Resources

About Us

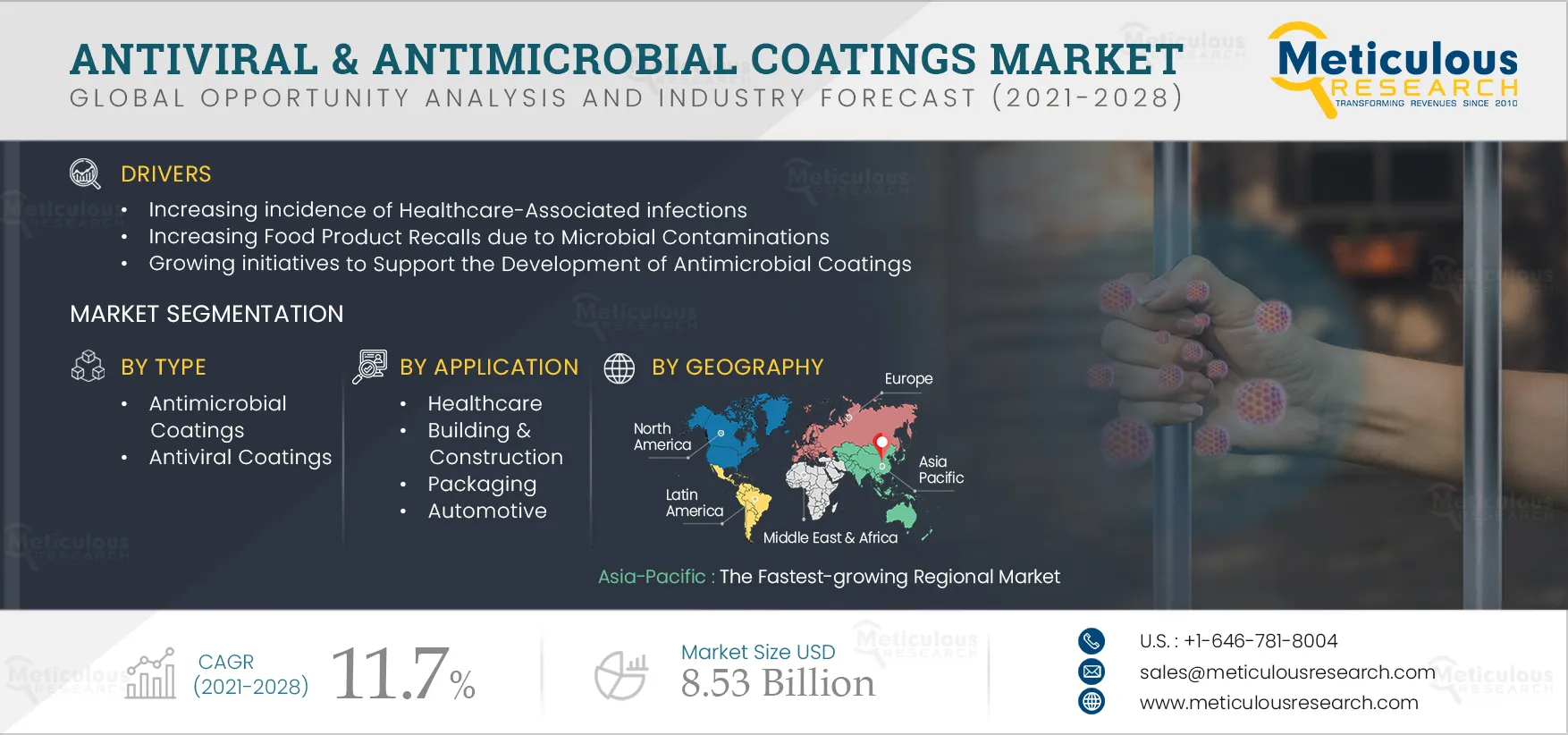

Antiviral & Antimicrobial Coatings Market by Type (Antimicrobial, Antiviral), Material (Copper, Silver, Aluminum), Form (Powder, Aerosol), Application (Healthcare, Building & Construction, Automotive, Packaging), and Geography - Forecast to 2028

Report ID: MRCHM - 104521 Pages: 183 Nov-2021 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe Antiviral & Antimicrobial Coatings Market is expected to grow at a CAGR of 11.7% from 2021 to 2028 to reach $8.53 billion by 2028. Antiviral & antimicrobial coatings are used to restrict the growth of viruses and other microorganisms. These coatings provide long-lasting protection against microorganisms and help maintain permanent hygiene. They have wide applications in healthcare, building & construction, food & beverage, packaging, air & water treatment, automotive, protective clothing, and other industries like oil & gas, electronics, and aeronautics & defense.

The growth of this market is mainly attributed to the increasing incidence of healthcare-associated infections, the rising number of food product recalls due to microbial contamination, and government initiatives & funding for the development of antimicrobial coatings. Favorable development in the emerging economies is expected to offer significant growth opportunities for players in this market. However, stringent government regulation on the emission of volatile organic compounds (VOCs) is expected to restrain the growth of this market to a certain extent. Additionally, the growing antimicrobial resistance among micro-organisms is expected to pose challenges to market growth.

COVID-19 Impact Assessment

The ongoing global COVID-19 pandemic has diversely impacted healthcare markets either positively or negatively. The ongoing COVID-19 pandemic has created awareness toward ensuring best practices to avoid the spread of microorganisms. The high burden of COVID-19 disease is expected to improve the demand for antiviral & antimicrobial coatings across various sectors. The combination of antibacterial & antiviral chemical entities represents a potentially path-breaking intervention to mitigate the spread of disease-causing agents. The manufacturers of antimicrobial coatings, including Novapura AG (Germany), Dortrend International Ltd. (U.K.), Nippon Paint Holdings Co., Ltd, (Japan), Smart Separations Ltd (U.K.), and Sciessent LLC (U.S.), are actively engaged in developing coatings effective against SARs-Cov-2 for various applications.

Active R&D to develop antimicrobial coatings against SARS- CoV- 2 virus also positively impacted the market. For instance, in May 2020, the University of Arizona (U.S.) researchers developed antimicrobial coating effective against SARS- CoV- 2. The coating was designed to be used for the building and construction sector. Similarly, in April 2020, the Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR) India developed an anti-microbial coating effective against SARS-CoV-2 in textile and plastics.

Thus, increased awareness of antimicrobial coatings against SARS-CoV-2 and the manufacturer’s focus on developing highly specific antiviral &antimicrobial coatings against COVID-19 are the factors that positively influence the market amid the pandemic.

Click here to: Get Free Sample Pages of this Report

Increasing Food Recalls Due to Microbial Contamination is Driving the Adoption of Antiviral & Antimicrobial Coatings in the Food & Beverage Industry

Ready-to-eat food packaging is contaminated with numerous viruses due to a lack of proper antiviral packaging material. The viral pathogens transmitted from contaminated food packaging surfaces can cause viral foodborne outbreaks. According to Food Standards Australia & New Zealand data, between 2011–2020, there were 195 food product recalls related to microbial contamination in Australia. The most commonly infecting micro-organisms for food products include Listeria monocytogenes, Salmonella, E. Coli. Listeria monocytogenes contamination occurred in meat, dairy, and mixed & processed foods. Salmonella contamination was observed in eggs and fruits, vegetables, and herbs. Dairy products are more commonly recalled due to concerns with process hygiene, indicated through E. coli testing. Other products commonly recalled for E. coli include fresh sprouts and fermented sausages.

A similar trend is being observed in the U.S and France. In the U.S., the Stericycle Recall Index tracks product recalls related to food and beverages. Food recalls due to bacterial contamination are skyrocketing in the U.S. Between 2012–2017, the number of food products recalled due to microbial contamination increased from 28% in 2012 to 31.3% in 2017. In 2020, bacterial contamination accounted for 62% of total recalled units, wherein Salmonella was the most common contaminant. Additionally, in 2018, French authorities reported a foodborne outbreak due to the consumption of Fuet sausage infected with Salmonella typhimurium.

Thus, to reduce the risk associated with contaminated packaging, several organizations across the globe are developing antimicrobial coatings to reduce food contamination. For instance, in 2017, in the U.S., Oregon State University developed an edible antimicrobial coating that inhibits the growth of E. coli and Listeria. Further, various organizations are arranging conferences to increase awareness about antimicrobial-coated packaging to reduce problems associated with food contamination. For instance, in 2018, the Institute of Tropical Forestry and Forest Products, Malaysia, organized a conference on safe, biodegradable packaging technology to address the issues related to microbial contaminated food and increase awareness about antimicrobial coated food packaging among academician, researchers, and packaging industry.

Thus, the increase in the recalls of food products due to microbial contamination is driving the adoption of antimicrobial coatings in food processing and packaging.

Growing Awareness Pertaining to the Use of Antiviral & Antimicrobial Coatings and Developments in the Emerging Economies is Offering Opportunities for the Market Growth

Biocontamination of medical devices and implants is a growing issue in developing countries, causing medical complications and increased expenses. In the fight against biocontamination, developing synthetic surfaces, which reduce the adhesion of microbes and provide biocidal activity or combinatory effects, has emerged as a major strategy across emerging economies. Advances in nanotechnology and biological sciences have made it possible to design smart surfaces for decreasing infections.

Developing and underdeveloped countries have limited penetration of antiviral & antimicrobial coatings due to a lack of awareness. However, industries like automobile, aviation, food, and medical device manufacturing are expanding in these countries. This provides a great opportunity for the antiviral and antimicrobial market to expand in these countries.

Countries such as Singapore, Japan, South Korea, and Australia have been at the forefront of technology adoption in the healthcare sector of the APAC region, whereas China, India, Malaysia, Indonesia, and Thailand are the emerging markets. Though developed markets dominate medical device sales, emerging markets represent high growth opportunities.

As per the International Trade Administration (ITA) data, the Chinese medical devices market increased from USD 53.6 billion in 2016 to USD 96.3 billion in 2019. This provides high growth opportunities for the antiviral & antimicrobial coating market to expand in China. Another such emerging economy is India, where the medical devices market is expected to grow from USD 11 billion in 2020 to USD 65 billion in 2024, according to the India Brand Equity Foundation.

Furthermore, recently up until the outbreak of COVID-19, the automotive industry was booming in some of the emerging economies. According to the International Organization of Motor Vehicle Manufacturer, South African cars and commercial vehicles production increased by 3.5% in 2019 from 2018. In Brazil, the production of vehicles increased by 2.2% in 2019 compared to 2018.

Corresponding to the automotive industry, the aviation industry is also expanding in emerging economies. Similarly, in Indonesia, Indonesia's number of aviation passengers increased from 826,400 in 1970 to 91.3 million in 2019, increasing at a 12.36 % annual rate. In recent years, there has been a growing interest in biocidal polymers because of their inherent properties such as non-volatility, chemical stability, environmental friendliness, and durability, which make them advantageous over other polymers as antimicrobial materials.

Antiviral & antimicrobial coatings have wide applications in the automotive, aviation, food, and medical devices industries. Hence, the growth in these industries in emerging economies presents a lucrative opportunity for the antiviral & antimicrobial coatings market.

Key Findings in the Global Antiviral & Antimicrobial Coatings Market Study:

In 2021, the antimicrobial coatings segment is estimated to generate a large proportion of revenue

Antimicrobial coatings are designed to inhibit the growth of pathogenic microorganisms, including bacteria, molds/fungi, parasites, and helminths. The growth of this segment is driven by the growing adoption of continuously active antimicrobial coatings to combat the spread of infectious diseases caused by pathogens, including bacteria, molds/fungi, parasites, and helminths across various applications.

Based on material, the silver segment is projected to grow with the fastest CAGR over the forecast period

The growing usage of silver coatings to prevent the spread of pathogens in the food, textile, and medical equipment industries and hospitals drives the growth of this segment. Silver-based antimicrobial coatings have exhibited better antimicrobial activity as compared to other materials, including copper. Thus, the preference for use for silver is more while developing antimicrobial coatings.

Copper coatings offer significant market opportunities in terms of the revenue estimated to generate from metallic coatings. The use of copper in the antimicrobial coatings post-pandemic world is gradually rising, creating favorable opportunities for market growth.

Based on form, the liquid coatings segment is estimated to generate a large proportion of revenue

A high preference for liquid coatings by the end-use industries due to their advantages, such as better protection against corrosion and provision of a more uniform finish than powder coatings, is a key factor for the highest adoption of liquid antiviral & antimicrobial coatings.

Based on application, the healthcare segment is estimated to generate a large proportion of revenue

The growth of this segment is mainly attributed to the surging incidence of hospital-acquired infections (HAIs) and infectious diseases. The applications of antiviral & antimicrobial coatings in the healthcare sector include surfaces of medical equipment, pharmaceutical processing & manufacturing equipment, hospital beds, and other furniture.

Microbial contamination of pharmaceutical R&D and production equipment is a serious threat. Thus, pharmaceutical manufacturers use antimicrobial coatings on their manufacturing lines and custom containers. Healthcare facilities are highly prone to the spreading of infections, and the majority of hospital-acquired infections occur through medical devices and other frequently touched surfaces.

Asia-Pacific: Fastest-growing Regional Market

Asia-Pacific is one of the fastest-growing markets for antiviral & antimicrobial coatings, mainly due to the significant burden of healthcare-associated infections and growing food product recalls due to microbial contamination. The adoption of antiviral & antimicrobial coatings in food facilities, the transport sector, air purifiers, medical devices, and others have also contributed to the market's growth.

Contamination of the healthcare environment with pathogenic organisms contributes to the burden of healthcare-associated infection (HCAI). The risk of emerging healthcare-associated infections is common in the Asia-Pacific region. For instance, according to an article published in Infectious Diseases Society of America, developing countries in APAC have 2-20 times higher chances of healthcare-associated infections than developed countries. The initial role of surface coatings in industrial applications was to provide protection from corrosion and mechanical resistance. Recently, with the advancement in nanoscience, polymer-/nanocomposite-based coatings have been developed and utilized for several purposes, including biomedical applications, such as antibacterial surfaces. Antimicrobial surfaces are designed to reduce microbial contamination of healthcare surfaces.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that leading market participants adopted over the past four years. The key players profiled in the global antiviral & antimicrobial coatings market report are Akzo Nobel N.V. (Netherlands), Lonza Group Ltd (Switzerland), PPG Industries Inc (U.S.), Axalta Coating System (U.S.), The Sherwin-Williams Company (U.S.), Nippon Paint Holdings Co., Ltd. (Japan), RPM International Inc. (U.S.), Sciessent LLC (U.S.), Sika AG (Switzerland), BASF SE (Germany), Jotun Group (Norway), DuPont De Nemours, Inc. (U.S.), NanoGraphene Inc (U.S.).

Scope of the Report:

Antiviral & Antimicrobial Coatings Market, by Type

Antiviral & Antimicrobial Coatings Market, by Material

Antiviral & Antimicrobial Coatings Market, by Form

Antiviral & Antimicrobial Coatings Market, by Application

Antiviral & Antimicrobial Coatings Market, by Geography

Key questions answered in the report:

Which type of antiviral & antimicrobial coatings is estimated to hold the major share of the market?

Published Date: Sep-2025

Published Date: Oct-2024

Published Date: Sep-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates