Resources

About Us

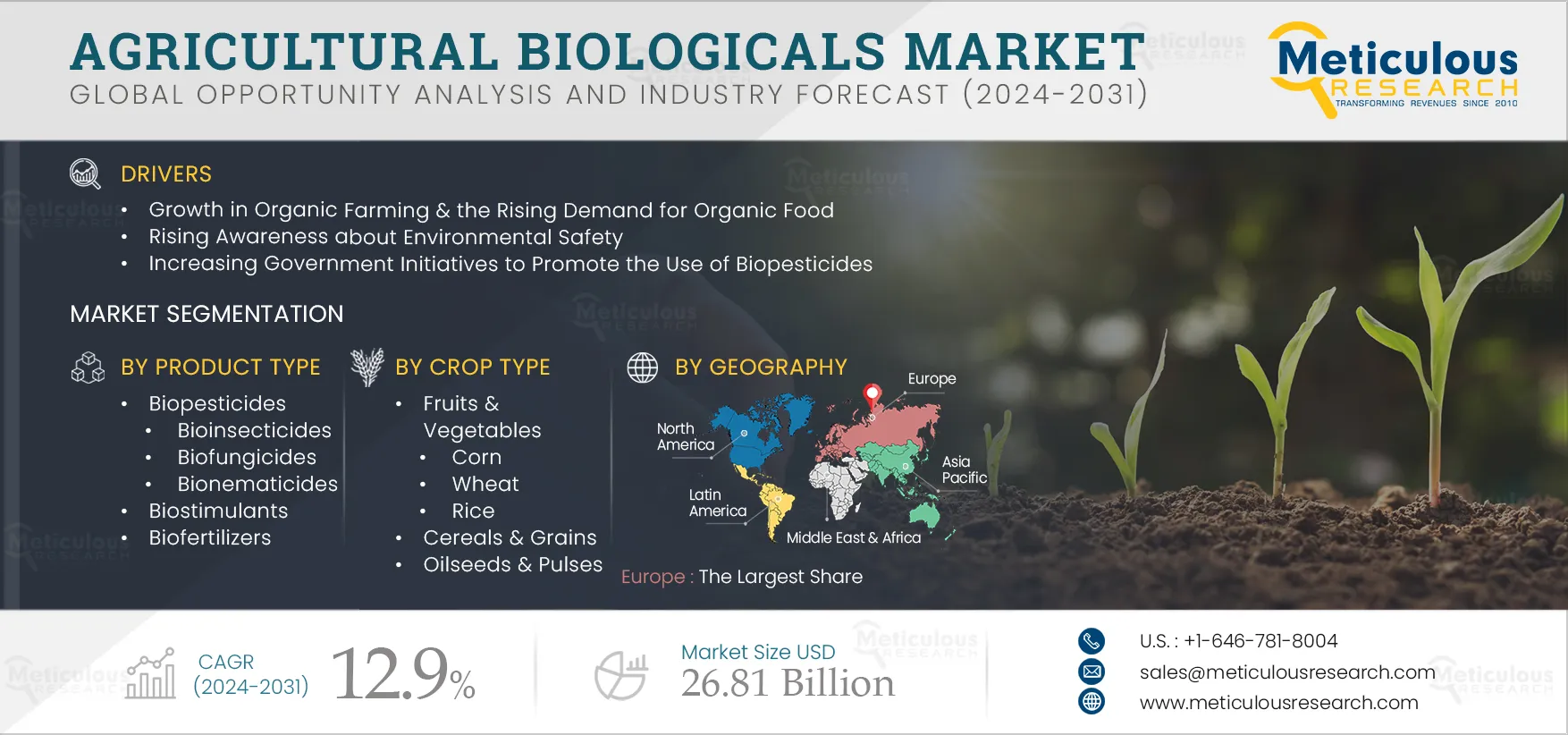

Agricultural Biologicals Market Size, Share, Forecast, & Trends Analysis by Product Type (Biopesticides, Biostimulants, Biofertilizer), Source (Microbial, Biochemical), Formulation (Dry), Mode of Application, (Fruits & Vegetables) - Global Forecast to 2031

Report ID: MRAGR - 104628 Pages: 270 Dec-2024 Formats*: PDF Category: Agriculture Delivery: 24 to 48 Hours Download Free Sample ReportThis market's growth is attributed to the growth in organic farming and the rising demand for organic food, rising awareness about environmental safety, increasing government initiatives to promote the use of biopesticides, and increasing investments from leading market players. However, the lack of education and awareness among farmers and regulatory and financial hurdles for new entrants restrain the market’s growth.

Moreover, agricultural diversity & arable land in emerging countries and the growing adoption of advanced agricultural practices and technologies are expected to offer growth opportunities for the players operating in this market. However, lengthy product registration & approval processes are a major challenge impeding the market’s growth.

The North American Free Trade Agreement (NAFTA) countries—the U.S., Canada, and Mexico—are major consumers of biopesticides, accounting for approximately 29% of global sales. In comparison, the European Union uses 33%. In the U.S., the Environmental Protection Agency (EPA) supports biopesticide development and use through the Biopesticides and Pollution Prevention Division, part of the Pesticide Programs. This division streamlines the registration process for biopesticides, which generally require less data than conventional pesticides due to their lower risk profile. Registrants must submit information on composition, toxicity, degradation, and other characteristics to ensure safety. Typically, registering a new biopesticide takes less than a year, whereas registering a chemical pesticide can exceed three years.

As demand in Canada for reduced pesticide use grew, the government introduced new regulations and management practices. Research identified new biopesticides, and expansion efforts accelerated, sparking a biopesticide revolution in the country.

Other nations are also shifting their political and public perspectives toward biopesticides and investing in related research globally. However, Canada stands out for effectively leveraging biopesticides as a viable alternative to reduce pesticide use, setting an example for others to follow.

In the European Union (EU), recent legislation aligns with the political will to decrease traditional chemical usage and increase biopesticide adoption. The EU's 2013 ban on neonicotinoid pesticides has led many growers to seek biopesticide alternatives for crop protection. According to the Biopesticides Industry Alliance (BPIA), by 2018, France, Denmark, and Sweden had reduced overall agricultural chemical use by more than 30%. Additionally, France's “EcoPhyto Plan,” launched in 2008, aimed to cut pesticide and plant protection product use by 50% by 2018.

Click here to: Get Free Sample Pages of this Report

In India, several government agencies, such as the Ministry of Agriculture and Farmers Welfare, the Department of Biotechnology (DBT), and the Ministry of Science and Technology, have promoted research, development, and commercialization of biopesticides and biofertilizers. The Indian Government is pushing organic farming by providing subsidies for new biofertilizer/ biopesticide units. The central government of India provides grants in aid of INR 4.5 million for building and INR 2 million for procuring equipment for biocontrol laboratories for producing biocontrol agents, including biopesticides, to state governments. It also provides around INR 2 million for procuring equipment for biopesticide testing laboratories. The requirement for registration of biopesticides has been simplified to facilitate the introduction of biopesticides.

China has acknowledged the problems caused by pesticide use and launched the “Zero Growth on Chemical Fertilizer and Pesticides” action plan to reduce reliance on these substances. Additionally, the nation has begun collaborating with the U.S. EPA on pollution issues, resulting in adapted registration procedures that favor biopesticides.

Many countries have revised their policies, recognizing the adverse effects of chemical pesticides—such as pest resistance, pest resurgence, secondary pest outbreaks, and pesticide residues in food, feed, soil, air, and water—which pose health risks and ecological imbalances. They are now working to minimize chemical pesticide use and promote biological alternatives. This proactive stance by governments is driving the growth of the agricultural biologicals market.

Biologicals have become a key component in pest management and are increasingly recognized as viable alternatives to chemical pesticides. This has led to heightened interest from the international research community, reflected in a significant rise in related publications. Agricultural crop protection companies are investing heavily in biocontrol, R&D, product development, field trials, and marketing to capitalize on these opportunities.

In the past five years, leading companies have engaged in agreements, partnerships, and collaborations to broaden their biological product portfolios. For instance, in July 2023, Bioceres Crop Solutions Corp. (Argentina) partnered with Corteva Agriscience to enhance the availability of biological solutions in Europe. Similarly, in February 2022, Koppert B.V. and UPL Iberia agreed to distribute biological products in Spain and Portugal. In June 2021, Marrone Bio Innovations partnered with ATP Nutrition to distribute Stargus Biofungicide in Canada. Such increased investments from major market players are expected to drive growth in the agricultural biologicals market.

Asian markets present substantial growth opportunities for players in the biological sector, particularly as China and India expand their use of these products. The market competitiveness of biologicals is rising with increasing demand for organic food in these countries. Biologicals are becoming crucial crop protection tools as growers focus on producing high-quality crops without chemical residues.

The Asia-Pacific region has some of the largest arable lands worldwide. According to the World Bank, India has the largest arable land, followed by the U.S., Russia, China, and Brazil.

In May 2024, Brazil’s Ministry of Agriculture and Livestock (MAPA - Ministério da Agricultura e Pecuária) approved three new bio-insecticidal/bio-nematicidal solutions manufactured by Bioceres Crop Solutions. These products are based on Burkholderia-derived metabolites and are used on various cash crops of Brazil, such as corn, cotton, and soybeans, as a replacement for abamectin in seed treatments while boosting the control of soil-dwelling insect pests that are typically controlled by neonicotinoids, pyrethroids, and organophosphates.

The combination of extensive arable lands, increasing demand for organic food, high prevalence of crop diseases, and ongoing initiatives to develop biologicals in emerging countries is expected to create substantial growth opportunities in the market.

Based on product type, the agricultural biologicals market is segmented into biopesticides, biostimulants and biofertilizers. In 2024, the biopesticides segment is expected to account for the largest share of 52.7% of the agricultural biologicals market. The large market share of this segment is due to several factors, such as increased investment from leading crop protection companies, growing awareness of environmental safety, improved crop quality and yield from biopesticides, rising organic farming and demand for organic food, and expanding government initiatives.

However, the biostimulants segment is slated to register the highest CAGR of 13.8% during the forecast period. This segment's rapid growth is driven by the increasing need to boost crop yield and quality, the expansion of organic farming, and the rising demand for organic food. Moreover, the wide range of benefits offered by biostimulants in crop production and growing awareness of environmental safety with their use are contributing to this growth.

Based on source, the agricultural biologicals market is segmented into microbials, biochemicals, and other sources. In 2024, the microbials segment is expected to account for the largest share of 60.5% of the agricultural biologicals market. The large market share of this segment is due to microbials’ selectivity, high effectiveness, lack of adverse effects on humans, plants, and animals, and ease of use. Additionally, minimal to no re-entry periods and post-harvest intervals post-application of microbials are expected to further drive its market demand. Moreover, this segment is estimated to register the highest CAGR of 14.2% during the forecast period.

Based on formulation, the agricultural biologicals market is segmented into liquid agricultural biologicals and dry agricultural biologicals. In 2024, the liquid agricultural biologicals segment is expected to account for the larger share of the agricultural biologicals market. The large market share of this segment is attributed to uniform and easy application, superior performance, and a longer effective duration (up to 6 months) compared to dry formulations (up to 3 months). Additionally, the growth of this segment is driven by the increasing importance of liquid formulations in modern irrigation technologies, such as drip and sprinkler irrigation, which reduce blockages. Moreover, this segment is poised to record the highest CAGR during the forecast period.

Based on crop type, the agricultural biologicals market is segmented into fruits & vegetables, cereals & grains, oilseeds & pulses, and other crop types. In 2024, the fruits & vegetables segment is expected to account for the largest share of the agricultural biologicals market. The large market share of this segment is attributed to several factors, such as the rising global production of fruits and vegetables, increasing demand for chemical-free organic produce, and a growing number of diseases affecting fruit and vegetable crops.

However, the cereals and grains segment is anticipated to register the highest CAGR during the forecast period. This segment's rapid growth is driven by the rising demand for organic cereals and grains and the extensive area dedicated to their cultivation. Moreover, growing awareness of health issues and the adverse effects of chemical pesticides on public health are expected to further boost demand for organic cereals and grains.

Based on mode of application, the agricultural biologicals market is segmented into foliar spray, soil treatment, seed treatment, and other modes of application. In 2024, the foliar spray segment is expected to account for the largest share of 70.3% of the agricultural biologicals market. The large market share of this segment is due to the advantages of the foliar spray technique, including uniform distribution of biochemicals, efficient use of biopesticides, and minimal to no wastage of biologicals.

However, the seed treatment segment is expected to register the highest CAGR of 14.3% during the forecast period. This segment's growth is driven by several factors, including increased nutrient availability in the rhizosphere, enhanced root and shoot growth, improved nutrient uptake, pathogen protection, and better nutrient utilization efficiency. Furthermore, farmers in developed countries are increasingly adopting seed treatment techniques to boost germination and ensure uniform seedling emergence. This trend is expected to significantly drive demand for seed treatment in the market.

Based on geography, the agricultural biologicals market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Europe is expected to account for the largest share of 35.6% of the agricultural biologicals market, followed by North America and Asia-Pacific. Europe's agricultural biologicals market is projected to reach $4.09 billion in 2024. This significant market share is driven by several key factors, including rising demand for organic products, increased government support, a preference for natural over synthetic products, and growing health consciousness.

However, Latin America is poised to register the highest CAGR during the forecast period. This rapid growth is driven by increasing food demand, the rising popularity of organic products and organic farming, environmental concerns over agrochemical use, and the need to boost agricultural production.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the agricultural biologicals market are Bayer AG (Germany), Koppert B.V. (Netherlands), FMC Corporation (U.S.), Gowan Company LLC (U.S.), Vegalab SA (Switzerland), The Stockton (STK) Group (Israel), IPL Biologicals Limited (India), InVivo Group (France), Biolchim Group (Italy), Seipasa S.A. (Spain), Syngenta AG (Switzerland), BASF SE (Germany), Corteva, Inc. (U.S.), Novonesis Group (Denmark), Andermatt Group AG (Switzerland), Certis U.S.A. LLC (U.S.), Som Phytopharma India Limited (India), W. Neudorff GmbH KG (Germany), Rizobacter S.A. (Argentina), Lallemand Inc. (U.S.), Valent U.S.A. LLC (U.S.), and UPL Limited (India).

Agricultural biologicals Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

~ 270 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

12.9% |

|

Market Size (Value) |

$26.81 Billion by 2031 |

|

Segments Covered |

By Product Type

By Source

By Formulation

By Mode of Application

By Crop Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (Spain, France, Germany, Italy, U.K., Netherlands, and Rest of Europe), Asia-Pacific (China, India, Australia, Japan, South Korea, Indonesia, Philippines, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Chile, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Bayer AG (Germany), Koppert B.V. (Netherlands), FMC Corporation (U.S.), Gowan Company LLC (U.S.), Vegalab SA (Switzerland), The Stockton (STK) Group (Israel), IPL Biologicals Limited (India), InVivo Group (France), Biolchim Group (Italy), Seipasa S.A. (Spain), Syngenta AG (Switzerland), BASF SE (Germany), Corteva, Inc. (U.S.), Novonesis Group (Denmark), Andermatt Group AG (Switzerland), Certis U.S.A. LLC (U.S.), Som Phytopharma India Limited (India), W. Neudorff GmbH KG (Germany), Rizobacter S.A. (Argentina), Lallemand Inc. (U.S.), Valent U.S.A. LLC (U.S.), and UPL Limited (India) |

Agricultural biologicals are a diverse group of products derived from naturally occurring microorganisms, plant extracts, beneficial insects, or other organic matter. They provide growers with valuable tools by delivering highly effective solutions in managing pests and diseases without negatively impacting the environment. Their active and inert ingredients are generally considered safe.

The agricultural biologicals market study provides valuable insights, market sizes, and forecasts in terms of value and volume by product type and geography. However, the study provides insights, market sizes, and forecasts only in terms of value based on source, formulations, mode of application, and crop type.

The agricultural biologicals market is projected to reach $26.81 billion by 2031, at a CAGR of 12.9% from 2024 to 2031.

In 2024, the biopesticides segment is expected to hold a major share of the market.

The seed treatment segment is expected to witness the fastest growth during the forecast period of 2024–2031.

The growth in organic farming & the rising demand for organic food, rising awareness about environmental safety, increasing government initiatives to promote the use of biopesticides, and the increasing investments from leading market players are factors supporting the growth of this market. Moreover, agricultural diversity & arable land in emerging countries and the growing adoption of advanced agricultural practices and technologies create opportunities for players operating in this market.

The key players operating in the agricultural biologicals market are Bayer AG (Germany), Koppert B.V. (Netherlands), FMC Corporation (U.S.), Gowan Company LLC (U.S.), Vegalab SA (Switzerland), The Stockton (STK) Group (Israel), IPL Biologicals Limited (India), InVivo Group (France), Biolchim Group (Italy), Seipasa S.A. (Spain), Syngenta AG (Switzerland), BASF SE (Germany), Corteva, Inc. (U.S.), Novonesis Group (Denmark), Andermatt Group AG (Switzerland), Certis U.S.A. LLC (U.S.), Som Phytopharma India Limited (India), W. Neudorff GmbH KG (Germany), Rizobacter S.A. (Argentina), Lallemand Inc. (U.S.), Valent U.S.A. LLC (U.S.), and UPL Limited (India).

Latin America region is slated to register the highest growth rate during the forecast period due to the growing food demand, the rising demand and popularity of organic products with growing organic farming, environmental concerns over agrochemical usage, and the rising need to increase agricultural production.

Published Date: Mar-2024

Published Date: Feb-2024

Published Date: Feb-2024

Published Date: Jun-2023

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates