regulatory requirements.

Key Players

The companies such as BASF SE, Evonik Industries AG, Solvay S.A., and Stepan Company lead the global biosurfactants market with a comprehensive range of glycolipid and lipopeptide solutions, particularly for large-scale household and personal care applications. Meanwhile, players including Jeneil Biotech Inc., Holiferm Limited, AGAE Technologies, and Saraya Co., Ltd. focus on specialized fermentation platforms, proprietary microbial strains, and niche agricultural applications. Emerging manufacturers and integrated players such as Croda International Plc, Allied Carbon Solutions Co., Ltd., and Biotensidon GmbH are strengthening the market through innovations in downstream purification and custom biosurfactant formulations.

Key Questions Answered in the Report: